User login

Collaboration, Not Calculation: A Qualitative Study of How Hospital Executives Value Hospital Medicine Groups

The field of hospital medicine has expanded rapidly since its inception in the late 1990s, and currently, most hospitals in the United States employ or contract with hospital medicine groups (HMGs).1-4 This dramatic growth began in response to several factors: primary care physicians (PCPs) opting out of inpatient care, the increasing acuity and complexity of inpatient care, and cost pressures on hospitals.5,6 Recent studies associate greater use of hospitalists with increased hospital revenues and modest improvements in hospital financial performance.7 However, funding the hospitalist delivery model required hospitals to share the savings hospitalists generate through facility billing and quality incentives.

Hospitalists’ professional fee revenues alone generally do not fund their salaries. An average HMG serving adult patients requires $176,658 from the hospital to support a full-time physician.8 Determining the appropriate level of HMG support typically occurs through negotiation with hospital executives. During the last 10 years, HMG size and hospitalist compensation have risen steadily, combining to increase the hospitalist labor costs borne by hospitals.4,8 Accordingly, hospital executives in challenging economic environments may pressure HMG leaders to accept diminished support or to demonstrate a better return on the hospital’s investment.

These negotiations are influenced by the beliefs of hospital executives about the value of the hospitalist labor model. Little is known about how hospital and health system executive leadership assess the value of hospitalists. A deeper understanding of executive attitudes and beliefs could inform HMG leaders seeking integrative (“win-win”) outcomes in contract and compensation negotiations. Members of the Society of Hospital Medicine (SHM) Practice Management Committee surveyed hospital executives to guide SHM program development. We sought to analyze transcripts from these interviews to describe how executives assess HMGs and to test the hypothesis that hospital executives apply specific financial models when determining the return on investment (ROI) from subsidizing an HMG.

METHODS

Study Design, Setting, and Participants

Members of the SHM Practice Management Committee conducted interviews with a convenience sample of 24 key informants representing the following stakeholders at hospitals employing hospitalists: Chief Executive Officers (CEOs), Presidents, Vice Presidents, Chief Medical Officers (CMOs), and Chief Financial Officers (CFOs). Participants were recruited from 17 fee-for-service healthcare organizations, including rural, suburban, urban, community, and academic medical centers. The semi-structured interviews occurred in person between January and March 2018; each one lasted an average of 45 minutes and were designed to guide SHM program and product development. Twenty-eight executives were recruited by e-mail, and four did not complete the interview due to scheduling difficulty. All the participants provided informed consent. The University of Washington Institutional Review Board approved the secondary analysis of deidentified transcripts.

Interview Guide and Data Collection

All interviews followed a guide with eight demographic questions and 10 open-ended questions (Appendix). Cognitive interviews were performed with two hospital executives outside the study cohort, resulting in the addition of one question and rewording one question for clarity. One-on-one interviews were performed by 10 committee members (range, 1-3 interviews). All interview audios were recorded, and no field notes were kept. The goal of the interviews was to obtain an understanding of how hospital executives value the contributions and costs of hospitalist groups.

The interviews began with questions about the informant’s current interactions with hospitalists and the origin of the hospitalist group at their facility. Informants then described the value they feel hospitalists bring to their hospital and occasions they were surprised or dissatisfied with the clinical or financial value delivered by the hospitalists. Participants described how they calculate a return on investment (ROI) for their hospitalist group, nonfinancial benefits and disadvantages to hospitalists, and how they believe hospitalists should participate in risk-sharing contracts.

Data Analysis

The interview audiotapes were transcribed and deidentified. A sample of eight transcripts was verified by participants to ensure accuracy. Three investigators (AAW, RC, CC) reviewed a random sample of five transcripts to identify and codify preliminary themes. We applied a general inductive framework with a content analysis approach. Two investigators (TM and MC) read all transcripts independently, coding the presence of each theme and quotations exemplifying these themes using qualitative analysis software (Dedoose Version 7.0.23, SocioCultural Research Consultants). A third investigator (AAW) read all the transcripts and resolved differences of opinion. Themes and code application were discussed among the study team after the second and fifth transcripts to add or clarify codes. No new codes were identified after the first review of the preliminary codebook, although investigators intermittently used an “unknown” code through the 20th transcript. After discussion to reach consensus, excerpts initially coded “unknown” were assigned existing codes; the 20th transcript represents the approximate point of reaching thematic saturation.

RESULTS

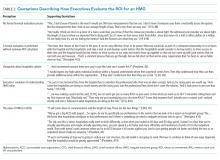

Of the 24 participants, 18 (75%) were male, representing a variety of roles: 7 (29.2%) CMOs, 5 (20.8%) Presidents, 5 (20.8%) CFOs, 4 (16.7%) CEOs, and 3 (12.5%) Vice Presidents. The participants represented all regions (Midwest 12 [50%], South 6 [25%], West 4 [16.7%], and East 2 [8.3%], community size (Urban 11 [45.8%], Suburban 8 [33.3%], and Rural 5 [20.8%]), and Hospital Types (Community 11 [45.8%], Multihospital System 5 [20.8%], Academic 5 [20.8%], Safety Net 2 [8.3%], and Critical Access 1 [4.2%]). We present specific themes below and supporting quotations in Tables 1 and 2.

Current Value of the HMG at the Respondent’s Hospital

Most executives reported their hospital’s HMG had operated for over a decade and had developed an earlier, outdated value framework. Interviewees described an initial mix of financial pressures, shifts in physician work preferences, increasing patient acuity, resident labor shortages, and unsolved hospital throughput needs that triggered a reactive conversion from community PCP staffing to hospitalist care teams, followed by refinements to realize value.

“I think initially here it was to deal with the resident caps, right? So, at that moment, the solution that was put in place probably made a lot of sense. If that’s all someone came in with, now I’d be scratching my head and said, what are you thinking?” (President, #2)

Respondents perceived that HMGs provide value in many domains, including financial contributions, high-quality care, organizational efficiency, academics, leadership of interprofessional teams, effective communication, system improvement, and beneficial influence on the care environment and other employees. Regarding the measurable generation of financial benefit, documentation for improved billing accuracy, increased hospital efficiency (eg, lower length of stay, early discharges), and comanagement arrangements were commonly identified.

“I don’t want a urologist with a stethoscope, so I’m happy to have the hospitalists say, ‘Look, I’ll take care of the patient. You do the procedure.’ Well, that’s inherently valuable, whether we measure it or whether we don’t.” (CMO, #21)

Executives generally expressed satisfaction with their HMG’s quality of care and the related pay-for-performance financial benefits from payers, attributing success to hospitalists’ familiarity with inpatient systems and willingness to standardize.

“I just think it’s having one structure, one group to go to, a standard rather than trying to push it through the medical staff.” (VP, #18)

Executives reported that HMGs generate substantial value that is difficult to measure financially. For example, a large bundle of excerpts organized around communication with patients, nurses, and other providers.

