In addition to supplying information on residence and employment/student history for the past 2 years, there are three primary components to a borrower’s credit portfolio:

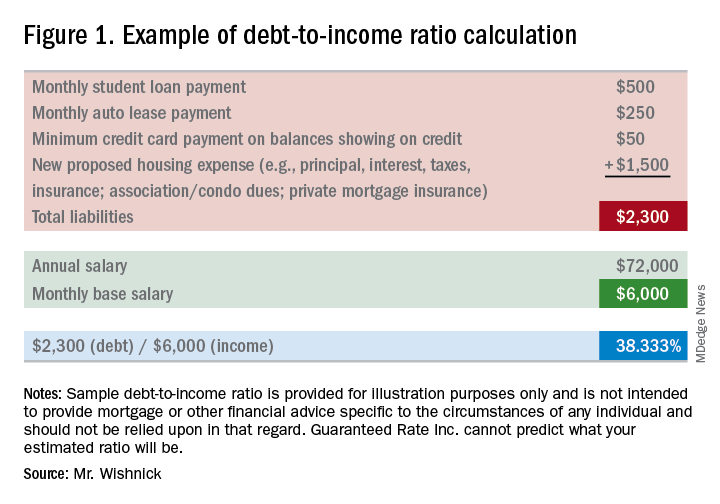

1) Debt-to-income ratio: What monthly expenses will show on your credit report (car loans/leases, student loans, credit card payments, personal loans/lines of credit, and mortgages for other properties owned)? Do you own any other real estate? Do you have other required obligations, such as alimony or child support payments? To calculate, first combine these liabilities on a monthly expense basis along with the new proposed monthly housing payment. Take these monthly liabilities and divide by monthly income. Gross income (pretax) for employees of a company they do not own is typically utilized (bonus or commission income can have some alternate rules to be allowed as qualifying income); for self-employed borrowers, tax returns will be required to be reviewed; tax write offs could reduce qualifying income. Self-employed individuals will typically need to show a 2-year income history via personal tax returns (as well as business tax returns if applicable). See Figure 1 for an example of a debt-to-income ratio calculation. Many loan programs will require a debt-to-income ratio of 45% or less. There are various loan programs that will be more or less restrictive than this percentage. A lender will be able to guide you to the proper program for your scenario.

2) Liquid assets: Lenders will review the amount of liquid funds you have available for down payment, closing costs, and any necessary reserves. These may include, but are not limited to, checking/savings/money market accounts, investment accounts (stocks, bonds, mutual funds), and retirement funds. Are there enough allowable funds available for the down payment and closing costs, as well as any required reserves needed for qualification? Large non–payroll deposits can be required to be sourced to make sure the funds are from an allowable source.

3) Credit history/scores: Buying a home will be one of the largest purchases you will make in a lifetime. Credit scores have a major impact on the cost of credit (the interest rate you will obtain). Having higher scores could result in a lower interest rate, as well as open up certain loan programs that may be more advantageous for you. Oftentimes, lenders will take the middle of the three scores as your mortgage score (one score from each of the three credit bureaus). In most cases, if applying jointly, the lowest of the middle scores for all borrowers is the score that is used as the score for the applicants. In general, a 740 middle credit score is considered to be excellent for mortgage financing but is not a requirement for all programs.

**You may have heard about specific mortgage programs for physicians. These programs are intended for use for lesser down payments, and/or not calculating student loan payments when qualifying for home financing. As future income potential is typically not considered when determining debt-to-income ratios, not counting these liabilities potentially increases borrowing power.