User login

Tax Questions Frequently Asked by Physicians

Physicians spend years of their lives in education and training. There are countless hours devoted to studying, researching, and clinical training, not to mention residency and possible fellowships. Then literally overnight, they transition out of a resident salary into a full-time attending pay with little to no education around what to do with this significant increase in salary.

Every job position is unique in terms of benefits, how compensation is earned, job expectations, etc. But they all share one thing in common — taxes. Increased income comes with increased taxes.

FAQ 1. What is the difference between W2 income and 1099 income?

A: If you are a W2 employee, your employer is responsible for paying half of your Social Security and Medicare taxes. You, as the employee, are then responsible only for the remaining half of your Social Security and Medicare taxes. Additionally, your employer will withhold these taxes, along with federal income taxes, from your paycheck each pay period. You are not responsible for remitting any taxes to the IRS or state agencies, as your employer will do this for you. As a W2 employee, you are not able to deduct any employee expenses against your income.

As a 1099 contractor, you are considered self-employed and are responsible for the employer and employee portion of the Social Security and Medicare taxes. You are also responsible for remitting these taxes, as well as quarterly estimated federal withholding, to the IRS and state agencies. You can deduct work-related expenses against your 1099 income.

Both types of income have pros and cons. Either of these can be more beneficial to a specific situation.

FAQ 2. How do I know if I am withholding enough taxes?

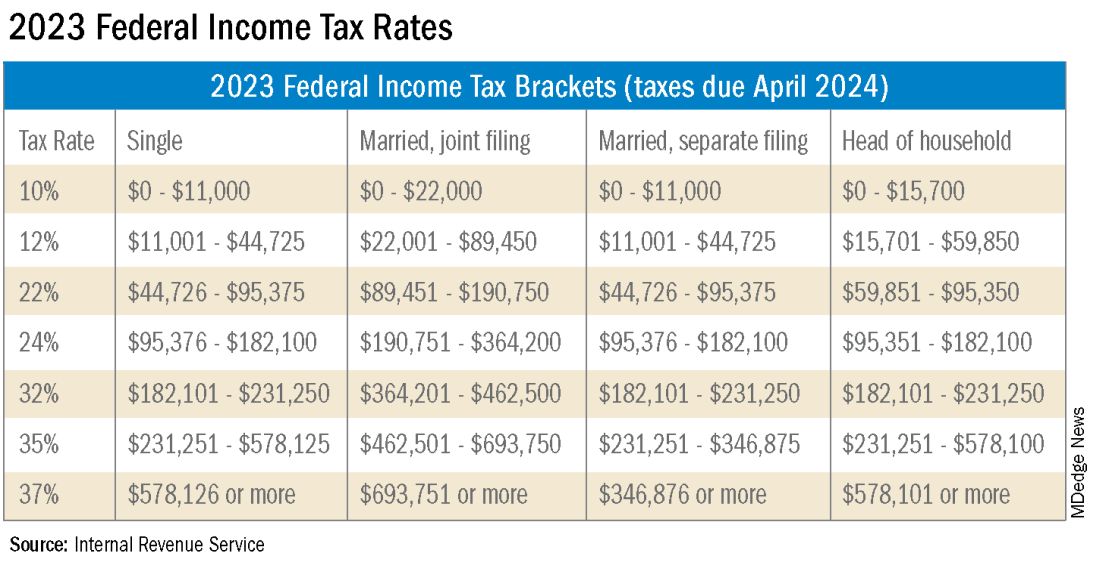

A: This is a very common issue I see, especially with physicians who are transitioning out of training into their full-time attending salary. Because this transition happens mid-year, often the first half of the year you are withholding at a rate much lower than what you will be earning as an attending and end up with a tax surprise at filing. One way to remedy this is to look at how much taxes are being withheld from your paycheck and compare this to what tax bracket you anticipate to be in, depending on filing status (Figure 1). If you do this and realize you are not withholding enough taxes, you can submit an amended form W4 to your employer to have additional withholding taken out each pay period.

FAQ 3. I am a 1099 contractor; do I need a PLLC, and should I file as an S-Corporation?

