TALKIN’ ’BOUT YOUR (REVENUE) GENERATION

To know how much you can negotiate for your salary and benefits—your total compensation package (of which benefits is often about 30%)—it is critical to know how much revenue you can generate for your employer.4 How can you figure this out?

If you are already working, you can ask your practice manager for some data. In some practices, this information is readily shared, perhaps as a means to boost productivity and even allow comparison between employees. If your practice manager is not forthcoming, you can collect the relevant information yourself. It may be challenging, but it is vital information to have. You need to know how many patients you see per day (keep a log for a month), what their payment source is (specific insurer or self-pay), and what the reimbursement rates are. Although reimbursement rates are deemed confidential per your insurance contract and therefore can’t be shared, you can find Medicare and Medicaid rates online. You can also call the provider representative from each insurer and ask for your reimbursement rates for your five or so most commonly used codes.

Another consideration is payment received (ie, not just what you charge). Do all patients pay everything they owe? Not always. Understand the difference between what you bill, what is allowed, and what you collect. The percentage of what is not collected is called the uncollectable rate. Factor that in.

Furthermore, how much do you contribute to the organization by testing? Dana works for a primary care clinic within a hospital system. Let’s assume her practice doesn’t offer colonoscopies or mammograms; how many referrals does she make to the hospital system for these tests? While she may not know the hospital’s profit margin on them, she can figure out how many she orders in a year. And what about the PA who works for a surgeon? Does he or she do the post-surgical checks? How much time does that save the surgeon, who can be providing higher revenue–producing services with the time saved? That contributes to the income of the practice, too! These are points you can make to justify your salary.

MIX IT UP

There is another major consideration for computing your financial contribution to the practice: understanding case mix. Let’s say your most common visit is billed as a 99213 and you charge $100 for this visit. You use this code 50 times in a week. Do you collect $100 x 50 or $5,000 per week? If you have a direct-pay practice and you collect all of it, yes, you will. If your practice accepts insurance, the number of patients you see with different insurers is called your case mix.

Let’s look at the impact of case mix on what you generate. Remember, it will take you about the same amount of time and effort to see these patients regardless of their insurer. Ask your practice manager what your case mix is. If he/she is not willing to share this information, you can get an estimate by looking at the demographics of your patient community. How many are older than 65? How many are on public assistance? Community needs assessments will provide you with this data; you can also check the patient’s chart or ask what insurance they have and add this to your log.

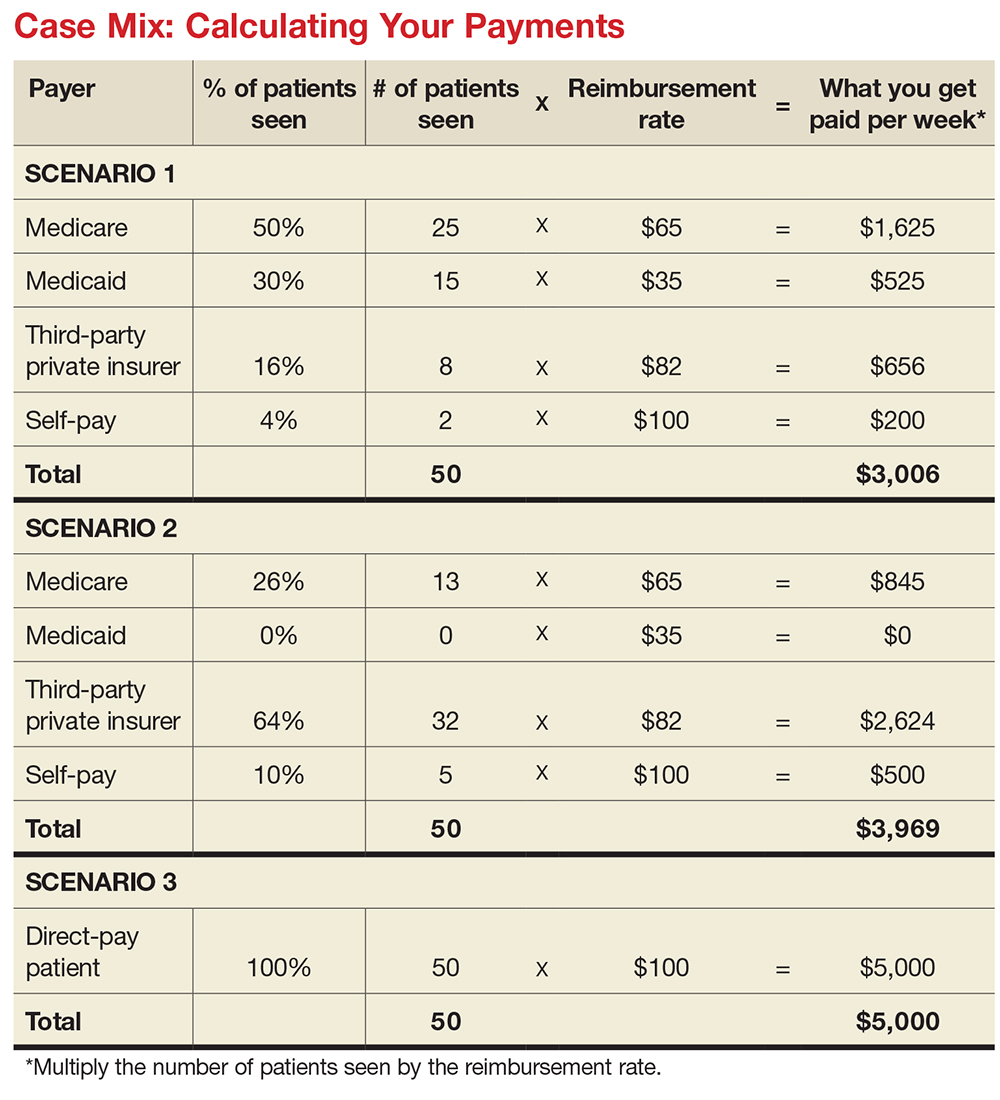

How much will you generate by seeing 50 patients in a week for a 99213 for which you charge $100? Let’s start with sample (not actual) base rates to illustrate the concept: $65 for Medicare, $35 for Medicaid, $82 for third-party private insurance, and $100 for self-pay.

Now let’s explore how case mix impacts revenue, with three different scenarios (see charts). In Scenario 1, 50% of your patients have Medicare, 30% have Medicaid, 16% have third-party private insurance, and 4% pay cash (self-pay). In Scenario 2, 26% have Medicare, 0% have Medicaid, 64% have private insurance, and 10% self-pay. In Scenario 3, your practice is a direct-pay practice with 100% self-payers and a 0% uncollectable rate.

In Scenario 1, with a case mix of 80% of your patient payments from Medicare or Medicaid, you generate $3,006 per week. If you see patients 48 weeks per year, you generate $144,288. In Scenario 2, with a case mix of 74% of your patient payments from private insurance, you generate $3,969 per week. In a year, you generate $190,512. And in Scenario 3, with 100% direct-pay patients, you generate $5,000 per week or $240,000 per year.

This example illustrates how case mix influences health care business, based on the current US reimbursement system. If you work for a practice that serves mostly Medicare and Medicaid patients, you do not command the same salary as an NP or PA who works for a direct-pay practice or one with a majority of privately insured patients.