User login

High Deductible Health Plans: Take Accounts Receivable Action Now

If you missed the recent headlines, Why Patients Delay Medical Payments: 12 findings 1 and You think your health insurance costs too much. Try being a farmer.2, you may not be too worried about your ever-rising accounts receivables. But you should be.

The facts in these stories and the 2017 Employer Health Benefits Survey,3 released on September 19 by the non-partisan Kaiser Family Foundation and Health Research & Educational Trust (HRET), are alarming. Let’s look at some of the survey results.

Since 2007, the average family premium has increased 55% and the average worker contribution toward the premium has increased 74%.3 How does that translate into dollars and cents? Well, the average annual premiums this year are $6690 for single coverage and $18,764 for family coverage.

What does that mean exactly to the farm couple in the Crain’s story? The farmer who “will be lucky to net $75,000” on his hay crop this year has a policy premium with Blue Cross Blue Shield of Illinois that was $22,000 last year. And then there is a $5000 deductible for each him and his wife. Do the math: it means they’d spend 43% of their income before health insurance covers anything.

Do premiums vary significantly by firm size or region? Should surgeons in certain areas of the country be less concerned about these trends? No, the premiums don’t significantly vary by size or region.

The point here is not to write an essay about health insurance premiums, but rather to discuss what this economic reality means to patients who are seeing you tomorrow, next week, and next month. Given these economic realities, what is their attitude about your bill?

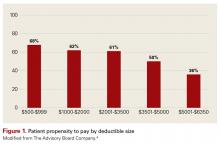

For insight, let’s look at an Advisory Board Company brief, “Minimizing Bad Debt: Point-of-Service Collections,”4 which states: “Patient propensity to pay decreases as patient obligation increases.” According to the brief, “Our analysis indicates that as the dollar value of a patient’s obligation increases, their propensity to pay any portion of the obligation decreases—for all patients, at all income levels.” See Figure 1.

Given that market statistics show that more than a quarter of the commercially insured patients are covered by high deductible health plans (HDHPs), your practice must adapt to these changing times.

Review Your Pay or Mix

Smart practice administrators will keep their finger on the pulse of the insurance local market as more employers move toward offering HDHPs or health savings accounts. Knowing what the largest manufacturers are offering, along with local hospitals that are typically sizable employers in most communities, is critical. The coverage for school systems, police departments, fire departments, and governments should also be the practice radar.

A recent West Corporation survey5 reveals more about the demographic profile of patients who are less likely to pay or delay payments. Their study shows that 79% of patients cite affordability as the largest healthcare problem with 93% of patients saying it costs too much. So it should be no surprise that 67% say their financial situation makes it challenging to submit timely payments. If you are not familiar with the company name, you’ll be familiar with West Corporation’s products, like Televox, which are automated tools used by practices to remind patients about appointments and copays.

Here are other relevant findings from the West Corporation survey:

- 56% delay payments of medical bills at least some of the time.

- 70% of millennials have missed medical payment deadlines.

- 42% of patients cite their HDHP as the reason for delaying their payments.

- 36% of patients said they have difficulty remembering to make timely medical payments.

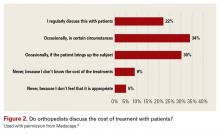

It’s no surprise that orthopedic surgeons are not discussing fees with patients. Although only 9% admitted that they don’t discuss costs with patients, it is safe to estimate that few surgeons have their fee schedules memorized.

In a 2013 article, Ubel and colleagues7 said, “Because treatments can be ‘financially toxic,’ physicians need to disclose the financial consequences of treatment alternatives just as they inform patients about treatments’ side effects.”

While uniquely qualified to discuss treatment options, few orthopedic surgeons have the time or the facts to personally discuss fees, out-of-pocket expenses, uncovered services and payment plans. Detailed discussions about patients’ financial liabilities are better done by qualified staff, who verify benefits and use modern technology tools to generate an electronic “estimate of costs and benefits.”

