User login

Hospitalizations with observation services and the Medicare Part A complex appeals process at three academic medical centers

Hospitalists and other inpatient providers are familiar with hospitalizations classified observation. The Centers for Medicare & Medicaid Services (CMS) uses the “2-midnight rule” to distinguish between outpatient services (which include all observation stays) and inpatient services for most hospitalizations. The rule states that “inpatient admissions will generally be payable … if the admitting practitioner expected the patient to require a hospital stay that crossed two midnights and the medical record supports that reasonable expectation.”1

Hospitalization under inpatient versus outpatient status is a billing distinction that can have significant financial consequences for patients, providers, and hospitals. The inpatient or outpatient observation orders written by hospitalists and other hospital-based providers direct billing based on CMS and other third-party regulation. However, providers may have variable expertise writing such orders. To audit the correct use of the visit-status orders by hospital providers, CMS uses recovery auditors (RAs), also referred to as recovery audit contractors.2,3

Historically, RAs had up to 3 years from date of service (DOS) to perform an audit, which involves asking a hospital for a medical record for a particular stay. The audit timeline includes 45 days for hospitals to produce such documentation, and 60 days for the RA either to agree with the hospital’s billing or to make an “overpayment determination” that the hospital should have billed Medicare Part B (outpatient) instead of Part A (inpatient).3,4 The hospital may either accept the RA decision, or contest it by using the pre-appeals discussion period or by directly entering the 5-level Medicare administrative appeals process.3,4 Level 1 and Level 2 appeals are heard by a government contractor, Level 3 by an administrative law judge (ALJ), Level 4 by a Medicare appeals council, and Level 5 by a federal district court. These different appeal types have different deadlines (Appendix 1). The deadlines for hospitals and government responses beyond Level 1 are set by Congress and enforced by CMS,3,4 and CMS sets discussion period timelines. Hospitals that miss an appeals deadline automatically default their appeals request, but there are no penalties for missed government deadlines.

Recently, there has been increased scrutiny of the audit-and-appeals process of outpatient and inpatient status determinations.5 Despite the 2-midnight rule, the Medicare Benefit Policy Manual (MBPM) retains the passage: “Physicians should use a 24-hour period as a benchmark, i.e., they should order admission for patients who are expected to need hospital care for 24 hours or more, and treat other patients on an outpatient basis.”6 Auditors often cite “medical necessity” in their decisions, which is not well defined in the MBPM and can be open to different interpretation. This lack of clarity likely contributed to the large number of status determination discrepancies between providers and RAs, thereby creating a federal appeals backlog that caused the Office of Medicare Hearings and Appeals to halt hospital appeals assignments7 and prompted an ongoing lawsuit against CMS regarding the lengthy appeals process.4 To address these problems and clear the appeals backlog, CMS proposed a “$0.68 settlement offer.”4 The settlement “offered an administrative agreement to any hospital willing to withdraw their pending appeals in exchange for timely partial payment (68% of the net allowable amount)”8 and paid out almost $1.5 billion to the third of eligible hospitals that accepted the offer.9 CMS also made programmatic improvements to the RA program.10

Despite these efforts, problems remain. On June 9, 2016, the U.S. Government Accountability Office (GAO) published Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process, citing an approximate 2000% increase in hospital inpatient appeals during the period 2010–2014 and the concern that appeals requests will continue to exceed adjudication capabilities.11 On July 5, 2016, CMS issued its proposed rule for appeals reform that allows the Medicare Appeals Council (Level 4) to set precedents which would be binding at lower levels and allows senior attorneys to handle some cases and effectively increase manpower at the Level 3 (ALJ). In addition, CMS proposes to revise the method for calculating dollars at risk needed to schedule an ALJ hearing, and develop methods to better adjudicate similar claims, and other process improvements aimed at decreasing the more than 750,000 current claims awaiting ALJ decisions.12

We conducted a study to better understand the Medicare appeals process in the context of the proposed CMS reforms by investigating all appeals reaching Level 3 at Johns Hopkins Hospital (JHH), University of Wisconsin Hospitals and Clinics (UWHC), and University of Utah Hospital (UU). Because relatively few cases nationally are appealed beyond Level 3, the study focused on most-relevant data.3 We examined time spent at each appeal Level and whether it met federally mandated deadlines, as well as the percentage accountable to hospitals versus government contractors or ALJs. We also recorded the overturn rate at Level 3 and evaluated standardized text in de-identified decision letters to determine criteria cited by contractors in their decisions to deny hospital appeal requests.

METHODS

The JHH, UWHC, and UU Institutional Review Boards did not require a review. The study included all complex Part A appeals involving DOS before October 1, 2013 and reaching Level 3 (ALJ) as of May 1, 2016.

Our general methods were described previously.2 Briefly, the 3 academic medical centers are geographically diverse. JHH is in region A, UWHC in region B, and UU in region D (3 of the 4 RA regions are represented). The hospitals had different Medicare administrative contractors but the same qualified independent contractor until March 1, 2015 (Appendix 2).

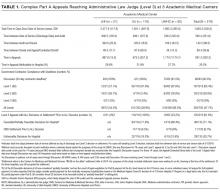

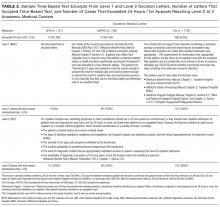

For this paper, time spent in the discussion period, if applicable, is included in appeals time, except as specified (Table 1). The term partially favorable is used for UU cases only, based on the O’Connor Hospital decision13 (Table 1). Reflecting ambiguity in the MBPM, for time-based encounter length of stay (LOS) statements, JHH and UU used time between admission order and discharge order, whereas UWHC used time between decision to admit (for emergency department patients) or time care began (direct admissions) and time patient stopped receiving care (Table 2). Although CMS now defines when a hospital encounter begins under the 2-midnight rule,14 there was no standard definition when the cases in this study were audited.

We reviewed de-identified standardized text in Level 1 and Level 2 decision letters. Each hospital designated an analyst to search letters for Medicare Benefit Policy Manual chapter 1, which references the 24-hour benchmark, or the MBPM statement regarding use of the 24-hour period as a benchmark to guide inpatient admission orders.6 Associated paragraphs that included these terms were coded and reviewed by Drs. Sheehy, Engel, and Locke to confirm that the 24-hour time-based benchmark was mentioned, as per the MBPM statement (Table 2, Appendix 3).

Descriptive statistics are used to describe the data, and representative de-identified standardized text is included.

RESULTS

Of 219 Level 3 cases, 135 (61.6%) concluded at Level 3. Of these 135 cases, 96 (71.1%) were decided in favor of the hospital, 11 (8.1%) were settled in the CMS $0.68 settlement offer, and 28 (20.7%) were unfavorable to the hospital (Table 1).

Mean total days since DOS was 1,663.3 (536.8) (mean [SD]), with median 1708 days. This included 560.4 (351.6) days between DOS and audit (median 556 days) and 891.3 (320.3) days in appeal (median 979 days). The hospitals were responsible for 29.3% of that time (260.7 [68.2] days) while government contractors were responsible for 70.7% (630.6 [277.2] days). Government contractors and ALJs met deadlines 47.7% of the time, meeting appeals deadlines 92.5% of the time for Discussion, 85.4% for Level 1, 38.8% for Level 2, and 0% for Level 3 (Table 1).

All “redetermination” (level 1 appeals letters) received at UU and UWHC, and all “reconsideration” (level 2 appeals letters) received by UU, UWHC, and JHH contained standardized time-based 24–hour benchmark text directly or referencing the MBPM containing such text, to describe criteria for inpatient status (Table 2 and Appendix 3).6 In total, 417 of 438 (95.2%) of Level 1 and Level 2 appeals results letters contained time-based 24-hour benchmark criteria for inpatient status despite 154 of 219 (70.3%) of denied cases exceeding a 24-hour LOS.

DISCUSSION

This study demonstrated process and timeliness concerns in the Medicare RA program for Level 3 cases at 3 academic medical centers. Although hospitals forfeit any appeal for which they miss a filing deadline, government contractors and ALJs met their deadlines less than half the time without default or penalty. Average time from the rendering of services to the conclusion of the audit-and-appeals process exceeded 4.5 years, which included an average 560 days between hospital stay and initial RA audit, and almost 900 days in appeals, with more than 70% of that time attributable to government contractors and ALJs.