“If we have the right hospitalist staff, to engage them with the nursing staff would help to reduce my turnover rate…and create a very positive morale within the nursing units. That’s huge. That’s nonfinancial” (President, #15)

Executives particularly appreciated hospitalists’ work to aggregate input from multiple specialists and present a cohesive explanation to patients. Executives also felt that HMGs create significant unmeasured value by improving processes and outcomes on service lines beyond hospital medicine, achieving this through culture change, involvement in leadership, hospital-wide process redesign, and running rapid response teams. Some executives expressed a desire for hospitalists to assume this global quality responsibility more explicitly as a job expectation.

Executives described how they would evaluate a de novo proposal for hospitalist services, usually enumerating key general domains without explaining specifically how they would measure each element. The following priorities emerged: clinical excellence, capacity to collaborate with hospital leadership, the scope of services provided, cultural fit/alignment, financial performance, contract cost, pay-for-performance measures, and turnover. Regarding financial performance, respondents expected to know the cost of the proposal but lacked a specific price threshold. Instead, they sought to understand the total value of the proposal through its effect on metrics such as facility fees or resource use. Nonetheless, cultural fit was a critical, overriding driver of the hypothetical decision, despite difficulty defining beyond estimates of teamwork, alignment with hospital priorities, and qualities of the group leader.

“For us, it usually ends being how do we mix personally, do we like them?” (CMO, #5)

Alignment and Collaboration

The related concepts of “collaboration” and “alignment” emerged as prominent themes during all interviews. Executives highly valued hospitalist groups that could demonstrate alignment with hospital priorities and often used this concept to summarize the HMG’s success or failure across a group of value domains.

“If you’re just coming in to fill a shift and see 10 patients, you have much less value than somebody who’s going to play that active partnership role… hospitalist services need to partner with hospitals and be intimately involved with the success of the hospital.” (CMO, #20)

Alignment sometimes manifested in a quantified, explicit way, through incentive plans or shared savings plans. However, it most often manifested as a broader sense that the hospitalists’ work targeted the same priorities as the executive leaders and that hospitalists genuinely cared about those priorities. A “shift-work mentality” was expressed by some as the antithesis of alignment. Incorporating hospitalist leaders in hospital leadership and frequent communication arose as mechanisms to increase alignment.

Ways HMGs Fail to Meet Expectations

Respondents described unresolved disadvantages to the hospitalist care model.

“I mean, OPPE, how do you do that for a hospitalist? How can you do it? It’s hard to attribute a patient to someone….it is a weakness and I think we all know it.” (CMO, #21)

Executives also worried about inconsistent handoffs with primary care providers and the field’s demographics, finding it disproportionately comprised of junior or transient physicians. They also hoped that hospitalist innovators would solve clinician burnout and the high cost of inpatient care. Disappointments specific to the local HMG revolved around difficulty developing shared models of value and mechanisms to achieve them.

“I would like to have more dialog between the hospital leadership team and the hospitalist group…I would like to see a little bit more collaboration.” (President, #13)

These challenges emerged not as a deficiency with hospital medicine as a specialty, but a failure at their specific facility to achieve the goal of alignment through joint strategic planning.

Calculating Value

When asked if their hospital had a formal process to evaluate ROI for their HMG, two dominant answers emerged: (1) the executive lacked a formal process for determining ROI and was unaware of one used at their facility or (2) the executive evaluated HMG performance based on multiple measures, including cost, but did not attempt to calculate ROI or a summary value. Several described the financial evaluation process as too difficult or unnecessary.

“No. It’s too difficult to extract that data. I would say the best proxy that we could do it is our case mix index on our medicine service line.” (CMO, #20)

“No, not a formal process, no… I question the value of some of the other things we do with the medical group…but not the value of the hospitalists… I don’t think we’ve done a formal assessment. I appreciate the flexibility, especially in a small hospital.” (President, #10)

Rarely, executives described specific financial calculations that served as a proxy for ROI. These included calculating a contribution margin to compare against the cost of salary support or the application of external survey benchmarking comparisons for productivity and salary to evaluate the appropriateness of a limited set of financial indicators. Twice respondents alluded to more sophisticated measurements conducted by the finance department but lacked familiarity with the process. Several executives described ROI calculations for specific projects and discrete business decisions involving hospitalists, particularly considering hiring an additional hospitalist.

Executives generally struggled to recall specific ways that the nonfinancial contributions of hospitalists were incorporated into executive decisions regarding the hospitalist group. Two related themes emerged: first, the belief that hospitals could not function effectively without hospitalists, making their presence an expected cost of doing business. Second, absent measures of HMG ROI, executives appeared to determine an approximate overall value of hospitalists, rather than parsing the various contributions. A few respondents expressed alarm at the rise in hospitalist salaries, whereas others acknowledged market forces beyond their control.

“… there is going to be more of a demand for hospitalists, which is definitely going to drive up the compensation. So, I don’t worry that the compensation will be driven up so high that there won’t be a return [on investment].” (CFO, #16)

Some urged individual hospitalists to develop a deeper understanding of what supports their salary to avoid strained relationships with executives.

Evolution and Risk-Sharing Contracts

Respondents described an evolving conceptualization of the hospitalist’s value, occurring at both a broad, long-term scale and at an incremental, annual scale through minor modifications to incentive pay schemes. For most executives, hiring hospitalists as replacements for PCPs had become necessary and not a source of novel value; many executives described it as “the cost of doing business.” Some described gradually deemphasizing relative value unit (RVU) production to recognize other contributions. Several reported their general appreciation of hospitalists evolved as specific hospitalists matured and demonstrated new contributions to hospital function. Some leaders tried to speculate about future phases of this evolution, although details were sparse.

Among respondents with greater implementation of risk-sharing contracts or ACOs, executives did not describe significantly different goals for hospitalists; executives emphasized that hospitalists should accelerate existing efforts to reduce inpatient costs, length of stay, healthcare-acquired conditions, unnecessary testing, and readmissions. A theme emerged around hospitalists supporting the continuum of care, through improved communication and increased alignment with health systems.

“Where I see the real benefit…is to figure out a way to use hospitalists and match them up with the primary care physicians on the outpatient side to truly develop an integrated population-based medicine practice for all our patients.” (President, #15)

Executives believed that communication and collaboration with PCPs and postacute care providers would attract more measurement.

DISCUSSION

Our findings provide hospitalists with insight into the approach hospital executives may follow when determining the rationale for and extent of financial support for HMGs. The results did not support our hypothesis that executives commonly determine the appropriate support by summing detailed quantitative models for various HMG contributions. Instead, most hospital executives appear to make decisions about the appropriateness of financial support based on a small number of basic financial or care quality metrics combined with a subjective assessment of the HMG’s broader alignment with hospital priorities. However, we did find substantial evidence that hospital executives’ expectations of hospitalists have evolved in the last decade, creating the potential for dissociation from how hospitalists prioritize and value their own efforts. Together, our findings suggest that enhanced communication, relationship building, and collaboration with hospital leaders may help HMGs to maintain a shared model of value with hospital executives.

