User login

As physicians, including hospitalists, focus on the now—getting the patient in front of them better—they may lose sight of the trends shaping their professional lives. Those trends, called “business drivers” occupy CEOs, CFOs, and other top managers who build strategies by understanding what drivers make organizations successful.

It’s not an easy job. Even the Delphic Oracle might have trouble divining which of the myriad competing drivers will make a hospital better and more profitable than its rivals. Take your pick: Sluggish inpatient volumes, shifts to outpatient procedures, high construction costs, expensive new technologies, an aging population, and consumer-driven care are among the business drivers currently on managers’ minds. (See “Trend Spotters,” p. 48.)

Michael Guthrie, MD, MBA, an executive-in-residence at the University of Colorado, School of Business (Boulder), Health Administration and a presenter at SHM’s September 2005 Leadership Conference in Vail, Colo., sees our aging population as a key business driver shaping hospital and physician livelihoods.

“The aging population and the shift to consumerism in healthcare are definitely on the hospital CEO’s mind,” he says. “Hospitalists need to understand how patient satisfaction drives market share and is highly correlated with the hospital’s business objectives.” By extension, hospitalists’ key metrics, such as compliance with Medicare core measures, reducing length of stay (LOS), and costs per case, mesh well with administration’s.

Keeping the CEO’s need to enhance the organization’s reputation and growth in mind, Dr. Guthrie suggests that hospitalists have their hands full. By focusing on measuring quality, providing the 24/7 coverage that patients want and the hospital needs and finding ways to decrease LOS and costs per case, their interests and those of the hospital’s align.

“Based on their conversations and observations of the hospital’s senior managers, hospitalists can figure out what business drivers are preoccupying them,” adds Dr. Guthrie.

Smart hospitalists can significantly boost their hospital’s bottom line according to Tom Hochhausler, Deloitte & Touche USA LLP’s partner of Life Sciences and Health Care Practice and director of the firm’s biennial survey on trends concerning hospital CEOs. Hochhausler says that with hospitals operating on razor-thin margins, hospitalists can increase their value to hospital CEOs and CFOs by improving communication among clinical staff, better adherence to guidelines, and shortening LOS. “They also have some of the best insights into improving quality in hospitals and are powerful teachers of interns and residents,” he adds. (See “What Worries Hospital CEOs,” at left.)

The difficult part for hospitalists is keeping focused on the hospital’s big picture while doing their jobs. For example, Michael Freed, CFO of Grand Rapids, Mich.-based Spectrum Health, ponders the financial aspects of a huge integrated delivery system with seven hospitals, 12,000 employees, a medical staff of 1,400 and a $2.1 billion budget. Rather than day-to-day concerns he focuses on the future—not one year, but five to 10 years ahead.

“Since the hospitalist team’s job is to cover the hospital 24/7, they don’t always connect the dots of what’s happening throughout the system,” says Ford. That’s why top managers must focus on the future. “If management has the right road map and vision for the future, a lot of good things happen for hospitalists: Patients get better care, which leads to better outcomes, [and] we lower costs and pass the savings along to payers. That, in turn, drives higher market share and increases the hospital’s value proposition.”

Hospital medicine groups rather than individual physicians may be best suited to track the hospital’s business drivers, and align incentives accordingly. Davin Juckett, CPA, MBA, of the Charlotte, N.C., Piedmont Healthcare Management Group, a physician-owned consultancy to more than 100 hospitalists in the southeast, advises hospitalists to use their billing and encounter data to improve their decision-making.

“Hospitalists tend to be very focused on their LOS and quality indicators but there’s a lot more out there,” says Juckett. “Business drivers such as consumer-directed care and P4P [pay for performance] make quantifiable data extremely important. Some MCOs have started star ratings of hospitalist and ER groups, and some doctors are up in arms because they feel it’s subjective. But that’s the future.”

Juckett sees another key business driver for 2006 and 2007: an increasingly competitive business environment for hospitalists. “Hospital medicine groups will have to defend their contracts,” he says. “True, the newness of the specialty makes recruitment an issue, but supply will eventually catch up with demand, and P4P will happen.”

