User login

From the Washington Office: Brave new world of acronyms

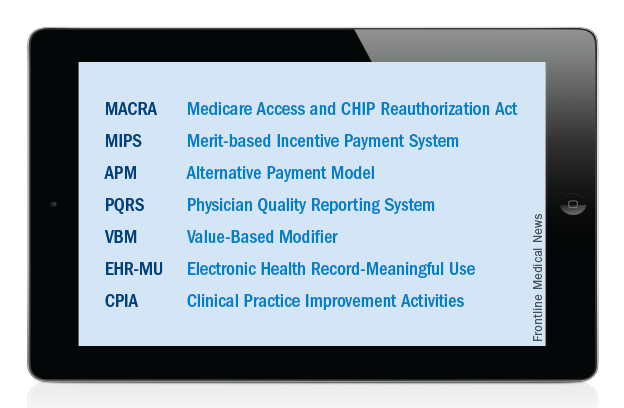

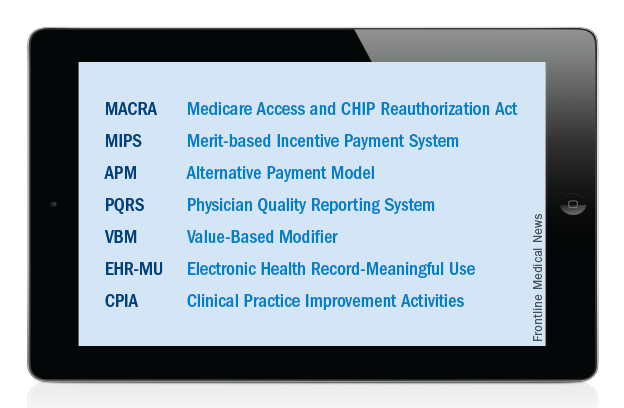

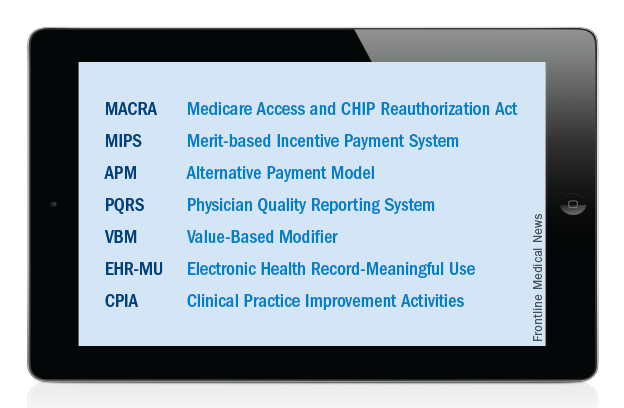

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

Just over a year ago, Congress passed and the President signed into law the MACRA legislation, which will serve as the basis for Medicare physician payment beginning in 2019. At the recent Leadership and Advocacy Summit, it became apparent to me that a “refresher” on seven key acronyms would be useful for surgeons as they gear up to understand and effectively participate in this “brave new world” which is rapidly approaching.

Accordingly, let us start at the beginning. MACRA stands for the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act of 2015. As noted above, this legislation, signed into law by President Obama on April 16, 2015, replaces the flawed sustainable growth rate formula and will be the template utilized to determine Medicare physician payment beginning in 2019. However, it is important to note that it is anticipated that the data to be utilized as the basis for payment in 2019 will likely be collected sometime in 2017.

MACRA provides modest but stable positive updates of 0.5 percent/year for the 5-year period of 2015-2019. Fellows may remember that this provision was included in the legislation as a direct result of objections made by the leadership of the ACS to the original draft legislation, which contained no provision for a positive update. In addition, MACRA provides for the elimination, after 2018, of the current-law penalties associated with the existing Medicare quality programs, including the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program. That said, and as outlined below, we will not be saying goodbye to these programs completely. Accordingly, surgeons need to remain, or become, familiar with those acronyms and the programs they represent.

MACRA has two payment pathways. Physicians will choose to participate in one or the other. Those choices are: 1) MIPS (Merit-based Incentive Payment System) and 2) APMs (Alternative Payment Models).

Beginning in 2019, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier) program and the EHR-MU (Electronic Health Record–Meaningful Use) program will be combined into MIPS (Merit-based Incentive Payment System). In this program, it is possible for all surgeons to receive an annual positive update based on their individual performance in the four categories of Quality, Resource Use, Electronic Health Record–Meaningful Use, and lastly the newly created category of Clinical Practice Improvement Activities (CPIA).

Individual surgeons’ performance in the four categories will be combined into a composite score. Each individual composite score will then be compared with a performance threshold. The threshold will be set as either the mean or median of the composite performance scores for all MIPS-eligible professionals from a prior performance period. The threshold will reset every year. Those with an individual composite performance score above the threshold will receive a positive payment adjustment while those with an individual composite performance score below the threshold will receive a negative payment adjustment.

The Quality component of the MIPS will consist of quality measures currently used in existing quality performance programs namely, the PQRS (Physician Quality Reporting System), the VBM (Value-Based Modifier program), and EHR-MU (Electronic Health Record–Meaningful Use), as well as measures developed by stakeholders to meet the needs of specialties lacking meaningful measures in the current programs. The RESOURCE USE component of MIPS will include the cost measures used in the current VBM (Value-Based Modifier) program. With regard to the Electronic Health Record–Meaningful Use (EHR-MU) component of MIPS, current EHR-MU requirements will continue to apply but are expected to be modified significantly. ACS continues to advocate for changes to the EHR-MU program to make it easier for surgeons to comply with requirements. Evidence of the effectiveness of our advocacy in this area is found in the success achieved in obtaining a blanket exception for the 2015 reporting period, Stage 2 Meaningful Use rule about which I wrote in the December 2015 and January 2016 editions of this column.

The CPIA (Clinical Practice Improvement Activities) are designed to assess surgeons’ effort toward improving their clinical practice and/or their preparation toward participating in APMs (Alternative Payment Models). The menu of specific, approved activities has yet to be firmly established. ACS provided significant input on the CPIA component of MIPS in our November 2015 response to the request for information issued by the Centers for Medicare & Medicaid Services (CMS) last fall. The MACRA legislation specifies that the CPIA be applicable to all specialties and be attainable for small practices and professionals in rural and underserved areas.

Those Fellows interested in knowing specifically the areas on which CMS requested input in the process of drafting the first proposed rule on MACRA and how ACS responded to same may find the letter sent in response to CMS at https://www.facs.org/~/media/files/advocacy/medicare/cms%20mips%20apm%20rfi%20final.ashx.

