User login

As of Jan. 1, the Centers for Medicare and Medicaid Services (CMS) ceased physician payment for consultations. The elimination of consult codes will affect physician group payments as well as relative-value-unit (RVU)-based incentive payments to individual physicians.

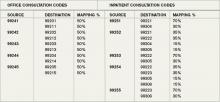

The Medicare-designated status of outpatient consultation (99241-99245) and inpatient consultation (99251-99255) codes has changed from “A” (separately payable under the physician fee schedule, when covered) to “I” (not valid for Medicare purposes; Medicare uses another code for the reporting of and the payment for these services). So if you submit consultation codes for Medicare beneficiaries, the result will be nonpayment.

While many physicians fear the negative impact of this ruling, hospitalists should consider its potential. Let’s take a look at a scenario hospitalists encounter on a routine basis.

Typical HM Scenario

A surgeon admits a 76-year-old man for aortic valve replacement. The patient’s history also includes well-controlled hypertension and chronic obstructive pulmonary disease (COPD). Postoperatively, the patient experiences an exacerbation of COPD related to anesthesia, elevated blood pressure, and hyperglycemia. The surgeon requests the hospitalist’s advice on appropriate medical interventions of these conditions. How should the hospitalist report the initial encounter with this Medicare beneficiary?

The hospitalist should select the CPT code that best fits the service and the payor. While most physicians regard this requested service as an inpatient consultation (99251-99255), Medicare no longer recognizes those codes. Instead, the hospitalist should report this encounter as an initial hospital care service (99221-99223).

Comanagement Issues

CMS and Medicare administrative contractors regularly uncover reporting errors for co-management requests. CMS decided the nature of these services were not consultative because the surgeon is not asking the physician or qualified nonphysician provider’s (NPP’s) opinion or advice for the surgeon’s use in treating the patient. Instead, these services constituted concurrent care and should have been billed using subsequent hospital care codes (99231-99233) in the hospital inpatient setting, subsequent NF care codes (99307-99310) in the SNF/NF setting, or office or other outpatient visit codes (99201-99215) in the office or outpatient settings.1

The new ruling simplifies coding and reduces reporting errors. The initial encounter with the patient is reported as such. Regardless of who is the attending of record or the consultant, the first physician from a particular provider group reports initial hospital care codes (i.e., 99221-99223) to represent the first patient encounter, even when this encounter does not occur on the admission date. Other physicians of the same specialty within the same provider group will not be permitted to report initial hospital care codes for their own initial encounter if someone from the group and specialty has already seen the patient during that hospitalization. In other words, the first hospitalist in the provider group reports 9922x, while the remaining hospitalists use subsequent hospital care codes (9923x).

In order to differentiate “consultant” services from “attending” services, CMS will be creating a modifier. The anticipated “AI” modifier must be appended to the attending physician’s initial encounter. Other initial hospital care codes reported throughout the hospital stay, as appropriate, are presumed to be that of “consultants” (i.e., physicians with a different specialty designation than the attending physician) participating in the case. Therefore, the hospitalist now can rightfully recover the increased work effort of the initial patient encounter (99223: 3.79 relative value units, ~$147 vs. 99233: 2.0 relative value units, ~$78, based on 2010 Medicare rates). Physicians will be required to meet the minimum documentation required for the selected visit code.

Other and Undefined Service Locations

Consultations in nursing facilities are handled much like inpatient hospital care. Physicians should report initial nursing facility services (99203-99306) for the first patient encounter, and subsequent nursing facility care codes (99307-99310) for each encounter thereafter. The attending physician of record appends the assigned modifier (presumed to be “AI”) when submitting their initial care service. All other initial care codes are presumed to be those of “consulting” physicians.

Initial information from CMS does not address observation services. Logically, these hospital-based services would follow the same methodology as inpatient care: report initial observation care (99218-99220) for the first “consulting” encounter. However, this might not be appropriate given Medicare’s existing rules for observation services, which guide physicians other than the admitting physician/group to “bill the office and other outpatient service codes or outpatient consultation codes as appropriate when they provide services to the patient.”2 With Medicare’s elimination of consultation codes, the consultant reports “office and other outpatient service codes” (i.e., new patient, 99201-99205, or established patient codes, 99212-99215) by default.

Without further clarification on observation services, hospitalists should report new or established patient service codes, depending on whether the patient has been seen by a group member within the last three years.