Objective time-based 24-hour inpatient status criteria were referenced in 95% of decision letters, even though LOS exceeded 24 hours in more than 70% of these cases, suggesting that objective LOS data played only a small role in contractor decisions, or that contractors did not actually audit for LOS when reviewing cases. Unclear criteria likely contributed to payment denials and improper payments, despite admitting providers’ best efforts to comply with Medicare rules when writing visit-status orders. There was also a significant cost to hospitals; our prior study found that navigating the appeals process required 5 full-time equivalents per institution.2

At the 2 study hospitals with Level 3 decisions, more than two thirds of the decisions favored the hospital, suggesting the hospitals were justified in appealing RA Level 1 and Level 2 determinations. This proportion is consistent with the 43% ALJ overturn rate (including RA- and non-RA-derived appeals) cited in the recent U.S. Court of Appeals for the DC Circuit decision.9

This study potentially was limited by contractor and hospital use of the nonstandardized LOS calculation during the study period. That the majority of JHH and UU cases cited the 24-hour benchmark in their letters but nevertheless exceeded 24-hour LOS (using the most conservative definition of LOS) suggests contractors did not audit for or consider LOS in their decisions.

Our results support recent steps taken by CMS to reform the appeals process, including shortening the RA “look-back period” from 3 years to 6 months,10 which will markedly shorten the 560-day lag between DOS and audit found in this study. In addition, CMS has replaced RAs with beneficiary and family-centered care quality improvement organizations (BFCC-QIOs)1,8 for initial status determination audits. Although it is too soon to tell, the hope is that BFCC-QIOs will decrease the volume of audits and denials that have overwhelmed the system and most probably contributed to process delays and the appeals backlog.

However, our data demonstrate several areas of concern not addressed in the recent GAO report11 or in the rule proposed by CMS.12 Most important, CMS could consider an appeals deadline missed by a government contractor as a decision for the hospital, in the same way a hospital’s missed deadline defaults its appeal. Such equity would ensure due process and prevent another appeals backlog. In addition, the large number of Level 3 decisions favoring hospitals suggests a need for process improvement at the Medicare administrative contractor and qualified independent contractor Level of appeals—such as mandatory review of Level 1 and Level 2 decision letters for appeals overturned at Level 3, accountability for Level 1 and Level 2 contractors with high rates of Level 3 overturn, and clarification of criteria used to judge determinations.

Medicare fraud cannot be tolerated, and a robust auditing process is essential to the integrity of the Medicare program. CMS’s current and proposed reforms may not be enough to eliminate the appeals backlog and restore a timely and fair appeals process. As CMS explores bundled payments and other reimbursement reforms, perhaps the need to distinguish observation hospital care will be eliminated. Short of that, additional actions must be taken so that a just and efficient Medicare appeals system can be realized for observation hospitalizations.

Acknowledgments

For invaluable assistance in data preparation and presentation, the authors thank Becky Borchert, RN, MS, MBA, Program Manager for Medicare/Medicaid Utilization Review, University of Wisconsin Hospital and Clinics; Carol Duhaney, Calvin Young, and Joan Kratz, RN, Johns Hopkins Hospital; and Morgan Walker and Lisa Whittaker, RN, University of Utah.

Disclosure

Nothing to report.

1. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Fact sheet: 2-midnight rule. https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2015-Fact-sheets-items/2015-07-01-2.html. Published July 1, 2015. Accessed August 9, 2016.

2. Sheehy AM, Locke C, Engel JZ, et al. Recovery Audit Contractor audits and appeals at three academic medical centers. J Hosp Med. 2015;10(4):212-219. PubMed

3. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery auditing in Medicare for fiscal year 2014. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/RAC-RTC-FY2014.pdf. Accessed August 9, 2016.

4. American Hospital Association vs Burwell. No 15-5015. Circuit court decision. https://www.cadc.uscourts.gov/internet/opinions.nsf/CDFE9734F0D36C2185257F540052A39D/$file/15-5015-1597907.pdf. Decided February 9, 2016. Accessed August 9, 2016

5. AMA news: Payment recovery audit program needs overhaul: Doctors to CMS. https://wire.ama-assn.org/ama-news/payment-recovery-audit-program-needs-overhaul-doctors-cms. Accessed March 17, 2017.

6. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital services covered under Part A. In: Medicare Benefit Policy Manual. Chapter 1. Publication 100-02. https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/bp102c01.pdf. Accessed August 9, 2016.

7. Griswold NJ; Office of Medicare Hearings and Appeals, US Dept of Health and Human Services. Memorandum to OMHA Medicare appellants. http://www.modernhealthcare.com/assets/pdf/CH92573110.pdf. Accessed August 9, 2016.

8. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital reviews. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Medical-Review/InpatientHospitalReviews.html. Accessed August 9, 2016.

9. Galewitz P. CMS identifies hospitals paid nearly $1.5B in 2015 Medicare billing settlement. Kaiser Health News. http://khn.org/news/cms-identifies-hospitals-paid-nearly-1-5b-in-2015-medicare-billing-settlement/. Published August 23, 2016. Accessed October 14, 2016.

10. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery audit program improvements. https://www.cms.gov/research-statistics-data-and-systems/monitoring-programs/medicare-ffs-compliance-programs/recovery-audit-program/downloads/RAC-program-improvements.pdf. Accessed August 9, 2016.

11. US Government Accountability Office. Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process. http://www.gao.gov/assets/680/677034.pdf. Publication GAO-16-366. Published May 10, 2016. Accessed August 9, 2016.

12. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Changes to the Medicare Claims and Entitlement, Medicare Advantage Organization Determination, and Medicare Prescription Drug Coverage Determination Appeals Procedures. https://www.gpo.gov/fdsys/pkg/FR-2016-07-05/pdf/2016-15192.pdf. Accessed August 9, 2016.

13. Departmental Appeals Board, US Dept of Health and Human Services. Action and Order of Medicare Appeals Council: in the case of O’Connor Hospital. http://www.hhs.gov/dab/divisions/medicareoperations/macdecisions/oconnorhospital.pdf. Accessed August 9, 2016.

14. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Frequently asked questions: 2 midnight inpatient admission guidance & patient status reviews for admissions on or after October 1, 2013. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medical-Review/Downloads/QAsforWebsitePosting_110413-v2-CLEAN.pdf. Accessed August 9, 2016.

Hospitalists and other inpatient providers are familiar with hospitalizations classified observation. The Centers for Medicare & Medicaid Services (CMS) uses the “2-midnight rule” to distinguish between outpatient services (which include all observation stays) and inpatient services for most hospitalizations. The rule states that “inpatient admissions will generally be payable … if the admitting practitioner expected the patient to require a hospital stay that crossed two midnights and the medical record supports that reasonable expectation.”1

Hospitalization under inpatient versus outpatient status is a billing distinction that can have significant financial consequences for patients, providers, and hospitals. The inpatient or outpatient observation orders written by hospitalists and other hospital-based providers direct billing based on CMS and other third-party regulation. However, providers may have variable expertise writing such orders. To audit the correct use of the visit-status orders by hospital providers, CMS uses recovery auditors (RAs), also referred to as recovery audit contractors.2,3

Historically, RAs had up to 3 years from date of service (DOS) to perform an audit, which involves asking a hospital for a medical record for a particular stay. The audit timeline includes 45 days for hospitals to produce such documentation, and 60 days for the RA either to agree with the hospital’s billing or to make an “overpayment determination” that the hospital should have billed Medicare Part B (outpatient) instead of Part A (inpatient).3,4 The hospital may either accept the RA decision, or contest it by using the pre-appeals discussion period or by directly entering the 5-level Medicare administrative appeals process.3,4 Level 1 and Level 2 appeals are heard by a government contractor, Level 3 by an administrative law judge (ALJ), Level 4 by a Medicare appeals council, and Level 5 by a federal district court. These different appeal types have different deadlines (Appendix 1). The deadlines for hospitals and government responses beyond Level 1 are set by Congress and enforced by CMS,3,4 and CMS sets discussion period timelines. Hospitals that miss an appeals deadline automatically default their appeals request, but there are no penalties for missed government deadlines.

