User login

While reimbursement for ObGyn services seemingly should be a simple matter of putting codes on a claim form, the reality is that it is complex, and it requires a team approach to accomplish timely filing to receive fair and accurate reimbursement.

Reimbursement occurs over the length of the revenue cycle for a patient encounter and involves many steps. It starts when the patient makes an appointment for services and ends when the practice receives payment. Along the way, there must be good clinician documentation and sound knowledge about the billing process (including the Current Procedural Terminology [CPT] or Healthcare Common Procedure Coding System [HCPCS] codes for services), the International Classification of Diseases, Tenth Revision, Clinical Modification [ICD-10-CM] codes that establish medical necessity, the modifiers that alter the meaning of the codes, and, of course, the bundling issues that now accompany many coding situations.

In addition, ObGyn practices must contend with a multitude of payers—from federal to commercial—and must understand and adhere to each payer’s rules and policies to maximize and retain reimbursement.

In this article, I detail stumbling blocks to maximizing reimbursement and how to avoid them.

Coding considerations for office services

Good documentation before, during, and after a patient’s office visit is essential, along with accurate codes, modifiers, and order of services on the claims you submit.

Prep paperwork before the patient encounter

Once a patient makes an appointment, the front-end staff can handle some of the tasks in the cycle. This includes ensuring that the patient’s insurance coverage information is current, informing the patient of any additional information to bring at the time of the visit (such as a patient history form for a new patient visit or a list of current prescriptions), or, if an established patient will be having a procedure, making sure that prior authorization is complete. This streamlines the process, assists the clinician with documentation housekeeping, and ensures that incorrect or missing information does not cause a claim to be denied or not be filed in a timely manner (many payers require submission of an initial claim 30 days from the date of service).

Continue to: Document details of the clinician-patient interaction

Document details of the clinician-patient interaction

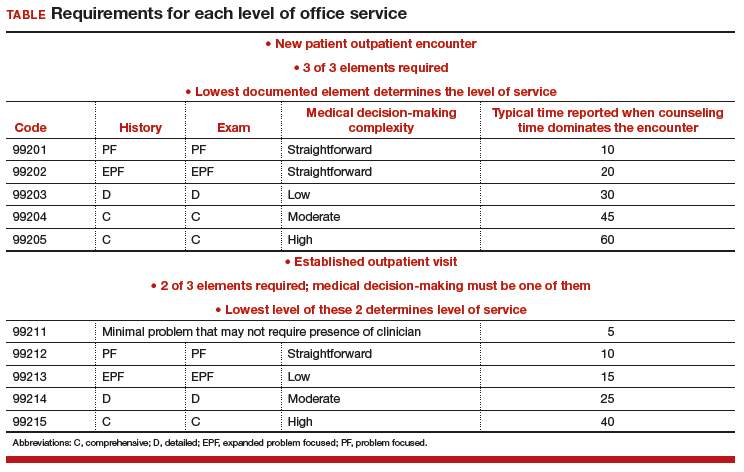

At the time of the encounter, you are responsible for documenting your contact with the patient in enough detail to support billing a CPT evaluation and management (E/M) code at the level selected and/or any procedures or other services performed. The TABLE provides an overview of the requirements for each level of office service.

If both an E/M and a procedure are performed on the same date of service, the E/M must be documented to show it was separate from the procedure and that the work was significantly more than would be required to accomplish the procedure. Documentation of the procedure should include the indication, steps performed, findings, the patient’s condition afterward, and instructions for aftercare or follow-up.

If you use an electronic health record for reporting, you may be the one responsible for selecting both the CPT code for services performed and an ICD-10-CM code(s) to establish the medical need for them. Select the most accurate CPT codes, and clearly link them to a supporting diagnosis for each service that will be billed. If more than one diagnosis is applicable, the first one linked to any given service should represent the most important justification, as not all payers will accept more than one diagnosis code on the claim per service billed.