Target Your Efforts

What steps can your practice take to help patients pay their portion, even when it’s large, as well as help your practice reduce receivables and avoid collection problems and bad debt write-offs?

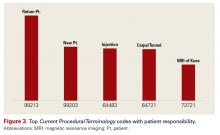

Start by analyzing the top Current Procedural Terminology (CPT) codes with patient responsibility, so you can focus your efforts. One such analysis, conducted by our firm, is shown in Figure 3. Although you might think the highest percent of patient financial responsibilities are for surgical procedures, notice that 4 of the top 5 services this practice identified as having the highest amount of patient collectible dollars are rendered in the office-carpal tunnel surgery being the only exception.

Take Action

After conducting a thorough analysis and reviewing the results, here are 5 actionable steps your practice could take:

1. Make sure your patient portal has the capacity to take patient payments. Offering online payment options increases the opportunity for patients to pay. Promote this option on the patient statement.

2. Implement a system of collecting from patients before they leave the office. After a new visit, which involves a more expensive evaluation and management code, and possibly imaging and durable medical device, counsel patients to leave a credit card on file, so the minute insurance pays, their credit card can be charged.

The 2017 Navicure Patient Payment Check-Up survey8 conducted by Healthcare Information and Management Systems Society (HIMSS) Analytics shows that 78% of patients would provide a card to be charged for one time up to $200. Think about the previously illustrated collection amounts this would alleviate.

3. Provide all surgery patients with a cost estimate. Generating cost estimates has been possible for close to 10 years. It’s done through your clearinghouse and practice management software by entering the CPT codes and diagnosis codes, along with the patient’s information. Save time and avoid tying staff up on hold.

According to the Navicure Patient Payment Check-Up survey,8 75% of provider organizations are able to provide a cost estimate upon request. It makes good business sense.

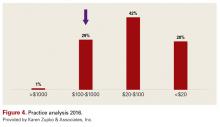

4. Collect a pre-treatment or pre-surgery scheduling deposit. In the KarenZupko & Associates/American Academy of Orthopaedic Surgeons (AAOS) pre-course survey of those attending the 2017 coding and reimbursement workshops, 55% of orthopedic practices reported that they have instituted such a practice. With the proliferation of HDHPs, asking for a scheduling deposit is fast becoming a must for all surgeons.

5. Offer patients a healthcare financing option through a third party. In response to another pre-course survey question, about offering CareCredit or another healthcare credit card, 28% of orthopedic practices say they do. Still, that leaves >70% of the orthopedic patients without a financing option. Given the reality of high deductible HDHPs and the patient responsibilities going uncollected, it’s time surgeons take a look at financing. It’s a fool’s wish to believe the practice is “saving” the service fee by sending dozens of statements, having staff make calls, and ultimately writing off unpaid balances as uncollectible.

Practices that fail to change, will fail to prosper. Those who have technology-phobic staff will suffer as healthcare continues to automate. Practices led by surgeons like one recently interviewed who said, “If patients knew how much it cost, they’d never schedule” will see patient accounts receivable soar and patient online ratings sink. The first quarter of 2018 means the number of patients with HDHPs will increase and that deductibles will have to be met. It’s wise to have a full staff meeting, share the facts, and put an action plan in place.

1. Gooch K. Why patients delay medical payments: 12 findings. Becker’s ASC. https://www.beckershospitalreview.com/finance/why-patients-delay-medical-payments-12-findings.html. Published August 28, 2017.

2. Murphy HL. You think your health insurance costs too much. Try being a farmer. Crain’s Chicago Business. http://www.chicagobusiness.com/article/20170929/ISSUE01/170929835. Published September 29, 2017. Accessed October 2, 2017.

3. 2017 Employer Health Benefits Survey. The Henry J. Kaiser Family Foundation and the Health Research & Educational Trust (HRET). https://www.kff.org/health-costs/report/2017-employer-health-benefits-survey/. Published September 19, 2017.

