User login

Philanthropy is a driving force supporting and promoting pioneering research and programs in many fields of medicine. Charitable giving, foundation support, and grants touch the lives of millions of patients and also have an impact across all fields of practice of medical practice. But philanthropy is being transformed by changing technology, interests of the giving public, and demands for accountability and transparency. Understanding where these trends are going will give physicians insights into what they can expect from philanthropy and what it might mean for their own institutions and interests.

In 2019, Charity Navigator reported total giving to charitable organizations was $427.1 billion, 0.7% measured in current dollars over the revised total of $424.74 billion contributed in 2017. Yet adjusted for inflation, overall giving declined 1.7%, primarily because individual giving declined. Foundation giving increased by an estimated 7.3% over 2017, to $75.86 billion in 2018 (an increase of 4.7%, adjusted for inflation). Giving by corporations is estimated to have increased by 5.4% in 2018, totaling $20.05 billion (an increase of 2.9%, adjusted for inflation).1

Impact investing, transparency, and trust

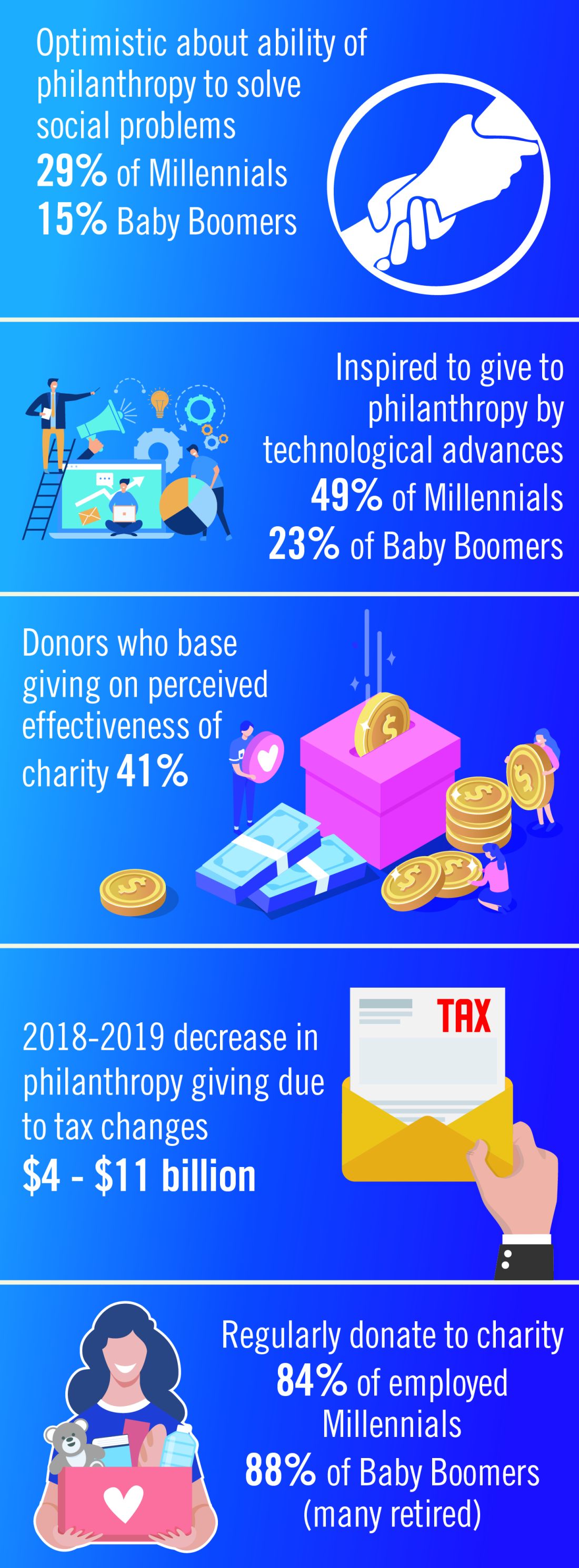

The demand for increased accountability in philanthropy is growing. Today’s donors want to know their contributions will have a real impact in causes they believe in. As donors become more focused on results, organizations will need to demonstrate their ability to achieve short-term goals that bring them closer to accomplishing their mission and vision. This sentiment may be strongest among Millennials. Nonprofit organizations should expect an increased level of due diligence and a higher level of personal involvement by donors. At least 41% of donors have changed their giving because of increased knowledge about nonprofit effectiveness. Foundations and corporations donate to medical centers and research institutions, but recipients are have an expectation of close involvement of donors, the need for detailed accounts of how funds are spent, and a responsibility to show progress or measurable outcomes.2