Recently, there has been increased scrutiny of the audit-and-appeals process of outpatient and inpatient status determinations.5 Despite the 2-midnight rule, the Medicare Benefit Policy Manual (MBPM) retains the passage: “Physicians should use a 24-hour period as a benchmark, i.e., they should order admission for patients who are expected to need hospital care for 24 hours or more, and treat other patients on an outpatient basis.”6 Auditors often cite “medical necessity” in their decisions, which is not well defined in the MBPM and can be open to different interpretation. This lack of clarity likely contributed to the large number of status determination discrepancies between providers and RAs, thereby creating a federal appeals backlog that caused the Office of Medicare Hearings and Appeals to halt hospital appeals assignments7 and prompted an ongoing lawsuit against CMS regarding the lengthy appeals process.4 To address these problems and clear the appeals backlog, CMS proposed a “$0.68 settlement offer.”4 The settlement “offered an administrative agreement to any hospital willing to withdraw their pending appeals in exchange for timely partial payment (68% of the net allowable amount)”8 and paid out almost $1.5 billion to the third of eligible hospitals that accepted the offer.9 CMS also made programmatic improvements to the RA program.10

Despite these efforts, problems remain. On June 9, 2016, the U.S. Government Accountability Office (GAO) published Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process, citing an approximate 2000% increase in hospital inpatient appeals during the period 2010–2014 and the concern that appeals requests will continue to exceed adjudication capabilities.11 On July 5, 2016, CMS issued its proposed rule for appeals reform that allows the Medicare Appeals Council (Level 4) to set precedents which would be binding at lower levels and allows senior attorneys to handle some cases and effectively increase manpower at the Level 3 (ALJ). In addition, CMS proposes to revise the method for calculating dollars at risk needed to schedule an ALJ hearing, and develop methods to better adjudicate similar claims, and other process improvements aimed at decreasing the more than 750,000 current claims awaiting ALJ decisions.12

We conducted a study to better understand the Medicare appeals process in the context of the proposed CMS reforms by investigating all appeals reaching Level 3 at Johns Hopkins Hospital (JHH), University of Wisconsin Hospitals and Clinics (UWHC), and University of Utah Hospital (UU). Because relatively few cases nationally are appealed beyond Level 3, the study focused on most-relevant data.3 We examined time spent at each appeal Level and whether it met federally mandated deadlines, as well as the percentage accountable to hospitals versus government contractors or ALJs. We also recorded the overturn rate at Level 3 and evaluated standardized text in de-identified decision letters to determine criteria cited by contractors in their decisions to deny hospital appeal requests.

METHODS

The JHH, UWHC, and UU Institutional Review Boards did not require a review. The study included all complex Part A appeals involving DOS before October 1, 2013 and reaching Level 3 (ALJ) as of May 1, 2016.

Our general methods were described previously.2 Briefly, the 3 academic medical centers are geographically diverse. JHH is in region A, UWHC in region B, and UU in region D (3 of the 4 RA regions are represented). The hospitals had different Medicare administrative contractors but the same qualified independent contractor until March 1, 2015 (Appendix 2).

For this paper, time spent in the discussion period, if applicable, is included in appeals time, except as specified (Table 1). The term partially favorable is used for UU cases only, based on the O’Connor Hospital decision13 (Table 1). Reflecting ambiguity in the MBPM, for time-based encounter length of stay (LOS) statements, JHH and UU used time between admission order and discharge order, whereas UWHC used time between decision to admit (for emergency department patients) or time care began (direct admissions) and time patient stopped receiving care (Table 2). Although CMS now defines when a hospital encounter begins under the 2-midnight rule,14 there was no standard definition when the cases in this study were audited.

We reviewed de-identified standardized text in Level 1 and Level 2 decision letters. Each hospital designated an analyst to search letters for Medicare Benefit Policy Manual chapter 1, which references the 24-hour benchmark, or the MBPM statement regarding use of the 24-hour period as a benchmark to guide inpatient admission orders.6 Associated paragraphs that included these terms were coded and reviewed by Drs. Sheehy, Engel, and Locke to confirm that the 24-hour time-based benchmark was mentioned, as per the MBPM statement (Table 2, Appendix 3).

Descriptive statistics are used to describe the data, and representative de-identified standardized text is included.

RESULTS

Of 219 Level 3 cases, 135 (61.6%) concluded at Level 3. Of these 135 cases, 96 (71.1%) were decided in favor of the hospital, 11 (8.1%) were settled in the CMS $0.68 settlement offer, and 28 (20.7%) were unfavorable to the hospital (Table 1).

Mean total days since DOS was 1,663.3 (536.8) (mean [SD]), with median 1708 days. This included 560.4 (351.6) days between DOS and audit (median 556 days) and 891.3 (320.3) days in appeal (median 979 days). The hospitals were responsible for 29.3% of that time (260.7 [68.2] days) while government contractors were responsible for 70.7% (630.6 [277.2] days). Government contractors and ALJs met deadlines 47.7% of the time, meeting appeals deadlines 92.5% of the time for Discussion, 85.4% for Level 1, 38.8% for Level 2, and 0% for Level 3 (Table 1).

All “redetermination” (level 1 appeals letters) received at UU and UWHC, and all “reconsideration” (level 2 appeals letters) received by UU, UWHC, and JHH contained standardized time-based 24–hour benchmark text directly or referencing the MBPM containing such text, to describe criteria for inpatient status (Table 2 and Appendix 3).6 In total, 417 of 438 (95.2%) of Level 1 and Level 2 appeals results letters contained time-based 24-hour benchmark criteria for inpatient status despite 154 of 219 (70.3%) of denied cases exceeding a 24-hour LOS.

DISCUSSION

This study demonstrated process and timeliness concerns in the Medicare RA program for Level 3 cases at 3 academic medical centers. Although hospitals forfeit any appeal for which they miss a filing deadline, government contractors and ALJs met their deadlines less than half the time without default or penalty. Average time from the rendering of services to the conclusion of the audit-and-appeals process exceeded 4.5 years, which included an average 560 days between hospital stay and initial RA audit, and almost 900 days in appeals, with more than 70% of that time attributable to government contractors and ALJs.

Objective time-based 24-hour inpatient status criteria were referenced in 95% of decision letters, even though LOS exceeded 24 hours in more than 70% of these cases, suggesting that objective LOS data played only a small role in contractor decisions, or that contractors did not actually audit for LOS when reviewing cases. Unclear criteria likely contributed to payment denials and improper payments, despite admitting providers’ best efforts to comply with Medicare rules when writing visit-status orders. There was also a significant cost to hospitals; our prior study found that navigating the appeals process required 5 full-time equivalents per institution.2

At the 2 study hospitals with Level 3 decisions, more than two thirds of the decisions favored the hospital, suggesting the hospitals were justified in appealing RA Level 1 and Level 2 determinations. This proportion is consistent with the 43% ALJ overturn rate (including RA- and non-RA-derived appeals) cited in the recent U.S. Court of Appeals for the DC Circuit decision.9

This study potentially was limited by contractor and hospital use of the nonstandardized LOS calculation during the study period. That the majority of JHH and UU cases cited the 24-hour benchmark in their letters but nevertheless exceeded 24-hour LOS (using the most conservative definition of LOS) suggests contractors did not audit for or consider LOS in their decisions.

Our results support recent steps taken by CMS to reform the appeals process, including shortening the RA “look-back period” from 3 years to 6 months,10 which will markedly shorten the 560-day lag between DOS and audit found in this study. In addition, CMS has replaced RAs with beneficiary and family-centered care quality improvement organizations (BFCC-QIOs)1,8 for initial status determination audits. Although it is too soon to tell, the hope is that BFCC-QIOs will decrease the volume of audits and denials that have overwhelmed the system and most probably contributed to process delays and the appeals backlog.

However, our data demonstrate several areas of concern not addressed in the recent GAO report11 or in the rule proposed by CMS.12 Most important, CMS could consider an appeals deadline missed by a government contractor as a decision for the hospital, in the same way a hospital’s missed deadline defaults its appeal. Such equity would ensure due process and prevent another appeals backlog. In addition, the large number of Level 3 decisions favoring hospitals suggests a need for process improvement at the Medicare administrative contractor and qualified independent contractor Level of appeals—such as mandatory review of Level 1 and Level 2 decision letters for appeals overturned at Level 3, accountability for Level 1 and Level 2 contractors with high rates of Level 3 overturn, and clarification of criteria used to judge determinations.

Medicare fraud cannot be tolerated, and a robust auditing process is essential to the integrity of the Medicare program. CMS’s current and proposed reforms may not be enough to eliminate the appeals backlog and restore a timely and fair appeals process. As CMS explores bundled payments and other reimbursement reforms, perhaps the need to distinguish observation hospital care will be eliminated. Short of that, additional actions must be taken so that a just and efficient Medicare appeals system can be realized for observation hospitalizations.

Acknowledgments

For invaluable assistance in data preparation and presentation, the authors thank Becky Borchert, RN, MS, MBA, Program Manager for Medicare/Medicaid Utilization Review, University of Wisconsin Hospital and Clinics; Carol Duhaney, Calvin Young, and Joan Kratz, RN, Johns Hopkins Hospital; and Morgan Walker and Lisa Whittaker, RN, University of Utah.

Disclosure

Nothing to report.