The general absence of summary value calculations suggests specific opportunities, benefits, and risks for HMG group leaders (Table 3). An important opportunity relates to the communication agenda about unmeasured or nonfinancial contributions. Although executives recognized many of these, our data suggest a need for HMG leaders to educate hospital leaders about their unmeasured contributions proactively. Although some might recommend doing so by quantifying and financially rewarding key intangible contributions (eg, measuring leadership in culture change9), this entails important risks.10 Some experts propose that the proliferation of physician pay-for-performance schemes threatens medical professionalism, fails patients, and misunderstands what motivates physicians.11 HMG groups that feel undervalued should hesitate before monetizing all aspects of their work, and consider emphasizing relationship-building as a platform for communication about their performance. Achieving better alignment with executives is not just an opportunity for HMG leaders, but for each hospitalist within the group. Although executives wanted to have deeper relationships with group members, this may not be feasible in large organizations. Instead, it is incumbent for HMG leaders to translate executives’ expectations and forge better alignment.

Residency may not adequately prepare hospitalists to meet key expectations hospital executives hold related to system leadership and interprofessional team leadership. For example, hospital leaders particularly valued HMGs’ perceived ability to improve nurse retention and morale. Unfortunately, residency curricula generally lack concerted instruction on the skills required to produce such interprofessional inpatient teams reliably. Similarly, executives strongly wanted HMGs to acknowledge a role as partners in running the quality, stewardship, and safety missions of the entire hospital. While residency training builds clinical competence through the care of individual patients, many residents do not receive experiential education in system design and leadership. This suggests a need for HMGs to provide early career training or mentorship in quality improvement and interprofessional teamwork. Executives and HMG leaders seeking a stable, mature workforce, should allocate resources to retaining mid and late career hospitalists through leadership roles or financial incentives for longevity.

As with many qualitative studies, the generalizability of our findings may be limited, particularly outside the US healthcare system. We invited executives from diverse practice settings but may not have captured all the relevant viewpoints. This study did not include Veterans Affairs hospitals, safety net hospitals were underrepresented, Midwestern hospitals were overrepresented and the participants were predominantly male. We were unable to determine the influence of employment model on participant beliefs about HMGs, nor did we elicit comparisons to other physician specialties that would highlight a distinct approach to negotiating with HMGs. Because we used hospitalists as interviewers, including some from the same institution as the interviewee, respondents may have dampened critiques or descriptions of unmet expectations. Our data do not provide quantitative support for any approach to determining or negotiating appropriate financial support for an HMG.

CONCLUSIONS

This work contributes new understanding of the expectations executives have for HMGs and individual hospitalists. This highlights opportunities for group leaders, hospitalists, medical educators, and quality improvement experts to produce a hospitalist labor force that can engage in productive and mutually satisfying relationships with hospital leaders. Hospitalists should strive to improve alignment and communication with executive groups.

Disclosures

The authors report no potential conflict of interest.

1. Lapps J, Flansbaum B, Leykum L, et al. Updating threshold-based identification of hospitalists in 2012 Medicare pay data. J Hosp Med. 2016;11(1):45-47. https://doi.org/10.1002/jhm.2480.

2. Wachter RM, Goldman L. Zero to 50,000–the 20th Anniversary of the hospitalist. NEJM. 2016;375(11):1009-1011. https://doi.org/10.1056/nejmp1607958.

3. Stevens JP, Nyweide DJ, Maresh S, et al. Comparison of hospital resource use and outcomes among hospitalists, primary care physicians, and other generalists. JAMA Intern Med. 2017;177(12):1781-1787. https://doi.org/10.1001/jamainternmed.2017.5824.

4. American Hospital Association (AHA) (2017), Hospital Statistics, AHA, Chicago, IL.

5. Wachter RM, Goldman L. The emerging role of “hospitalists” in the American health care system. NEJM. 1996;335(7):514-517. https://doi.org/10.1093/ajhp/53.20.2389a.

6. Pham HH, Devers KJ, Kuo S, et al. Health care market trends and the evolution of hospitalist use and roles. J Gen Intern Med. 2005;20(2):101-107. https://doi.org/10.1111/j.1525-1497.2005.40184.x.

7. Epané JP, Weech-Maldonado R, Hearld L, et al. Hospitals’ use of hospitalistas: implications for financial performance. Health Care Manage Rev. 2019;44(1):10-18. https://doi.org/10.1097/hmr.0000000000000170.

8. State of Hospital Medicine: 2018 Report Based on 2017 Data. Society of Hospital Medicine. https://sohm.hospitalmedicine.org/ Accessed December 9, 2018.

9. Carmeli A, Tishler A. The relationships between intangible organizational elements and organizational performance. Strategic Manag J. 2004;25(13):1257-1278. https://doi.org/10.1002/smj.428.

10. Bernard M. Strategic performance management: leveraging and measuring your intangible value drivers. Amsterdam: Butterworth-Heinemann, 2006.

11. Khullar D, Wolfson D, Casalino LP. Professionalism, performance, and the future of physician incentives. JAMA. 2018;320(23):2419-2420. https://doi.org/10.1001/jama.2018.17719.

The field of hospital medicine has expanded rapidly since its inception in the late 1990s, and currently, most hospitals in the United States employ or contract with hospital medicine groups (HMGs).1-4 This dramatic growth began in response to several factors: primary care physicians (PCPs) opting out of inpatient care, the increasing acuity and complexity of inpatient care, and cost pressures on hospitals.5,6 Recent studies associate greater use of hospitalists with increased hospital revenues and modest improvements in hospital financial performance.7 However, funding the hospitalist delivery model required hospitals to share the savings hospitalists generate through facility billing and quality incentives.

Hospitalists’ professional fee revenues alone generally do not fund their salaries. An average HMG serving adult patients requires $176,658 from the hospital to support a full-time physician.8 Determining the appropriate level of HMG support typically occurs through negotiation with hospital executives. During the last 10 years, HMG size and hospitalist compensation have risen steadily, combining to increase the hospitalist labor costs borne by hospitals.4,8 Accordingly, hospital executives in challenging economic environments may pressure HMG leaders to accept diminished support or to demonstrate a better return on the hospital’s investment.

These negotiations are influenced by the beliefs of hospital executives about the value of the hospitalist labor model. Little is known about how hospital and health system executive leadership assess the value of hospitalists. A deeper understanding of executive attitudes and beliefs could inform HMG leaders seeking integrative (“win-win”) outcomes in contract and compensation negotiations. Members of the Society of Hospital Medicine (SHM) Practice Management Committee surveyed hospital executives to guide SHM program development. We sought to analyze transcripts from these interviews to describe how executives assess HMGs and to test the hypothesis that hospital executives apply specific financial models when determining the return on investment (ROI) from subsidizing an HMG.

METHODS

Study Design, Setting, and Participants

Members of the SHM Practice Management Committee conducted interviews with a convenience sample of 24 key informants representing the following stakeholders at hospitals employing hospitalists: Chief Executive Officers (CEOs), Presidents, Vice Presidents, Chief Medical Officers (CMOs), and Chief Financial Officers (CFOs). Participants were recruited from 17 fee-for-service healthcare organizations, including rural, suburban, urban, community, and academic medical centers. The semi-structured interviews occurred in person between January and March 2018; each one lasted an average of 45 minutes and were designed to guide SHM program and product development. Twenty-eight executives were recruited by e-mail, and four did not complete the interview due to scheduling difficulty. All the participants provided informed consent. The University of Washington Institutional Review Board approved the secondary analysis of deidentified transcripts.