Hospitalists might examine how another major business driver—aggressive competition for payer dollars—can put them at odds with office-based colleagues. By competing with hospitals for lucrative procedures in orthopedics, gynecology, cardiology, and other specialties, community physicians can lure market share away. Hospitalists are well positioned to mediate the conflict, although a report by VHA of Irving, Texas, says hospitalists often don’t keep community doctors informed of issues facing their hospitals. That report adds that hospitalists do a poor job of bringing hospital administrators and physicians together to forge common solutions.

Bricks and Mortar

Balancing soaring construction costs with the need to give picky consumers and physicians the latest technology in gleaming new buildings is another trend. Big-ticket items keep Joann Marqusee, MPP, senior vice-president of operations and facilities at Boston-based Beth Israel Deaconess Medical Center occupied. Her job—prioritizing capital projects, keeping facilities up to date, and tailoring spending to reduce future maintenance needs—got even more challenging with Hurricane Katrina. “Things are always difficult, but now the price of oil and steel are rising,” says Marqusee. “And we can’t find dehumidifiers to help with our little floods; they’re all in New Orleans.”

She has capital-spending decisions down to a disciplined process: Match projects with the strategic plan (e.g., neurosurgery ahead of ob/gyn), assess impact on patient volume and return on investment, and improve patient safety and quality. Explaining those decisions to physicians who get feisty when a favored project is delayed or cancelled is the tough part.

To gain doctors’ support for management’s spending priorities, Marqusee has a PowerPoint presentation for them: “Space: The Final Frontier.” She raves about hospitalists’ response: ”The hospitalists’ input has been fantastic because of their analytic training. For example, they understand ED throughput, and we use their expertise to improve design. And when we tell them that the new ICU can’t open as soon as they’d like because it’s being built above the bone marrow transplant center, and we need a new HVAC system installed first, they get it. They care about patients and when we introduce bottom line issues as well, we strengthen our working relationship.”

Where the (Aging) Consumer Is King

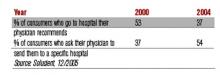

Consumerism is another business driver that hospitals can’t ignore. Individuals are increasingly willing to push their physicians to send them to the hospitals the consumers prefer, according to Solucient, a healthcare market intelligence firm in Evanston, Ill. In a survey of nearly 20,000 households Solucient identified a group of “responsive consumers,” (i.e., those proactive about managing their healthcare). Slightly older than the average consumer surveyed, the respondents have between 20% and 80% higher incidence of chronic diseases, and increasingly choose where they’re hospitalized rather than accept their physician’s recommendation:

Solucient’s data also show that responsive consumers heavily research and utilize hospital and physician ratings.

Homegrown Effort

While consultants are oracles of healthcare trends, some physician administrators rely on themselves instead. Akram Boutrous, MD, executive vice-president and CMO of South Nassau Community Hospital (Oceanside, N.Y.), turned the hospital around with an eight-year business improvement program based on understanding business trends. Some achievements: a 73% increase in patient revenues, 57% jump in outpatient services, and 27% increase in inpatient discharges.

Dr. Boutros considered using consultants, but disliked their high fees and lack of ongoing involvement. Instead he read stacks of books and articles on business drivers and strategies before selecting General Electric’s Accelerated Action Approach to Success. The method uses teams to solve problems that make organizations non-competitive.

“Hospitals face incredibly complex problems and competing demands from different departments,” says Dr. Boutros. “As a physician administrator I felt I could translate for all sides.”

He cites consumer-directed care as a key trend blindsiding most doctors. “They are completely unprepared for the changing market dynamics of consumer choice,” he says.

Consultants, administrators, and physicians agree: Hospitalists need to avoid the tunnel vision when it comes to their own metrics and pay attention to the business drivers changing healthcare. If they learn to spot key trends, they’re perfectly situated to work with hospital administrators and their office-based colleagues on using that knowledge to increase market share, and to have better and more profitable hospitals. TH

Writer Marlene Piturro covered SHM’s Leadership Conference in Vail for The Hospitalist.