Hospitalists and other inpatient providers are familiar with hospitalizations classified observation. The Centers for Medicare & Medicaid Services (CMS) uses the “2-midnight rule” to distinguish between outpatient services (which include all observation stays) and inpatient services for most hospitalizations. The rule states that “inpatient admissions will generally be payable … if the admitting practitioner expected the patient to require a hospital stay that crossed two midnights and the medical record supports that reasonable expectation.”1

Hospitalization under inpatient versus outpatient status is a billing distinction that can have significant financial consequences for patients, providers, and hospitals. The inpatient or outpatient observation orders written by hospitalists and other hospital-based providers direct billing based on CMS and other third-party regulation. However, providers may have variable expertise writing such orders. To audit the correct use of the visit-status orders by hospital providers, CMS uses recovery auditors (RAs), also referred to as recovery audit contractors.2,3

Historically, RAs had up to 3 years from date of service (DOS) to perform an audit, which involves asking a hospital for a medical record for a particular stay. The audit timeline includes 45 days for hospitals to produce such documentation, and 60 days for the RA either to agree with the hospital’s billing or to make an “overpayment determination” that the hospital should have billed Medicare Part B (outpatient) instead of Part A (inpatient).3,4 The hospital may either accept the RA decision, or contest it by using the pre-appeals discussion period or by directly entering the 5-level Medicare administrative appeals process.3,4 Level 1 and Level 2 appeals are heard by a government contractor, Level 3 by an administrative law judge (ALJ), Level 4 by a Medicare appeals council, and Level 5 by a federal district court. These different appeal types have different deadlines (Appendix 1). The deadlines for hospitals and government responses beyond Level 1 are set by Congress and enforced by CMS,3,4 and CMS sets discussion period timelines. Hospitals that miss an appeals deadline automatically default their appeals request, but there are no penalties for missed government deadlines.

Recently, there has been increased scrutiny of the audit-and-appeals process of outpatient and inpatient status determinations.5 Despite the 2-midnight rule, the Medicare Benefit Policy Manual (MBPM) retains the passage: “Physicians should use a 24-hour period as a benchmark, i.e., they should order admission for patients who are expected to need hospital care for 24 hours or more, and treat other patients on an outpatient basis.”6 Auditors often cite “medical necessity” in their decisions, which is not well defined in the MBPM and can be open to different interpretation. This lack of clarity likely contributed to the large number of status determination discrepancies between providers and RAs, thereby creating a federal appeals backlog that caused the Office of Medicare Hearings and Appeals to halt hospital appeals assignments7 and prompted an ongoing lawsuit against CMS regarding the lengthy appeals process.4 To address these problems and clear the appeals backlog, CMS proposed a “$0.68 settlement offer.”4 The settlement “offered an administrative agreement to any hospital willing to withdraw their pending appeals in exchange for timely partial payment (68% of the net allowable amount)”8 and paid out almost $1.5 billion to the third of eligible hospitals that accepted the offer.9 CMS also made programmatic improvements to the RA program.10

Despite these efforts, problems remain. On June 9, 2016, the U.S. Government Accountability Office (GAO) published Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process, citing an approximate 2000% increase in hospital inpatient appeals during the period 2010–2014 and the concern that appeals requests will continue to exceed adjudication capabilities.11 On July 5, 2016, CMS issued its proposed rule for appeals reform that allows the Medicare Appeals Council (Level 4) to set precedents which would be binding at lower levels and allows senior attorneys to handle some cases and effectively increase manpower at the Level 3 (ALJ). In addition, CMS proposes to revise the method for calculating dollars at risk needed to schedule an ALJ hearing, and develop methods to better adjudicate similar claims, and other process improvements aimed at decreasing the more than 750,000 current claims awaiting ALJ decisions.12

We conducted a study to better understand the Medicare appeals process in the context of the proposed CMS reforms by investigating all appeals reaching Level 3 at Johns Hopkins Hospital (JHH), University of Wisconsin Hospitals and Clinics (UWHC), and University of Utah Hospital (UU). Because relatively few cases nationally are appealed beyond Level 3, the study focused on most-relevant data.3 We examined time spent at each appeal Level and whether it met federally mandated deadlines, as well as the percentage accountable to hospitals versus government contractors or ALJs. We also recorded the overturn rate at Level 3 and evaluated standardized text in de-identified decision letters to determine criteria cited by contractors in their decisions to deny hospital appeal requests.

METHODS

The JHH, UWHC, and UU Institutional Review Boards did not require a review. The study included all complex Part A appeals involving DOS before October 1, 2013 and reaching Level 3 (ALJ) as of May 1, 2016.

Our general methods were described previously.2 Briefly, the 3 academic medical centers are geographically diverse. JHH is in region A, UWHC in region B, and UU in region D (3 of the 4 RA regions are represented). The hospitals had different Medicare administrative contractors but the same qualified independent contractor until March 1, 2015 (Appendix 2).

For this paper, time spent in the discussion period, if applicable, is included in appeals time, except as specified (Table 1). The term partially favorable is used for UU cases only, based on the O’Connor Hospital decision13 (Table 1). Reflecting ambiguity in the MBPM, for time-based encounter length of stay (LOS) statements, JHH and UU used time between admission order and discharge order, whereas UWHC used time between decision to admit (for emergency department patients) or time care began (direct admissions) and time patient stopped receiving care (Table 2). Although CMS now defines when a hospital encounter begins under the 2-midnight rule,14 there was no standard definition when the cases in this study were audited.

We reviewed de-identified standardized text in Level 1 and Level 2 decision letters. Each hospital designated an analyst to search letters for Medicare Benefit Policy Manual chapter 1, which references the 24-hour benchmark, or the MBPM statement regarding use of the 24-hour period as a benchmark to guide inpatient admission orders.6 Associated paragraphs that included these terms were coded and reviewed by Drs. Sheehy, Engel, and Locke to confirm that the 24-hour time-based benchmark was mentioned, as per the MBPM statement (Table 2, Appendix 3).

Descriptive statistics are used to describe the data, and representative de-identified standardized text is included.

RESULTS

Of 219 Level 3 cases, 135 (61.6%) concluded at Level 3. Of these 135 cases, 96 (71.1%) were decided in favor of the hospital, 11 (8.1%) were settled in the CMS $0.68 settlement offer, and 28 (20.7%) were unfavorable to the hospital (Table 1).

Mean total days since DOS was 1,663.3 (536.8) (mean [SD]), with median 1708 days. This included 560.4 (351.6) days between DOS and audit (median 556 days) and 891.3 (320.3) days in appeal (median 979 days). The hospitals were responsible for 29.3% of that time (260.7 [68.2] days) while government contractors were responsible for 70.7% (630.6 [277.2] days). Government contractors and ALJs met deadlines 47.7% of the time, meeting appeals deadlines 92.5% of the time for Discussion, 85.4% for Level 1, 38.8% for Level 2, and 0% for Level 3 (Table 1).

All “redetermination” (level 1 appeals letters) received at UU and UWHC, and all “reconsideration” (level 2 appeals letters) received by UU, UWHC, and JHH contained standardized time-based 24–hour benchmark text directly or referencing the MBPM containing such text, to describe criteria for inpatient status (Table 2 and Appendix 3).6 In total, 417 of 438 (95.2%) of Level 1 and Level 2 appeals results letters contained time-based 24-hour benchmark criteria for inpatient status despite 154 of 219 (70.3%) of denied cases exceeding a 24-hour LOS.

DISCUSSION

This study demonstrated process and timeliness concerns in the Medicare RA program for Level 3 cases at 3 academic medical centers. Although hospitals forfeit any appeal for which they miss a filing deadline, government contractors and ALJs met their deadlines less than half the time without default or penalty. Average time from the rendering of services to the conclusion of the audit-and-appeals process exceeded 4.5 years, which included an average 560 days between hospital stay and initial RA audit, and almost 900 days in appeals, with more than 70% of that time attributable to government contractors and ALJs.

Objective time-based 24-hour inpatient status criteria were referenced in 95% of decision letters, even though LOS exceeded 24 hours in more than 70% of these cases, suggesting that objective LOS data played only a small role in contractor decisions, or that contractors did not actually audit for LOS when reviewing cases. Unclear criteria likely contributed to payment denials and improper payments, despite admitting providers’ best efforts to comply with Medicare rules when writing visit-status orders. There was also a significant cost to hospitals; our prior study found that navigating the appeals process required 5 full-time equivalents per institution.2

At the 2 study hospitals with Level 3 decisions, more than two thirds of the decisions favored the hospital, suggesting the hospitals were justified in appealing RA Level 1 and Level 2 determinations. This proportion is consistent with the 43% ALJ overturn rate (including RA- and non-RA-derived appeals) cited in the recent U.S. Court of Appeals for the DC Circuit decision.9

This study potentially was limited by contractor and hospital use of the nonstandardized LOS calculation during the study period. That the majority of JHH and UU cases cited the 24-hour benchmark in their letters but nevertheless exceeded 24-hour LOS (using the most conservative definition of LOS) suggests contractors did not audit for or consider LOS in their decisions.

Our results support recent steps taken by CMS to reform the appeals process, including shortening the RA “look-back period” from 3 years to 6 months,10 which will markedly shorten the 560-day lag between DOS and audit found in this study. In addition, CMS has replaced RAs with beneficiary and family-centered care quality improvement organizations (BFCC-QIOs)1,8 for initial status determination audits. Although it is too soon to tell, the hope is that BFCC-QIOs will decrease the volume of audits and denials that have overwhelmed the system and most probably contributed to process delays and the appeals backlog.