Health care–related issues

Two of the top three issues identified by donors as a challenge to be addressed are related to health care, according to Fidelity Charitable. Thirty-nine percent identified “developing treatment or cures for a disease” and 33% cited “access to basic health services” as priority issues. A study by Giving USA estimated that charitable giving to health care organizations rose a strong 7.3% (5.5% adjusted for inflation) in 2017, but giving that year was fueled by a booming stock market and a favorable tax environment. Charitable donations to hospitals tend to reflect the economic health of the community in which the institution is located. Donations to rural hospitals in depressed communities are likely to be far less than to urban institutions in economically strong areas.3

Tax reform

The Tax Cuts and Jobs Act of 2017 will likely affect donations to charitable organizations in 2019. Specifically, the 2017 Tax Act doubled the standard tax deduction, thereby reducing the number of households having to itemize their deductions and eliminating many tax benefits for charitable donations. Middle-class families are expected to opt for the standard deduction while wealthier taxpayers will likely continue itemizing their deductions. As a result, some predict that donors may switch from giving annually to giving every third year so they can itemize in their giving years to get the deduction. Estimates that charitable donations from individuals may decrease as much as $4 billion to $11 billion because of the increase in standard deductions and $0.9 billion to $2.1 billion because of the decrease in the marginal tax rate.4

Technology and peer-to-peer giving

Technological advances that make researching and giving easier and more convenient are likely to have a significant impact on many charitable organizations in 2019. Online donations are likely to increase as organizations make it simple to donate from mobile devices, social media platforms and their websites. Although charitable organizations will continue to directly ask individuals for a donation, many are expanding their efforts to include online social campaigns that leverage peer-to-peer giving. Other technological advancements likely to affect donations in the future include the ability for organizations to incorporate contactless payment programs and blockchain technology. Online giving grew by 12.1% over 2018-2019 with monthly automatic giving increasing by 40% over 2016 to 2017.5

Generational differences in giving

Although the trends identified above are likely to affect the decision to give in 2019, there are some meaningful differences in how different generations embrace these changes. Technological advances, the rise of alternative forms of giving, and increased opportunities to connect with peers about giving influence Millennials significantly more than Baby Boomers. Millennials are more likely to say that they give to make a meaningful difference while Boomers are likely to say that giving is part of their values. Millennials also are more likely to say their giving is more spontaneous while Boomers say their giving is more planned. As many as 49% of Millennials cite technological advances influencing their giving, compared with only 23% of Baby Boomers. This trend continues for the rise of alternative forms of giving (32% of Millennials, compared with 14% of Boomers) and increased opportunities to connect with peers about giving (30%, compared with 11%).

Twenty-nine percent of Millennials are very optimistic about philanthropy’s ability to solve the issues most important to them, compared with only 15% of Baby Boomers.2

One thing they have in common is their priorities. Both generations prioritize challenges related to health, hunger, and the environment.6

Today, foundations need to focus on impact, not just education programs or scholarships. New tech-driven trends in giving, such as the emergence of digital peer-to-peer giving and crowdfunding campaigns, make it possible to tap into high-volume, small-amount donations. To recruit new donors, organizations will need to target their messages based on the audience segment.

References:

1. Giving USA 2019: Annual report for philanthropy for 2018. Accessed Nov. 14, 2019.

2. Fidelity Charitable (2019) Future of philanthropy. Accessed Nov. 10, 2019.3. Betbeze, Philip (2018) Charitable giving to health giving to health organizations rose 7.3% last year. Health Leaders. July 11.