Medicare also has existing guidelines for the ED, which suggest that any physician not meeting the consultation criteria report ED service codes (99281-99285). Without further clarification, hospitalists should continue to follow this instruction for Medicare beneficiaries.

Nonphysician Providers

Medicare’s split/shared billing guidelines apply to most hospital inpatient, hospital outpatient, and ED evaluation and management (E/M) services, with consultations as one exception. Now, in accordance with the new ruling, hospitalists should select the appropriate initial service codes that correspond to patient’s location (e.g., 99223 for inpatients). NPPs can participate in the initial service provided to patients in these locations without the hospitalist having to replicate the entire service. The hospitalist can submit the claim in their name after selecting the visit level based upon the cumulative service personally provided on the same calendar day by both the NPP and the physician. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center in Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.10I. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/ manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.8A. CMS Web site. Available at: www. cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- PFS Federal Regulation Notices: Proposed Revisions to Payment Policies Under the Physician Fee Schedule and Part B for CY 2010. CMS Web site. Available at: www.cms.hhs.gov/PhysicianFeeSched/PFSFRN/itemdetail.asp?filterType=none&filterByDID=99&sortByDID=4&sortOrder=descending&itemID=CMS1223902&intNumPerPage=10. Accessed Nov. 12, 2009.

- Payment Policies Under the Physician Fee Schedule and Other Revisions to Part B (for CY 2010). CMS Web site. Available at: www.federalregister.gov/OFR Upload/OFRData/2009-26502_PI.pdf. Accessed Nov. 10, 2009.

As of Jan. 1, the Centers for Medicare and Medicaid Services (CMS) ceased physician payment for consultations. The elimination of consult codes will affect physician group payments as well as relative-value-unit (RVU)-based incentive payments to individual physicians.

The Medicare-designated status of outpatient consultation (99241-99245) and inpatient consultation (99251-99255) codes has changed from “A” (separately payable under the physician fee schedule, when covered) to “I” (not valid for Medicare purposes; Medicare uses another code for the reporting of and the payment for these services). So if you submit consultation codes for Medicare beneficiaries, the result will be nonpayment.

While many physicians fear the negative impact of this ruling, hospitalists should consider its potential. Let’s take a look at a scenario hospitalists encounter on a routine basis.

Typical HM Scenario

A surgeon admits a 76-year-old man for aortic valve replacement. The patient’s history also includes well-controlled hypertension and chronic obstructive pulmonary disease (COPD). Postoperatively, the patient experiences an exacerbation of COPD related to anesthesia, elevated blood pressure, and hyperglycemia. The surgeon requests the hospitalist’s advice on appropriate medical interventions of these conditions. How should the hospitalist report the initial encounter with this Medicare beneficiary?

The hospitalist should select the CPT code that best fits the service and the payor. While most physicians regard this requested service as an inpatient consultation (99251-99255), Medicare no longer recognizes those codes. Instead, the hospitalist should report this encounter as an initial hospital care service (99221-99223).

Comanagement Issues

CMS and Medicare administrative contractors regularly uncover reporting errors for co-management requests. CMS decided the nature of these services were not consultative because the surgeon is not asking the physician or qualified nonphysician provider’s (NPP’s) opinion or advice for the surgeon’s use in treating the patient. Instead, these services constituted concurrent care and should have been billed using subsequent hospital care codes (99231-99233) in the hospital inpatient setting, subsequent NF care codes (99307-99310) in the SNF/NF setting, or office or other outpatient visit codes (99201-99215) in the office or outpatient settings.1

The new ruling simplifies coding and reduces reporting errors. The initial encounter with the patient is reported as such. Regardless of who is the attending of record or the consultant, the first physician from a particular provider group reports initial hospital care codes (i.e., 99221-99223) to represent the first patient encounter, even when this encounter does not occur on the admission date. Other physicians of the same specialty within the same provider group will not be permitted to report initial hospital care codes for their own initial encounter if someone from the group and specialty has already seen the patient during that hospitalization. In other words, the first hospitalist in the provider group reports 9922x, while the remaining hospitalists use subsequent hospital care codes (9923x).

In order to differentiate “consultant” services from “attending” services, CMS will be creating a modifier. The anticipated “AI” modifier must be appended to the attending physician’s initial encounter. Other initial hospital care codes reported throughout the hospital stay, as appropriate, are presumed to be that of “consultants” (i.e., physicians with a different specialty designation than the attending physician) participating in the case. Therefore, the hospitalist now can rightfully recover the increased work effort of the initial patient encounter (99223: 3.79 relative value units, ~$147 vs. 99233: 2.0 relative value units, ~$78, based on 2010 Medicare rates). Physicians will be required to meet the minimum documentation required for the selected visit code.