However, our data demonstrate several areas of concern not addressed in the recent GAO report11 or in the rule proposed by CMS.12 Most important, CMS could consider an appeals deadline missed by a government contractor as a decision for the hospital, in the same way a hospital’s missed deadline defaults its appeal. Such equity would ensure due process and prevent another appeals backlog. In addition, the large number of Level 3 decisions favoring hospitals suggests a need for process improvement at the Medicare administrative contractor and qualified independent contractor Level of appeals—such as mandatory review of Level 1 and Level 2 decision letters for appeals overturned at Level 3, accountability for Level 1 and Level 2 contractors with high rates of Level 3 overturn, and clarification of criteria used to judge determinations.

Medicare fraud cannot be tolerated, and a robust auditing process is essential to the integrity of the Medicare program. CMS’s current and proposed reforms may not be enough to eliminate the appeals backlog and restore a timely and fair appeals process. As CMS explores bundled payments and other reimbursement reforms, perhaps the need to distinguish observation hospital care will be eliminated. Short of that, additional actions must be taken so that a just and efficient Medicare appeals system can be realized for observation hospitalizations.

Acknowledgments

For invaluable assistance in data preparation and presentation, the authors thank Becky Borchert, RN, MS, MBA, Program Manager for Medicare/Medicaid Utilization Review, University of Wisconsin Hospital and Clinics; Carol Duhaney, Calvin Young, and Joan Kratz, RN, Johns Hopkins Hospital; and Morgan Walker and Lisa Whittaker, RN, University of Utah.

Disclosure

Nothing to report.

1. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Fact sheet: 2-midnight rule. https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2015-Fact-sheets-items/2015-07-01-2.html. Published July 1, 2015. Accessed August 9, 2016.

2. Sheehy AM, Locke C, Engel JZ, et al. Recovery Audit Contractor audits and appeals at three academic medical centers. J Hosp Med. 2015;10(4):212-219. PubMed

3. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery auditing in Medicare for fiscal year 2014. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/RAC-RTC-FY2014.pdf. Accessed August 9, 2016.

4. American Hospital Association vs Burwell. No 15-5015. Circuit court decision. https://www.cadc.uscourts.gov/internet/opinions.nsf/CDFE9734F0D36C2185257F540052A39D/$file/15-5015-1597907.pdf. Decided February 9, 2016. Accessed August 9, 2016

5. AMA news: Payment recovery audit program needs overhaul: Doctors to CMS. https://wire.ama-assn.org/ama-news/payment-recovery-audit-program-needs-overhaul-doctors-cms. Accessed March 17, 2017.

6. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital services covered under Part A. In: Medicare Benefit Policy Manual. Chapter 1. Publication 100-02. https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/bp102c01.pdf. Accessed August 9, 2016.

7. Griswold NJ; Office of Medicare Hearings and Appeals, US Dept of Health and Human Services. Memorandum to OMHA Medicare appellants. http://www.modernhealthcare.com/assets/pdf/CH92573110.pdf. Accessed August 9, 2016.

8. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital reviews. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Medical-Review/InpatientHospitalReviews.html. Accessed August 9, 2016.

9. Galewitz P. CMS identifies hospitals paid nearly $1.5B in 2015 Medicare billing settlement. Kaiser Health News. http://khn.org/news/cms-identifies-hospitals-paid-nearly-1-5b-in-2015-medicare-billing-settlement/. Published August 23, 2016. Accessed October 14, 2016.

10. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery audit program improvements. https://www.cms.gov/research-statistics-data-and-systems/monitoring-programs/medicare-ffs-compliance-programs/recovery-audit-program/downloads/RAC-program-improvements.pdf. Accessed August 9, 2016.

11. US Government Accountability Office. Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process. http://www.gao.gov/assets/680/677034.pdf. Publication GAO-16-366. Published May 10, 2016. Accessed August 9, 2016.

12. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Changes to the Medicare Claims and Entitlement, Medicare Advantage Organization Determination, and Medicare Prescription Drug Coverage Determination Appeals Procedures. https://www.gpo.gov/fdsys/pkg/FR-2016-07-05/pdf/2016-15192.pdf. Accessed August 9, 2016.

13. Departmental Appeals Board, US Dept of Health and Human Services. Action and Order of Medicare Appeals Council: in the case of O’Connor Hospital. http://www.hhs.gov/dab/divisions/medicareoperations/macdecisions/oconnorhospital.pdf. Accessed August 9, 2016.

14. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Frequently asked questions: 2 midnight inpatient admission guidance & patient status reviews for admissions on or after October 1, 2013. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medical-Review/Downloads/QAsforWebsitePosting_110413-v2-CLEAN.pdf. Accessed August 9, 2016.

1. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Fact sheet: 2-midnight rule. https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2015-Fact-sheets-items/2015-07-01-2.html. Published July 1, 2015. Accessed August 9, 2016.

2. Sheehy AM, Locke C, Engel JZ, et al. Recovery Audit Contractor audits and appeals at three academic medical centers. J Hosp Med. 2015;10(4):212-219. PubMed

3. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery auditing in Medicare for fiscal year 2014. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/RAC-RTC-FY2014.pdf. Accessed August 9, 2016.

4. American Hospital Association vs Burwell. No 15-5015. Circuit court decision. https://www.cadc.uscourts.gov/internet/opinions.nsf/CDFE9734F0D36C2185257F540052A39D/$file/15-5015-1597907.pdf. Decided February 9, 2016. Accessed August 9, 2016

5. AMA news: Payment recovery audit program needs overhaul: Doctors to CMS. https://wire.ama-assn.org/ama-news/payment-recovery-audit-program-needs-overhaul-doctors-cms. Accessed March 17, 2017.

6. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital services covered under Part A. In: Medicare Benefit Policy Manual. Chapter 1. Publication 100-02. https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/bp102c01.pdf. Accessed August 9, 2016.

7. Griswold NJ; Office of Medicare Hearings and Appeals, US Dept of Health and Human Services. Memorandum to OMHA Medicare appellants. http://www.modernhealthcare.com/assets/pdf/CH92573110.pdf. Accessed August 9, 2016.

8. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Inpatient hospital reviews. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Medical-Review/InpatientHospitalReviews.html. Accessed August 9, 2016.

9. Galewitz P. CMS identifies hospitals paid nearly $1.5B in 2015 Medicare billing settlement. Kaiser Health News. http://khn.org/news/cms-identifies-hospitals-paid-nearly-1-5b-in-2015-medicare-billing-settlement/. Published August 23, 2016. Accessed October 14, 2016.

10. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Recovery audit program improvements. https://www.cms.gov/research-statistics-data-and-systems/monitoring-programs/medicare-ffs-compliance-programs/recovery-audit-program/downloads/RAC-program-improvements.pdf. Accessed August 9, 2016.

11. US Government Accountability Office. Medicare Fee-for-Service: Opportunities Remain to Improve Appeals Process. http://www.gao.gov/assets/680/677034.pdf. Publication GAO-16-366. Published May 10, 2016. Accessed August 9, 2016.

12. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Changes to the Medicare Claims and Entitlement, Medicare Advantage Organization Determination, and Medicare Prescription Drug Coverage Determination Appeals Procedures. https://www.gpo.gov/fdsys/pkg/FR-2016-07-05/pdf/2016-15192.pdf. Accessed August 9, 2016.

13. Departmental Appeals Board, US Dept of Health and Human Services. Action and Order of Medicare Appeals Council: in the case of O’Connor Hospital. http://www.hhs.gov/dab/divisions/medicareoperations/macdecisions/oconnorhospital.pdf. Accessed August 9, 2016.

14. Centers for Medicare & Medicaid Services, US Dept of Health and Human Services. Frequently asked questions: 2 midnight inpatient admission guidance & patient status reviews for admissions on or after October 1, 2013. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medical-Review/Downloads/QAsforWebsitePosting_110413-v2-CLEAN.pdf. Accessed August 9, 2016.