If the billing staff is assigned the task of selecting the CPT and/or ICD-10-CM diagnostic codes based on your documentation, they should be well versed in the services, procedures, and diagnoses reported for their ObGyn practice.

The actual code selection may end up being a joint venture between the clinician and the staff to ensure that accurate information will be entered on the claim. Good and frequent clinician-staff communication on billing of services can transform average reimbursement into maximized reimbursement.

Be aware of bundles

Sometimes more than one service or procedure is listed on a claim on the same date of service. However, it is important to identify all potential bundles before billing to ensure correct payment. For instance, payers like to bundle an E/M service and a procedure, or you may be in the global period (defined below) of a surgery but need to report an unrelated service.

You and your staff must work together to ensure the claim is submitted with the correct modifiers; on the other hand, you may decide that a better method of coding is in order. Some payers, for example, will not reimburse both an insertion and a removal of an intrauterine device (IUD) on the same date of service. If that does happen, a modifier on the removal code might save the day, rather than billing 2 codes.

Continue to: Manage the modifiers

Manage the modifiers

Sometimes the code billed requires a modifier to ensure payment. Typical modifiers used in an ObGyn office setting include the following:

- 22, Increased procedural services (the clinician must assign a fee that is higher than the usual fee for the procedure and be able to document CPT equivalents to the work involved)

- 24, Unrelated E/M during the postoperative period (note that this modifier does not apply during the antepartum period for pregnancy)

- 25, Significant and separate E/M on the same date as another service or minor procedure

- 52, Reduced services (generally, the payer will expect an explanation of the reduced service and will determine payment accordingly)

- 57, Decision to perform major surgery the day of or the day before the surgery

- 59, Distinct procedural service (used when 2 procedures are bundled and a modifier is allowed). Note that payment reductions for multiple procedures will still apply.

- 79, Unrelated procedure during the postoperative period (usually paid at the full allowable).

Organize the order of services on the claim

For an outpatient claim that includes both an E/M service and procedures, the order of the services—not the order in which they were performed—may be important to obtaining maximum reimbursement. In general, payers will pay in full for a supported E/M service no matter where it appears on the claim, but they apply reductions only for multiple procedures.

For instance, if you insert levonorgestrel implants on the same date as you remove a large polyp from the cervix, you would want to report the code with the highest relative value unit (RVU) first. In this case, it would be 11981 (4.05 RVUs), 57500 (3.61 RVUs).

In the IUD case mentioned earlier (removal and insertion of IUDs on the same date), the order of the codes, assuming the payer reimburses for both, will be even more important since removal usually has a higher payment: 58301 (2.70 RUVs), 58300 (1.54 RVUs).

Coding considerations for surgical services

Surgical services performed in a hospital or ambulatory surgical center present another set of must-dos to ensure timely and fair reimbursement.

Grasp the ‘global package’ concept

Understanding this concept can be crucial to getting paid for additional services during this time period and correct billing for any E/M services performed prior to surgery. In general, the routine history and physical examination performed prior to a major surgery is considered included in the work and should not be billed separately. Surgical clearance for a patient’s condition, such as hypertension, a heart condition, or lung issues, can be billed separately, but these generally are performed by someone other than the operating surgeon.

Procedures performed in the hospital setting generally will have a 10- or 90-day global period. During this time, any related E/M service should not be billed separately, and the use of modifiers becomes even more important than with office services.

Applicable modifiers for use with hospital surgery can include all those for outpatient services plus:

- 50, Bilateral procedure (for which you may be paid up to 150% of the allowable)

- 58, Staged or related procedure during the postoperative period (this may be paid at the full allowable)

- 62, Co-surgeons (both surgeons bill the same CPT code and both document their involvement in the surgery). Medicare will reimburse each surgeon 62.5% of the allowable.

- 78, Return to the operating room for an unplanned related procedure (the full allowable may be reduced by some payers owing to their belief that this is soon after the original procedure so intraoperative time only is considered).