The new law takes concerted steps to incentivize and encourage providers to develop and participate in APMs (Alternative Payment Models). As with the CPIA discussed above, the details of APMs are not yet fully clear and are currently being developed. ACS is actively working on behalf of surgeons to develop APMs as part of the policy efforts of the Division of Advocacy and Health Policy. In general, these programs will require quality measures, the inclusion of elements of upside and downside financial risk for providers and use of certified electronic health record technology. For those surgeons who receive a significant share of their revenue from an APM, an annual 5% bonus will be available for each of the years 2019-2024. To qualify for that bonus, surgeons must receive 25% of their Medicare revenue from an APM in the years 2019 and 2020. That threshold requirement subsequently increases to 50% in 2021 and ultimately to 75% beginning in 2023.

As MACRA specifies that providers participate in either MIPS or APMs, surgeons who meet the aforementioned threshold of payment from a qualified APM will be exempted from many of the MIPS reporting requirements and receive the 5% bonus in lieu of the previously described MIPS payment adjustment. Those who participate in APMs but fail to meet the threshold necessary to receive the 5% bonus will receive credit for their participation in the CPIA component of their MIPS composite score but will not receive the 5% incentive.

While it is completely understandable that acronyms add to surgeons’ collective frustration, I am confident that all Fellows can, with relative ease, master the seven acronyms above and thus be well on their way to both understanding and successfully participating in the new Medicare physician payment system.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

From the Washington Office: A guide to in-district meetings with your representatives and senators

WHY should surgeons take time out of their busy schedules to meet with legislators?

To become an effective surgeon advocate, nothing is more important than establishing a personal relationship with your legislators. Conversely, to a legislator, there is nothing more valuable than the input and support of constituents. After all, constituents are VOTERS. Meeting with policy makers and/or their staff is extremely valuable in advancing the overall advocacy agenda of The American College of Surgeons and provides surgeons with the opportunity to develop key contacts in the offices of their legislators.

WHERE do such meetings take place?

All U.S. Representatives and Senators have one or more offices for constituent service in their home districts or states. These offices serve as a readily accessible meeting point. As an alternative, legislators frequently will schedule meetings with constituents in mutually convenient locations such as a coffee shop, or during a local legislative event such as a town hall.

WHEN is it most feasible to schedule in-district meetings?

You might be surprised to discover how much time is allotted by both the House and Senate for in-district work periods. Typical times include periods around President’s Day in February, Easter/Passover in March/April, Memorial Day, Independence Day, and summer recess (late July and the month of August). If Congress does not officially adjourn in early October, additional work periods include time around Columbus Day in October, Veteran’s Day in November, and Thanksgiving. Congress will usually adjourn for the year in December. A specific schedule for each legislative body for the year 2016 can be found at:

House of Representatives: http://www.majorityleader.gov/wp-content/uploads/2011/07/2016_ANNUAL_CALENDAR.pdf

Senate: http://www.senate.gov/legislative/resources/pdf/2016_calendar.pdf

HOW does one schedule an in-district meeting?

To set up a meeting you should first search the websites of your representatives (www.house.gov) and senators (www.senate.gov) for information as to the preferred scheduling procedures. Expect each office’s procedure to be a bit different. You will be asked to provide your name, address, and basic contact information as well as to briefly describe what issue(s) you wish to discuss. Be sure to mention that you are a surgeon and also whether you have previously met with the representative or senator.

If several days pass and staff from the office have not followed up, you should not hesitate to call or contact the office again. Remember, persistence is key! Keep in mind that legislators typically maintain busy schedules during the in-district work period and accordingly, the scheduled appointment time will be brief and subject to change, perhaps on short notice.

If you experience difficulty or simply would like to have assistance in scheduling an in-district meeting, staff in the ACS Division of Advocacy and Health Policy are available to assist and may be contacted by e-mail at surgeonsvoice.org.

WHAT should one discuss?

As a surgeon advocate, your most powerful tool is frequent contact and meetings with your elected officials. Meetings provide an opportunity to offer knowledge and perspective to educate legislators on key topics important to ensuring access to quality surgical care. Your personal experience brings a personal, human touch to issues about which legislators only have knowledge based upon raw numbers and impersonal policy jargon. Most legislators, as well as their staff, will be grateful to have the reliable resource of a constituent’s experience and perspective on complicated medical issues.

To maximize the opportunity for a successful meeting and thereby lay the foundation for the development of a mutually beneficial future relationship, I would offer the following three tips:

1) KNOW YOUR LEGISLATOR: Visit your legislators’ websites, read their biographies, ascertain to what congressional committees they are assigned, and what leadership roles they may have. All of this serves to help determine what issues are important to them and what positions they have previously taken on such issues.

2) KNOW YOUR ISSUE and be able to FRAME IT: Nothing substitutes for a solid knowledge base of the issue and the position you are trying to convey. Be focused and resist the temptation to try to cover too many topics in any one visit. When presenting your argument, “frame it” in layman’s terms much as you would explain it to a patient. Including examples of real-life, anecdotal experiences demonstrating how the status quo or the proposed legislation (depending upon the circumstance) is impacting providers and patients is particularly important.

3) HAVE AN ASK: It is imperative that you always be clear with your legislators about what you want them to do. This serves to reinforce the importance of your having taken time out of your schedule to communicate with them and also serves to hold the legislator accountable. “Asks” can be as specific as a request to cosponsor and support legislation or simply making the offer to serve as a resource to them as a constituent with expertise in health care.

Lastly, I would respectfully request that when surgeons meet with their legislators they inform the ACS Division of Advocacy and Health Policy. Having basic information about the outcome of the meeting, whether knowing that the legislator committed to taking a specific action or knowing that the legislator has requested additional information, is incredibly valuable to us in our ongoing advocacy efforts on behalf of surgeons and their patients here in Washington, DC.

Until next month ….

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

WHY should surgeons take time out of their busy schedules to meet with legislators?

To become an effective surgeon advocate, nothing is more important than establishing a personal relationship with your legislators. Conversely, to a legislator, there is nothing more valuable than the input and support of constituents. After all, constituents are VOTERS. Meeting with policy makers and/or their staff is extremely valuable in advancing the overall advocacy agenda of The American College of Surgeons and provides surgeons with the opportunity to develop key contacts in the offices of their legislators.

WHERE do such meetings take place?

All U.S. Representatives and Senators have one or more offices for constituent service in their home districts or states. These offices serve as a readily accessible meeting point. As an alternative, legislators frequently will schedule meetings with constituents in mutually convenient locations such as a coffee shop, or during a local legislative event such as a town hall.

WHEN is it most feasible to schedule in-district meetings?