© 2017 Society of Hospital Medicine

Observation, Visit Status, and RAC Audits

Medicare patients are increasingly hospitalized as outpatients under observation. From 2006 to 2012, outpatient services grew nationally by 28.5%, whereas inpatient discharges decreased by 12.6% per Medicare beneficiary.[1] This increased use of observation stays for hospitalized Medicare beneficiaries and the recent Centers for Medicare & Medicaid Services (CMS) 2‐Midnight rule for determination of visit status are increasing areas of concern for hospitals, policymakers, and the public,[2] as patients hospitalized under observation are not covered by Medicare Part A hospital insurance, are subject to uncapped out‐of‐pocket charges under Medicare Part B, and may be billed by the hospital for certain medications. Additionally, Medicare beneficiaries hospitalized in outpatient status, which includes all hospitalizations under observation, do not qualify for skilled nursing facility care benefits after discharge, which requires a stay that spans at least 3 consecutive midnights as an inpatient.[3]

In contrast, the federal Recovery Audit program, previously called and still commonly referred to as the Recovery Audit Contractor (RAC) program, responsible for postpayment review of inpatient claims, has received relatively little attention. Established in 2006, and fully operationalized in federal fiscal year (FY) 2010,[4] RACs are private government contractors granted the authority to audit hospital charts for appropriate medical necessity, which can consider whether the care delivered was indicated and whether it was delivered in the appropriate Medicare visit status, outpatient or inpatient. Criteria for hospitalization status (inpatient vs outpatient) as defined in the Medicare Conditions of Participation, often allow for subjectivity (medical judgment) in determining which status is appropriate.[5] Hospitals may contest RAC decisions and payment denials through a preappeals discussion period, then through a 5‐level appeals process. Although early appeals occur between the hospital and private contractors, appeals reaching level 3 are heard by the Department of Health and Human Services (HHS) Office of Medicare Hearings and Appeals (OMHA) Administrative Law Judges (ALJ). Levels 4 (Medicare Appeals Council) and 5 (United States District Court) appeals are also handled by the federal government.[6]

Medicare fraud and abuse should not be tolerated, and systematic surveillance needs to be an integral part of the Medicare program.[4] However, there are increasing concerns that the RAC program has resulted in overaggressive denials.[7, 8] Unlike other Medicare contractors, RAC auditors are paid a contingency fee based on the percentage of hospital payment recouped for cases they audit and deny for improper payment.[4] RACs are not subject to any financial penalty for cases they deny but are overturned in the discussion period or in the appeals process. This may create an incentive system that financially encourages RACs to assert improper payment, and the current system lacks both transparency and clear performance metrics for auditors. Of particular concern are Medicare Part A complex reviews, the most fiscally impactful area of RAC activity. According to CMS FY 2013 data, 41.1% of all claims with collections were complex reviews, yet these claims accounted for almost all (95.2%) of total dollars recovered by the RACs, with almost all (96%) dollars recovered being from Part A claims.[9] Complex reviews involve an auditor retrospectively and manually reviewing a medical record and then using his or her clinical and related professional judgment to decide whether the care was medically necessary. This is compared to automated coding or billing reviews, which are based solely on claims data.

Increased RAC activity and the willingness of hospitals to challenge RAC findings of improper payment has led to an increase in appeals volume that has overloaded the appeals process. On March 13, 2013, CMS offered hospitals the ability to rebill Medicare Part B as an appeals alternative.[10] This did not temper level 3 appeals requests received by the OMHA, which increased from 1250 per week in January 2012 to over 15,000 per week by November 2013.[11] Citing an overwhelmingly increased rate of appeal submissions and the resultant backlog, the OMHA decided to freeze new hospital appeals assignments in December 2013.[11] In another attempt to clear the backlog, on August 29, 2014, CMS offered a settlement that would pay hospitals 68% of the net allowable amount of the original Part A claim (minus any beneficiary deductibles) if a hospital agreed to concede all of its eligible appeals.[12] Notably, cases settled under this agreement would remain officially categorized as denied for improper payment.

The HHS Office of Inspector General (OIG)[4] and the CMS[9, 13, 14] have produced recent reports of RAC auditing and appeals activity that contain variable numbers that conflict with hospital accounts of auditing and appeals activity.[15, 16] In addition to these conflicting reports, little is known about RAC auditing of individual programs over time, the length of time cases spend in appeals, and staff required to navigate the audit and appeals processes. Given these questions, and the importance of RAC auditing pressure in the growth of hospital observation care, we conducted a retrospective descriptive study of all RAC activity for complex Medicare Part A alleged overpayment determinations at the Johns Hopkins Hospital, the University of Utah, and University of Wisconsin Hospital and Clinics for calendar years 2010 to 2013.

METHODS

The University of Wisconsin‐Madison Health Sciences institutional review board (IRB) and the Johns Hopkins Hospital IRB did not require review of this study. The University of Utah received an exemption. All 3 hospitals are tertiary care academic medical centers. The University of Wisconsin Hospital and Clinics (UWHC) is a 592‐bed hospital located in Madison, Wisconsin,[17] the Johns Hopkins Hospital (JHH) is a 1145‐bed medical center located in Baltimore, Maryland,[18] and the University of Utah Hospital (UU) is a 770‐bed facility in Salt Lake City, Utah (information available upon request). Each hospital is under a different RAC, representing 3 of the 4 RAC regions, and each is under a different Medicare Administrative Contractor, contractors responsible for level 1 appeals. The 3 hospitals have the same Qualified Independent Contractor responsible for level 2 appeals.

For the purposes of this study, any chart or medical record requested for review by an RAC was considered a medical necessity chart request or an audit. The terms overpayment determinations and denials were used interchangeably to describe audits the RACs alleged did not meet medical necessity for Medicare Part A billing. As previously described, the term medical necessity specifically considered not only whether actual medical services were appropriate, but also whether the services were delivered in the appropriate status, outpatient or inpatient. Appeals and/or request for discussion were cases where the overpayment determination was disputed and challenged by the hospital.

All complex review Medicare Part A RAC medical record requests by date of RAC request from the official start of the RAC program, January 1, 2010,[4] to December 31, 2013, were included in this study. Medical record requests for automated reviews that related to coding and billing clarifications were not included in this study, nor were complex Medicare Part B reviews, complex reviews for inpatient rehabilitation facilities, or psychiatric day hospitalizations. Notably, JHH is a Periodic Interim Payment (PIP) Medicare hospital, which is a reimbursement mechanism where biweekly payments [are] made to a Provider enrolled in the PIP program, and are based on the hospital's estimate of applicable Medicare reimbursement for the current cost report period.[19] Because PIP payments are made collectively to the hospital based on historical data, adjustments for individual inpatients could not be easily adjudicated and processed. Due to the increased complexity of this reimbursement mechanism, RAC audits did not begin at JHH until 2012. In addition, in contrast to the other 2 institutions, all of the RAC complex review audits at JHH in 2013 were for Part B cases, such as disputing need for intensity‐modulated radiation therapy versus conventional radiation therapy, or contesting the medical necessity of blepharoplasty. As a result, JHH had complex Part A review audits only for 2012 during the study time period. All data were deidentified prior to review by investigators.

As RACs can audit charts for up to 3 years after the bill is submitted,[13] a chart request in 2013 may represent a 2010 hospitalization, but for purposes of this study, was logged as a 2013 case. There currently is no standard methodology to calculate time spent in appeals. The UWHC and JHH calculate time in discussion or appeals from the day the discussion or appeal was initiated by the hospital, and the UU calculates the time in appeals from the date of the findings letter from the RAC, which makes comparable recorded time in appeals longer at UU (estimated 510 days for 20112013 cases, up to 120 days for 2010 cases).Time in appeals includes all cases that remain in the discussion or appeals process as of June 30, 2014.

The RAC process is as follows (Tables 1 and 2):

- The RAC requests hospital claims (RAC Medical Necessity Chart Requests [Audits]).

- The RAC either concludes the hospital claim was compliant as filed/paid and the process ends or the RAC asserts improper payment and requests repayment (RAC Overpayment Determinations of Requested Charts [Denials]).

- The hospital makes an initial decision to not contest the RAC decision (and repay), or to dispute the decision (Hospital Disputes Overpayment Determination [Appeal/Discussion]). Prior to filing an appeal, the hospital may request a discussion of the case with an RAC medical director, during which the RAC medical director can overturn the original determination. If the RAC declines to overturn the decision in discussion, the hospital may proceed with a formal appeal. Although CMS does not calculate the discussion period as part of the appeals process,[12] overpayment determinations contested by the hospital in either discussion or appeal represent the sum total of RAC denials disputed by the hospital.

Contested cases have 1 of 4 outcomes:

Contested overpayment determinations can be decided in favor of the hospital (Discussion or Appeal Decided in Favor of Hospital or RAC Withdrew)

- Contested overpayment determinations can be decided in favor of the RAC during the appeal process, and either the hospital exhausts the appeal process or elects not to take the appeal to the next level. Although the appeals process has 5 levels, no cases at our 3 hospitals have reached level 4 or 5, so cases without a decision to date remain in appeals at 1 of the first 3 levels (Case Still in Discussion or Appeals).[4]

- Hospital may miss an appeal deadline (Hospital Missed Appeal Deadline at Any Level) and the case is automatically decided in favor of the RAC.