Be savvy about surgical bundles

Here, it is important to understand all published bundling edits for multiple procedures performed by the same surgeon at the same surgical session. If a code combination is never allowed but the surgery is more intense due to additional work required, a modifier -22 may be your only option. Again, clear, concise documentation of the additional work is imperative to receive the additional payment.

When a modifier is allowed, it generally will be one that denotes a procedure done on bilateral organs (such as the ovaries) when there is no extensive code to cover all of the work or when the additional procedure is “distinct” and meets the criteria for using a modifier 59.

Medicare has expanded the modifier -59 into additional modifiers to further explain the situation. These additional modifiers are:

- XE, A service that is distinct because it occurred during a separate encounter on the same date of service

- XS, A service that is distinct because it was performed on a separate organ/structure

- XP, A service that is distinct because it was performed by a different practitioner

- XU, The use of a service that is distinct because it does not overlap usual components of the main service.

Standards of care: Some steps are inherent to the surgery

Expect to receive claim denials if you bill separately for adhesiolysis during a surgical procedure. Every payer considers this procedure related to access to the surgical site and will deny separate coding. If the lysis was truly significant in terms of work, try reporting the modifier 22 and provide adequate documentation.

Other procedures at the time of surgery that generally are not paid for include 1) examination under anesthesia, 2) any procedure done to check the surgeon’s work (for example, cystoscopy, especially when done after urinary or pelvic reconstruction procedures, or chromotubation following extensive ovariolysis), 3) placement of catheters, and 4) placement of devices to alleviate postsurgical pain.

Bottom line

Maximizing reimbursement involves good documentation, correct CPT codes linked to specific and accurate medical indications, the use of appropriate modifiers, and listing codes in order of their relative values from highest to lowest.

Should a denial or unfair reduction in payment come your way, analyze the rejection to determine the cause and make billing and reporting changes as needed to improve your future reimbursements.

Share your thoughts! Send your Letter to the Editor to rbarbieri@mdedge.com. Please include your name and the city and state in which you practice.

While reimbursement for ObGyn services seemingly should be a simple matter of putting codes on a claim form, the reality is that it is complex, and it requires a team approach to accomplish timely filing to receive fair and accurate reimbursement.

Reimbursement occurs over the length of the revenue cycle for a patient encounter and involves many steps. It starts when the patient makes an appointment for services and ends when the practice receives payment. Along the way, there must be good clinician documentation and sound knowledge about the billing process (including the Current Procedural Terminology [CPT] or Healthcare Common Procedure Coding System [HCPCS] codes for services), the International Classification of Diseases, Tenth Revision, Clinical Modification [ICD-10-CM] codes that establish medical necessity, the modifiers that alter the meaning of the codes, and, of course, the bundling issues that now accompany many coding situations.

In addition, ObGyn practices must contend with a multitude of payers—from federal to commercial—and must understand and adhere to each payer’s rules and policies to maximize and retain reimbursement.

In this article, I detail stumbling blocks to maximizing reimbursement and how to avoid them.

Coding considerations for office services

Good documentation before, during, and after a patient’s office visit is essential, along with accurate codes, modifiers, and order of services on the claims you submit.

Prep paperwork before the patient encounter

Once a patient makes an appointment, the front-end staff can handle some of the tasks in the cycle. This includes ensuring that the patient’s insurance coverage information is current, informing the patient of any additional information to bring at the time of the visit (such as a patient history form for a new patient visit or a list of current prescriptions), or, if an established patient will be having a procedure, making sure that prior authorization is complete. This streamlines the process, assists the clinician with documentation housekeeping, and ensures that incorrect or missing information does not cause a claim to be denied or not be filed in a timely manner (many payers require submission of an initial claim 30 days from the date of service).