Interview Guide and Data Collection

All interviews followed a guide with eight demographic questions and 10 open-ended questions (Appendix). Cognitive interviews were performed with two hospital executives outside the study cohort, resulting in the addition of one question and rewording one question for clarity. One-on-one interviews were performed by 10 committee members (range, 1-3 interviews). All interview audios were recorded, and no field notes were kept. The goal of the interviews was to obtain an understanding of how hospital executives value the contributions and costs of hospitalist groups.

The interviews began with questions about the informant’s current interactions with hospitalists and the origin of the hospitalist group at their facility. Informants then described the value they feel hospitalists bring to their hospital and occasions they were surprised or dissatisfied with the clinical or financial value delivered by the hospitalists. Participants described how they calculate a return on investment (ROI) for their hospitalist group, nonfinancial benefits and disadvantages to hospitalists, and how they believe hospitalists should participate in risk-sharing contracts.

Data Analysis

The interview audiotapes were transcribed and deidentified. A sample of eight transcripts was verified by participants to ensure accuracy. Three investigators (AAW, RC, CC) reviewed a random sample of five transcripts to identify and codify preliminary themes. We applied a general inductive framework with a content analysis approach. Two investigators (TM and MC) read all transcripts independently, coding the presence of each theme and quotations exemplifying these themes using qualitative analysis software (Dedoose Version 7.0.23, SocioCultural Research Consultants). A third investigator (AAW) read all the transcripts and resolved differences of opinion. Themes and code application were discussed among the study team after the second and fifth transcripts to add or clarify codes. No new codes were identified after the first review of the preliminary codebook, although investigators intermittently used an “unknown” code through the 20th transcript. After discussion to reach consensus, excerpts initially coded “unknown” were assigned existing codes; the 20th transcript represents the approximate point of reaching thematic saturation.

RESULTS

Of the 24 participants, 18 (75%) were male, representing a variety of roles: 7 (29.2%) CMOs, 5 (20.8%) Presidents, 5 (20.8%) CFOs, 4 (16.7%) CEOs, and 3 (12.5%) Vice Presidents. The participants represented all regions (Midwest 12 [50%], South 6 [25%], West 4 [16.7%], and East 2 [8.3%], community size (Urban 11 [45.8%], Suburban 8 [33.3%], and Rural 5 [20.8%]), and Hospital Types (Community 11 [45.8%], Multihospital System 5 [20.8%], Academic 5 [20.8%], Safety Net 2 [8.3%], and Critical Access 1 [4.2%]). We present specific themes below and supporting quotations in Tables 1 and 2.

Current Value of the HMG at the Respondent’s Hospital

Most executives reported their hospital’s HMG had operated for over a decade and had developed an earlier, outdated value framework. Interviewees described an initial mix of financial pressures, shifts in physician work preferences, increasing patient acuity, resident labor shortages, and unsolved hospital throughput needs that triggered a reactive conversion from community PCP staffing to hospitalist care teams, followed by refinements to realize value.

“I think initially here it was to deal with the resident caps, right? So, at that moment, the solution that was put in place probably made a lot of sense. If that’s all someone came in with, now I’d be scratching my head and said, what are you thinking?” (President, #2)

Respondents perceived that HMGs provide value in many domains, including financial contributions, high-quality care, organizational efficiency, academics, leadership of interprofessional teams, effective communication, system improvement, and beneficial influence on the care environment and other employees. Regarding the measurable generation of financial benefit, documentation for improved billing accuracy, increased hospital efficiency (eg, lower length of stay, early discharges), and comanagement arrangements were commonly identified.

“I don’t want a urologist with a stethoscope, so I’m happy to have the hospitalists say, ‘Look, I’ll take care of the patient. You do the procedure.’ Well, that’s inherently valuable, whether we measure it or whether we don’t.” (CMO, #21)

Executives generally expressed satisfaction with their HMG’s quality of care and the related pay-for-performance financial benefits from payers, attributing success to hospitalists’ familiarity with inpatient systems and willingness to standardize.

“I just think it’s having one structure, one group to go to, a standard rather than trying to push it through the medical staff.” (VP, #18)

Executives reported that HMGs generate substantial value that is difficult to measure financially. For example, a large bundle of excerpts organized around communication with patients, nurses, and other providers.

“If we have the right hospitalist staff, to engage them with the nursing staff would help to reduce my turnover rate…and create a very positive morale within the nursing units. That’s huge. That’s nonfinancial” (President, #15)

Executives particularly appreciated hospitalists’ work to aggregate input from multiple specialists and present a cohesive explanation to patients. Executives also felt that HMGs create significant unmeasured value by improving processes and outcomes on service lines beyond hospital medicine, achieving this through culture change, involvement in leadership, hospital-wide process redesign, and running rapid response teams. Some executives expressed a desire for hospitalists to assume this global quality responsibility more explicitly as a job expectation.

Executives described how they would evaluate a de novo proposal for hospitalist services, usually enumerating key general domains without explaining specifically how they would measure each element. The following priorities emerged: clinical excellence, capacity to collaborate with hospital leadership, the scope of services provided, cultural fit/alignment, financial performance, contract cost, pay-for-performance measures, and turnover. Regarding financial performance, respondents expected to know the cost of the proposal but lacked a specific price threshold. Instead, they sought to understand the total value of the proposal through its effect on metrics such as facility fees or resource use. Nonetheless, cultural fit was a critical, overriding driver of the hypothetical decision, despite difficulty defining beyond estimates of teamwork, alignment with hospital priorities, and qualities of the group leader.

“For us, it usually ends being how do we mix personally, do we like them?” (CMO, #5)

Alignment and Collaboration

The related concepts of “collaboration” and “alignment” emerged as prominent themes during all interviews. Executives highly valued hospitalist groups that could demonstrate alignment with hospital priorities and often used this concept to summarize the HMG’s success or failure across a group of value domains.

“If you’re just coming in to fill a shift and see 10 patients, you have much less value than somebody who’s going to play that active partnership role… hospitalist services need to partner with hospitals and be intimately involved with the success of the hospital.” (CMO, #20)

Alignment sometimes manifested in a quantified, explicit way, through incentive plans or shared savings plans. However, it most often manifested as a broader sense that the hospitalists’ work targeted the same priorities as the executive leaders and that hospitalists genuinely cared about those priorities. A “shift-work mentality” was expressed by some as the antithesis of alignment. Incorporating hospitalist leaders in hospital leadership and frequent communication arose as mechanisms to increase alignment.

Ways HMGs Fail to Meet Expectations

Respondents described unresolved disadvantages to the hospitalist care model.

“I mean, OPPE, how do you do that for a hospitalist? How can you do it? It’s hard to attribute a patient to someone….it is a weakness and I think we all know it.” (CMO, #21)

Executives also worried about inconsistent handoffs with primary care providers and the field’s demographics, finding it disproportionately comprised of junior or transient physicians. They also hoped that hospitalist innovators would solve clinician burnout and the high cost of inpatient care. Disappointments specific to the local HMG revolved around difficulty developing shared models of value and mechanisms to achieve them.