As physicians, including hospitalists, focus on the now—getting the patient in front of them better—they may lose sight of the trends shaping their professional lives. Those trends, called “business drivers” occupy CEOs, CFOs, and other top managers who build strategies by understanding what drivers make organizations successful.

It’s not an easy job. Even the Delphic Oracle might have trouble divining which of the myriad competing drivers will make a hospital better and more profitable than its rivals. Take your pick: Sluggish inpatient volumes, shifts to outpatient procedures, high construction costs, expensive new technologies, an aging population, and consumer-driven care are among the business drivers currently on managers’ minds. (See “Trend Spotters,” p. 48.)

Michael Guthrie, MD, MBA, an executive-in-residence at the University of Colorado, School of Business (Boulder), Health Administration and a presenter at SHM’s September 2005 Leadership Conference in Vail, Colo., sees our aging population as a key business driver shaping hospital and physician livelihoods.

“The aging population and the shift to consumerism in healthcare are definitely on the hospital CEO’s mind,” he says. “Hospitalists need to understand how patient satisfaction drives market share and is highly correlated with the hospital’s business objectives.” By extension, hospitalists’ key metrics, such as compliance with Medicare core measures, reducing length of stay (LOS), and costs per case, mesh well with administration’s.

Keeping the CEO’s need to enhance the organization’s reputation and growth in mind, Dr. Guthrie suggests that hospitalists have their hands full. By focusing on measuring quality, providing the 24/7 coverage that patients want and the hospital needs and finding ways to decrease LOS and costs per case, their interests and those of the hospital’s align.

“Based on their conversations and observations of the hospital’s senior managers, hospitalists can figure out what business drivers are preoccupying them,” adds Dr. Guthrie.

Smart hospitalists can significantly boost their hospital’s bottom line according to Tom Hochhausler, Deloitte & Touche USA LLP’s partner of Life Sciences and Health Care Practice and director of the firm’s biennial survey on trends concerning hospital CEOs. Hochhausler says that with hospitals operating on razor-thin margins, hospitalists can increase their value to hospital CEOs and CFOs by improving communication among clinical staff, better adherence to guidelines, and shortening LOS. “They also have some of the best insights into improving quality in hospitals and are powerful teachers of interns and residents,” he adds. (See “What Worries Hospital CEOs,” at left.)

The difficult part for hospitalists is keeping focused on the hospital’s big picture while doing their jobs. For example, Michael Freed, CFO of Grand Rapids, Mich.-based Spectrum Health, ponders the financial aspects of a huge integrated delivery system with seven hospitals, 12,000 employees, a medical staff of 1,400 and a $2.1 billion budget. Rather than day-to-day concerns he focuses on the future—not one year, but five to 10 years ahead.

“Since the hospitalist team’s job is to cover the hospital 24/7, they don’t always connect the dots of what’s happening throughout the system,” says Ford. That’s why top managers must focus on the future. “If management has the right road map and vision for the future, a lot of good things happen for hospitalists: Patients get better care, which leads to better outcomes, [and] we lower costs and pass the savings along to payers. That, in turn, drives higher market share and increases the hospital’s value proposition.”

Hospital medicine groups rather than individual physicians may be best suited to track the hospital’s business drivers, and align incentives accordingly. Davin Juckett, CPA, MBA, of the Charlotte, N.C., Piedmont Healthcare Management Group, a physician-owned consultancy to more than 100 hospitalists in the southeast, advises hospitalists to use their billing and encounter data to improve their decision-making.

“Hospitalists tend to be very focused on their LOS and quality indicators but there’s a lot more out there,” says Juckett. “Business drivers such as consumer-directed care and P4P [pay for performance] make quantifiable data extremely important. Some MCOs have started star ratings of hospitalist and ER groups, and some doctors are up in arms because they feel it’s subjective. But that’s the future.”

Juckett sees another key business driver for 2006 and 2007: an increasingly competitive business environment for hospitalists. “Hospital medicine groups will have to defend their contracts,” he says. “True, the newness of the specialty makes recruitment an issue, but supply will eventually catch up with demand, and P4P will happen.”