4. Minimizing Bad Debt: Point-of-Service Collections. The Advisory Board Company. https://www.advisory.com/-/media/Advisory-com/Research/FLC/Resources/2015/CFO-Brief-POS.pdf. Published August 21, 2015.

5. Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology-Enabled Communications. West Corporation. https://cdn2.hubspot.net/hubfs/402746/Assets/West%20Assets/Optimizing%20Revenue%20Report/Reports%20and%20Handouts/WEST-Optimizing%20Revenue%20Report%20final.pdf?t=1508789915319. Accessed October 26, 2017.

6. Peckham C. Medscape Orthopedist Compensation Report 2016. Medscape. https://www.medscape.com/features/slideshow/compensation/2016/orthopedics. Published April 1, 2016.

7. Ubel PA, Abernathy AP, Zafar SY. Full disclosure - out-of-pocket costs as side effects. N Engl J. Med. 2013;369:1484-1486. doi:10.1056/NEJMp1306826.

8. Patient Payment Check-Up 2017. Navicure. http://info.navicure.com/rs/669-OIJ-380/images/Navicure-Survey-Report-2017-Patient-Payment-Check-Up.pdf?mkt_tok=eyJpIjoiTVdKak1HUmhObVV6WkRVeSIsInQiOiJRcFNyRGVrOXlTS0pjalwvWEw3c2s1UmRMRHJVXC9EQzRkSnBkWCs0S2FEbUt3Z1I1a2Y3d1BBY3FKY0I1QWpEdkJRWU9ibmFlUlpnYVRIbVJMcStTVmdkRVwvSTJzcHE1cDVTajBRM3B1Q25lbDQwamViWnMwWGd1c1QzVk1cL2hYdkYifQ%3D%3D. Accessed October 26, 2017.

If you missed the recent headlines, Why Patients Delay Medical Payments: 12 findings 1 and You think your health insurance costs too much. Try being a farmer.2, you may not be too worried about your ever-rising accounts receivables. But you should be.

The facts in these stories and the 2017 Employer Health Benefits Survey,3 released on September 19 by the non-partisan Kaiser Family Foundation and Health Research & Educational Trust (HRET), are alarming. Let’s look at some of the survey results.

Since 2007, the average family premium has increased 55% and the average worker contribution toward the premium has increased 74%.3 How does that translate into dollars and cents? Well, the average annual premiums this year are $6690 for single coverage and $18,764 for family coverage.

What does that mean exactly to the farm couple in the Crain’s story? The farmer who “will be lucky to net $75,000” on his hay crop this year has a policy premium with Blue Cross Blue Shield of Illinois that was $22,000 last year. And then there is a $5000 deductible for each him and his wife. Do the math: it means they’d spend 43% of their income before health insurance covers anything.

Do premiums vary significantly by firm size or region? Should surgeons in certain areas of the country be less concerned about these trends? No, the premiums don’t significantly vary by size or region.

The point here is not to write an essay about health insurance premiums, but rather to discuss what this economic reality means to patients who are seeing you tomorrow, next week, and next month. Given these economic realities, what is their attitude about your bill?

For insight, let’s look at an Advisory Board Company brief, “Minimizing Bad Debt: Point-of-Service Collections,”4 which states: “Patient propensity to pay decreases as patient obligation increases.” According to the brief, “Our analysis indicates that as the dollar value of a patient’s obligation increases, their propensity to pay any portion of the obligation decreases—for all patients, at all income levels.” See Figure 1.

Given that market statistics show that more than a quarter of the commercially insured patients are covered by high deductible health plans (HDHPs), your practice must adapt to these changing times.

Review Your Pay or Mix

Smart practice administrators will keep their finger on the pulse of the insurance local market as more employers move toward offering HDHPs or health savings accounts. Knowing what the largest manufacturers are offering, along with local hospitals that are typically sizable employers in most communities, is critical. The coverage for school systems, police departments, fire departments, and governments should also be the practice radar.