“I would like to have more dialog between the hospital leadership team and the hospitalist group…I would like to see a little bit more collaboration.” (President, #13)

These challenges emerged not as a deficiency with hospital medicine as a specialty, but a failure at their specific facility to achieve the goal of alignment through joint strategic planning.

Calculating Value

When asked if their hospital had a formal process to evaluate ROI for their HMG, two dominant answers emerged: (1) the executive lacked a formal process for determining ROI and was unaware of one used at their facility or (2) the executive evaluated HMG performance based on multiple measures, including cost, but did not attempt to calculate ROI or a summary value. Several described the financial evaluation process as too difficult or unnecessary.

“No. It’s too difficult to extract that data. I would say the best proxy that we could do it is our case mix index on our medicine service line.” (CMO, #20)

“No, not a formal process, no… I question the value of some of the other things we do with the medical group…but not the value of the hospitalists… I don’t think we’ve done a formal assessment. I appreciate the flexibility, especially in a small hospital.” (President, #10)

Rarely, executives described specific financial calculations that served as a proxy for ROI. These included calculating a contribution margin to compare against the cost of salary support or the application of external survey benchmarking comparisons for productivity and salary to evaluate the appropriateness of a limited set of financial indicators. Twice respondents alluded to more sophisticated measurements conducted by the finance department but lacked familiarity with the process. Several executives described ROI calculations for specific projects and discrete business decisions involving hospitalists, particularly considering hiring an additional hospitalist.

Executives generally struggled to recall specific ways that the nonfinancial contributions of hospitalists were incorporated into executive decisions regarding the hospitalist group. Two related themes emerged: first, the belief that hospitals could not function effectively without hospitalists, making their presence an expected cost of doing business. Second, absent measures of HMG ROI, executives appeared to determine an approximate overall value of hospitalists, rather than parsing the various contributions. A few respondents expressed alarm at the rise in hospitalist salaries, whereas others acknowledged market forces beyond their control.

“… there is going to be more of a demand for hospitalists, which is definitely going to drive up the compensation. So, I don’t worry that the compensation will be driven up so high that there won’t be a return [on investment].” (CFO, #16)

Some urged individual hospitalists to develop a deeper understanding of what supports their salary to avoid strained relationships with executives.

Evolution and Risk-Sharing Contracts

Respondents described an evolving conceptualization of the hospitalist’s value, occurring at both a broad, long-term scale and at an incremental, annual scale through minor modifications to incentive pay schemes. For most executives, hiring hospitalists as replacements for PCPs had become necessary and not a source of novel value; many executives described it as “the cost of doing business.” Some described gradually deemphasizing relative value unit (RVU) production to recognize other contributions. Several reported their general appreciation of hospitalists evolved as specific hospitalists matured and demonstrated new contributions to hospital function. Some leaders tried to speculate about future phases of this evolution, although details were sparse.

Among respondents with greater implementation of risk-sharing contracts or ACOs, executives did not describe significantly different goals for hospitalists; executives emphasized that hospitalists should accelerate existing efforts to reduce inpatient costs, length of stay, healthcare-acquired conditions, unnecessary testing, and readmissions. A theme emerged around hospitalists supporting the continuum of care, through improved communication and increased alignment with health systems.

“Where I see the real benefit…is to figure out a way to use hospitalists and match them up with the primary care physicians on the outpatient side to truly develop an integrated population-based medicine practice for all our patients.” (President, #15)

Executives believed that communication and collaboration with PCPs and postacute care providers would attract more measurement.

DISCUSSION

Our findings provide hospitalists with insight into the approach hospital executives may follow when determining the rationale for and extent of financial support for HMGs. The results did not support our hypothesis that executives commonly determine the appropriate support by summing detailed quantitative models for various HMG contributions. Instead, most hospital executives appear to make decisions about the appropriateness of financial support based on a small number of basic financial or care quality metrics combined with a subjective assessment of the HMG’s broader alignment with hospital priorities. However, we did find substantial evidence that hospital executives’ expectations of hospitalists have evolved in the last decade, creating the potential for dissociation from how hospitalists prioritize and value their own efforts. Together, our findings suggest that enhanced communication, relationship building, and collaboration with hospital leaders may help HMGs to maintain a shared model of value with hospital executives.

The general absence of summary value calculations suggests specific opportunities, benefits, and risks for HMG group leaders (Table 3). An important opportunity relates to the communication agenda about unmeasured or nonfinancial contributions. Although executives recognized many of these, our data suggest a need for HMG leaders to educate hospital leaders about their unmeasured contributions proactively. Although some might recommend doing so by quantifying and financially rewarding key intangible contributions (eg, measuring leadership in culture change9), this entails important risks.10 Some experts propose that the proliferation of physician pay-for-performance schemes threatens medical professionalism, fails patients, and misunderstands what motivates physicians.11 HMG groups that feel undervalued should hesitate before monetizing all aspects of their work, and consider emphasizing relationship-building as a platform for communication about their performance. Achieving better alignment with executives is not just an opportunity for HMG leaders, but for each hospitalist within the group. Although executives wanted to have deeper relationships with group members, this may not be feasible in large organizations. Instead, it is incumbent for HMG leaders to translate executives’ expectations and forge better alignment.

Residency may not adequately prepare hospitalists to meet key expectations hospital executives hold related to system leadership and interprofessional team leadership. For example, hospital leaders particularly valued HMGs’ perceived ability to improve nurse retention and morale. Unfortunately, residency curricula generally lack concerted instruction on the skills required to produce such interprofessional inpatient teams reliably. Similarly, executives strongly wanted HMGs to acknowledge a role as partners in running the quality, stewardship, and safety missions of the entire hospital. While residency training builds clinical competence through the care of individual patients, many residents do not receive experiential education in system design and leadership. This suggests a need for HMGs to provide early career training or mentorship in quality improvement and interprofessional teamwork. Executives and HMG leaders seeking a stable, mature workforce, should allocate resources to retaining mid and late career hospitalists through leadership roles or financial incentives for longevity.

As with many qualitative studies, the generalizability of our findings may be limited, particularly outside the US healthcare system. We invited executives from diverse practice settings but may not have captured all the relevant viewpoints. This study did not include Veterans Affairs hospitals, safety net hospitals were underrepresented, Midwestern hospitals were overrepresented and the participants were predominantly male. We were unable to determine the influence of employment model on participant beliefs about HMGs, nor did we elicit comparisons to other physician specialties that would highlight a distinct approach to negotiating with HMGs. Because we used hospitalists as interviewers, including some from the same institution as the interviewee, respondents may have dampened critiques or descriptions of unmet expectations. Our data do not provide quantitative support for any approach to determining or negotiating appropriate financial support for an HMG.

CONCLUSIONS

This work contributes new understanding of the expectations executives have for HMGs and individual hospitalists. This highlights opportunities for group leaders, hospitalists, medical educators, and quality improvement experts to produce a hospitalist labor force that can engage in productive and mutually satisfying relationships with hospital leaders. Hospitalists should strive to improve alignment and communication with executive groups.