Other and Undefined Service Locations

Consultations in nursing facilities are handled much like inpatient hospital care. Physicians should report initial nursing facility services (99203-99306) for the first patient encounter, and subsequent nursing facility care codes (99307-99310) for each encounter thereafter. The attending physician of record appends the assigned modifier (presumed to be “AI”) when submitting their initial care service. All other initial care codes are presumed to be those of “consulting” physicians.

Initial information from CMS does not address observation services. Logically, these hospital-based services would follow the same methodology as inpatient care: report initial observation care (99218-99220) for the first “consulting” encounter. However, this might not be appropriate given Medicare’s existing rules for observation services, which guide physicians other than the admitting physician/group to “bill the office and other outpatient service codes or outpatient consultation codes as appropriate when they provide services to the patient.”2 With Medicare’s elimination of consultation codes, the consultant reports “office and other outpatient service codes” (i.e., new patient, 99201-99205, or established patient codes, 99212-99215) by default.

Without further clarification on observation services, hospitalists should report new or established patient service codes, depending on whether the patient has been seen by a group member within the last three years.

Medicare also has existing guidelines for the ED, which suggest that any physician not meeting the consultation criteria report ED service codes (99281-99285). Without further clarification, hospitalists should continue to follow this instruction for Medicare beneficiaries.

Nonphysician Providers

Medicare’s split/shared billing guidelines apply to most hospital inpatient, hospital outpatient, and ED evaluation and management (E/M) services, with consultations as one exception. Now, in accordance with the new ruling, hospitalists should select the appropriate initial service codes that correspond to patient’s location (e.g., 99223 for inpatients). NPPs can participate in the initial service provided to patients in these locations without the hospitalist having to replicate the entire service. The hospitalist can submit the claim in their name after selecting the visit level based upon the cumulative service personally provided on the same calendar day by both the NPP and the physician. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center in Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.10I. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/ manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.8A. CMS Web site. Available at: www. cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- PFS Federal Regulation Notices: Proposed Revisions to Payment Policies Under the Physician Fee Schedule and Part B for CY 2010. CMS Web site. Available at: www.cms.hhs.gov/PhysicianFeeSched/PFSFRN/itemdetail.asp?filterType=none&filterByDID=99&sortByDID=4&sortOrder=descending&itemID=CMS1223902&intNumPerPage=10. Accessed Nov. 12, 2009.

- Payment Policies Under the Physician Fee Schedule and Other Revisions to Part B (for CY 2010). CMS Web site. Available at: www.federalregister.gov/OFR Upload/OFRData/2009-26502_PI.pdf. Accessed Nov. 10, 2009.

As of Jan. 1, the Centers for Medicare and Medicaid Services (CMS) ceased physician payment for consultations. The elimination of consult codes will affect physician group payments as well as relative-value-unit (RVU)-based incentive payments to individual physicians.

The Medicare-designated status of outpatient consultation (99241-99245) and inpatient consultation (99251-99255) codes has changed from “A” (separately payable under the physician fee schedule, when covered) to “I” (not valid for Medicare purposes; Medicare uses another code for the reporting of and the payment for these services). So if you submit consultation codes for Medicare beneficiaries, the result will be nonpayment.

While many physicians fear the negative impact of this ruling, hospitalists should consider its potential. Let’s take a look at a scenario hospitalists encounter on a routine basis.

Typical HM Scenario

A surgeon admits a 76-year-old man for aortic valve replacement. The patient’s history also includes well-controlled hypertension and chronic obstructive pulmonary disease (COPD). Postoperatively, the patient experiences an exacerbation of COPD related to anesthesia, elevated blood pressure, and hyperglycemia. The surgeon requests the hospitalist’s advice on appropriate medical interventions of these conditions. How should the hospitalist report the initial encounter with this Medicare beneficiary?

The hospitalist should select the CPT code that best fits the service and the payor. While most physicians regard this requested service as an inpatient consultation (99251-99255), Medicare no longer recognizes those codes. Instead, the hospitalist should report this encounter as an initial hospital care service (99221-99223).