Continue to: Document details of the clinician-patient interaction

Document details of the clinician-patient interaction

At the time of the encounter, you are responsible for documenting your contact with the patient in enough detail to support billing a CPT evaluation and management (E/M) code at the level selected and/or any procedures or other services performed. The TABLE provides an overview of the requirements for each level of office service.

If both an E/M and a procedure are performed on the same date of service, the E/M must be documented to show it was separate from the procedure and that the work was significantly more than would be required to accomplish the procedure. Documentation of the procedure should include the indication, steps performed, findings, the patient’s condition afterward, and instructions for aftercare or follow-up.

If you use an electronic health record for reporting, you may be the one responsible for selecting both the CPT code for services performed and an ICD-10-CM code(s) to establish the medical need for them. Select the most accurate CPT codes, and clearly link them to a supporting diagnosis for each service that will be billed. If more than one diagnosis is applicable, the first one linked to any given service should represent the most important justification, as not all payers will accept more than one diagnosis code on the claim per service billed.

If the billing staff is assigned the task of selecting the CPT and/or ICD-10-CM diagnostic codes based on your documentation, they should be well versed in the services, procedures, and diagnoses reported for their ObGyn practice.

The actual code selection may end up being a joint venture between the clinician and the staff to ensure that accurate information will be entered on the claim. Good and frequent clinician-staff communication on billing of services can transform average reimbursement into maximized reimbursement.

Be aware of bundles

Sometimes more than one service or procedure is listed on a claim on the same date of service. However, it is important to identify all potential bundles before billing to ensure correct payment. For instance, payers like to bundle an E/M service and a procedure, or you may be in the global period (defined below) of a surgery but need to report an unrelated service.

You and your staff must work together to ensure the claim is submitted with the correct modifiers; on the other hand, you may decide that a better method of coding is in order. Some payers, for example, will not reimburse both an insertion and a removal of an intrauterine device (IUD) on the same date of service. If that does happen, a modifier on the removal code might save the day, rather than billing 2 codes.

Continue to: Manage the modifiers

Manage the modifiers

Sometimes the code billed requires a modifier to ensure payment. Typical modifiers used in an ObGyn office setting include the following:

- 22, Increased procedural services (the clinician must assign a fee that is higher than the usual fee for the procedure and be able to document CPT equivalents to the work involved)

- 24, Unrelated E/M during the postoperative period (note that this modifier does not apply during the antepartum period for pregnancy)

- 25, Significant and separate E/M on the same date as another service or minor procedure

- 52, Reduced services (generally, the payer will expect an explanation of the reduced service and will determine payment accordingly)

- 57, Decision to perform major surgery the day of or the day before the surgery

- 59, Distinct procedural service (used when 2 procedures are bundled and a modifier is allowed). Note that payment reductions for multiple procedures will still apply.

- 79, Unrelated procedure during the postoperative period (usually paid at the full allowable).

Organize the order of services on the claim

For an outpatient claim that includes both an E/M service and procedures, the order of the services—not the order in which they were performed—may be important to obtaining maximum reimbursement. In general, payers will pay in full for a supported E/M service no matter where it appears on the claim, but they apply reductions only for multiple procedures.

For instance, if you insert levonorgestrel implants on the same date as you remove a large polyp from the cervix, you would want to report the code with the highest relative value unit (RVU) first. In this case, it would be 11981 (4.05 RVUs), 57500 (3.61 RVUs).

In the IUD case mentioned earlier (removal and insertion of IUDs on the same date), the order of the codes, assuming the payer reimburses for both, will be even more important since removal usually has a higher payment: 58301 (2.70 RUVs), 58300 (1.54 RVUs).

Coding considerations for surgical services

Surgical services performed in a hospital or ambulatory surgical center present another set of must-dos to ensure timely and fair reimbursement.