- As of March 13, 2013,[10] for appeals that meet certain criteria and involve dispute over the billing of hospital services under Part A, CMS allowed hospitals to withdraw an appeal and rebill Medicare Part B. Prior to this time, hospitals could rebill for a very limited list of ancillary Part B Only services, and only within the 1‐year timely filing period.[13] Due to the lengthy appeals process and associated legal and administrative costs, hospitals may not agree with the RAC determination but make a business decision to recoup some payment under this mechanism (Hospital Chose to Rebill as Part B During Discussion or Appeals Process).

| Totals | Johns Hopkins Hospital | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | All Years | 2010 | 2011 | 2012 | 2013 | All Years | ||

| University of Wisconsin Hospital and Clinics | University of Utah | ||||||||||

| 2010 | 2011 | 2012 | 2013 | All Years | 2010 | 2011 | 2012 | 2013 | All Years | ||

| |||||||||||

| Total no. of Medicare encounters | 24,400 | 24,998 | 25,370 | 27,094 | 101,862 | 11,212b | 11,750b | 11,842 | 12,674c | 47,478 | |

| RAC Medical Necessity Chart Requests (Audits) | 547 | 1,735 | 3,887 | 1,941 | 8,110 (8.0%) | 0 | 0 | 938 | 0 | 938 (2.0%) | |

| RAC Overpayment Determinations Of Requested Charts (Denials)d | 164 (30.0%) | 516 (29.7%) | 1,200 (30.9%) | 656 (33.8%) | 2,536 (31.3%) | 0 (0%) | 0 (0%) | 432 (46.1%) | 0 (0%) | 432 (46.1%) | |

| Hospital Disputes Overpayment Determination (Appeal/Discussion) | 128 (78.0%) | 409 (79.3%) | 1,129 (94.1%) | 643 (98.0%) | 2,309 (91.0% | 0 (0%) | 0 (0%) | 431 (99.8%) | 0 (0%) | 431 (99.8%) | |

| Outcome of Disputed Overpayment Determinatione | |||||||||||

| Hospital Missed Appeal Deadline at Any Level | 0 (0.0%) | 1 (0.2%) | 13 (1.2%) | 4 (0.6%) | 18 (0.8%) | 0 (0%) | 0 (0%) | 0 (0.0%) | 0 (0%) | 0 (0.0%) | |

| Hospital Chose To Rebill as Part B During Discussion Or Appeals Process | 80 (62.5%) | 202 (49.4%) | 511 (45.3%) | 158 (24.6%) | 951 (41.2%) | 0 (0%) | 0 (0%) | 208 (48.3%) | 0 (0%) | 208 (48.3%) | |

| Discussion or Appeal Decided In Favor Of Hospital or RAC Withdrewf | 45 (35.2%) | 127 (31.1%) | 449 (39.8%) | 345 (53.7%) | 966 (41.8%) | 0 (0%) | 0 (0%) | 151 (35.0%) | 0 (0%) | 151 (35.0%) | |

| Case Still in Discussion or Appeals | 3 (2.3%) | 79 (19.3%) | 156 13.8%) | 136 (21.2%) | 374 (16.2%) | 0 (0%) | 0 (0%) | 72 (16.7%) | 0 (0%) | 72 (16.7%) | |

| Mean Time for Cases Still in Discussion or Appeals, d (SD) | 1208 (41) | 958 (79) | 518 (125) | 350 (101) | 555 (255) | N/A | N/A | 478 (164) | N/A | 478 (164) | |

| Total no. of Medicare encounters l | 8,096 | 8,038 | 8,429 | 9,086 | 33,649 | 5,092 | 5,210 | 5,099 | 5,334 | 20,735 | |

| RAC Medical Necessity Chart Requests (Audits) | 15 | 526 | 1,484 | 960 | 2,985 (8.9%) | 532 | 1,209 | 1,465 | 981 | 4,187 (20.2%) | |

| RAC Overpayment Determinations of Requested Charts (Denials)bd | 3 (20.0%) | 147 (27.9%) | 240 (16.2%) | 164 (17.1%) | 554 (18.6%) | 161 (30.3%) | 369 (30.5%) | 528 (36.0%) | 492 (50.2%) | 1,550 (37.0%) | |

| Hospital Disputes Overpayment Determination (Appeal/Discussion) | 1 (33.3%) | 71 (48.3%) | 170 (70.8%) | 151 (92.1%) | 393 (70.9%) | 127 (78.9%) | 338 (91.6%) | 528 (100.0%) | 492 (100.0%) | 1,485 (95.8%) | |

| Outcome of Disputed Overpayment Determinatione | |||||||||||

| Hospital Missed Appeal Deadline at Any Level | 0 (0.0%) | 1 (1.4%) | 0 (0.0%) | 4 (2.6%) | 5 (1.3%) | 0 (0.0%) | 0 (0.0%) | 13 (2.5%) | 0 (0.0%) | 13 (0.9%) | |

| Hospital Chose to Rebill as Part B During Discussion or Appeals Process | 1 (100%) | 3 (4.2%) | 13 (7.6%) | 3 (2.0%) | 20 (5.1%) | 79 (62.2%) | 199 (58.9%) | 290 (54.9%) | 155 (31.5%) | 723 (48.7%) | |

| Discussion or Appeal Decided in Favor of Hospital or RAC Withdrewf | 0 (0.0%) | 44 (62.0%) | 123 (72.4%) | 93 (61.6%) | 260 (66.2%) | 45 (35.4%) | 83 (24.6%) | 175 (33.1%) | 252 (51.2%) | 555 (37.4%) | |

| Case Still in Discussion or Appeals | 0 0.0% | 23 (32.4%) | 34 (20.0%) | 51 (33.8%) | 108 (27.5%) | 3 (2.4%) | 56 (16.6%) | 50 (9.5%) | 85 (17.3%) | 194 (13.1%) | |

| Mean Time for Cases Still in Discussion or Appeals, d (SD) | N/A | 926 (70) | 564 (90) | 323 (134) | 528 (258) | 1,208 (41) | 970 (80) | 544 (25) | 365 (72) | 599 (273) | |

| 2010 | 2011 | 2012 | 2013 | All | 2010 | 2011 | 2012 | 2013 | All | |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Appeals With Decisions | Johns Hopkins Hospital | |||||||||

| Total no. | 125 | 330 | 973 | 507 | 1,935 | 0 | 0 | 359 | 0 | 359 |

| ||||||||||

| Hospital Missed Appeal Deadline at Any Level | 0 (0.0%) | 1 (0.3%) | 13 (1.3%) | 4 (0.8%) | 18 (0.9%) | 0 (0.0%) | 0 (0.0%) | 0 (0.0%) | 0 (0.0%) | 0 (0.0%) |

| Hospital Chose to Rebill as Part B During Discussion or Appeals Process | 80 (64.0%) | 202 (61.2%) | 511 (52.5%) | 158 (31.2%) | 951 (49.1%) | 0 (0.0%) | 0 (0.0%) | 208 (57.9%) | 0 (0.0%) | 208 (57.9%) |

| Discussion or Appeal Decided in Favor of Hospital or RAC Withdrew | 45 (36.0%) | 127 (38.5%) | 449 (46.1%) | 345 (68.0%) | 966 (49.9%) | 0 (0.0%) | 0 (0.0%) | 151 (42.1%) | 0 (0.0%) | 151 (42.1%) |

| Discussion Period and RAC Withdrawals | 0 (0.0%) | 59 (17.9%) | 351 (36.1%) | 235 (46.4%) | 645 (33.3%) | 0 (0.0%) | 0 (0.0%) | 139 (38.7%) | 0 (0.0%) | 139 (38.7%) |

| Level 1 Appeal | 10 (8.0%) | 22 (6.7%) | 60 (6.2%) | 62 (12.2%)1 | 154 (8.0%) | 0 (0.0%) | 0 (0.0%) | 2 (0.6%) | 0 (0.0%) | 2 (0.6%) |

| Level 2 Appeal | 22 (17.6%) | 36 (10.9%) | 38 (3.9%) | 48 (9.5%)1 | 144 (7.4%) | 0 (0.0%) | 0 (0.0%) | 10 (2.8%) | 0 (0.0%) | 10 (2.8%) |

| Level 3 Appealc | 13 (10.4%) | 10 (3.0%) | N/A (N/A) | N/A (N/A) | 23 (1.2%) | 0 (0.0%) | 0 (0.0%) | N/A (N/A) | 0 (0.0%) | 0 (0.0%) |

| 2010 | 2011 | 2012 | 2013 | All | 2010 | 2011 | 2012 | 2013 | All | |

| University of Wisconsin Hospital and Clinics | University of Utah | |||||||||

| Total no. | 1 | 48 | 136 | 100 | 285 | 124 | 282 | 478 | 407 | 1,291 |

| Hospital Missed Appeal Deadline at Any Level | 0 (0.0%) | 1 (2.1% | 0 (0.0%) | 4 (4.0%) | 5 (1.8%) | 0 (0.0%) | 0 (0.0%) | 13 (2.7%) | 0 (0.0%) | 13 (1.0%) |

| Hospital Chose to Rebill as Part B During Discussion or Appeals Process | 1 (100.0%) | 3 (6.3% | 13 (9.6%) | 3 (3.0%) | 20 (7.0%) | 79 (63.7%) | 199 (70.6%) | 290 (60.7%) | 155 (38.1%) | 723 (56.0%) |