You might be surprised to discover how much time is allotted by both the House and Senate for in-district work periods. Typical times include periods around President’s Day in February, Easter/Passover in March/April, Memorial Day, Independence Day, and summer recess (late July and the month of August). If Congress does not officially adjourn in early October, additional work periods include time around Columbus Day in October, Veteran’s Day in November, and Thanksgiving. Congress will usually adjourn for the year in December. A specific schedule for each legislative body for the year 2016 can be found at:

House of Representatives: http://www.majorityleader.gov/wp-content/uploads/2011/07/2016_ANNUAL_CALENDAR.pdf

Senate: http://www.senate.gov/legislative/resources/pdf/2016_calendar.pdf

HOW does one schedule an in-district meeting?

To set up a meeting you should first search the websites of your representatives (www.house.gov) and senators (www.senate.gov) for information as to the preferred scheduling procedures. Expect each office’s procedure to be a bit different. You will be asked to provide your name, address, and basic contact information as well as to briefly describe what issue(s) you wish to discuss. Be sure to mention that you are a surgeon and also whether you have previously met with the representative or senator.

If several days pass and staff from the office have not followed up, you should not hesitate to call or contact the office again. Remember, persistence is key! Keep in mind that legislators typically maintain busy schedules during the in-district work period and accordingly, the scheduled appointment time will be brief and subject to change, perhaps on short notice.

If you experience difficulty or simply would like to have assistance in scheduling an in-district meeting, staff in the ACS Division of Advocacy and Health Policy are available to assist and may be contacted by e-mail at surgeonsvoice.org.

WHAT should one discuss?

As a surgeon advocate, your most powerful tool is frequent contact and meetings with your elected officials. Meetings provide an opportunity to offer knowledge and perspective to educate legislators on key topics important to ensuring access to quality surgical care. Your personal experience brings a personal, human touch to issues about which legislators only have knowledge based upon raw numbers and impersonal policy jargon. Most legislators, as well as their staff, will be grateful to have the reliable resource of a constituent’s experience and perspective on complicated medical issues.

To maximize the opportunity for a successful meeting and thereby lay the foundation for the development of a mutually beneficial future relationship, I would offer the following three tips:

1) KNOW YOUR LEGISLATOR: Visit your legislators’ websites, read their biographies, ascertain to what congressional committees they are assigned, and what leadership roles they may have. All of this serves to help determine what issues are important to them and what positions they have previously taken on such issues.

2) KNOW YOUR ISSUE and be able to FRAME IT: Nothing substitutes for a solid knowledge base of the issue and the position you are trying to convey. Be focused and resist the temptation to try to cover too many topics in any one visit. When presenting your argument, “frame it” in layman’s terms much as you would explain it to a patient. Including examples of real-life, anecdotal experiences demonstrating how the status quo or the proposed legislation (depending upon the circumstance) is impacting providers and patients is particularly important.

3) HAVE AN ASK: It is imperative that you always be clear with your legislators about what you want them to do. This serves to reinforce the importance of your having taken time out of your schedule to communicate with them and also serves to hold the legislator accountable. “Asks” can be as specific as a request to cosponsor and support legislation or simply making the offer to serve as a resource to them as a constituent with expertise in health care.

Lastly, I would respectfully request that when surgeons meet with their legislators they inform the ACS Division of Advocacy and Health Policy. Having basic information about the outcome of the meeting, whether knowing that the legislator committed to taking a specific action or knowing that the legislator has requested additional information, is incredibly valuable to us in our ongoing advocacy efforts on behalf of surgeons and their patients here in Washington, DC.

Until next month ….

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

WHY should surgeons take time out of their busy schedules to meet with legislators?

To become an effective surgeon advocate, nothing is more important than establishing a personal relationship with your legislators. Conversely, to a legislator, there is nothing more valuable than the input and support of constituents. After all, constituents are VOTERS. Meeting with policy makers and/or their staff is extremely valuable in advancing the overall advocacy agenda of The American College of Surgeons and provides surgeons with the opportunity to develop key contacts in the offices of their legislators.

WHERE do such meetings take place?

All U.S. Representatives and Senators have one or more offices for constituent service in their home districts or states. These offices serve as a readily accessible meeting point. As an alternative, legislators frequently will schedule meetings with constituents in mutually convenient locations such as a coffee shop, or during a local legislative event such as a town hall.

WHEN is it most feasible to schedule in-district meetings?

You might be surprised to discover how much time is allotted by both the House and Senate for in-district work periods. Typical times include periods around President’s Day in February, Easter/Passover in March/April, Memorial Day, Independence Day, and summer recess (late July and the month of August). If Congress does not officially adjourn in early October, additional work periods include time around Columbus Day in October, Veteran’s Day in November, and Thanksgiving. Congress will usually adjourn for the year in December. A specific schedule for each legislative body for the year 2016 can be found at:

House of Representatives: http://www.majorityleader.gov/wp-content/uploads/2011/07/2016_ANNUAL_CALENDAR.pdf

Senate: http://www.senate.gov/legislative/resources/pdf/2016_calendar.pdf

HOW does one schedule an in-district meeting?

To set up a meeting you should first search the websites of your representatives (www.house.gov) and senators (www.senate.gov) for information as to the preferred scheduling procedures. Expect each office’s procedure to be a bit different. You will be asked to provide your name, address, and basic contact information as well as to briefly describe what issue(s) you wish to discuss. Be sure to mention that you are a surgeon and also whether you have previously met with the representative or senator.

If several days pass and staff from the office have not followed up, you should not hesitate to call or contact the office again. Remember, persistence is key! Keep in mind that legislators typically maintain busy schedules during the in-district work period and accordingly, the scheduled appointment time will be brief and subject to change, perhaps on short notice.

If you experience difficulty or simply would like to have assistance in scheduling an in-district meeting, staff in the ACS Division of Advocacy and Health Policy are available to assist and may be contacted by e-mail at surgeonsvoice.org.

WHAT should one discuss?

As a surgeon advocate, your most powerful tool is frequent contact and meetings with your elected officials. Meetings provide an opportunity to offer knowledge and perspective to educate legislators on key topics important to ensuring access to quality surgical care. Your personal experience brings a personal, human touch to issues about which legislators only have knowledge based upon raw numbers and impersonal policy jargon. Most legislators, as well as their staff, will be grateful to have the reliable resource of a constituent’s experience and perspective on complicated medical issues.

To maximize the opportunity for a successful meeting and thereby lay the foundation for the development of a mutually beneficial future relationship, I would offer the following three tips:

1) KNOW YOUR LEGISLATOR: Visit your legislators’ websites, read their biographies, ascertain to what congressional committees they are assigned, and what leadership roles they may have. All of this serves to help determine what issues are important to them and what positions they have previously taken on such issues.