Grasp the ‘global package’ concept

Understanding this concept can be crucial to getting paid for additional services during this time period and correct billing for any E/M services performed prior to surgery. In general, the routine history and physical examination performed prior to a major surgery is considered included in the work and should not be billed separately. Surgical clearance for a patient’s condition, such as hypertension, a heart condition, or lung issues, can be billed separately, but these generally are performed by someone other than the operating surgeon.

Procedures performed in the hospital setting generally will have a 10- or 90-day global period. During this time, any related E/M service should not be billed separately, and the use of modifiers becomes even more important than with office services.

Applicable modifiers for use with hospital surgery can include all those for outpatient services plus:

- 50, Bilateral procedure (for which you may be paid up to 150% of the allowable)

- 58, Staged or related procedure during the postoperative period (this may be paid at the full allowable)

- 62, Co-surgeons (both surgeons bill the same CPT code and both document their involvement in the surgery). Medicare will reimburse each surgeon 62.5% of the allowable.

- 78, Return to the operating room for an unplanned related procedure (the full allowable may be reduced by some payers owing to their belief that this is soon after the original procedure so intraoperative time only is considered).

Be savvy about surgical bundles

Here, it is important to understand all published bundling edits for multiple procedures performed by the same surgeon at the same surgical session. If a code combination is never allowed but the surgery is more intense due to additional work required, a modifier -22 may be your only option. Again, clear, concise documentation of the additional work is imperative to receive the additional payment.

When a modifier is allowed, it generally will be one that denotes a procedure done on bilateral organs (such as the ovaries) when there is no extensive code to cover all of the work or when the additional procedure is “distinct” and meets the criteria for using a modifier 59.

Medicare has expanded the modifier -59 into additional modifiers to further explain the situation. These additional modifiers are:

- XE, A service that is distinct because it occurred during a separate encounter on the same date of service

- XS, A service that is distinct because it was performed on a separate organ/structure

- XP, A service that is distinct because it was performed by a different practitioner

- XU, The use of a service that is distinct because it does not overlap usual components of the main service.

Standards of care: Some steps are inherent to the surgery

Expect to receive claim denials if you bill separately for adhesiolysis during a surgical procedure. Every payer considers this procedure related to access to the surgical site and will deny separate coding. If the lysis was truly significant in terms of work, try reporting the modifier 22 and provide adequate documentation.

Other procedures at the time of surgery that generally are not paid for include 1) examination under anesthesia, 2) any procedure done to check the surgeon’s work (for example, cystoscopy, especially when done after urinary or pelvic reconstruction procedures, or chromotubation following extensive ovariolysis), 3) placement of catheters, and 4) placement of devices to alleviate postsurgical pain.

Bottom line

Maximizing reimbursement involves good documentation, correct CPT codes linked to specific and accurate medical indications, the use of appropriate modifiers, and listing codes in order of their relative values from highest to lowest.

Should a denial or unfair reduction in payment come your way, analyze the rejection to determine the cause and make billing and reporting changes as needed to improve your future reimbursements.

Share your thoughts! Send your Letter to the Editor to rbarbieri@mdedge.com. Please include your name and the city and state in which you practice.

While reimbursement for ObGyn services seemingly should be a simple matter of putting codes on a claim form, the reality is that it is complex, and it requires a team approach to accomplish timely filing to receive fair and accurate reimbursement.

Reimbursement occurs over the length of the revenue cycle for a patient encounter and involves many steps. It starts when the patient makes an appointment for services and ends when the practice receives payment. Along the way, there must be good clinician documentation and sound knowledge about the billing process (including the Current Procedural Terminology [CPT] or Healthcare Common Procedure Coding System [HCPCS] codes for services), the International Classification of Diseases, Tenth Revision, Clinical Modification [ICD-10-CM] codes that establish medical necessity, the modifiers that alter the meaning of the codes, and, of course, the bundling issues that now accompany many coding situations.

In addition, ObGyn practices must contend with a multitude of payers—from federal to commercial—and must understand and adhere to each payer’s rules and policies to maximize and retain reimbursement.