A recent West Corporation survey5 reveals more about the demographic profile of patients who are less likely to pay or delay payments. Their study shows that 79% of patients cite affordability as the largest healthcare problem with 93% of patients saying it costs too much. So it should be no surprise that 67% say their financial situation makes it challenging to submit timely payments. If you are not familiar with the company name, you’ll be familiar with West Corporation’s products, like Televox, which are automated tools used by practices to remind patients about appointments and copays.

Here are other relevant findings from the West Corporation survey:

- 56% delay payments of medical bills at least some of the time.

- 70% of millennials have missed medical payment deadlines.

- 42% of patients cite their HDHP as the reason for delaying their payments.

- 36% of patients said they have difficulty remembering to make timely medical payments.

It’s no surprise that orthopedic surgeons are not discussing fees with patients. Although only 9% admitted that they don’t discuss costs with patients, it is safe to estimate that few surgeons have their fee schedules memorized.

In a 2013 article, Ubel and colleagues7 said, “Because treatments can be ‘financially toxic,’ physicians need to disclose the financial consequences of treatment alternatives just as they inform patients about treatments’ side effects.”

While uniquely qualified to discuss treatment options, few orthopedic surgeons have the time or the facts to personally discuss fees, out-of-pocket expenses, uncovered services and payment plans. Detailed discussions about patients’ financial liabilities are better done by qualified staff, who verify benefits and use modern technology tools to generate an electronic “estimate of costs and benefits.”

Target Your Efforts

What steps can your practice take to help patients pay their portion, even when it’s large, as well as help your practice reduce receivables and avoid collection problems and bad debt write-offs?

Start by analyzing the top Current Procedural Terminology (CPT) codes with patient responsibility, so you can focus your efforts. One such analysis, conducted by our firm, is shown in Figure 3. Although you might think the highest percent of patient financial responsibilities are for surgical procedures, notice that 4 of the top 5 services this practice identified as having the highest amount of patient collectible dollars are rendered in the office-carpal tunnel surgery being the only exception.

Take Action

After conducting a thorough analysis and reviewing the results, here are 5 actionable steps your practice could take:

1. Make sure your patient portal has the capacity to take patient payments. Offering online payment options increases the opportunity for patients to pay. Promote this option on the patient statement.

2. Implement a system of collecting from patients before they leave the office. After a new visit, which involves a more expensive evaluation and management code, and possibly imaging and durable medical device, counsel patients to leave a credit card on file, so the minute insurance pays, their credit card can be charged.

The 2017 Navicure Patient Payment Check-Up survey8 conducted by Healthcare Information and Management Systems Society (HIMSS) Analytics shows that 78% of patients would provide a card to be charged for one time up to $200. Think about the previously illustrated collection amounts this would alleviate.

3. Provide all surgery patients with a cost estimate. Generating cost estimates has been possible for close to 10 years. It’s done through your clearinghouse and practice management software by entering the CPT codes and diagnosis codes, along with the patient’s information. Save time and avoid tying staff up on hold.

According to the Navicure Patient Payment Check-Up survey,8 75% of provider organizations are able to provide a cost estimate upon request. It makes good business sense.

4. Collect a pre-treatment or pre-surgery scheduling deposit. In the KarenZupko & Associates/American Academy of Orthopaedic Surgeons (AAOS) pre-course survey of those attending the 2017 coding and reimbursement workshops, 55% of orthopedic practices reported that they have instituted such a practice. With the proliferation of HDHPs, asking for a scheduling deposit is fast becoming a must for all surgeons.

5. Offer patients a healthcare financing option through a third party. In response to another pre-course survey question, about offering CareCredit or another healthcare credit card, 28% of orthopedic practices say they do. Still, that leaves >70% of the orthopedic patients without a financing option. Given the reality of high deductible HDHPs and the patient responsibilities going uncollected, it’s time surgeons take a look at financing. It’s a fool’s wish to believe the practice is “saving” the service fee by sending dozens of statements, having staff make calls, and ultimately writing off unpaid balances as uncollectible.