Comanagement Issues

CMS and Medicare administrative contractors regularly uncover reporting errors for co-management requests. CMS decided the nature of these services were not consultative because the surgeon is not asking the physician or qualified nonphysician provider’s (NPP’s) opinion or advice for the surgeon’s use in treating the patient. Instead, these services constituted concurrent care and should have been billed using subsequent hospital care codes (99231-99233) in the hospital inpatient setting, subsequent NF care codes (99307-99310) in the SNF/NF setting, or office or other outpatient visit codes (99201-99215) in the office or outpatient settings.1

The new ruling simplifies coding and reduces reporting errors. The initial encounter with the patient is reported as such. Regardless of who is the attending of record or the consultant, the first physician from a particular provider group reports initial hospital care codes (i.e., 99221-99223) to represent the first patient encounter, even when this encounter does not occur on the admission date. Other physicians of the same specialty within the same provider group will not be permitted to report initial hospital care codes for their own initial encounter if someone from the group and specialty has already seen the patient during that hospitalization. In other words, the first hospitalist in the provider group reports 9922x, while the remaining hospitalists use subsequent hospital care codes (9923x).

In order to differentiate “consultant” services from “attending” services, CMS will be creating a modifier. The anticipated “AI” modifier must be appended to the attending physician’s initial encounter. Other initial hospital care codes reported throughout the hospital stay, as appropriate, are presumed to be that of “consultants” (i.e., physicians with a different specialty designation than the attending physician) participating in the case. Therefore, the hospitalist now can rightfully recover the increased work effort of the initial patient encounter (99223: 3.79 relative value units, ~$147 vs. 99233: 2.0 relative value units, ~$78, based on 2010 Medicare rates). Physicians will be required to meet the minimum documentation required for the selected visit code.

Other and Undefined Service Locations

Consultations in nursing facilities are handled much like inpatient hospital care. Physicians should report initial nursing facility services (99203-99306) for the first patient encounter, and subsequent nursing facility care codes (99307-99310) for each encounter thereafter. The attending physician of record appends the assigned modifier (presumed to be “AI”) when submitting their initial care service. All other initial care codes are presumed to be those of “consulting” physicians.

Initial information from CMS does not address observation services. Logically, these hospital-based services would follow the same methodology as inpatient care: report initial observation care (99218-99220) for the first “consulting” encounter. However, this might not be appropriate given Medicare’s existing rules for observation services, which guide physicians other than the admitting physician/group to “bill the office and other outpatient service codes or outpatient consultation codes as appropriate when they provide services to the patient.”2 With Medicare’s elimination of consultation codes, the consultant reports “office and other outpatient service codes” (i.e., new patient, 99201-99205, or established patient codes, 99212-99215) by default.

Without further clarification on observation services, hospitalists should report new or established patient service codes, depending on whether the patient has been seen by a group member within the last three years.

Medicare also has existing guidelines for the ED, which suggest that any physician not meeting the consultation criteria report ED service codes (99281-99285). Without further clarification, hospitalists should continue to follow this instruction for Medicare beneficiaries.

Nonphysician Providers

Medicare’s split/shared billing guidelines apply to most hospital inpatient, hospital outpatient, and ED evaluation and management (E/M) services, with consultations as one exception. Now, in accordance with the new ruling, hospitalists should select the appropriate initial service codes that correspond to patient’s location (e.g., 99223 for inpatients). NPPs can participate in the initial service provided to patients in these locations without the hospitalist having to replicate the entire service. The hospitalist can submit the claim in their name after selecting the visit level based upon the cumulative service personally provided on the same calendar day by both the NPP and the physician. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center in Philadelphia. She also is faculty for SHM’s inpatient coding course.

References

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.10I. Centers for Medicare and Medicaid Services Web site. Available at: www.cms.hhs.gov/ manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- Medicare Claims Processing Manual: Chapter 12, Section 30.6.8A. CMS Web site. Available at: www. cms.hhs.gov/manuals/downloads/clm104c12.pdf. Accessed Nov. 14, 2009.

- PFS Federal Regulation Notices: Proposed Revisions to Payment Policies Under the Physician Fee Schedule and Part B for CY 2010. CMS Web site. Available at: www.cms.hhs.gov/PhysicianFeeSched/PFSFRN/itemdetail.asp?filterType=none&filterByDID=99&sortByDID=4&sortOrder=descending&itemID=CMS1223902&intNumPerPage=10. Accessed Nov. 12, 2009.

- Payment Policies Under the Physician Fee Schedule and Other Revisions to Part B (for CY 2010). CMS Web site. Available at: www.federalregister.gov/OFR Upload/OFRData/2009-26502_PI.pdf. Accessed Nov. 10, 2009.