Hospitalists might examine how another major business driver—aggressive competition for payer dollars—can put them at odds with office-based colleagues. By competing with hospitals for lucrative procedures in orthopedics, gynecology, cardiology, and other specialties, community physicians can lure market share away. Hospitalists are well positioned to mediate the conflict, although a report by VHA of Irving, Texas, says hospitalists often don’t keep community doctors informed of issues facing their hospitals. That report adds that hospitalists do a poor job of bringing hospital administrators and physicians together to forge common solutions.

Bricks and Mortar

Balancing soaring construction costs with the need to give picky consumers and physicians the latest technology in gleaming new buildings is another trend. Big-ticket items keep Joann Marqusee, MPP, senior vice-president of operations and facilities at Boston-based Beth Israel Deaconess Medical Center occupied. Her job—prioritizing capital projects, keeping facilities up to date, and tailoring spending to reduce future maintenance needs—got even more challenging with Hurricane Katrina. “Things are always difficult, but now the price of oil and steel are rising,” says Marqusee. “And we can’t find dehumidifiers to help with our little floods; they’re all in New Orleans.”

She has capital-spending decisions down to a disciplined process: Match projects with the strategic plan (e.g., neurosurgery ahead of ob/gyn), assess impact on patient volume and return on investment, and improve patient safety and quality. Explaining those decisions to physicians who get feisty when a favored project is delayed or cancelled is the tough part.

To gain doctors’ support for management’s spending priorities, Marqusee has a PowerPoint presentation for them: “Space: The Final Frontier.” She raves about hospitalists’ response: ”The hospitalists’ input has been fantastic because of their analytic training. For example, they understand ED throughput, and we use their expertise to improve design. And when we tell them that the new ICU can’t open as soon as they’d like because it’s being built above the bone marrow transplant center, and we need a new HVAC system installed first, they get it. They care about patients and when we introduce bottom line issues as well, we strengthen our working relationship.”

Where the (Aging) Consumer Is King

Consumerism is another business driver that hospitals can’t ignore. Individuals are increasingly willing to push their physicians to send them to the hospitals the consumers prefer, according to Solucient, a healthcare market intelligence firm in Evanston, Ill. In a survey of nearly 20,000 households Solucient identified a group of “responsive consumers,” (i.e., those proactive about managing their healthcare). Slightly older than the average consumer surveyed, the respondents have between 20% and 80% higher incidence of chronic diseases, and increasingly choose where they’re hospitalized rather than accept their physician’s recommendation:

Solucient’s data also show that responsive consumers heavily research and utilize hospital and physician ratings.

Homegrown Effort

While consultants are oracles of healthcare trends, some physician administrators rely on themselves instead. Akram Boutrous, MD, executive vice-president and CMO of South Nassau Community Hospital (Oceanside, N.Y.), turned the hospital around with an eight-year business improvement program based on understanding business trends. Some achievements: a 73% increase in patient revenues, 57% jump in outpatient services, and 27% increase in inpatient discharges.

Dr. Boutros considered using consultants, but disliked their high fees and lack of ongoing involvement. Instead he read stacks of books and articles on business drivers and strategies before selecting General Electric’s Accelerated Action Approach to Success. The method uses teams to solve problems that make organizations non-competitive.

“Hospitals face incredibly complex problems and competing demands from different departments,” says Dr. Boutros. “As a physician administrator I felt I could translate for all sides.”

He cites consumer-directed care as a key trend blindsiding most doctors. “They are completely unprepared for the changing market dynamics of consumer choice,” he says.

Consultants, administrators, and physicians agree: Hospitalists need to avoid the tunnel vision when it comes to their own metrics and pay attention to the business drivers changing healthcare. If they learn to spot key trends, they’re perfectly situated to work with hospital administrators and their office-based colleagues on using that knowledge to increase market share, and to have better and more profitable hospitals. TH

Writer Marlene Piturro covered SHM’s Leadership Conference in Vail for The Hospitalist.