Practices that fail to change, will fail to prosper. Those who have technology-phobic staff will suffer as healthcare continues to automate. Practices led by surgeons like one recently interviewed who said, “If patients knew how much it cost, they’d never schedule” will see patient accounts receivable soar and patient online ratings sink. The first quarter of 2018 means the number of patients with HDHPs will increase and that deductibles will have to be met. It’s wise to have a full staff meeting, share the facts, and put an action plan in place.

If you missed the recent headlines, Why Patients Delay Medical Payments: 12 findings 1 and You think your health insurance costs too much. Try being a farmer.2, you may not be too worried about your ever-rising accounts receivables. But you should be.

The facts in these stories and the 2017 Employer Health Benefits Survey,3 released on September 19 by the non-partisan Kaiser Family Foundation and Health Research & Educational Trust (HRET), are alarming. Let’s look at some of the survey results.

Since 2007, the average family premium has increased 55% and the average worker contribution toward the premium has increased 74%.3 How does that translate into dollars and cents? Well, the average annual premiums this year are $6690 for single coverage and $18,764 for family coverage.

What does that mean exactly to the farm couple in the Crain’s story? The farmer who “will be lucky to net $75,000” on his hay crop this year has a policy premium with Blue Cross Blue Shield of Illinois that was $22,000 last year. And then there is a $5000 deductible for each him and his wife. Do the math: it means they’d spend 43% of their income before health insurance covers anything.

Do premiums vary significantly by firm size or region? Should surgeons in certain areas of the country be less concerned about these trends? No, the premiums don’t significantly vary by size or region.

The point here is not to write an essay about health insurance premiums, but rather to discuss what this economic reality means to patients who are seeing you tomorrow, next week, and next month. Given these economic realities, what is their attitude about your bill?

For insight, let’s look at an Advisory Board Company brief, “Minimizing Bad Debt: Point-of-Service Collections,”4 which states: “Patient propensity to pay decreases as patient obligation increases.” According to the brief, “Our analysis indicates that as the dollar value of a patient’s obligation increases, their propensity to pay any portion of the obligation decreases—for all patients, at all income levels.” See Figure 1.

Given that market statistics show that more than a quarter of the commercially insured patients are covered by high deductible health plans (HDHPs), your practice must adapt to these changing times.

Review Your Pay or Mix

Smart practice administrators will keep their finger on the pulse of the insurance local market as more employers move toward offering HDHPs or health savings accounts. Knowing what the largest manufacturers are offering, along with local hospitals that are typically sizable employers in most communities, is critical. The coverage for school systems, police departments, fire departments, and governments should also be the practice radar.

A recent West Corporation survey5 reveals more about the demographic profile of patients who are less likely to pay or delay payments. Their study shows that 79% of patients cite affordability as the largest healthcare problem with 93% of patients saying it costs too much. So it should be no surprise that 67% say their financial situation makes it challenging to submit timely payments. If you are not familiar with the company name, you’ll be familiar with West Corporation’s products, like Televox, which are automated tools used by practices to remind patients about appointments and copays.

Here are other relevant findings from the West Corporation survey:

- 56% delay payments of medical bills at least some of the time.

- 70% of millennials have missed medical payment deadlines.

- 42% of patients cite their HDHP as the reason for delaying their payments.

- 36% of patients said they have difficulty remembering to make timely medical payments.

It’s no surprise that orthopedic surgeons are not discussing fees with patients. Although only 9% admitted that they don’t discuss costs with patients, it is safe to estimate that few surgeons have their fee schedules memorized.

In a 2013 article, Ubel and colleagues7 said, “Because treatments can be ‘financially toxic,’ physicians need to disclose the financial consequences of treatment alternatives just as they inform patients about treatments’ side effects.”

While uniquely qualified to discuss treatment options, few orthopedic surgeons have the time or the facts to personally discuss fees, out-of-pocket expenses, uncovered services and payment plans. Detailed discussions about patients’ financial liabilities are better done by qualified staff, who verify benefits and use modern technology tools to generate an electronic “estimate of costs and benefits.”