2) KNOW YOUR ISSUE and be able to FRAME IT: Nothing substitutes for a solid knowledge base of the issue and the position you are trying to convey. Be focused and resist the temptation to try to cover too many topics in any one visit. When presenting your argument, “frame it” in layman’s terms much as you would explain it to a patient. Including examples of real-life, anecdotal experiences demonstrating how the status quo or the proposed legislation (depending upon the circumstance) is impacting providers and patients is particularly important.

3) HAVE AN ASK: It is imperative that you always be clear with your legislators about what you want them to do. This serves to reinforce the importance of your having taken time out of your schedule to communicate with them and also serves to hold the legislator accountable. “Asks” can be as specific as a request to cosponsor and support legislation or simply making the offer to serve as a resource to them as a constituent with expertise in health care.

Lastly, I would respectfully request that when surgeons meet with their legislators they inform the ACS Division of Advocacy and Health Policy. Having basic information about the outcome of the meeting, whether knowing that the legislator committed to taking a specific action or knowing that the legislator has requested additional information, is incredibly valuable to us in our ongoing advocacy efforts on behalf of surgeons and their patients here in Washington, DC.

Until next month ….

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

From the Washington Office: 2016 Leadership and Advocacy Summit

The American College of Surgeons (ACS) will host the fifth annual Leadership & Advocacy Summit, April 9-12, at the JW Marriott in Washington, D.C. This annual Summit event is a dual-purpose meeting that offers volunteer ACS leaders and surgeon advocates comprehensive and specialized sessions focused on the tools needed to be more effective leaders as well as comprehensive, focused, and interactive advocacy training. The meeting “capstones” on April 12 with Capitol Hill meetings in congressional offices scheduled with the senators and representatives of whom individual Fellows are constituents.

I first attended the program in 2010 and with each subsequent year become ever more convinced of how critically important it is that surgeons be informed about and engaged in the processes of both the legislative and the administrative branches of their individual state and federal governments. This year’s program promises to educate, challenge and prepare Fellows to assist the ACS in shaping the future of surgical practice while working collaboratively with ACS leaders, key elected officials, as well as their surgery colleagues.

As surgeons, we must be leaders and experts in the building and maintenance of effective teams, changing and ever-evolving cultures, time management, mentoring, coaching, and taking decisive action. The leadership program is designed to develop and hone exemplary leadership skills. Current topics and presenters include Leading Through Team Conflict, David A. Rogers, MD, FACS; Toward Better Communications and Teamwork: Skills for Handling Difficult Conversations, Kurt O’Brien, MHROD; Social Media for the Surgeon: Lifelong Learning, Engagement, and Reputation Management, Deanna J. Attai, MD, FACS; and Enhancing Our Cultural Dexterity: The Next Step in Reducing Disparities and Providing Patient Centered Care, Adil H. Hader, MPH, MD, FACS. In addition, chapter success stories will be presented by ACS Governors from West Virginia, North Texas, and Georgia.

The advocacy portion of the program kicks off on the evening of April 10 with a dinner during which those assembled will hear from Chris Matthews, the host of Hardball on MSNBC.

We will begin the morning of April 11 with a panel session entitled, Strategies for Successful State Advocacy, followed by breakout sessions for advocacy training tailored to individual experience levels. Attendees will then hear from Patrick Conway, MD, MSc, the Deputy Administrator for Innovation and Quality and Chief Medical Officer, Centers for Medicare & Medicaid Services (CMS). Dr. Conway leads the Center for Clinical Standards and Quality (CCSQ) and the Center for Medicare and Medicaid Innovation (CMMI) at CMS. As such he is leading the way within CMS to move into the new physician payment systems prescribed by the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which will replace the current physician payment system in 2019.

The Political Luncheon, sponsored by SurgeonsPAC will feature Dr. Larry J. Sabato, founder and director, the University of Virginia Center for Politics and the University Professor of Politics at the University of Virginia, Charlottesville.

In recognition of the fact that “data” is THE buzzword today in health care policy, the afternoon session will feature a panel on how data is being utilized to change our current delivery and payment systems. Panelists include Vindell Washington, MD, the Principal Deputy National Coordinator in the Office of the National Coordinator for Health Information Technology (ONC), and Brian Kelly, MD, President, Payer and Provider Solutions for Quintiles. ACS has recently partnered with Quintiles on a major project to make the College’s multiple systems of data management more effective.

As mentioned above, the Leadership and Advocacy Summit closes on Tuesday, April 12, with a trip to Capitol Hill for Fellows to meet their individual members of the House of Representatives and Senate as well as their staff. This activity provides an important opportunity to put to good use the skills learned or refined on Sunday and Monday. We strongly encourage everyone who attends to stay through to the end of the Summit and participate in this important advocacy initiative.

Make a difference and join us in Washington. Register today to attend the 2016 Leadership and Advocacy Summit.

For questions about registration, please contact ACS Registration Services at registration@facs.org or 312-202-5244.

For questions surrounding the Leadership Summit, please contact Donna Tieberg at dtieberg@facs.org or 312-202-5361.

For questions regarding the Advocacy Summit, please contact Michael Carmody at mcarmody@facs.org or 202-672-1511.

I look forward to seeing you in April in Washington!

Until next month …

The American College of Surgeons (ACS) will host the fifth annual Leadership & Advocacy Summit, April 9-12, at the JW Marriott in Washington, D.C. This annual Summit event is a dual-purpose meeting that offers volunteer ACS leaders and surgeon advocates comprehensive and specialized sessions focused on the tools needed to be more effective leaders as well as comprehensive, focused, and interactive advocacy training. The meeting “capstones” on April 12 with Capitol Hill meetings in congressional offices scheduled with the senators and representatives of whom individual Fellows are constituents.

I first attended the program in 2010 and with each subsequent year become ever more convinced of how critically important it is that surgeons be informed about and engaged in the processes of both the legislative and the administrative branches of their individual state and federal governments. This year’s program promises to educate, challenge and prepare Fellows to assist the ACS in shaping the future of surgical practice while working collaboratively with ACS leaders, key elected officials, as well as their surgery colleagues.

As surgeons, we must be leaders and experts in the building and maintenance of effective teams, changing and ever-evolving cultures, time management, mentoring, coaching, and taking decisive action. The leadership program is designed to develop and hone exemplary leadership skills. Current topics and presenters include Leading Through Team Conflict, David A. Rogers, MD, FACS; Toward Better Communications and Teamwork: Skills for Handling Difficult Conversations, Kurt O’Brien, MHROD; Social Media for the Surgeon: Lifelong Learning, Engagement, and Reputation Management, Deanna J. Attai, MD, FACS; and Enhancing Our Cultural Dexterity: The Next Step in Reducing Disparities and Providing Patient Centered Care, Adil H. Hader, MPH, MD, FACS. In addition, chapter success stories will be presented by ACS Governors from West Virginia, North Texas, and Georgia.