4. Martis & Landy/Indiana University Lilly Family School of Philanthropy (2018) The Philanthropy Outlook 2018 & 2019.

5. M&R Benchmarks 2019.

6. Nonprofit Source (2019) The ultimate list of charitable giving statistics for 2018. Accessed Nov. 10, 2019.

Note: Background research performed by Avenue M Group.

CHEST Inspiration is a collection of programmatic initiatives developed by the American College of Chest Physicians leadership and aimed at stimulating and encouraging innovation within the association. One of the components of CHEST Inspiration is the Environmental Scan, a series of articles focusing on the internal and external environmental factors that bear on success currently and in the future. See “Envisioning the Future: The CHEST Environmental Scan,” CHEST Physician, June 2019, p. 44, for an introduction to the series.

Philanthropy is a driving force supporting and promoting pioneering research and programs in many fields of medicine. Charitable giving, foundation support, and grants touch the lives of millions of patients and also have an impact across all fields of practice of medical practice. But philanthropy is being transformed by changing technology, interests of the giving public, and demands for accountability and transparency. Understanding where these trends are going will give physicians insights into what they can expect from philanthropy and what it might mean for their own institutions and interests.

In 2019, Charity Navigator reported total giving to charitable organizations was $427.1 billion, 0.7% measured in current dollars over the revised total of $424.74 billion contributed in 2017. Yet adjusted for inflation, overall giving declined 1.7%, primarily because individual giving declined. Foundation giving increased by an estimated 7.3% over 2017, to $75.86 billion in 2018 (an increase of 4.7%, adjusted for inflation). Giving by corporations is estimated to have increased by 5.4% in 2018, totaling $20.05 billion (an increase of 2.9%, adjusted for inflation).1

Impact investing, transparency, and trust

The demand for increased accountability in philanthropy is growing. Today’s donors want to know their contributions will have a real impact in causes they believe in. As donors become more focused on results, organizations will need to demonstrate their ability to achieve short-term goals that bring them closer to accomplishing their mission and vision. This sentiment may be strongest among Millennials. Nonprofit organizations should expect an increased level of due diligence and a higher level of personal involvement by donors. At least 41% of donors have changed their giving because of increased knowledge about nonprofit effectiveness. Foundations and corporations donate to medical centers and research institutions, but recipients are have an expectation of close involvement of donors, the need for detailed accounts of how funds are spent, and a responsibility to show progress or measurable outcomes.2

Health care–related issues

Two of the top three issues identified by donors as a challenge to be addressed are related to health care, according to Fidelity Charitable. Thirty-nine percent identified “developing treatment or cures for a disease” and 33% cited “access to basic health services” as priority issues. A study by Giving USA estimated that charitable giving to health care organizations rose a strong 7.3% (5.5% adjusted for inflation) in 2017, but giving that year was fueled by a booming stock market and a favorable tax environment. Charitable donations to hospitals tend to reflect the economic health of the community in which the institution is located. Donations to rural hospitals in depressed communities are likely to be far less than to urban institutions in economically strong areas.3

Tax reform

The Tax Cuts and Jobs Act of 2017 will likely affect donations to charitable organizations in 2019. Specifically, the 2017 Tax Act doubled the standard tax deduction, thereby reducing the number of households having to itemize their deductions and eliminating many tax benefits for charitable donations. Middle-class families are expected to opt for the standard deduction while wealthier taxpayers will likely continue itemizing their deductions. As a result, some predict that donors may switch from giving annually to giving every third year so they can itemize in their giving years to get the deduction. Estimates that charitable donations from individuals may decrease as much as $4 billion to $11 billion because of the increase in standard deductions and $0.9 billion to $2.1 billion because of the decrease in the marginal tax rate.4

Technology and peer-to-peer giving

Technological advances that make researching and giving easier and more convenient are likely to have a significant impact on many charitable organizations in 2019. Online donations are likely to increase as organizations make it simple to donate from mobile devices, social media platforms and their websites. Although charitable organizations will continue to directly ask individuals for a donation, many are expanding their efforts to include online social campaigns that leverage peer-to-peer giving. Other technological advancements likely to affect donations in the future include the ability for organizations to incorporate contactless payment programs and blockchain technology. Online giving grew by 12.1% over 2018-2019 with monthly automatic giving increasing by 40% over 2016 to 2017.5