As physicians, including hospitalists, focus on the now—getting the patient in front of them better—they may lose sight of the trends shaping their professional lives. Those trends, called “business drivers” occupy CEOs, CFOs, and other top managers who build strategies by understanding what drivers make organizations successful.

It’s not an easy job. Even the Delphic Oracle might have trouble divining which of the myriad competing drivers will make a hospital better and more profitable than its rivals. Take your pick: Sluggish inpatient volumes, shifts to outpatient procedures, high construction costs, expensive new technologies, an aging population, and consumer-driven care are among the business drivers currently on managers’ minds. (See “Trend Spotters,” p. 48.)

Michael Guthrie, MD, MBA, an executive-in-residence at the University of Colorado, School of Business (Boulder), Health Administration and a presenter at SHM’s September 2005 Leadership Conference in Vail, Colo., sees our aging population as a key business driver shaping hospital and physician livelihoods.

“The aging population and the shift to consumerism in healthcare are definitely on the hospital CEO’s mind,” he says. “Hospitalists need to understand how patient satisfaction drives market share and is highly correlated with the hospital’s business objectives.” By extension, hospitalists’ key metrics, such as compliance with Medicare core measures, reducing length of stay (LOS), and costs per case, mesh well with administration’s.

Keeping the CEO’s need to enhance the organization’s reputation and growth in mind, Dr. Guthrie suggests that hospitalists have their hands full. By focusing on measuring quality, providing the 24/7 coverage that patients want and the hospital needs and finding ways to decrease LOS and costs per case, their interests and those of the hospital’s align.

“Based on their conversations and observations of the hospital’s senior managers, hospitalists can figure out what business drivers are preoccupying them,” adds Dr. Guthrie.

Smart hospitalists can significantly boost their hospital’s bottom line according to Tom Hochhausler, Deloitte & Touche USA LLP’s partner of Life Sciences and Health Care Practice and director of the firm’s biennial survey on trends concerning hospital CEOs. Hochhausler says that with hospitals operating on razor-thin margins, hospitalists can increase their value to hospital CEOs and CFOs by improving communication among clinical staff, better adherence to guidelines, and shortening LOS. “They also have some of the best insights into improving quality in hospitals and are powerful teachers of interns and residents,” he adds. (See “What Worries Hospital CEOs,” at left.)

The difficult part for hospitalists is keeping focused on the hospital’s big picture while doing their jobs. For example, Michael Freed, CFO of Grand Rapids, Mich.-based Spectrum Health, ponders the financial aspects of a huge integrated delivery system with seven hospitals, 12,000 employees, a medical staff of 1,400 and a $2.1 billion budget. Rather than day-to-day concerns he focuses on the future—not one year, but five to 10 years ahead.

“Since the hospitalist team’s job is to cover the hospital 24/7, they don’t always connect the dots of what’s happening throughout the system,” says Ford. That’s why top managers must focus on the future. “If management has the right road map and vision for the future, a lot of good things happen for hospitalists: Patients get better care, which leads to better outcomes, [and] we lower costs and pass the savings along to payers. That, in turn, drives higher market share and increases the hospital’s value proposition.”

Hospital medicine groups rather than individual physicians may be best suited to track the hospital’s business drivers, and align incentives accordingly. Davin Juckett, CPA, MBA, of the Charlotte, N.C., Piedmont Healthcare Management Group, a physician-owned consultancy to more than 100 hospitalists in the southeast, advises hospitalists to use their billing and encounter data to improve their decision-making.

“Hospitalists tend to be very focused on their LOS and quality indicators but there’s a lot more out there,” says Juckett. “Business drivers such as consumer-directed care and P4P [pay for performance] make quantifiable data extremely important. Some MCOs have started star ratings of hospitalist and ER groups, and some doctors are up in arms because they feel it’s subjective. But that’s the future.”

Juckett sees another key business driver for 2006 and 2007: an increasingly competitive business environment for hospitalists. “Hospital medicine groups will have to defend their contracts,” he says. “True, the newness of the specialty makes recruitment an issue, but supply will eventually catch up with demand, and P4P will happen.”