The advocacy portion of the program kicks off on the evening of April 10 with a dinner during which those assembled will hear from Chris Matthews, the host of Hardball on MSNBC.

We will begin the morning of April 11 with a panel session entitled, Strategies for Successful State Advocacy, followed by breakout sessions for advocacy training tailored to individual experience levels. Attendees will then hear from Patrick Conway, MD, MSc, the Deputy Administrator for Innovation and Quality and Chief Medical Officer, Centers for Medicare & Medicaid Services (CMS). Dr. Conway leads the Center for Clinical Standards and Quality (CCSQ) and the Center for Medicare and Medicaid Innovation (CMMI) at CMS. As such he is leading the way within CMS to move into the new physician payment systems prescribed by the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which will replace the current physician payment system in 2019.

The Political Luncheon, sponsored by SurgeonsPAC will feature Dr. Larry J. Sabato, founder and director, the University of Virginia Center for Politics and the University Professor of Politics at the University of Virginia, Charlottesville.

In recognition of the fact that “data” is THE buzzword today in health care policy, the afternoon session will feature a panel on how data is being utilized to change our current delivery and payment systems. Panelists include Vindell Washington, MD, the Principal Deputy National Coordinator in the Office of the National Coordinator for Health Information Technology (ONC), and Brian Kelly, MD, President, Payer and Provider Solutions for Quintiles. ACS has recently partnered with Quintiles on a major project to make the College’s multiple systems of data management more effective.

As mentioned above, the Leadership and Advocacy Summit closes on Tuesday, April 12, with a trip to Capitol Hill for Fellows to meet their individual members of the House of Representatives and Senate as well as their staff. This activity provides an important opportunity to put to good use the skills learned or refined on Sunday and Monday. We strongly encourage everyone who attends to stay through to the end of the Summit and participate in this important advocacy initiative.

Make a difference and join us in Washington. Register today to attend the 2016 Leadership and Advocacy Summit.

For questions about registration, please contact ACS Registration Services at registration@facs.org or 312-202-5244.

For questions surrounding the Leadership Summit, please contact Donna Tieberg at dtieberg@facs.org or 312-202-5361.

For questions regarding the Advocacy Summit, please contact Michael Carmody at mcarmody@facs.org or 202-672-1511.

I look forward to seeing you in April in Washington!

Until next month …

The American College of Surgeons (ACS) will host the fifth annual Leadership & Advocacy Summit, April 9-12, at the JW Marriott in Washington, D.C. This annual Summit event is a dual-purpose meeting that offers volunteer ACS leaders and surgeon advocates comprehensive and specialized sessions focused on the tools needed to be more effective leaders as well as comprehensive, focused, and interactive advocacy training. The meeting “capstones” on April 12 with Capitol Hill meetings in congressional offices scheduled with the senators and representatives of whom individual Fellows are constituents.

I first attended the program in 2010 and with each subsequent year become ever more convinced of how critically important it is that surgeons be informed about and engaged in the processes of both the legislative and the administrative branches of their individual state and federal governments. This year’s program promises to educate, challenge and prepare Fellows to assist the ACS in shaping the future of surgical practice while working collaboratively with ACS leaders, key elected officials, as well as their surgery colleagues.

As surgeons, we must be leaders and experts in the building and maintenance of effective teams, changing and ever-evolving cultures, time management, mentoring, coaching, and taking decisive action. The leadership program is designed to develop and hone exemplary leadership skills. Current topics and presenters include Leading Through Team Conflict, David A. Rogers, MD, FACS; Toward Better Communications and Teamwork: Skills for Handling Difficult Conversations, Kurt O’Brien, MHROD; Social Media for the Surgeon: Lifelong Learning, Engagement, and Reputation Management, Deanna J. Attai, MD, FACS; and Enhancing Our Cultural Dexterity: The Next Step in Reducing Disparities and Providing Patient Centered Care, Adil H. Hader, MPH, MD, FACS. In addition, chapter success stories will be presented by ACS Governors from West Virginia, North Texas, and Georgia.

The advocacy portion of the program kicks off on the evening of April 10 with a dinner during which those assembled will hear from Chris Matthews, the host of Hardball on MSNBC.

We will begin the morning of April 11 with a panel session entitled, Strategies for Successful State Advocacy, followed by breakout sessions for advocacy training tailored to individual experience levels. Attendees will then hear from Patrick Conway, MD, MSc, the Deputy Administrator for Innovation and Quality and Chief Medical Officer, Centers for Medicare & Medicaid Services (CMS). Dr. Conway leads the Center for Clinical Standards and Quality (CCSQ) and the Center for Medicare and Medicaid Innovation (CMMI) at CMS. As such he is leading the way within CMS to move into the new physician payment systems prescribed by the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which will replace the current physician payment system in 2019.

The Political Luncheon, sponsored by SurgeonsPAC will feature Dr. Larry J. Sabato, founder and director, the University of Virginia Center for Politics and the University Professor of Politics at the University of Virginia, Charlottesville.

In recognition of the fact that “data” is THE buzzword today in health care policy, the afternoon session will feature a panel on how data is being utilized to change our current delivery and payment systems. Panelists include Vindell Washington, MD, the Principal Deputy National Coordinator in the Office of the National Coordinator for Health Information Technology (ONC), and Brian Kelly, MD, President, Payer and Provider Solutions for Quintiles. ACS has recently partnered with Quintiles on a major project to make the College’s multiple systems of data management more effective.

As mentioned above, the Leadership and Advocacy Summit closes on Tuesday, April 12, with a trip to Capitol Hill for Fellows to meet their individual members of the House of Representatives and Senate as well as their staff. This activity provides an important opportunity to put to good use the skills learned or refined on Sunday and Monday. We strongly encourage everyone who attends to stay through to the end of the Summit and participate in this important advocacy initiative.

Make a difference and join us in Washington. Register today to attend the 2016 Leadership and Advocacy Summit.

For questions about registration, please contact ACS Registration Services at registration@facs.org or 312-202-5244.

For questions surrounding the Leadership Summit, please contact Donna Tieberg at dtieberg@facs.org or 312-202-5361.

For questions regarding the Advocacy Summit, please contact Michael Carmody at mcarmody@facs.org or 202-672-1511.

I look forward to seeing you in April in Washington!