| Discussion or Appeal Decided in Favor of Hospital or RAC Withdrewb | 0 (0.0%) | 44 (91.7%) | 123 (90.4%) | 93 (93.0%) | 260 (91.2%) | 45 (36.3%) | 83 (29.4%) | 175 (36.6%) | 252 (61.9%) | 555 (43.0%) |

| Discussion Period and RAC Withdrawals | 0 (0.0%) | 38 (79.2%) | 66 (48.5%) | 44 (44.0%) | 148 (51.9% | 0 (0.0%) | 21 (7.4%) | 146 (30.5%) | 191 (46.9%) | 358 (27.7%) |

| Level 1 Appeal | 0 (0.0%) | 2 (4.2%) | 47 (34.6%) | 34 (34.0%) | 83 (29.1%) | 10 (8.1%) | 20 (7.1%) | 11 (2.3%) | 28 (6.9%) | 69 (5.3%) |

| Level 2 Appeal | 0 (0.0%) | 4 (8.3%) | 10 (7.4%) | 15 (15.0%) | 29 (10.2%) | 22 (17.7%) | 32 (11.3%) | 18 (3.8%) | 33 (8.1%) | 105 (8.1%) |

| Level 3 Appealc | 0 (0.0%) | N/A (N/A) | N/A (N/A) | N/A (N/A) | 0 (0.0%) | 13 (10.5%) | 10 (3.5%) | N/A (N/A) | N/A(N/A) | 23 (1.8%) |

The administration at each hospital provided labor estimates for workforce dedicated to the review process generated by the RACs based on hourly accounting of one‐quarter of work during 2012, updated to FY 2014 accounting (Table 3). Concurrent case management status determination work was not included in these numbers due to the difficulty in solely attributing concurrent review workforce numbers to the RACs, as concurrent case management is a CMS Condition of Participation irrespective of the RAC program.

| JHH | UWHC | UU | Mean | |

|---|---|---|---|---|

| ||||

| Physicians: assist with status determinations, audits, and appeals | 1.0 | 0.5 | 0.6 | 0.7 |

| Nursing administration: audit and appeal preparation | 0.9 | 0.2 | 1.9 | 1.0 |

| Legal counsel: assist with rules interpretation, audit, and appeal preparation | 0.2 | 0.3 | 0.1 | 0.2 |

| Data analyst: prepare and track reports of audit and appeals | 2.0 | 1.8 | 2.4 | 2.0 |

| Administration and other directors | 2.3 | 0.9 | 0.3 | 1.2 |

| Total FTE workforce | 6.4 | 3.7 | 5.3 | 5.1 |

Statistics

Descriptive statistics were used to describe the data. Staffing numbers are expressed as full‐time equivalents (FTE).

RESULTS

Yearly Medicare Encounters and RAC Activity of Part A Complex Reviews

RACs audited 8.0% (8110/101,862) of inpatient Medicare cases, alleged noncompliance (all overpayments) for 31.3% (2536/8110) of Part A complex review cases requested, and the hospitals disputed 91.0% (2309/2536) of these assertions. None of these cases of alleged noncompliance claimed the actual medical services were unnecessary. Rather, every Part A complex review overpayment determination by all 3 RACs contested medical necessity related to outpatient versus inpatient status. In 2010 and 2011, there were in aggregate fewer audits (2282), overpayment determinations (680), and appeals or discussion requests (537 of 680, 79.0%), compared to audits (5828), overpayment determinations (1856), and appeals or discussion requests (1772 of 1856, 95.5%) in 2012 and 2013. The hospitals appealed or requested discussion of a greater percentage each successive year (2010, 78.0%; 2011, 79.3%; 2012, 94.1%; and 2013, 98.0%). This increased RAC activity, and hospital willingness to dispute the RAC overpayment determinations equaled a more than 300% increase in appeals and discussion request volume related to Part A complex review audits in just 2 years.

The 16.2% (374/2309) of disputed cases still under discussion or appeal have spent an average mean of 555 days (standard deviation 255 days) without a decision, with time in appeals exceeding 900 days for cases from 2010 and 2011. Notably, the 3 programs were subject to Part A complex review audits at widely different rates (Table 1).

Yearly RAC Part A Complex Review Overpayment Determinations Disputed by Hospitals With Decisions

The hospitals won, either in discussion or appeal, a combined greater percentage of contested overpayment determinations annually, from 36.0% (45/125) in 2010, to 38.5% (127/330) in 2011, to 46.1% (449/973) in 2012, to 68.0% (345/507) in 2013. Overall, for 49.1% (951/1935) of cases with decisions, the hospitals withdrew or rebilled under Part B at some point in the discussion or appeals process to avoid the lengthy appeals process and/or loss of the amount of the entire claim. A total of 49.9% (966/1935) of appeals with decisions have been won in discussion or appeal over the 4‐year study period. One‐third of all resolved cases (33.3%, 645/1935) were decided in favor of the hospital in the discussion period, with these discussion cases accounting for two‐thirds (66.8%, 645/966) of all favorable resolved cases for the hospital. Importantly, if cases overturned in discussion were omitted as they are in federal reports, the hospitals' success rate would fall to 16.6% (321/1935), a number similar to those that appear in annual CMS reports.[9, 13, 14] The hospitals also conceded 18 cases (0.9%) by missing a filing deadline (Table 2).

Estimated Workforce Dedicated to Part A Complex Review Medical Necessity Audits and Appeals

The institutions each employ an average of 5.1 FTE staff to manage the audit and appeal process, a number that does not include concurrent case management staff who assist in daily status determinations (Table 3).

CONCLUSIONS

In this study of 3 academic medical centers, there was a more than 2‐fold increase in RAC audits and a nearly 3‐fold rise in overpayment determinations over the last 2 calendar years of the study, resulting in a more than 3‐fold increase in appeals or requests for discussion in 2012 to 2013 compared to 2010 to 2011. In addition, although CMS manually reviews less than 0.3% of submitted claims each year through programs such as the Recovery Audit Program,[9] at the study hospitals, complex Part A RAC audits occurred at a rate more than 25 times that (8.0%), suggesting that these types of claims are a disproportionate focus of auditing activity. The high overall complex Part A audit rate, accompanied by acceleration of RAC activity and the hospitals' increased willingness to dispute RAC overpayment determinations each year, if representative of similar institutions, would explain the appeals backlog, most notably at the ALJ (level 3) level. Importantly, none of these Part A complex review denials contested a need for the medical care delivered, demonstrating that much of the RAC process at the hospitals focused exclusively on the nuances of medical necessity and variation in interpretation of CMS guidelines that related to whether hospital care should be provided under inpatient or outpatient status.

These data also show continued aggressive RAC audit activity despite an increasing overturn rate in favor of the hospitals in discussion or on appeal each year (from 36.0% in 2010 to 68.0% in 2013). The majority of the hospitals' successful decisions occurred in the discussion period, when the hospital had the opportunity to review the denial with the RAC medical director, a physician, prior to beginning the official appeals process. The 33% overturn rate found in the discussion period represents an error rate by the initial RAC auditors that was internally verified by the RAC medical director. The RAC internal error rate was replicated at 3 different RACs, highlighting internal process problems across the RAC system. This is concerning, because the discussion period is not considered part of the formal appeals process, so these cases are not appearing in CMS or OIG reports of RAC activity, leading to an underestimation of the true successful overturned denial rates at the 3 study hospitals, and likely many other hospitals.

The study hospitals are also being denied timely due process and payments for services delivered. The hospitals currently face an appeals process that, on average, far exceeds 500 days. In almost half of the contested overpayment determinations, the hospitals withdrew a case or rebilled Part B, not due to agreement with a RAC determination, but to avoid the lengthy, cumbersome, and expensive appeals process and/or to minimize the risk of losing the amount of the entire Part A claim. This is concerning, as cases withdrawn in the appeals process are considered improper payments in federal reports, despite a large number of these cases being withdrawn simply to avoid an inefficient appeals process. Notably, Medicare is not adhering to its own rules, which require appeals to be heard in a timely manner, specifically 60 days for level 1 or 2 appeals, and 90 days for a level 3 appeal,[6, 20] even though the hospitals lost the ability to appeal cases when they missed a deadline. Even if hospitals agreed to the recent 68% settlement offer[12] from CMS, appeals may reaccumulate without auditing reform. As noted earlier, this recent settlement offer came more than a year after the enhanced ability to rebill denied Part A claims for Part B, yet the backlog remains.

This study also showed that a large hospital workforce is required to manage the lengthy audit and appeals process generated by RACs. These staff are paid with funds that could be used to provide direct patient care or internal process improvement. The federal government also directly pays for unchecked RAC activity through the complex appeals process. Any report of dollars that RACs recoup for the federal government should be considered in light of their administrative costs to hospitals and government contractors, and direct costs at the federal level.