Generational differences in giving

Although the trends identified above are likely to affect the decision to give in 2019, there are some meaningful differences in how different generations embrace these changes. Technological advances, the rise of alternative forms of giving, and increased opportunities to connect with peers about giving influence Millennials significantly more than Baby Boomers. Millennials are more likely to say that they give to make a meaningful difference while Boomers are likely to say that giving is part of their values. Millennials also are more likely to say their giving is more spontaneous while Boomers say their giving is more planned. As many as 49% of Millennials cite technological advances influencing their giving, compared with only 23% of Baby Boomers. This trend continues for the rise of alternative forms of giving (32% of Millennials, compared with 14% of Boomers) and increased opportunities to connect with peers about giving (30%, compared with 11%).

Twenty-nine percent of Millennials are very optimistic about philanthropy’s ability to solve the issues most important to them, compared with only 15% of Baby Boomers.2

One thing they have in common is their priorities. Both generations prioritize challenges related to health, hunger, and the environment.6

Today, foundations need to focus on impact, not just education programs or scholarships. New tech-driven trends in giving, such as the emergence of digital peer-to-peer giving and crowdfunding campaigns, make it possible to tap into high-volume, small-amount donations. To recruit new donors, organizations will need to target their messages based on the audience segment.

References:

1. Giving USA 2019: Annual report for philanthropy for 2018. Accessed Nov. 14, 2019.

2. Fidelity Charitable (2019) Future of philanthropy. Accessed Nov. 10, 2019.3. Betbeze, Philip (2018) Charitable giving to health giving to health organizations rose 7.3% last year. Health Leaders. July 11.

4. Martis & Landy/Indiana University Lilly Family School of Philanthropy (2018) The Philanthropy Outlook 2018 & 2019.

5. M&R Benchmarks 2019.

6. Nonprofit Source (2019) The ultimate list of charitable giving statistics for 2018. Accessed Nov. 10, 2019.

Note: Background research performed by Avenue M Group.

CHEST Inspiration is a collection of programmatic initiatives developed by the American College of Chest Physicians leadership and aimed at stimulating and encouraging innovation within the association. One of the components of CHEST Inspiration is the Environmental Scan, a series of articles focusing on the internal and external environmental factors that bear on success currently and in the future. See “Envisioning the Future: The CHEST Environmental Scan,” CHEST Physician, June 2019, p. 44, for an introduction to the series.

Philanthropy is a driving force supporting and promoting pioneering research and programs in many fields of medicine. Charitable giving, foundation support, and grants touch the lives of millions of patients and also have an impact across all fields of practice of medical practice. But philanthropy is being transformed by changing technology, interests of the giving public, and demands for accountability and transparency. Understanding where these trends are going will give physicians insights into what they can expect from philanthropy and what it might mean for their own institutions and interests.

In 2019, Charity Navigator reported total giving to charitable organizations was $427.1 billion, 0.7% measured in current dollars over the revised total of $424.74 billion contributed in 2017. Yet adjusted for inflation, overall giving declined 1.7%, primarily because individual giving declined. Foundation giving increased by an estimated 7.3% over 2017, to $75.86 billion in 2018 (an increase of 4.7%, adjusted for inflation). Giving by corporations is estimated to have increased by 5.4% in 2018, totaling $20.05 billion (an increase of 2.9%, adjusted for inflation).1

Impact investing, transparency, and trust

The demand for increased accountability in philanthropy is growing. Today’s donors want to know their contributions will have a real impact in causes they believe in. As donors become more focused on results, organizations will need to demonstrate their ability to achieve short-term goals that bring them closer to accomplishing their mission and vision. This sentiment may be strongest among Millennials. Nonprofit organizations should expect an increased level of due diligence and a higher level of personal involvement by donors. At least 41% of donors have changed their giving because of increased knowledge about nonprofit effectiveness. Foundations and corporations donate to medical centers and research institutions, but recipients are have an expectation of close involvement of donors, the need for detailed accounts of how funds are spent, and a responsibility to show progress or measurable outcomes.2