A: The term “S-Corp” gets mentioned often related to 1099 contractors and can be extremely beneficial from a tax savings perspective. Often physicians may moonlight — in addition to working in their W2 positions — and would receive this compensation as a 1099 contractor rather than an employee. This is an example of when a Professional Limited Liability Company (PLLC) might be advisable. A PLLC is created at a state level and helps shield owners from potential litigation. The owner of a PLLC pays Social Security and Medicare taxes on all income earned from the entity, and the PLLC is included in the owner’s individual income tax return.

A Small-Corporation (S-Corporation) is a tax classification that passes income through to the owners. The PLLC is now taxed as an S-Corporation, rather than a disregarded entity. The shareholders of the S-Corporation are required to pay a reasonable salary (W2 income). The remaining income passes through to the owner and is not subject to Social Security and Medicare taxes, only federal income tax. This taxation status requires an additional tax return and payroll service. Because there are additional expenses with being taxed as an S-Corporation, a cost-benefit analysis should be done before changing the tax classification to confirm that the tax savings are greater than the additional costs.

FAQ 4. What is the ‘backdoor Roth’ strategy? Should I implement it?

A: A Roth IRA is a specific type of Individual Retirement Account (IRA) that is funded with after-tax dollars. The contributions and growth in a Roth IRA can be withdrawn at retirement, tax free. As physicians who are typically high earners, you are not able to contribute directly to a Roth IRA because of income limitations. This is where the Roth conversion strategy — the backdoor Roth — comes into play. This strategy allows you to make a nondeductible traditional IRA contribution and then convert those dollars into a Roth IRA. In 2023, you can contribute up to $6,500 into this type of account. There are many additional considerations that must be made before implementing this strategy. Discussion with a financial advisor or CPA is recommended.

FAQ 5. I’ve always done my own taxes. Do I need to hire a CPA?

A: For many physicians, especially during training, your tax situation may not warrant the need for a Certified Public Accountant (CPA). However, as your income and tax complexity increase, working with a CPA not only decreases your risk for error, but also helps ensure you are not overpaying in taxes. There are many different types of services that a CPA can offer, the most basic being tax preparation. This is simply compiling your tax return based on the circumstances that occurred in the prior year. Tax planning is an additional level of service that may not be included in tax preparation cost. Tax planning is a proactive approach to taxes and helps maximize tax savings opportunities before return preparation. When interviewing a potential CPA, you can ask what level of services are included in the fees quoted.

These are just a few of the questions I regularly answer related to physicians’ taxation. The tax code is complex and ever changing. Recommendations that are made today might not be applicable or advisable in the future to any given situation. Working with a professional can ensure you have the most up-to-date and accurate information related to your taxes.

Ms. Anderson is with Physician’s Resource Services and is on Instagram @physiciansrs . Dr. Anderson is a CA-1 Resident in Anesthesia at Baylor Scott and White Health. The authors have no conflicts of interest.

Physicians spend years of their lives in education and training. There are countless hours devoted to studying, researching, and clinical training, not to mention residency and possible fellowships. Then literally overnight, they transition out of a resident salary into a full-time attending pay with little to no education around what to do with this significant increase in salary.

Every job position is unique in terms of benefits, how compensation is earned, job expectations, etc. But they all share one thing in common — taxes. Increased income comes with increased taxes.

FAQ 1. What is the difference between W2 income and 1099 income?

A: If you are a W2 employee, your employer is responsible for paying half of your Social Security and Medicare taxes. You, as the employee, are then responsible only for the remaining half of your Social Security and Medicare taxes. Additionally, your employer will withhold these taxes, along with federal income taxes, from your paycheck each pay period. You are not responsible for remitting any taxes to the IRS or state agencies, as your employer will do this for you. As a W2 employee, you are not able to deduct any employee expenses against your income.

As a 1099 contractor, you are considered self-employed and are responsible for the employer and employee portion of the Social Security and Medicare taxes. You are also responsible for remitting these taxes, as well as quarterly estimated federal withholding, to the IRS and state agencies. You can deduct work-related expenses against your 1099 income.

Both types of income have pros and cons. Either of these can be more beneficial to a specific situation.

FAQ 2. How do I know if I am withholding enough taxes?