Until next month …

From the Washington Office: Medicare audit accountability

The Recovery Audit Contractor (RAC) program was launched in 2010 by the Centers for Medicare and Medicaid Services (CMS) with the intention of identifying and preventing improper payments to Medicare providers. Recovery Audit Contractors are paid on “contingency fee” basis, i.e. a commission on each claim that they deny. Some have thus likened their actions to those of ‘bounty hunters.” Though there is an appeals process, hospitals and physicians bear the cost of audits, denials, and appeals, regardless of the ultimate outcome of the appeals process.

Because of the lack of accountability in the RAC process, concern has been expressed about both the number of inaccurate findings as well as the high volume of appeals. As evidence, the American Hospital Association (AHA) reported that the Office of the Inspector General (OIG) found that 49% of hospital denials are appealed and 72% of the appeals brought before an Administrative Law Judge are overturned in favor of the hospital.

In response to these concerns, Rep. George Holding (R-NC) introduced the H.R. 2568, the Fair Medical Audits Act in May 2015. The bill was jointly referred to the Ways and Means and Energy and Commerce committees in the House of Representatives for further consideration. Currently, H.R. 2568 has 23 cosponsors.

H.R. 2568 addresses many of the concerns in the RAC program by:

• Enhancing transparency in the audit process to improve compliance.

• Improving the claims-review process by mandating that contractors meet appropriate knowledge and experience requirements.

• Promoting provider education while increasing RAC accountability for inaccurate audit findings.

• Ensuring accuracy of those overpayment amounts calculated by contractors using extrapolation methodology.

• Requiring contractors to reimburse certain documentation requests to reduce provider burdens.

• Delaying payment to RACs until after external appeal.

• Reducing the appeals backlog by shortening the “look-back” period.

On Dec. 3, 2015, the American College of Surgeons joined 10 other surgical associations in sending a letter of support to Representative Holding thanking him for introducing the Fair Medical Audits Act. In addition, an ACTION ALERT was posted on the SurgeonsVoice website to facilitate the efforts of Fellows in contacting their individual representatives urging they support the legislation. I would urge all Fellows to log onto www.surgeonsvoice.org, and then click on the “TAKE ACTION” tab on the right side of the screen. It takes only a few moments to send a message to your Member of Congress requesting their assistance in passing this sensible legislation increasing accountability in the Medicare Recovery Audit Contractor program.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

The Recovery Audit Contractor (RAC) program was launched in 2010 by the Centers for Medicare and Medicaid Services (CMS) with the intention of identifying and preventing improper payments to Medicare providers. Recovery Audit Contractors are paid on “contingency fee” basis, i.e. a commission on each claim that they deny. Some have thus likened their actions to those of ‘bounty hunters.” Though there is an appeals process, hospitals and physicians bear the cost of audits, denials, and appeals, regardless of the ultimate outcome of the appeals process.

Because of the lack of accountability in the RAC process, concern has been expressed about both the number of inaccurate findings as well as the high volume of appeals. As evidence, the American Hospital Association (AHA) reported that the Office of the Inspector General (OIG) found that 49% of hospital denials are appealed and 72% of the appeals brought before an Administrative Law Judge are overturned in favor of the hospital.

In response to these concerns, Rep. George Holding (R-NC) introduced the H.R. 2568, the Fair Medical Audits Act in May 2015. The bill was jointly referred to the Ways and Means and Energy and Commerce committees in the House of Representatives for further consideration. Currently, H.R. 2568 has 23 cosponsors.

H.R. 2568 addresses many of the concerns in the RAC program by:

• Enhancing transparency in the audit process to improve compliance.

• Improving the claims-review process by mandating that contractors meet appropriate knowledge and experience requirements.

• Promoting provider education while increasing RAC accountability for inaccurate audit findings.

• Ensuring accuracy of those overpayment amounts calculated by contractors using extrapolation methodology.

• Requiring contractors to reimburse certain documentation requests to reduce provider burdens.

• Delaying payment to RACs until after external appeal.

• Reducing the appeals backlog by shortening the “look-back” period.

On Dec. 3, 2015, the American College of Surgeons joined 10 other surgical associations in sending a letter of support to Representative Holding thanking him for introducing the Fair Medical Audits Act. In addition, an ACTION ALERT was posted on the SurgeonsVoice website to facilitate the efforts of Fellows in contacting their individual representatives urging they support the legislation. I would urge all Fellows to log onto www.surgeonsvoice.org, and then click on the “TAKE ACTION” tab on the right side of the screen. It takes only a few moments to send a message to your Member of Congress requesting their assistance in passing this sensible legislation increasing accountability in the Medicare Recovery Audit Contractor program.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

The Recovery Audit Contractor (RAC) program was launched in 2010 by the Centers for Medicare and Medicaid Services (CMS) with the intention of identifying and preventing improper payments to Medicare providers. Recovery Audit Contractors are paid on “contingency fee” basis, i.e. a commission on each claim that they deny. Some have thus likened their actions to those of ‘bounty hunters.” Though there is an appeals process, hospitals and physicians bear the cost of audits, denials, and appeals, regardless of the ultimate outcome of the appeals process.

Because of the lack of accountability in the RAC process, concern has been expressed about both the number of inaccurate findings as well as the high volume of appeals. As evidence, the American Hospital Association (AHA) reported that the Office of the Inspector General (OIG) found that 49% of hospital denials are appealed and 72% of the appeals brought before an Administrative Law Judge are overturned in favor of the hospital.

In response to these concerns, Rep. George Holding (R-NC) introduced the H.R. 2568, the Fair Medical Audits Act in May 2015. The bill was jointly referred to the Ways and Means and Energy and Commerce committees in the House of Representatives for further consideration. Currently, H.R. 2568 has 23 cosponsors.

H.R. 2568 addresses many of the concerns in the RAC program by:

• Enhancing transparency in the audit process to improve compliance.

• Improving the claims-review process by mandating that contractors meet appropriate knowledge and experience requirements.

• Promoting provider education while increasing RAC accountability for inaccurate audit findings.

• Ensuring accuracy of those overpayment amounts calculated by contractors using extrapolation methodology.

• Requiring contractors to reimburse certain documentation requests to reduce provider burdens.

• Delaying payment to RACs until after external appeal.

• Reducing the appeals backlog by shortening the “look-back” period.

On Dec. 3, 2015, the American College of Surgeons joined 10 other surgical associations in sending a letter of support to Representative Holding thanking him for introducing the Fair Medical Audits Act. In addition, an ACTION ALERT was posted on the SurgeonsVoice website to facilitate the efforts of Fellows in contacting their individual representatives urging they support the legislation. I would urge all Fellows to log onto www.surgeonsvoice.org, and then click on the “TAKE ACTION” tab on the right side of the screen. It takes only a few moments to send a message to your Member of Congress requesting their assistance in passing this sensible legislation increasing accountability in the Medicare Recovery Audit Contractor program.