Health care–related issues

Two of the top three issues identified by donors as a challenge to be addressed are related to health care, according to Fidelity Charitable. Thirty-nine percent identified “developing treatment or cures for a disease” and 33% cited “access to basic health services” as priority issues. A study by Giving USA estimated that charitable giving to health care organizations rose a strong 7.3% (5.5% adjusted for inflation) in 2017, but giving that year was fueled by a booming stock market and a favorable tax environment. Charitable donations to hospitals tend to reflect the economic health of the community in which the institution is located. Donations to rural hospitals in depressed communities are likely to be far less than to urban institutions in economically strong areas.3

Tax reform

The Tax Cuts and Jobs Act of 2017 will likely affect donations to charitable organizations in 2019. Specifically, the 2017 Tax Act doubled the standard tax deduction, thereby reducing the number of households having to itemize their deductions and eliminating many tax benefits for charitable donations. Middle-class families are expected to opt for the standard deduction while wealthier taxpayers will likely continue itemizing their deductions. As a result, some predict that donors may switch from giving annually to giving every third year so they can itemize in their giving years to get the deduction. Estimates that charitable donations from individuals may decrease as much as $4 billion to $11 billion because of the increase in standard deductions and $0.9 billion to $2.1 billion because of the decrease in the marginal tax rate.4

Technology and peer-to-peer giving

Technological advances that make researching and giving easier and more convenient are likely to have a significant impact on many charitable organizations in 2019. Online donations are likely to increase as organizations make it simple to donate from mobile devices, social media platforms and their websites. Although charitable organizations will continue to directly ask individuals for a donation, many are expanding their efforts to include online social campaigns that leverage peer-to-peer giving. Other technological advancements likely to affect donations in the future include the ability for organizations to incorporate contactless payment programs and blockchain technology. Online giving grew by 12.1% over 2018-2019 with monthly automatic giving increasing by 40% over 2016 to 2017.5

Generational differences in giving

Although the trends identified above are likely to affect the decision to give in 2019, there are some meaningful differences in how different generations embrace these changes. Technological advances, the rise of alternative forms of giving, and increased opportunities to connect with peers about giving influence Millennials significantly more than Baby Boomers. Millennials are more likely to say that they give to make a meaningful difference while Boomers are likely to say that giving is part of their values. Millennials also are more likely to say their giving is more spontaneous while Boomers say their giving is more planned. As many as 49% of Millennials cite technological advances influencing their giving, compared with only 23% of Baby Boomers. This trend continues for the rise of alternative forms of giving (32% of Millennials, compared with 14% of Boomers) and increased opportunities to connect with peers about giving (30%, compared with 11%).

Twenty-nine percent of Millennials are very optimistic about philanthropy’s ability to solve the issues most important to them, compared with only 15% of Baby Boomers.2

One thing they have in common is their priorities. Both generations prioritize challenges related to health, hunger, and the environment.6

Today, foundations need to focus on impact, not just education programs or scholarships. New tech-driven trends in giving, such as the emergence of digital peer-to-peer giving and crowdfunding campaigns, make it possible to tap into high-volume, small-amount donations. To recruit new donors, organizations will need to target their messages based on the audience segment.

References:

1. Giving USA 2019: Annual report for philanthropy for 2018. Accessed Nov. 14, 2019.

2. Fidelity Charitable (2019) Future of philanthropy. Accessed Nov. 10, 2019.3. Betbeze, Philip (2018) Charitable giving to health giving to health organizations rose 7.3% last year. Health Leaders. July 11.

4. Martis & Landy/Indiana University Lilly Family School of Philanthropy (2018) The Philanthropy Outlook 2018 & 2019.

5. M&R Benchmarks 2019.

6. Nonprofit Source (2019) The ultimate list of charitable giving statistics for 2018. Accessed Nov. 10, 2019.

Note: Background research performed by Avenue M Group.

CHEST Inspiration is a collection of programmatic initiatives developed by the American College of Chest Physicians leadership and aimed at stimulating and encouraging innovation within the association. One of the components of CHEST Inspiration is the Environmental Scan, a series of articles focusing on the internal and external environmental factors that bear on success currently and in the future. See “Envisioning the Future: The CHEST Environmental Scan,” CHEST Physician, June 2019, p. 44, for an introduction to the series.