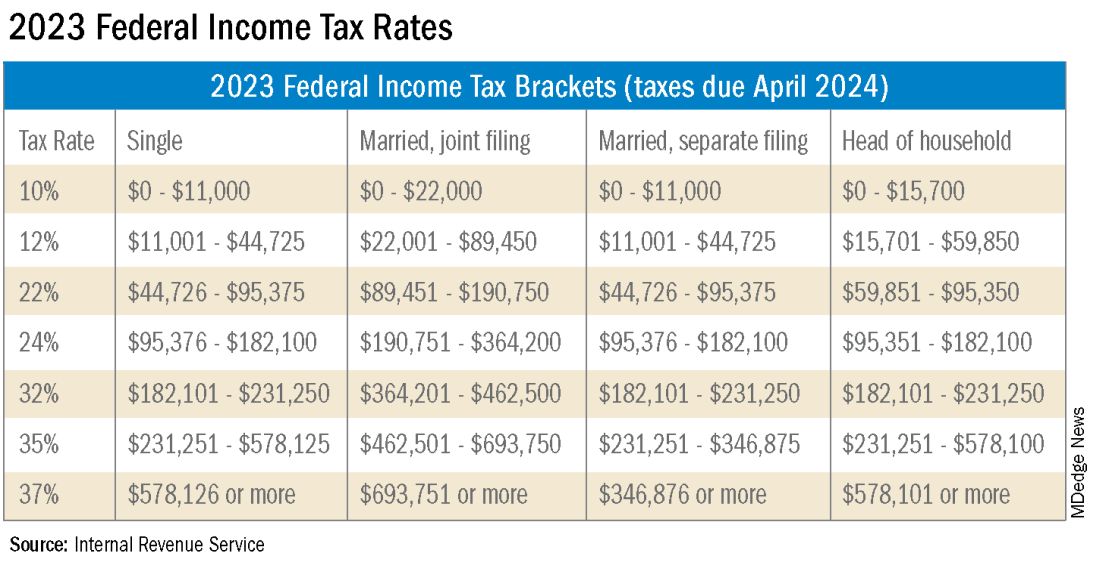

A: This is a very common issue I see, especially with physicians who are transitioning out of training into their full-time attending salary. Because this transition happens mid-year, often the first half of the year you are withholding at a rate much lower than what you will be earning as an attending and end up with a tax surprise at filing. One way to remedy this is to look at how much taxes are being withheld from your paycheck and compare this to what tax bracket you anticipate to be in, depending on filing status (Figure 1). If you do this and realize you are not withholding enough taxes, you can submit an amended form W4 to your employer to have additional withholding taken out each pay period.

FAQ 3. I am a 1099 contractor; do I need a PLLC, and should I file as an S-Corporation?

A: The term “S-Corp” gets mentioned often related to 1099 contractors and can be extremely beneficial from a tax savings perspective. Often physicians may moonlight — in addition to working in their W2 positions — and would receive this compensation as a 1099 contractor rather than an employee. This is an example of when a Professional Limited Liability Company (PLLC) might be advisable. A PLLC is created at a state level and helps shield owners from potential litigation. The owner of a PLLC pays Social Security and Medicare taxes on all income earned from the entity, and the PLLC is included in the owner’s individual income tax return.

A Small-Corporation (S-Corporation) is a tax classification that passes income through to the owners. The PLLC is now taxed as an S-Corporation, rather than a disregarded entity. The shareholders of the S-Corporation are required to pay a reasonable salary (W2 income). The remaining income passes through to the owner and is not subject to Social Security and Medicare taxes, only federal income tax. This taxation status requires an additional tax return and payroll service. Because there are additional expenses with being taxed as an S-Corporation, a cost-benefit analysis should be done before changing the tax classification to confirm that the tax savings are greater than the additional costs.

FAQ 4. What is the ‘backdoor Roth’ strategy? Should I implement it?

A: A Roth IRA is a specific type of Individual Retirement Account (IRA) that is funded with after-tax dollars. The contributions and growth in a Roth IRA can be withdrawn at retirement, tax free. As physicians who are typically high earners, you are not able to contribute directly to a Roth IRA because of income limitations. This is where the Roth conversion strategy — the backdoor Roth — comes into play. This strategy allows you to make a nondeductible traditional IRA contribution and then convert those dollars into a Roth IRA. In 2023, you can contribute up to $6,500 into this type of account. There are many additional considerations that must be made before implementing this strategy. Discussion with a financial advisor or CPA is recommended.

