User login

Protection of the Medicare program has reached new heights in recent years. One of the most important ways hospitalist groups can protect their Medicare funding is the discovery and recovery of improper contractor payments of Medicare claims.

The Centers for Medicare and Medicaid Services (CMS) reviews various types of contractors—Medicare administrative contractors (MACs), carriers, durable medical equipment regional carriers (DMERCs), fiscal intermediaries (FIs), and quality improvement organizations (QIOs)—through its protection efforts as part of the Comprehensive Error Rate Testing (CERT) program and Hospital Payment Monitoring Program (HPMP). The CERT program’s contractors review physician (i.e., professional) claims processed by MACs and carriers.

The primary goal of a contractor is to “pay it right”—that is, pay the correct amount to the right provider for covered and correctly coded services.1 During the 12-month reporting period ending Sept. 30, 2007, the CERT program sampled 129,875 claims from carriers, DMERCs, FIs, and MACs.

The CERT contractor randomly and electronically selects about 172 claims each month from each type of claims-processing contractor. Since some of these contractors were transitioning to MACs, the target Part B (i.e., professional) sample size for the May 2008 report was approximately 2,000 reviewable claims per MAC cluster. However, this might have varied if a MAC was not processing claims during the entire sampling period.

Document Requests

Physicians need to be mindful of CERT requests for documentation. When possible, every attempt is made to benefit the physician. Initial CERT requests are attempted by way of a letter. If the physician does not respond within 30 days, the CERT contractor attempts one to three more contacts with correspondence and phone calls. If documentation is received after 75 days, it is considered “late.” It then will be reviewed, unless the reporting period has expired.

However, this should not be considered a prudent approach, and timely responses are ideal. If the physician offers no response, and documentation is not received, it is counted as a “no documentation” error.

Physicians often worry about accusations of fraud. The purpose of the CERT program is not to assume or accuse physicians of fraud, although it may serve as a deterrent. It does not, and cannot, label a claim fraudulent.

One scenario of potential fraud the CERT program is able to identify occurs when a CERT documentation contractor is unable to locate a provider or supplier when requesting medical record documentation.2

Outcomes

Individual contractors are notified of improper payments. These include overpayments and underpayments. Unfortunately, contractors do not have to resolve CERT issues involving underpayments, although they are encouraged to do so by CMS.

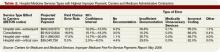

The CERT program identified overpayments totaling $875,005 during the 12-month reporting period, but collected only $650,418 in overpayments after consideration of appeals that overturned a CERT decision or the provider discontinued business operations. (See Table 1, p. 18, for error rates and Table 2, p. 18, for highest rates of improper payment)

To improve billing compliance and prevent repetitive errors, contractors must implement provider education regarding erroneously paid claims. A contractor may determine the best education method to distribute information about Medicare rules and effectively answer coverage and coding questions.

Some contractors have designed Web-based training modules, Web pages with frequently-asked-questions sections, or local coverage analyses to address contractor-specific errors. Detailed CERT contractor information can be found at www.cms.hhs.gov/ mcd/indexes.asp?from2=indexes.asp&

Due to its successful outcomes, future CMS goals include the continuation of the CERT program. MACs will look more closely at service types based on identified error rates.

Apart from CERT requests, prepayment contractor reviews already exist for most of the services included in Table 2 (p. 18). Timely response is crucial to justify and receive appropriate reimbursement. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She is on the faculty of SHM’s inpatient coding course.

References

1. Centers for Medicare and Medicaid Services. Improper Medicare fee-for-service payments report: May 2008. CMS Web site. Available at: www.cms.hhs.gov/apps/er_report/preview_er_report.asp?from=public&which=long&reportID=9. Accessed Dec. 20, 2008.

2. Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association; 2008.

Protection of the Medicare program has reached new heights in recent years. One of the most important ways hospitalist groups can protect their Medicare funding is the discovery and recovery of improper contractor payments of Medicare claims.

The Centers for Medicare and Medicaid Services (CMS) reviews various types of contractors—Medicare administrative contractors (MACs), carriers, durable medical equipment regional carriers (DMERCs), fiscal intermediaries (FIs), and quality improvement organizations (QIOs)—through its protection efforts as part of the Comprehensive Error Rate Testing (CERT) program and Hospital Payment Monitoring Program (HPMP). The CERT program’s contractors review physician (i.e., professional) claims processed by MACs and carriers.

The primary goal of a contractor is to “pay it right”—that is, pay the correct amount to the right provider for covered and correctly coded services.1 During the 12-month reporting period ending Sept. 30, 2007, the CERT program sampled 129,875 claims from carriers, DMERCs, FIs, and MACs.

The CERT contractor randomly and electronically selects about 172 claims each month from each type of claims-processing contractor. Since some of these contractors were transitioning to MACs, the target Part B (i.e., professional) sample size for the May 2008 report was approximately 2,000 reviewable claims per MAC cluster. However, this might have varied if a MAC was not processing claims during the entire sampling period.

Document Requests

Physicians need to be mindful of CERT requests for documentation. When possible, every attempt is made to benefit the physician. Initial CERT requests are attempted by way of a letter. If the physician does not respond within 30 days, the CERT contractor attempts one to three more contacts with correspondence and phone calls. If documentation is received after 75 days, it is considered “late.” It then will be reviewed, unless the reporting period has expired.

However, this should not be considered a prudent approach, and timely responses are ideal. If the physician offers no response, and documentation is not received, it is counted as a “no documentation” error.

Physicians often worry about accusations of fraud. The purpose of the CERT program is not to assume or accuse physicians of fraud, although it may serve as a deterrent. It does not, and cannot, label a claim fraudulent.

