For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

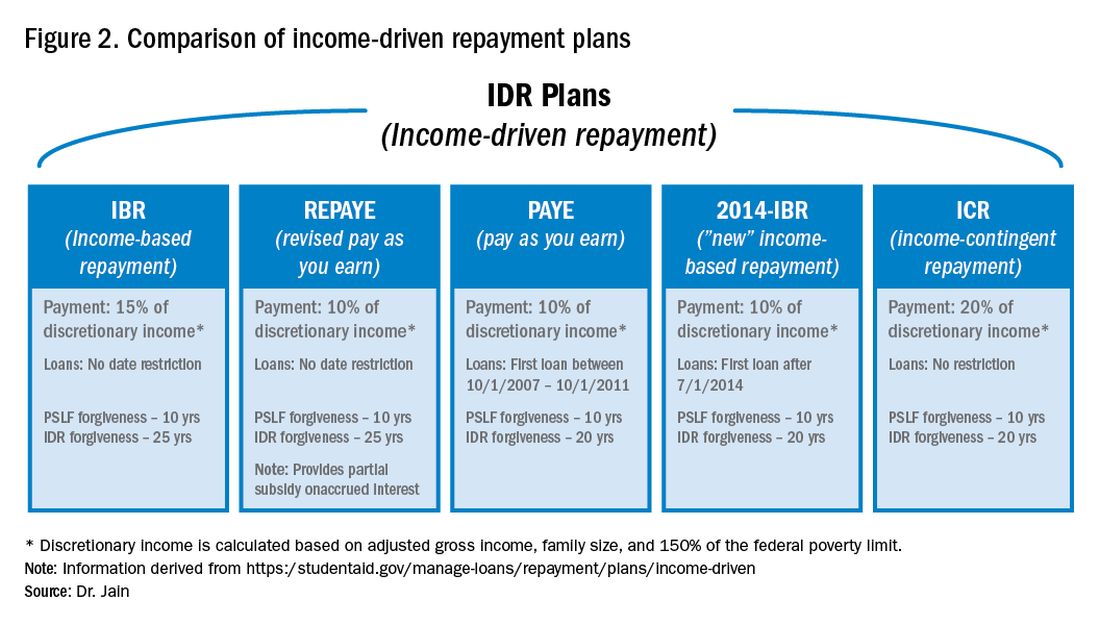

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

There are two important concerns with IDR-based forgiveness. First, the borrowers may make little progress on their loans during the 20-25 years of repayment. Even after 25 years of payments, the loan balance may be similar or even higher than the starting balance! Consequently, your financial future may depend heavily on the forgiveness program. Second, with this program, the amount of loans forgiven are considered taxable income. Hence, this program comes with a significant “tax bomb” (a stark contrast to PSLF where the forgiveness is tax free). In extreme cases, there could be a six-figure tax bill! Because of these limitations, this option should be considered only in specific niche cases, particularly borrowers with very high loan burdens.One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.