FAQ 5. I’ve always done my own taxes. Do I need to hire a CPA?

A: For many physicians, especially during training, your tax situation may not warrant the need for a Certified Public Accountant (CPA). However, as your income and tax complexity increase, working with a CPA not only decreases your risk for error, but also helps ensure you are not overpaying in taxes. There are many different types of services that a CPA can offer, the most basic being tax preparation. This is simply compiling your tax return based on the circumstances that occurred in the prior year. Tax planning is an additional level of service that may not be included in tax preparation cost. Tax planning is a proactive approach to taxes and helps maximize tax savings opportunities before return preparation. When interviewing a potential CPA, you can ask what level of services are included in the fees quoted.

These are just a few of the questions I regularly answer related to physicians’ taxation. The tax code is complex and ever changing. Recommendations that are made today might not be applicable or advisable in the future to any given situation. Working with a professional can ensure you have the most up-to-date and accurate information related to your taxes.

Ms. Anderson is with Physician’s Resource Services and is on Instagram @physiciansrs . Dr. Anderson is a CA-1 Resident in Anesthesia at Baylor Scott and White Health. The authors have no conflicts of interest.

Physicians spend years of their lives in education and training. There are countless hours devoted to studying, researching, and clinical training, not to mention residency and possible fellowships. Then literally overnight, they transition out of a resident salary into a full-time attending pay with little to no education around what to do with this significant increase in salary.

Every job position is unique in terms of benefits, how compensation is earned, job expectations, etc. But they all share one thing in common — taxes. Increased income comes with increased taxes.

FAQ 1. What is the difference between W2 income and 1099 income?

A: If you are a W2 employee, your employer is responsible for paying half of your Social Security and Medicare taxes. You, as the employee, are then responsible only for the remaining half of your Social Security and Medicare taxes. Additionally, your employer will withhold these taxes, along with federal income taxes, from your paycheck each pay period. You are not responsible for remitting any taxes to the IRS or state agencies, as your employer will do this for you. As a W2 employee, you are not able to deduct any employee expenses against your income.

As a 1099 contractor, you are considered self-employed and are responsible for the employer and employee portion of the Social Security and Medicare taxes. You are also responsible for remitting these taxes, as well as quarterly estimated federal withholding, to the IRS and state agencies. You can deduct work-related expenses against your 1099 income.

Both types of income have pros and cons. Either of these can be more beneficial to a specific situation.

FAQ 2. How do I know if I am withholding enough taxes?