One scenario of potential fraud the CERT program is able to identify occurs when a CERT documentation contractor is unable to locate a provider or supplier when requesting medical record documentation.2

Outcomes

Individual contractors are notified of improper payments. These include overpayments and underpayments. Unfortunately, contractors do not have to resolve CERT issues involving underpayments, although they are encouraged to do so by CMS.

The CERT program identified overpayments totaling $875,005 during the 12-month reporting period, but collected only $650,418 in overpayments after consideration of appeals that overturned a CERT decision or the provider discontinued business operations. (See Table 1, p. 18, for error rates and Table 2, p. 18, for highest rates of improper payment)

To improve billing compliance and prevent repetitive errors, contractors must implement provider education regarding erroneously paid claims. A contractor may determine the best education method to distribute information about Medicare rules and effectively answer coverage and coding questions.

Some contractors have designed Web-based training modules, Web pages with frequently-asked-questions sections, or local coverage analyses to address contractor-specific errors. Detailed CERT contractor information can be found at www.cms.hhs.gov/ mcd/indexes.asp?from2=indexes.asp&

Due to its successful outcomes, future CMS goals include the continuation of the CERT program. MACs will look more closely at service types based on identified error rates.

Apart from CERT requests, prepayment contractor reviews already exist for most of the services included in Table 2 (p. 18). Timely response is crucial to justify and receive appropriate reimbursement. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She is on the faculty of SHM’s inpatient coding course.

References

1. Centers for Medicare and Medicaid Services. Improper Medicare fee-for-service payments report: May 2008. CMS Web site. Available at: www.cms.hhs.gov/apps/er_report/preview_er_report.asp?from=public&which=long&reportID=9. Accessed Dec. 20, 2008.

2. Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association; 2008.

Protection of the Medicare program has reached new heights in recent years. One of the most important ways hospitalist groups can protect their Medicare funding is the discovery and recovery of improper contractor payments of Medicare claims.

The Centers for Medicare and Medicaid Services (CMS) reviews various types of contractors—Medicare administrative contractors (MACs), carriers, durable medical equipment regional carriers (DMERCs), fiscal intermediaries (FIs), and quality improvement organizations (QIOs)—through its protection efforts as part of the Comprehensive Error Rate Testing (CERT) program and Hospital Payment Monitoring Program (HPMP). The CERT program’s contractors review physician (i.e., professional) claims processed by MACs and carriers.

The primary goal of a contractor is to “pay it right”—that is, pay the correct amount to the right provider for covered and correctly coded services.1 During the 12-month reporting period ending Sept. 30, 2007, the CERT program sampled 129,875 claims from carriers, DMERCs, FIs, and MACs.

The CERT contractor randomly and electronically selects about 172 claims each month from each type of claims-processing contractor. Since some of these contractors were transitioning to MACs, the target Part B (i.e., professional) sample size for the May 2008 report was approximately 2,000 reviewable claims per MAC cluster. However, this might have varied if a MAC was not processing claims during the entire sampling period.

Document Requests

Physicians need to be mindful of CERT requests for documentation. When possible, every attempt is made to benefit the physician. Initial CERT requests are attempted by way of a letter. If the physician does not respond within 30 days, the CERT contractor attempts one to three more contacts with correspondence and phone calls. If documentation is received after 75 days, it is considered “late.” It then will be reviewed, unless the reporting period has expired.

However, this should not be considered a prudent approach, and timely responses are ideal. If the physician offers no response, and documentation is not received, it is counted as a “no documentation” error.

Physicians often worry about accusations of fraud. The purpose of the CERT program is not to assume or accuse physicians of fraud, although it may serve as a deterrent. It does not, and cannot, label a claim fraudulent.

One scenario of potential fraud the CERT program is able to identify occurs when a CERT documentation contractor is unable to locate a provider or supplier when requesting medical record documentation.2

Outcomes

Individual contractors are notified of improper payments. These include overpayments and underpayments. Unfortunately, contractors do not have to resolve CERT issues involving underpayments, although they are encouraged to do so by CMS.

The CERT program identified overpayments totaling $875,005 during the 12-month reporting period, but collected only $650,418 in overpayments after consideration of appeals that overturned a CERT decision or the provider discontinued business operations. (See Table 1, p. 18, for error rates and Table 2, p. 18, for highest rates of improper payment)

To improve billing compliance and prevent repetitive errors, contractors must implement provider education regarding erroneously paid claims. A contractor may determine the best education method to distribute information about Medicare rules and effectively answer coverage and coding questions.

Some contractors have designed Web-based training modules, Web pages with frequently-asked-questions sections, or local coverage analyses to address contractor-specific errors. Detailed CERT contractor information can be found at www.cms.hhs.gov/ mcd/indexes.asp?from2=indexes.asp&

Due to its successful outcomes, future CMS goals include the continuation of the CERT program. MACs will look more closely at service types based on identified error rates.

Apart from CERT requests, prepayment contractor reviews already exist for most of the services included in Table 2 (p. 18). Timely response is crucial to justify and receive appropriate reimbursement. TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She is on the faculty of SHM’s inpatient coding course.

References

1. Centers for Medicare and Medicaid Services. Improper Medicare fee-for-service payments report: May 2008. CMS Web site. Available at: www.cms.hhs.gov/apps/er_report/preview_er_report.asp?from=public&which=long&reportID=9. Accessed Dec. 20, 2008.

2. Beebe M, Dalton J, Espronceda M, Evans D, Glenn R. Current Procedural Terminology Professional Edition. Chicago: American Medical Association; 2008.