Disclosures

The authors report no potential conflict of interest.

The field of hospital medicine has expanded rapidly since its inception in the late 1990s, and currently, most hospitals in the United States employ or contract with hospital medicine groups (HMGs).1-4 This dramatic growth began in response to several factors: primary care physicians (PCPs) opting out of inpatient care, the increasing acuity and complexity of inpatient care, and cost pressures on hospitals.5,6 Recent studies associate greater use of hospitalists with increased hospital revenues and modest improvements in hospital financial performance.7 However, funding the hospitalist delivery model required hospitals to share the savings hospitalists generate through facility billing and quality incentives.

Hospitalists’ professional fee revenues alone generally do not fund their salaries. An average HMG serving adult patients requires $176,658 from the hospital to support a full-time physician.8 Determining the appropriate level of HMG support typically occurs through negotiation with hospital executives. During the last 10 years, HMG size and hospitalist compensation have risen steadily, combining to increase the hospitalist labor costs borne by hospitals.4,8 Accordingly, hospital executives in challenging economic environments may pressure HMG leaders to accept diminished support or to demonstrate a better return on the hospital’s investment.

These negotiations are influenced by the beliefs of hospital executives about the value of the hospitalist labor model. Little is known about how hospital and health system executive leadership assess the value of hospitalists. A deeper understanding of executive attitudes and beliefs could inform HMG leaders seeking integrative (“win-win”) outcomes in contract and compensation negotiations. Members of the Society of Hospital Medicine (SHM) Practice Management Committee surveyed hospital executives to guide SHM program development. We sought to analyze transcripts from these interviews to describe how executives assess HMGs and to test the hypothesis that hospital executives apply specific financial models when determining the return on investment (ROI) from subsidizing an HMG.

METHODS

Study Design, Setting, and Participants

Members of the SHM Practice Management Committee conducted interviews with a convenience sample of 24 key informants representing the following stakeholders at hospitals employing hospitalists: Chief Executive Officers (CEOs), Presidents, Vice Presidents, Chief Medical Officers (CMOs), and Chief Financial Officers (CFOs). Participants were recruited from 17 fee-for-service healthcare organizations, including rural, suburban, urban, community, and academic medical centers. The semi-structured interviews occurred in person between January and March 2018; each one lasted an average of 45 minutes and were designed to guide SHM program and product development. Twenty-eight executives were recruited by e-mail, and four did not complete the interview due to scheduling difficulty. All the participants provided informed consent. The University of Washington Institutional Review Board approved the secondary analysis of deidentified transcripts.

Interview Guide and Data Collection

All interviews followed a guide with eight demographic questions and 10 open-ended questions (Appendix). Cognitive interviews were performed with two hospital executives outside the study cohort, resulting in the addition of one question and rewording one question for clarity. One-on-one interviews were performed by 10 committee members (range, 1-3 interviews). All interview audios were recorded, and no field notes were kept. The goal of the interviews was to obtain an understanding of how hospital executives value the contributions and costs of hospitalist groups.

The interviews began with questions about the informant’s current interactions with hospitalists and the origin of the hospitalist group at their facility. Informants then described the value they feel hospitalists bring to their hospital and occasions they were surprised or dissatisfied with the clinical or financial value delivered by the hospitalists. Participants described how they calculate a return on investment (ROI) for their hospitalist group, nonfinancial benefits and disadvantages to hospitalists, and how they believe hospitalists should participate in risk-sharing contracts.

Data Analysis

The interview audiotapes were transcribed and deidentified. A sample of eight transcripts was verified by participants to ensure accuracy. Three investigators (AAW, RC, CC) reviewed a random sample of five transcripts to identify and codify preliminary themes. We applied a general inductive framework with a content analysis approach. Two investigators (TM and MC) read all transcripts independently, coding the presence of each theme and quotations exemplifying these themes using qualitative analysis software (Dedoose Version 7.0.23, SocioCultural Research Consultants). A third investigator (AAW) read all the transcripts and resolved differences of opinion. Themes and code application were discussed among the study team after the second and fifth transcripts to add or clarify codes. No new codes were identified after the first review of the preliminary codebook, although investigators intermittently used an “unknown” code through the 20th transcript. After discussion to reach consensus, excerpts initially coded “unknown” were assigned existing codes; the 20th transcript represents the approximate point of reaching thematic saturation.

RESULTS

Of the 24 participants, 18 (75%) were male, representing a variety of roles: 7 (29.2%) CMOs, 5 (20.8%) Presidents, 5 (20.8%) CFOs, 4 (16.7%) CEOs, and 3 (12.5%) Vice Presidents. The participants represented all regions (Midwest 12 [50%], South 6 [25%], West 4 [16.7%], and East 2 [8.3%], community size (Urban 11 [45.8%], Suburban 8 [33.3%], and Rural 5 [20.8%]), and Hospital Types (Community 11 [45.8%], Multihospital System 5 [20.8%], Academic 5 [20.8%], Safety Net 2 [8.3%], and Critical Access 1 [4.2%]). We present specific themes below and supporting quotations in Tables 1 and 2.

Current Value of the HMG at the Respondent’s Hospital

Most executives reported their hospital’s HMG had operated for over a decade and had developed an earlier, outdated value framework. Interviewees described an initial mix of financial pressures, shifts in physician work preferences, increasing patient acuity, resident labor shortages, and unsolved hospital throughput needs that triggered a reactive conversion from community PCP staffing to hospitalist care teams, followed by refinements to realize value.

“I think initially here it was to deal with the resident caps, right? So, at that moment, the solution that was put in place probably made a lot of sense. If that’s all someone came in with, now I’d be scratching my head and said, what are you thinking?” (President, #2)

Respondents perceived that HMGs provide value in many domains, including financial contributions, high-quality care, organizational efficiency, academics, leadership of interprofessional teams, effective communication, system improvement, and beneficial influence on the care environment and other employees. Regarding the measurable generation of financial benefit, documentation for improved billing accuracy, increased hospital efficiency (eg, lower length of stay, early discharges), and comanagement arrangements were commonly identified.

“I don’t want a urologist with a stethoscope, so I’m happy to have the hospitalists say, ‘Look, I’ll take care of the patient. You do the procedure.’ Well, that’s inherently valuable, whether we measure it or whether we don’t.” (CMO, #21)

Executives generally expressed satisfaction with their HMG’s quality of care and the related pay-for-performance financial benefits from payers, attributing success to hospitalists’ familiarity with inpatient systems and willingness to standardize.

“I just think it’s having one structure, one group to go to, a standard rather than trying to push it through the medical staff.” (VP, #18)

Executives reported that HMGs generate substantial value that is difficult to measure financially. For example, a large bundle of excerpts organized around communication with patients, nurses, and other providers.