In this article, I detail stumbling blocks to maximizing reimbursement and how to avoid them.

Coding considerations for office services

Good documentation before, during, and after a patient’s office visit is essential, along with accurate codes, modifiers, and order of services on the claims you submit.

Prep paperwork before the patient encounter

Once a patient makes an appointment, the front-end staff can handle some of the tasks in the cycle. This includes ensuring that the patient’s insurance coverage information is current, informing the patient of any additional information to bring at the time of the visit (such as a patient history form for a new patient visit or a list of current prescriptions), or, if an established patient will be having a procedure, making sure that prior authorization is complete. This streamlines the process, assists the clinician with documentation housekeeping, and ensures that incorrect or missing information does not cause a claim to be denied or not be filed in a timely manner (many payers require submission of an initial claim 30 days from the date of service).

Continue to: Document details of the clinician-patient interaction

Document details of the clinician-patient interaction

At the time of the encounter, you are responsible for documenting your contact with the patient in enough detail to support billing a CPT evaluation and management (E/M) code at the level selected and/or any procedures or other services performed. The TABLE provides an overview of the requirements for each level of office service.

If both an E/M and a procedure are performed on the same date of service, the E/M must be documented to show it was separate from the procedure and that the work was significantly more than would be required to accomplish the procedure. Documentation of the procedure should include the indication, steps performed, findings, the patient’s condition afterward, and instructions for aftercare or follow-up.

If you use an electronic health record for reporting, you may be the one responsible for selecting both the CPT code for services performed and an ICD-10-CM code(s) to establish the medical need for them. Select the most accurate CPT codes, and clearly link them to a supporting diagnosis for each service that will be billed. If more than one diagnosis is applicable, the first one linked to any given service should represent the most important justification, as not all payers will accept more than one diagnosis code on the claim per service billed.

If the billing staff is assigned the task of selecting the CPT and/or ICD-10-CM diagnostic codes based on your documentation, they should be well versed in the services, procedures, and diagnoses reported for their ObGyn practice.

The actual code selection may end up being a joint venture between the clinician and the staff to ensure that accurate information will be entered on the claim. Good and frequent clinician-staff communication on billing of services can transform average reimbursement into maximized reimbursement.

Be aware of bundles

Sometimes more than one service or procedure is listed on a claim on the same date of service. However, it is important to identify all potential bundles before billing to ensure correct payment. For instance, payers like to bundle an E/M service and a procedure, or you may be in the global period (defined below) of a surgery but need to report an unrelated service.

You and your staff must work together to ensure the claim is submitted with the correct modifiers; on the other hand, you may decide that a better method of coding is in order. Some payers, for example, will not reimburse both an insertion and a removal of an intrauterine device (IUD) on the same date of service. If that does happen, a modifier on the removal code might save the day, rather than billing 2 codes.

Continue to: Manage the modifiers

Manage the modifiers

Sometimes the code billed requires a modifier to ensure payment. Typical modifiers used in an ObGyn office setting include the following:

- 22, Increased procedural services (the clinician must assign a fee that is higher than the usual fee for the procedure and be able to document CPT equivalents to the work involved)

- 24, Unrelated E/M during the postoperative period (note that this modifier does not apply during the antepartum period for pregnancy)

- 25, Significant and separate E/M on the same date as another service or minor procedure

- 52, Reduced services (generally, the payer will expect an explanation of the reduced service and will determine payment accordingly)

- 57, Decision to perform major surgery the day of or the day before the surgery

- 59, Distinct procedural service (used when 2 procedures are bundled and a modifier is allowed). Note that payment reductions for multiple procedures will still apply.

- 79, Unrelated procedure during the postoperative period (usually paid at the full allowable).

Organize the order of services on the claim

For an outpatient claim that includes both an E/M service and procedures, the order of the services—not the order in which they were performed—may be important to obtaining maximum reimbursement. In general, payers will pay in full for a supported E/M service no matter where it appears on the claim, but they apply reductions only for multiple procedures.