Until next month …

Dr. Patrick V. Bailey is an ACS Fellow, a pediatric surgeon, and Medical Director, Advocacy, for the Division of Advocacy and Health Policy, in the ACS offices in Washington, D.C.

From the Washington Office: Avoid Medicare Penalties

In the August edition of this column, I wrote at length about the requirement for surgeons to successfully report Medicare quality data in the current calendar year of 2015 in order to avoid Medicare payment penalties of up to 9 percent in 2017. It is absolutely imperative that surgeons take the time necessary to comply with the requirements of Medicare’s three current law quality programs in order to avoid the penalties associated with such.

Even though the MACRA legislation passed earlier this year mandates significant changes in the way Medicare payment updates to physicians are calculated, those changes will not go into effect until 2019. In the meantime, penalties remain in effect for Medicare’s three current law quality programs: PQRS (Physician Quality Reporting System), VBM (Value-Based Modifier) and EHR-MU (Electronic Health Record-Meaningful Use).

While it is certainly understandable that one could deem this requirement to be an unnecessary administrative burden taking time away from otherwise already busy and complex lives, successful compliance is not as daunting as one might imagine. Specifically, only one key action is necessary to avoid the Medicare penalties otherwise imposed by both PQRS and the VBM. That key action is compliance with the requirements of PQRS. Additionally, there are several resources available to you through the College’s website specifically designed to facilitate successful reporting in the most efficient way possible and minimize the time on task necessary to comply.

As was recently communicated to all Fellows in an e-mail communication from Dr. Hoyt, the ACS Surgeon Specific Registry (SSR) allows surgeons to track their cases and also facilitates compliance with the regulatory requirements of PQRS. Registration for the SSR can be found at: https://www.facs.org/quality-programs/ssr

The SSR allows surgeons to report on:

1) PQRS General Surgery Measures Group

2) PQRS Individual Measures

3) ACS SSR QCDR – Trauma Measures Option

Surgeons can utilize any of the three options to meet the requirements for PQRS compliance. A list of all the reportable measures available for each of the above can be found at: https://www.facs.org/quality-programs/ssr/pqrs/options.

For those surgeons for whom it could be applicable, the PQRS General Surgery Measure Group option is perhaps the least onerous. With this option, surgeons need to report on only twenty patients, eleven of whom must be Medicare Part B patients. Should this option be selected, Fellows need to be certain to complete the information by reporting on ALL seven of the included measures along with all nine risk factor variables for each of the twenty patients.

The deadline for submission of calendar year 2015 data into the SSR is January 31, 2016. The SSR will submit PQRS data on behalf of surgeons to Centers for Medicare and Medicaid Services (CMS).

The SSR is free of charge to ACS members.

Links to additional resources which provide further information include:

1) Glossary of Terms: https://www.facs.org/advocacy/regulatory/medicare-penalties/glossary

2) “How to Avoid Medicare Penalties” – summary document: https://www.facs.org/advocacy/regulatory/medicare-penalties

3) Step by Step Flowchart of Participation in Medicare Quality Programs: https://www.facs.org/advocacy/quality/medicare-programs

As always, ACS staff in both the Washington and Chicago offices are available to answer questions and assist members in participating in the 2015 PQRS program:

General PQRS questions: ACS Division of Advocacy and Health Policy, 202/337-6701 or QualityDC@facs.org.

Specific SSR questions: ACS Division of Research and Optimal Patient Care, 312/202-5000 or ssr@facs.org.

In closing, I will again highly encourage all Fellows to invest the time necessary to successfully comply with the PQRS requirement through the SSR and thereby avoid penalties of up to 9 percent in their 2017 Medicare payment.

Until next month...

Dr. Bailey is a pediatric surgeon and Medical Director, Advocacy for the Division of Advocacy and Health Policy in the ACS offices in Washington.

In the August edition of this column, I wrote at length about the requirement for surgeons to successfully report Medicare quality data in the current calendar year of 2015 in order to avoid Medicare payment penalties of up to 9 percent in 2017. It is absolutely imperative that surgeons take the time necessary to comply with the requirements of Medicare’s three current law quality programs in order to avoid the penalties associated with such.

Even though the MACRA legislation passed earlier this year mandates significant changes in the way Medicare payment updates to physicians are calculated, those changes will not go into effect until 2019. In the meantime, penalties remain in effect for Medicare’s three current law quality programs: PQRS (Physician Quality Reporting System), VBM (Value-Based Modifier) and EHR-MU (Electronic Health Record-Meaningful Use).

While it is certainly understandable that one could deem this requirement to be an unnecessary administrative burden taking time away from otherwise already busy and complex lives, successful compliance is not as daunting as one might imagine. Specifically, only one key action is necessary to avoid the Medicare penalties otherwise imposed by both PQRS and the VBM. That key action is compliance with the requirements of PQRS. Additionally, there are several resources available to you through the College’s website specifically designed to facilitate successful reporting in the most efficient way possible and minimize the time on task necessary to comply.

As was recently communicated to all Fellows in an e-mail communication from Dr. Hoyt, the ACS Surgeon Specific Registry (SSR) allows surgeons to track their cases and also facilitates compliance with the regulatory requirements of PQRS. Registration for the SSR can be found at: https://www.facs.org/quality-programs/ssr

The SSR allows surgeons to report on:

1) PQRS General Surgery Measures Group

2) PQRS Individual Measures

3) ACS SSR QCDR – Trauma Measures Option

Surgeons can utilize any of the three options to meet the requirements for PQRS compliance. A list of all the reportable measures available for each of the above can be found at: https://www.facs.org/quality-programs/ssr/pqrs/options.

For those surgeons for whom it could be applicable, the PQRS General Surgery Measure Group option is perhaps the least onerous. With this option, surgeons need to report on only twenty patients, eleven of whom must be Medicare Part B patients. Should this option be selected, Fellows need to be certain to complete the information by reporting on ALL seven of the included measures along with all nine risk factor variables for each of the twenty patients.

The deadline for submission of calendar year 2015 data into the SSR is January 31, 2016. The SSR will submit PQRS data on behalf of surgeons to Centers for Medicare and Medicaid Services (CMS).

The SSR is free of charge to ACS members.

