The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

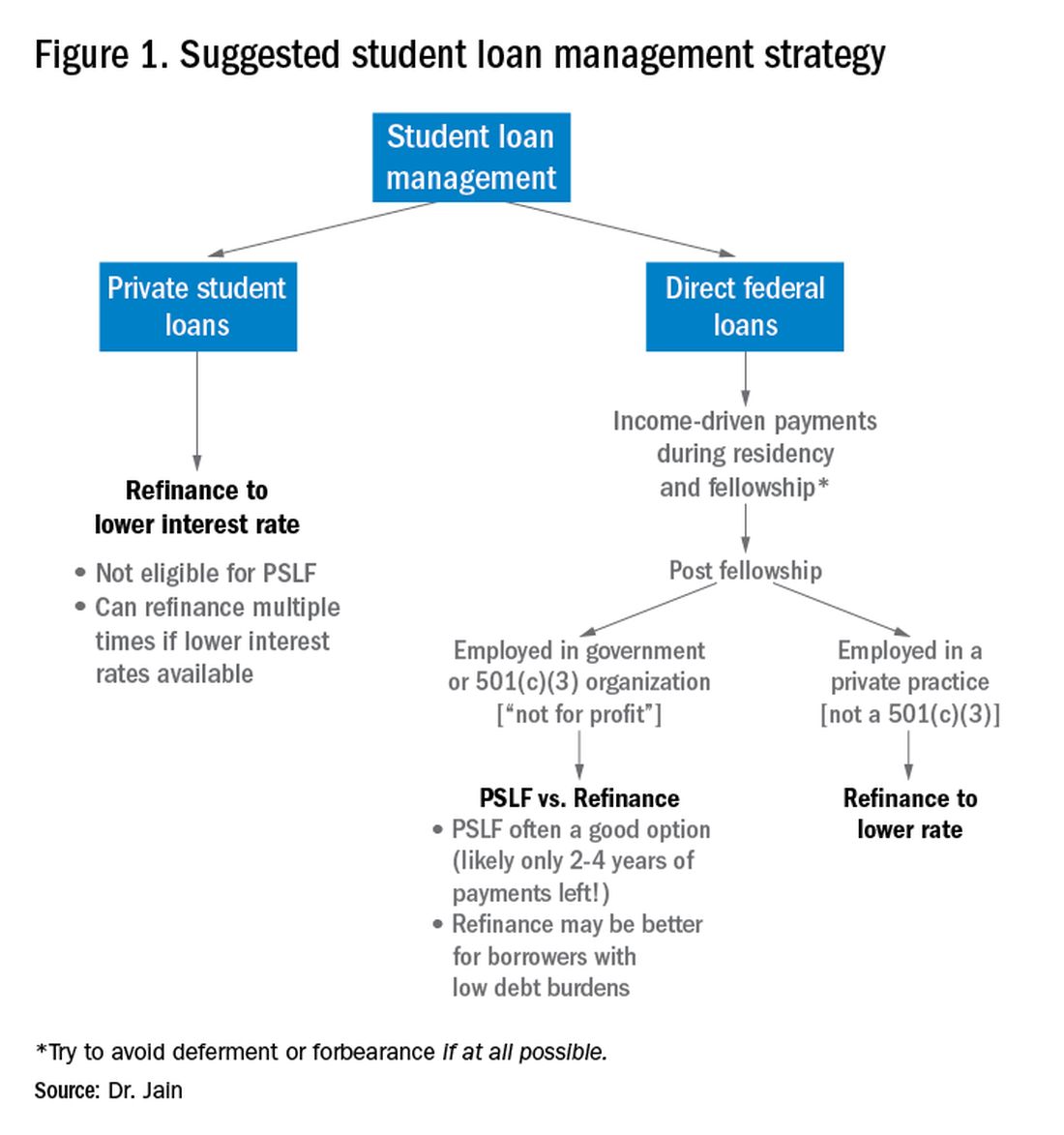

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

For gastroenterology trainees, I strongly recommend making income-driven repayments on federal loans throughout residency and fellowship; avoid forbearance or deferment if possible. After training is complete, you can decide on options depending on your career and personal situation as discussed below.Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.