- What licensure and related education do you have?

- What is your particular area of expertise?

- How long have you been in practice?

- How will you be managing my assets?

Financial Adviser Fee Schedules

Prior to working with a financial adviser, you must also inquire about their fee structure. There are two kinds of fee schedules used by financial advisers: fee-only and fee-based.

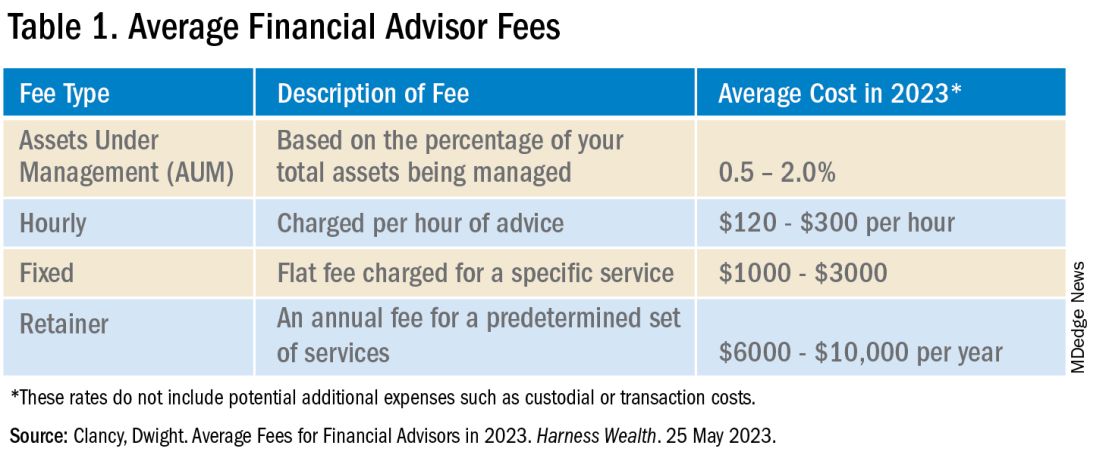

Fee-only advisers receive payment solely for the services they provide. They do not collect commissions from third parties providing the recommended products. There is variability in how this type of payment schedule is structured, encompassing flat fees, hourly rates, or the adviser charging a retainer. The Table below compares the types of fee-only structures and range of charges based on 2023 rates.9 Of note, fee-only advisers serve as fiduciaries.10

Fee-based financial advisers receive payment for services but may also receive commission on specific products they sell to you.9 Most, if not all, financial experts recommend avoiding advisers using commission-based charges given the potential conflict of interest: How can one be absolutely sure this recommended financial product is best for you, knowing your adviser has a financial stake in said item?

In addition to charging the fees above, your financial adviser, if they are actively managing your investment portfolio, will also charge an assets under management (AUM) fee. This is a percentage of the dollar amount within your portfolio. For example, if your adviser charges a 1% AUM rate for your account totaling $100,000, this equates to a $1,000 fee in that calendar year. AUM fees typically decrease as the size of your portfolio increases. As seen in the Table, there is a wide range of the average AUM rate (0.5%–2%); however, an AUM fee approaching 2% is unnecessarily high and consumes a significant portion of your portfolio. Thus, it is recommended to look for a money manager with an approximate 1% AUM fee.

Many of us delay or avoid working with a financial adviser due to the potential perceived risks of having poor portfolio management from an adviser not working in our best interest, along with the concern for excessive fees. In many ways, it is how we counsel our patients. While they can seek medical information on their own, their best care is under the guidance of an expert: a healthcare professional. That being said, personal finance is indeed personal, so I hope this guide helps facilitate your search and increase your financial wellness.

Dr. Luthra is a therapeutic endoscopist at Moffitt Cancer Center, Tampa, Florida, and the founder of The Scope of Finance, a financial wellness education and coaching company focused on physicians. Her interest in financial well-being is thanks to the teachings of her father, an entrepreneur and former Certified Financial Planner (CFP). She can be found on Instagram (thescopeoffinance) and X (@ScopeofFinance). She reports no financial disclosures relevant to this article.