Target Your Efforts

What steps can your practice take to help patients pay their portion, even when it’s large, as well as help your practice reduce receivables and avoid collection problems and bad debt write-offs?

Start by analyzing the top Current Procedural Terminology (CPT) codes with patient responsibility, so you can focus your efforts. One such analysis, conducted by our firm, is shown in Figure 3. Although you might think the highest percent of patient financial responsibilities are for surgical procedures, notice that 4 of the top 5 services this practice identified as having the highest amount of patient collectible dollars are rendered in the office-carpal tunnel surgery being the only exception.

Take Action

After conducting a thorough analysis and reviewing the results, here are 5 actionable steps your practice could take:

1. Make sure your patient portal has the capacity to take patient payments. Offering online payment options increases the opportunity for patients to pay. Promote this option on the patient statement.

2. Implement a system of collecting from patients before they leave the office. After a new visit, which involves a more expensive evaluation and management code, and possibly imaging and durable medical device, counsel patients to leave a credit card on file, so the minute insurance pays, their credit card can be charged.

The 2017 Navicure Patient Payment Check-Up survey8 conducted by Healthcare Information and Management Systems Society (HIMSS) Analytics shows that 78% of patients would provide a card to be charged for one time up to $200. Think about the previously illustrated collection amounts this would alleviate.

3. Provide all surgery patients with a cost estimate. Generating cost estimates has been possible for close to 10 years. It’s done through your clearinghouse and practice management software by entering the CPT codes and diagnosis codes, along with the patient’s information. Save time and avoid tying staff up on hold.

According to the Navicure Patient Payment Check-Up survey,8 75% of provider organizations are able to provide a cost estimate upon request. It makes good business sense.

4. Collect a pre-treatment or pre-surgery scheduling deposit. In the KarenZupko & Associates/American Academy of Orthopaedic Surgeons (AAOS) pre-course survey of those attending the 2017 coding and reimbursement workshops, 55% of orthopedic practices reported that they have instituted such a practice. With the proliferation of HDHPs, asking for a scheduling deposit is fast becoming a must for all surgeons.

5. Offer patients a healthcare financing option through a third party. In response to another pre-course survey question, about offering CareCredit or another healthcare credit card, 28% of orthopedic practices say they do. Still, that leaves >70% of the orthopedic patients without a financing option. Given the reality of high deductible HDHPs and the patient responsibilities going uncollected, it’s time surgeons take a look at financing. It’s a fool’s wish to believe the practice is “saving” the service fee by sending dozens of statements, having staff make calls, and ultimately writing off unpaid balances as uncollectible.

Practices that fail to change, will fail to prosper. Those who have technology-phobic staff will suffer as healthcare continues to automate. Practices led by surgeons like one recently interviewed who said, “If patients knew how much it cost, they’d never schedule” will see patient accounts receivable soar and patient online ratings sink. The first quarter of 2018 means the number of patients with HDHPs will increase and that deductibles will have to be met. It’s wise to have a full staff meeting, share the facts, and put an action plan in place.

1. Gooch K. Why patients delay medical payments: 12 findings. Becker’s ASC. https://www.beckershospitalreview.com/finance/why-patients-delay-medical-payments-12-findings.html. Published August 28, 2017.

2. Murphy HL. You think your health insurance costs too much. Try being a farmer. Crain’s Chicago Business. http://www.chicagobusiness.com/article/20170929/ISSUE01/170929835. Published September 29, 2017. Accessed October 2, 2017.

3. 2017 Employer Health Benefits Survey. The Henry J. Kaiser Family Foundation and the Health Research & Educational Trust (HRET). https://www.kff.org/health-costs/report/2017-employer-health-benefits-survey/. Published September 19, 2017.

4. Minimizing Bad Debt: Point-of-Service Collections. The Advisory Board Company. https://www.advisory.com/-/media/Advisory-com/Research/FLC/Resources/2015/CFO-Brief-POS.pdf. Published August 21, 2015.

5. Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology-Enabled Communications. West Corporation. https://cdn2.hubspot.net/hubfs/402746/Assets/West%20Assets/Optimizing%20Revenue%20Report/Reports%20and%20Handouts/WEST-Optimizing%20Revenue%20Report%20final.pdf?t=1508789915319. Accessed October 26, 2017.

6. Peckham C. Medscape Orthopedist Compensation Report 2016. Medscape. https://www.medscape.com/features/slideshow/compensation/2016/orthopedics. Published April 1, 2016.

7. Ubel PA, Abernathy AP, Zafar SY. Full disclosure - out-of-pocket costs as side effects. N Engl J. Med. 2013;369:1484-1486. doi:10.1056/NEJMp1306826.

8. Patient Payment Check-Up 2017. Navicure. http://info.navicure.com/rs/669-OIJ-380/images/Navicure-Survey-Report-2017-Patient-Payment-Check-Up.pdf?mkt_tok=eyJpIjoiTVdKak1HUmhObVV6WkRVeSIsInQiOiJRcFNyRGVrOXlTS0pjalwvWEw3c2s1UmRMRHJVXC9EQzRkSnBkWCs0S2FEbUt3Z1I1a2Y3d1BBY3FKY0I1QWpEdkJRWU9ibmFlUlpnYVRIbVJMcStTVmdkRVwvSTJzcHE1cDVTajBRM3B1Q25lbDQwamViWnMwWGd1c1QzVk1cL2hYdkYifQ%3D%3D. Accessed October 26, 2017.

1. Gooch K. Why patients delay medical payments: 12 findings. Becker’s ASC. https://www.beckershospitalreview.com/finance/why-patients-delay-medical-payments-12-findings.html. Published August 28, 2017.

2. Murphy HL. You think your health insurance costs too much. Try being a farmer. Crain’s Chicago Business. http://www.chicagobusiness.com/article/20170929/ISSUE01/170929835. Published September 29, 2017. Accessed October 2, 2017.

3. 2017 Employer Health Benefits Survey. The Henry J. Kaiser Family Foundation and the Health Research & Educational Trust (HRET). https://www.kff.org/health-costs/report/2017-employer-health-benefits-survey/. Published September 19, 2017.

4. Minimizing Bad Debt: Point-of-Service Collections. The Advisory Board Company. https://www.advisory.com/-/media/Advisory-com/Research/FLC/Resources/2015/CFO-Brief-POS.pdf. Published August 21, 2015.

5. Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology-Enabled Communications. West Corporation. https://cdn2.hubspot.net/hubfs/402746/Assets/West%20Assets/Optimizing%20Revenue%20Report/Reports%20and%20Handouts/WEST-Optimizing%20Revenue%20Report%20final.pdf?t=1508789915319. Accessed October 26, 2017.

6. Peckham C. Medscape Orthopedist Compensation Report 2016. Medscape. https://www.medscape.com/features/slideshow/compensation/2016/orthopedics. Published April 1, 2016.

7. Ubel PA, Abernathy AP, Zafar SY. Full disclosure - out-of-pocket costs as side effects. N Engl J. Med. 2013;369:1484-1486. doi:10.1056/NEJMp1306826.

8. Patient Payment Check-Up 2017. Navicure. http://info.navicure.com/rs/669-OIJ-380/images/Navicure-Survey-Report-2017-Patient-Payment-Check-Up.pdf?mkt_tok=eyJpIjoiTVdKak1HUmhObVV6WkRVeSIsInQiOiJRcFNyRGVrOXlTS0pjalwvWEw3c2s1UmRMRHJVXC9EQzRkSnBkWCs0S2FEbUt3Z1I1a2Y3d1BBY3FKY0I1QWpEdkJRWU9ibmFlUlpnYVRIbVJMcStTVmdkRVwvSTJzcHE1cDVTajBRM3B1Q25lbDQwamViWnMwWGd1c1QzVk1cL2hYdkYifQ%3D%3D. Accessed October 26, 2017.