Hospitalists might examine how another major business driver—aggressive competition for payer dollars—can put them at odds with office-based colleagues. By competing with hospitals for lucrative procedures in orthopedics, gynecology, cardiology, and other specialties, community physicians can lure market share away. Hospitalists are well positioned to mediate the conflict, although a report by VHA of Irving, Texas, says hospitalists often don’t keep community doctors informed of issues facing their hospitals. That report adds that hospitalists do a poor job of bringing hospital administrators and physicians together to forge common solutions.

Bricks and Mortar

Balancing soaring construction costs with the need to give picky consumers and physicians the latest technology in gleaming new buildings is another trend. Big-ticket items keep Joann Marqusee, MPP, senior vice-president of operations and facilities at Boston-based Beth Israel Deaconess Medical Center occupied. Her job—prioritizing capital projects, keeping facilities up to date, and tailoring spending to reduce future maintenance needs—got even more challenging with Hurricane Katrina. “Things are always difficult, but now the price of oil and steel are rising,” says Marqusee. “And we can’t find dehumidifiers to help with our little floods; they’re all in New Orleans.”

She has capital-spending decisions down to a disciplined process: Match projects with the strategic plan (e.g., neurosurgery ahead of ob/gyn), assess impact on patient volume and return on investment, and improve patient safety and quality. Explaining those decisions to physicians who get feisty when a favored project is delayed or cancelled is the tough part.

To gain doctors’ support for management’s spending priorities, Marqusee has a PowerPoint presentation for them: “Space: The Final Frontier.” She raves about hospitalists’ response: ”The hospitalists’ input has been fantastic because of their analytic training. For example, they understand ED throughput, and we use their expertise to improve design. And when we tell them that the new ICU can’t open as soon as they’d like because it’s being built above the bone marrow transplant center, and we need a new HVAC system installed first, they get it. They care about patients and when we introduce bottom line issues as well, we strengthen our working relationship.”

Where the (Aging) Consumer Is King

Consumerism is another business driver that hospitals can’t ignore. Individuals are increasingly willing to push their physicians to send them to the hospitals the consumers prefer, according to Solucient, a healthcare market intelligence firm in Evanston, Ill. In a survey of nearly 20,000 households Solucient identified a group of “responsive consumers,” (i.e., those proactive about managing their healthcare). Slightly older than the average consumer surveyed, the respondents have between 20% and 80% higher incidence of chronic diseases, and increasingly choose where they’re hospitalized rather than accept their physician’s recommendation:

Solucient’s data also show that responsive consumers heavily research and utilize hospital and physician ratings.

Homegrown Effort

While consultants are oracles of healthcare trends, some physician administrators rely on themselves instead. Akram Boutrous, MD, executive vice-president and CMO of South Nassau Community Hospital (Oceanside, N.Y.), turned the hospital around with an eight-year business improvement program based on understanding business trends. Some achievements: a 73% increase in patient revenues, 57% jump in outpatient services, and 27% increase in inpatient discharges.

Dr. Boutros considered using consultants, but disliked their high fees and lack of ongoing involvement. Instead he read stacks of books and articles on business drivers and strategies before selecting General Electric’s Accelerated Action Approach to Success. The method uses teams to solve problems that make organizations non-competitive.

“Hospitals face incredibly complex problems and competing demands from different departments,” says Dr. Boutros. “As a physician administrator I felt I could translate for all sides.”

He cites consumer-directed care as a key trend blindsiding most doctors. “They are completely unprepared for the changing market dynamics of consumer choice,” he says.

Consultants, administrators, and physicians agree: Hospitalists need to avoid the tunnel vision when it comes to their own metrics and pay attention to the business drivers changing healthcare. If they learn to spot key trends, they’re perfectly situated to work with hospital administrators and their office-based colleagues on using that knowledge to increase market share, and to have better and more profitable hospitals. TH

Writer Marlene Piturro covered SHM’s Leadership Conference in Vail for The Hospitalist.