“If we have the right hospitalist staff, to engage them with the nursing staff would help to reduce my turnover rate…and create a very positive morale within the nursing units. That’s huge. That’s nonfinancial” (President, #15)

Executives particularly appreciated hospitalists’ work to aggregate input from multiple specialists and present a cohesive explanation to patients. Executives also felt that HMGs create significant unmeasured value by improving processes and outcomes on service lines beyond hospital medicine, achieving this through culture change, involvement in leadership, hospital-wide process redesign, and running rapid response teams. Some executives expressed a desire for hospitalists to assume this global quality responsibility more explicitly as a job expectation.

Executives described how they would evaluate a de novo proposal for hospitalist services, usually enumerating key general domains without explaining specifically how they would measure each element. The following priorities emerged: clinical excellence, capacity to collaborate with hospital leadership, the scope of services provided, cultural fit/alignment, financial performance, contract cost, pay-for-performance measures, and turnover. Regarding financial performance, respondents expected to know the cost of the proposal but lacked a specific price threshold. Instead, they sought to understand the total value of the proposal through its effect on metrics such as facility fees or resource use. Nonetheless, cultural fit was a critical, overriding driver of the hypothetical decision, despite difficulty defining beyond estimates of teamwork, alignment with hospital priorities, and qualities of the group leader.

“For us, it usually ends being how do we mix personally, do we like them?” (CMO, #5)

Alignment and Collaboration

The related concepts of “collaboration” and “alignment” emerged as prominent themes during all interviews. Executives highly valued hospitalist groups that could demonstrate alignment with hospital priorities and often used this concept to summarize the HMG’s success or failure across a group of value domains.

“If you’re just coming in to fill a shift and see 10 patients, you have much less value than somebody who’s going to play that active partnership role… hospitalist services need to partner with hospitals and be intimately involved with the success of the hospital.” (CMO, #20)

Alignment sometimes manifested in a quantified, explicit way, through incentive plans or shared savings plans. However, it most often manifested as a broader sense that the hospitalists’ work targeted the same priorities as the executive leaders and that hospitalists genuinely cared about those priorities. A “shift-work mentality” was expressed by some as the antithesis of alignment. Incorporating hospitalist leaders in hospital leadership and frequent communication arose as mechanisms to increase alignment.

Ways HMGs Fail to Meet Expectations

Respondents described unresolved disadvantages to the hospitalist care model.

“I mean, OPPE, how do you do that for a hospitalist? How can you do it? It’s hard to attribute a patient to someone….it is a weakness and I think we all know it.” (CMO, #21)

Executives also worried about inconsistent handoffs with primary care providers and the field’s demographics, finding it disproportionately comprised of junior or transient physicians. They also hoped that hospitalist innovators would solve clinician burnout and the high cost of inpatient care. Disappointments specific to the local HMG revolved around difficulty developing shared models of value and mechanisms to achieve them.

“I would like to have more dialog between the hospital leadership team and the hospitalist group…I would like to see a little bit more collaboration.” (President, #13)

These challenges emerged not as a deficiency with hospital medicine as a specialty, but a failure at their specific facility to achieve the goal of alignment through joint strategic planning.

Calculating Value

When asked if their hospital had a formal process to evaluate ROI for their HMG, two dominant answers emerged: (1) the executive lacked a formal process for determining ROI and was unaware of one used at their facility or (2) the executive evaluated HMG performance based on multiple measures, including cost, but did not attempt to calculate ROI or a summary value. Several described the financial evaluation process as too difficult or unnecessary.

“No. It’s too difficult to extract that data. I would say the best proxy that we could do it is our case mix index on our medicine service line.” (CMO, #20)

“No, not a formal process, no… I question the value of some of the other things we do with the medical group…but not the value of the hospitalists… I don’t think we’ve done a formal assessment. I appreciate the flexibility, especially in a small hospital.” (President, #10)

Rarely, executives described specific financial calculations that served as a proxy for ROI. These included calculating a contribution margin to compare against the cost of salary support or the application of external survey benchmarking comparisons for productivity and salary to evaluate the appropriateness of a limited set of financial indicators. Twice respondents alluded to more sophisticated measurements conducted by the finance department but lacked familiarity with the process. Several executives described ROI calculations for specific projects and discrete business decisions involving hospitalists, particularly considering hiring an additional hospitalist.

Executives generally struggled to recall specific ways that the nonfinancial contributions of hospitalists were incorporated into executive decisions regarding the hospitalist group. Two related themes emerged: first, the belief that hospitals could not function effectively without hospitalists, making their presence an expected cost of doing business. Second, absent measures of HMG ROI, executives appeared to determine an approximate overall value of hospitalists, rather than parsing the various contributions. A few respondents expressed alarm at the rise in hospitalist salaries, whereas others acknowledged market forces beyond their control.

“… there is going to be more of a demand for hospitalists, which is definitely going to drive up the compensation. So, I don’t worry that the compensation will be driven up so high that there won’t be a return [on investment].” (CFO, #16)

Some urged individual hospitalists to develop a deeper understanding of what supports their salary to avoid strained relationships with executives.

Evolution and Risk-Sharing Contracts

Respondents described an evolving conceptualization of the hospitalist’s value, occurring at both a broad, long-term scale and at an incremental, annual scale through minor modifications to incentive pay schemes. For most executives, hiring hospitalists as replacements for PCPs had become necessary and not a source of novel value; many executives described it as “the cost of doing business.” Some described gradually deemphasizing relative value unit (RVU) production to recognize other contributions. Several reported their general appreciation of hospitalists evolved as specific hospitalists matured and demonstrated new contributions to hospital function. Some leaders tried to speculate about future phases of this evolution, although details were sparse.

Among respondents with greater implementation of risk-sharing contracts or ACOs, executives did not describe significantly different goals for hospitalists; executives emphasized that hospitalists should accelerate existing efforts to reduce inpatient costs, length of stay, healthcare-acquired conditions, unnecessary testing, and readmissions. A theme emerged around hospitalists supporting the continuum of care, through improved communication and increased alignment with health systems.

“Where I see the real benefit…is to figure out a way to use hospitalists and match them up with the primary care physicians on the outpatient side to truly develop an integrated population-based medicine practice for all our patients.” (President, #15)

Executives believed that communication and collaboration with PCPs and postacute care providers would attract more measurement.

DISCUSSION

Our findings provide hospitalists with insight into the approach hospital executives may follow when determining the rationale for and extent of financial support for HMGs. The results did not support our hypothesis that executives commonly determine the appropriate support by summing detailed quantitative models for various HMG contributions. Instead, most hospital executives appear to make decisions about the appropriateness of financial support based on a small number of basic financial or care quality metrics combined with a subjective assessment of the HMG’s broader alignment with hospital priorities. However, we did find substantial evidence that hospital executives’ expectations of hospitalists have evolved in the last decade, creating the potential for dissociation from how hospitalists prioritize and value their own efforts. Together, our findings suggest that enhanced communication, relationship building, and collaboration with hospital leaders may help HMGs to maintain a shared model of value with hospital executives.