Links to additional resources which provide further information include:

1) Glossary of Terms: https://www.facs.org/advocacy/regulatory/medicare-penalties/glossary

2) “How to Avoid Medicare Penalties” – summary document: https://www.facs.org/advocacy/regulatory/medicare-penalties

3) Step by Step Flowchart of Participation in Medicare Quality Programs: https://www.facs.org/advocacy/quality/medicare-programs

As always, ACS staff in both the Washington and Chicago offices are available to answer questions and assist members in participating in the 2015 PQRS program:

General PQRS questions: ACS Division of Advocacy and Health Policy, 202/337-6701 or QualityDC@facs.org.

Specific SSR questions: ACS Division of Research and Optimal Patient Care, 312/202-5000 or ssr@facs.org.

In closing, I will again highly encourage all Fellows to invest the time necessary to successfully comply with the PQRS requirement through the SSR and thereby avoid penalties of up to 9 percent in their 2017 Medicare payment.

Until next month...

Dr. Bailey is a pediatric surgeon and Medical Director, Advocacy for the Division of Advocacy and Health Policy in the ACS offices in Washington.

In the August edition of this column, I wrote at length about the requirement for surgeons to successfully report Medicare quality data in the current calendar year of 2015 in order to avoid Medicare payment penalties of up to 9 percent in 2017. It is absolutely imperative that surgeons take the time necessary to comply with the requirements of Medicare’s three current law quality programs in order to avoid the penalties associated with such.

Even though the MACRA legislation passed earlier this year mandates significant changes in the way Medicare payment updates to physicians are calculated, those changes will not go into effect until 2019. In the meantime, penalties remain in effect for Medicare’s three current law quality programs: PQRS (Physician Quality Reporting System), VBM (Value-Based Modifier) and EHR-MU (Electronic Health Record-Meaningful Use).

While it is certainly understandable that one could deem this requirement to be an unnecessary administrative burden taking time away from otherwise already busy and complex lives, successful compliance is not as daunting as one might imagine. Specifically, only one key action is necessary to avoid the Medicare penalties otherwise imposed by both PQRS and the VBM. That key action is compliance with the requirements of PQRS. Additionally, there are several resources available to you through the College’s website specifically designed to facilitate successful reporting in the most efficient way possible and minimize the time on task necessary to comply.

As was recently communicated to all Fellows in an e-mail communication from Dr. Hoyt, the ACS Surgeon Specific Registry (SSR) allows surgeons to track their cases and also facilitates compliance with the regulatory requirements of PQRS. Registration for the SSR can be found at: https://www.facs.org/quality-programs/ssr

The SSR allows surgeons to report on:

1) PQRS General Surgery Measures Group

2) PQRS Individual Measures

3) ACS SSR QCDR – Trauma Measures Option

Surgeons can utilize any of the three options to meet the requirements for PQRS compliance. A list of all the reportable measures available for each of the above can be found at: https://www.facs.org/quality-programs/ssr/pqrs/options.

For those surgeons for whom it could be applicable, the PQRS General Surgery Measure Group option is perhaps the least onerous. With this option, surgeons need to report on only twenty patients, eleven of whom must be Medicare Part B patients. Should this option be selected, Fellows need to be certain to complete the information by reporting on ALL seven of the included measures along with all nine risk factor variables for each of the twenty patients.

The deadline for submission of calendar year 2015 data into the SSR is January 31, 2016. The SSR will submit PQRS data on behalf of surgeons to Centers for Medicare and Medicaid Services (CMS).

The SSR is free of charge to ACS members.

Links to additional resources which provide further information include:

1) Glossary of Terms: https://www.facs.org/advocacy/regulatory/medicare-penalties/glossary

2) “How to Avoid Medicare Penalties” – summary document: https://www.facs.org/advocacy/regulatory/medicare-penalties

3) Step by Step Flowchart of Participation in Medicare Quality Programs: https://www.facs.org/advocacy/quality/medicare-programs

As always, ACS staff in both the Washington and Chicago offices are available to answer questions and assist members in participating in the 2015 PQRS program:

General PQRS questions: ACS Division of Advocacy and Health Policy, 202/337-6701 or QualityDC@facs.org.

Specific SSR questions: ACS Division of Research and Optimal Patient Care, 312/202-5000 or ssr@facs.org.

In closing, I will again highly encourage all Fellows to invest the time necessary to successfully comply with the PQRS requirement through the SSR and thereby avoid penalties of up to 9 percent in their 2017 Medicare payment.

Until next month...

Dr. Bailey is a pediatric surgeon and Medical Director, Advocacy for the Division of Advocacy and Health Policy in the ACS offices in Washington.

From the Washington Office

This month I am writing to encourage Fellows to contact their representatives and senators to ask that they support the Critical Access Hospital Relief Act, H.R. 169 and S. 258.

Approximately 2 years ago, surgeons working at Critical Access Hospitals (CAHs) began to encounter a new barrier to caring for their patients and in some cases have been forced to send patients to other hospitals far from their homes to receive care. The barrier responsible is contained in legislation originally passed in the Balanced Budget Act of 1997, the same legislation responsible for the sustainable growth rate (SGR) and the current caps on Medicare-sponsored graduate medical education positions.

Under current law, for facilities to qualify for Medicare certification and thus participate in the Medicare program itself, CAHs must meet minimum health and safety standards known as conditions of participation. In addition, the Centers for Medicare & Medicaid Services (CMS) imposes certain Medicare conditions of payment that must be met for a CAH to receive Medicare Part A reimbursement.

The CAH 96-hour rule imposes both a condition of participation and a condition of payment on CAHs. As mentioned above, though this provision has been in the law since 1997, it was not until fall of 2013 that the condition of payment began to be enforced. Prior to that time, only the condition of participation, requiring that acute inpatient care not exceed 96 hours per patient on an average basis, had been enforced by the CMS. Despite being written in the same legislation passed in 1997, the condition of payment was virtually unknown until September of 2013 when the CMS released a statement in a document pertaining to a related policy. At that time, it was indicated that the condition of payment in the 96-hour rule would be more strictly enforced. That condition of payment states that CAHs will receive Medicare Part A reimbursement only if the admitting physician certifies, at the time of admission, that the patient can reasonably be expected to be discharged or transferred within 96 hours. This was the first time many CAHs and the surgeons and other physicians working in such facilities had ever heard of the 96-hour rule’s condition of payment certification requirement.

Since the advisory was released, administrators at some CAHs have begun requiring surgeons to sign certifications upon admission stating that the patient being admitted can reasonably be expected to be discharged or transferred within 96 hours of admission. Obviously, this has caused great concern for surgeons and other providers serving populations who receive care in CAHs. Many surgeons practicing in such rural settings routinely perform procedures and provide care for surgical patients in those CAHs with expected stays likely to exceed 4 days. On the other hand, while any individual patient may require inpatient admission exceeding 96 hours, CAHs have generally not had difficulty maintaining the 96-hour average required by the condition of participation.