For instance, if you insert levonorgestrel implants on the same date as you remove a large polyp from the cervix, you would want to report the code with the highest relative value unit (RVU) first. In this case, it would be 11981 (4.05 RVUs), 57500 (3.61 RVUs).

In the IUD case mentioned earlier (removal and insertion of IUDs on the same date), the order of the codes, assuming the payer reimburses for both, will be even more important since removal usually has a higher payment: 58301 (2.70 RUVs), 58300 (1.54 RVUs).

Coding considerations for surgical services

Surgical services performed in a hospital or ambulatory surgical center present another set of must-dos to ensure timely and fair reimbursement.

Grasp the ‘global package’ concept

Understanding this concept can be crucial to getting paid for additional services during this time period and correct billing for any E/M services performed prior to surgery. In general, the routine history and physical examination performed prior to a major surgery is considered included in the work and should not be billed separately. Surgical clearance for a patient’s condition, such as hypertension, a heart condition, or lung issues, can be billed separately, but these generally are performed by someone other than the operating surgeon.

Procedures performed in the hospital setting generally will have a 10- or 90-day global period. During this time, any related E/M service should not be billed separately, and the use of modifiers becomes even more important than with office services.

Applicable modifiers for use with hospital surgery can include all those for outpatient services plus:

- 50, Bilateral procedure (for which you may be paid up to 150% of the allowable)

- 58, Staged or related procedure during the postoperative period (this may be paid at the full allowable)

- 62, Co-surgeons (both surgeons bill the same CPT code and both document their involvement in the surgery). Medicare will reimburse each surgeon 62.5% of the allowable.

- 78, Return to the operating room for an unplanned related procedure (the full allowable may be reduced by some payers owing to their belief that this is soon after the original procedure so intraoperative time only is considered).

Be savvy about surgical bundles

Here, it is important to understand all published bundling edits for multiple procedures performed by the same surgeon at the same surgical session. If a code combination is never allowed but the surgery is more intense due to additional work required, a modifier -22 may be your only option. Again, clear, concise documentation of the additional work is imperative to receive the additional payment.

When a modifier is allowed, it generally will be one that denotes a procedure done on bilateral organs (such as the ovaries) when there is no extensive code to cover all of the work or when the additional procedure is “distinct” and meets the criteria for using a modifier 59.

Medicare has expanded the modifier -59 into additional modifiers to further explain the situation. These additional modifiers are:

- XE, A service that is distinct because it occurred during a separate encounter on the same date of service

- XS, A service that is distinct because it was performed on a separate organ/structure

- XP, A service that is distinct because it was performed by a different practitioner

- XU, The use of a service that is distinct because it does not overlap usual components of the main service.

Standards of care: Some steps are inherent to the surgery

Expect to receive claim denials if you bill separately for adhesiolysis during a surgical procedure. Every payer considers this procedure related to access to the surgical site and will deny separate coding. If the lysis was truly significant in terms of work, try reporting the modifier 22 and provide adequate documentation.

Other procedures at the time of surgery that generally are not paid for include 1) examination under anesthesia, 2) any procedure done to check the surgeon’s work (for example, cystoscopy, especially when done after urinary or pelvic reconstruction procedures, or chromotubation following extensive ovariolysis), 3) placement of catheters, and 4) placement of devices to alleviate postsurgical pain.

Bottom line

Maximizing reimbursement involves good documentation, correct CPT codes linked to specific and accurate medical indications, the use of appropriate modifiers, and listing codes in order of their relative values from highest to lowest.

Should a denial or unfair reduction in payment come your way, analyze the rejection to determine the cause and make billing and reporting changes as needed to improve your future reimbursements.

Share your thoughts! Send your Letter to the Editor to rbarbieri@mdedge.com. Please include your name and the city and state in which you practice.