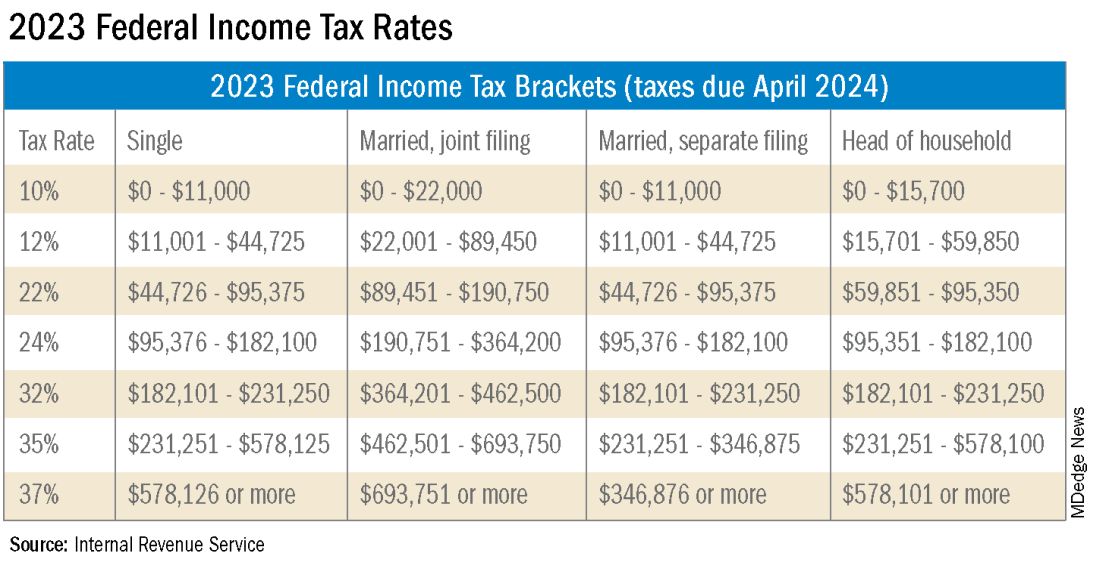

A: This is a very common issue I see, especially with physicians who are transitioning out of training into their full-time attending salary. Because this transition happens mid-year, often the first half of the year you are withholding at a rate much lower than what you will be earning as an attending and end up with a tax surprise at filing. One way to remedy this is to look at how much taxes are being withheld from your paycheck and compare this to what tax bracket you anticipate to be in, depending on filing status (Figure 1). If you do this and realize you are not withholding enough taxes, you can submit an amended form W4 to your employer to have additional withholding taken out each pay period.

FAQ 3. I am a 1099 contractor; do I need a PLLC, and should I file as an S-Corporation?

A: The term “S-Corp” gets mentioned often related to 1099 contractors and can be extremely beneficial from a tax savings perspective. Often physicians may moonlight — in addition to working in their W2 positions — and would receive this compensation as a 1099 contractor rather than an employee. This is an example of when a Professional Limited Liability Company (PLLC) might be advisable. A PLLC is created at a state level and helps shield owners from potential litigation. The owner of a PLLC pays Social Security and Medicare taxes on all income earned from the entity, and the PLLC is included in the owner’s individual income tax return.

A Small-Corporation (S-Corporation) is a tax classification that passes income through to the owners. The PLLC is now taxed as an S-Corporation, rather than a disregarded entity. The shareholders of the S-Corporation are required to pay a reasonable salary (W2 income). The remaining income passes through to the owner and is not subject to Social Security and Medicare taxes, only federal income tax. This taxation status requires an additional tax return and payroll service. Because there are additional expenses with being taxed as an S-Corporation, a cost-benefit analysis should be done before changing the tax classification to confirm that the tax savings are greater than the additional costs.

FAQ 4. What is the ‘backdoor Roth’ strategy? Should I implement it?

A: A Roth IRA is a specific type of Individual Retirement Account (IRA) that is funded with after-tax dollars. The contributions and growth in a Roth IRA can be withdrawn at retirement, tax free. As physicians who are typically high earners, you are not able to contribute directly to a Roth IRA because of income limitations. This is where the Roth conversion strategy — the backdoor Roth — comes into play. This strategy allows you to make a nondeductible traditional IRA contribution and then convert those dollars into a Roth IRA. In 2023, you can contribute up to $6,500 into this type of account. There are many additional considerations that must be made before implementing this strategy. Discussion with a financial advisor or CPA is recommended.

FAQ 5. I’ve always done my own taxes. Do I need to hire a CPA?

A: For many physicians, especially during training, your tax situation may not warrant the need for a Certified Public Accountant (CPA). However, as your income and tax complexity increase, working with a CPA not only decreases your risk for error, but also helps ensure you are not overpaying in taxes. There are many different types of services that a CPA can offer, the most basic being tax preparation. This is simply compiling your tax return based on the circumstances that occurred in the prior year. Tax planning is an additional level of service that may not be included in tax preparation cost. Tax planning is a proactive approach to taxes and helps maximize tax savings opportunities before return preparation. When interviewing a potential CPA, you can ask what level of services are included in the fees quoted.

These are just a few of the questions I regularly answer related to physicians’ taxation. The tax code is complex and ever changing. Recommendations that are made today might not be applicable or advisable in the future to any given situation. Working with a professional can ensure you have the most up-to-date and accurate information related to your taxes.

Ms. Anderson is with Physician’s Resource Services and is on Instagram @physiciansrs . Dr. Anderson is a CA-1 Resident in Anesthesia at Baylor Scott and White Health. The authors have no conflicts of interest.