The general absence of summary value calculations suggests specific opportunities, benefits, and risks for HMG group leaders (Table 3). An important opportunity relates to the communication agenda about unmeasured or nonfinancial contributions. Although executives recognized many of these, our data suggest a need for HMG leaders to educate hospital leaders about their unmeasured contributions proactively. Although some might recommend doing so by quantifying and financially rewarding key intangible contributions (eg, measuring leadership in culture change9), this entails important risks.10 Some experts propose that the proliferation of physician pay-for-performance schemes threatens medical professionalism, fails patients, and misunderstands what motivates physicians.11 HMG groups that feel undervalued should hesitate before monetizing all aspects of their work, and consider emphasizing relationship-building as a platform for communication about their performance. Achieving better alignment with executives is not just an opportunity for HMG leaders, but for each hospitalist within the group. Although executives wanted to have deeper relationships with group members, this may not be feasible in large organizations. Instead, it is incumbent for HMG leaders to translate executives’ expectations and forge better alignment.

Residency may not adequately prepare hospitalists to meet key expectations hospital executives hold related to system leadership and interprofessional team leadership. For example, hospital leaders particularly valued HMGs’ perceived ability to improve nurse retention and morale. Unfortunately, residency curricula generally lack concerted instruction on the skills required to produce such interprofessional inpatient teams reliably. Similarly, executives strongly wanted HMGs to acknowledge a role as partners in running the quality, stewardship, and safety missions of the entire hospital. While residency training builds clinical competence through the care of individual patients, many residents do not receive experiential education in system design and leadership. This suggests a need for HMGs to provide early career training or mentorship in quality improvement and interprofessional teamwork. Executives and HMG leaders seeking a stable, mature workforce, should allocate resources to retaining mid and late career hospitalists through leadership roles or financial incentives for longevity.

As with many qualitative studies, the generalizability of our findings may be limited, particularly outside the US healthcare system. We invited executives from diverse practice settings but may not have captured all the relevant viewpoints. This study did not include Veterans Affairs hospitals, safety net hospitals were underrepresented, Midwestern hospitals were overrepresented and the participants were predominantly male. We were unable to determine the influence of employment model on participant beliefs about HMGs, nor did we elicit comparisons to other physician specialties that would highlight a distinct approach to negotiating with HMGs. Because we used hospitalists as interviewers, including some from the same institution as the interviewee, respondents may have dampened critiques or descriptions of unmet expectations. Our data do not provide quantitative support for any approach to determining or negotiating appropriate financial support for an HMG.

CONCLUSIONS

This work contributes new understanding of the expectations executives have for HMGs and individual hospitalists. This highlights opportunities for group leaders, hospitalists, medical educators, and quality improvement experts to produce a hospitalist labor force that can engage in productive and mutually satisfying relationships with hospital leaders. Hospitalists should strive to improve alignment and communication with executive groups.

Disclosures

The authors report no potential conflict of interest.

1. Lapps J, Flansbaum B, Leykum L, et al. Updating threshold-based identification of hospitalists in 2012 Medicare pay data. J Hosp Med. 2016;11(1):45-47. https://doi.org/10.1002/jhm.2480.

2. Wachter RM, Goldman L. Zero to 50,000–the 20th Anniversary of the hospitalist. NEJM. 2016;375(11):1009-1011. https://doi.org/10.1056/nejmp1607958.

3. Stevens JP, Nyweide DJ, Maresh S, et al. Comparison of hospital resource use and outcomes among hospitalists, primary care physicians, and other generalists. JAMA Intern Med. 2017;177(12):1781-1787. https://doi.org/10.1001/jamainternmed.2017.5824.

4. American Hospital Association (AHA) (2017), Hospital Statistics, AHA, Chicago, IL.

5. Wachter RM, Goldman L. The emerging role of “hospitalists” in the American health care system. NEJM. 1996;335(7):514-517. https://doi.org/10.1093/ajhp/53.20.2389a.

6. Pham HH, Devers KJ, Kuo S, et al. Health care market trends and the evolution of hospitalist use and roles. J Gen Intern Med. 2005;20(2):101-107. https://doi.org/10.1111/j.1525-1497.2005.40184.x.

7. Epané JP, Weech-Maldonado R, Hearld L, et al. Hospitals’ use of hospitalistas: implications for financial performance. Health Care Manage Rev. 2019;44(1):10-18. https://doi.org/10.1097/hmr.0000000000000170.

8. State of Hospital Medicine: 2018 Report Based on 2017 Data. Society of Hospital Medicine. https://sohm.hospitalmedicine.org/ Accessed December 9, 2018.

9. Carmeli A, Tishler A. The relationships between intangible organizational elements and organizational performance. Strategic Manag J. 2004;25(13):1257-1278. https://doi.org/10.1002/smj.428.

10. Bernard M. Strategic performance management: leveraging and measuring your intangible value drivers. Amsterdam: Butterworth-Heinemann, 2006.

11. Khullar D, Wolfson D, Casalino LP. Professionalism, performance, and the future of physician incentives. JAMA. 2018;320(23):2419-2420. https://doi.org/10.1001/jama.2018.17719.

1. Lapps J, Flansbaum B, Leykum L, et al. Updating threshold-based identification of hospitalists in 2012 Medicare pay data. J Hosp Med. 2016;11(1):45-47. https://doi.org/10.1002/jhm.2480.

2. Wachter RM, Goldman L. Zero to 50,000–the 20th Anniversary of the hospitalist. NEJM. 2016;375(11):1009-1011. https://doi.org/10.1056/nejmp1607958.

3. Stevens JP, Nyweide DJ, Maresh S, et al. Comparison of hospital resource use and outcomes among hospitalists, primary care physicians, and other generalists. JAMA Intern Med. 2017;177(12):1781-1787. https://doi.org/10.1001/jamainternmed.2017.5824.

4. American Hospital Association (AHA) (2017), Hospital Statistics, AHA, Chicago, IL.

5. Wachter RM, Goldman L. The emerging role of “hospitalists” in the American health care system. NEJM. 1996;335(7):514-517. https://doi.org/10.1093/ajhp/53.20.2389a.

6. Pham HH, Devers KJ, Kuo S, et al. Health care market trends and the evolution of hospitalist use and roles. J Gen Intern Med. 2005;20(2):101-107. https://doi.org/10.1111/j.1525-1497.2005.40184.x.

7. Epané JP, Weech-Maldonado R, Hearld L, et al. Hospitals’ use of hospitalistas: implications for financial performance. Health Care Manage Rev. 2019;44(1):10-18. https://doi.org/10.1097/hmr.0000000000000170.

8. State of Hospital Medicine: 2018 Report Based on 2017 Data. Society of Hospital Medicine. https://sohm.hospitalmedicine.org/ Accessed December 9, 2018.

9. Carmeli A, Tishler A. The relationships between intangible organizational elements and organizational performance. Strategic Manag J. 2004;25(13):1257-1278. https://doi.org/10.1002/smj.428.

10. Bernard M. Strategic performance management: leveraging and measuring your intangible value drivers. Amsterdam: Butterworth-Heinemann, 2006.

11. Khullar D, Wolfson D, Casalino LP. Professionalism, performance, and the future of physician incentives. JAMA. 2018;320(23):2419-2420. https://doi.org/10.1001/jama.2018.17719.

© 2019 Society of Hospital Medicine