User login

The best-selling drug Humira (adalimumab) now faces competition in the United States after a 20-year monopoly. The first adalimumab biosimilar, Amjevita, launched in the United States on January 31, and in July, seven additional biosimilars became available. These drugs have the potential to lower prescription drug prices, but when and by how much remains to be seen.

Here’s what you need to know about adalimumab biosimilars.

What Humira biosimilars are now available?

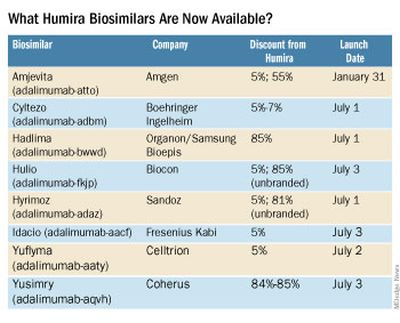

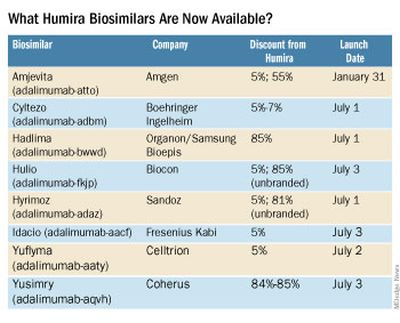

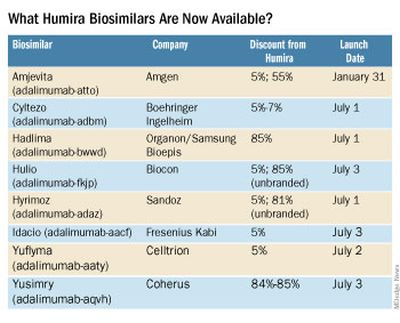

Eight different biosimilars have launched in 2023 with discounts as large at 85% from Humira’s list price of $6,922. A few companies also offer two price points.

Three of these biosimilars – Hadlima, Hyrimoz, and Yuflyma – are available in high concentration formulations. This high concentration formulation makes up 85% of Humira prescriptions, according to a report from Goodroot, a collection of companies focused on lowering health care costs.

Cyltezo is currently the only adalimumab biosimilar with an interchangeability designation, meaning that a pharmacist can substitute the biosimilar for an equivalent Humira prescription without the intervention of a clinician. A total of 47 states allow for these substitutions without prior approval from a clinician, according to Goodroot, and the clinician must be notified of the switch within a certain time frame. A total of 40 states require that patients be notified of the switch before substitution.

However, it’s not clear if this interchangeability designation will prove an advantage for Cyltezo, as it is interchangeable with the lower concentration version of Humira that makes up just 15% of prescriptions.

Most of the companies behind these biosimilars are pursuing interchangeability designations for their drugs, except for Fresenius Kabi (Idacio) and Coherus (Yusimry).

A ninth biosimilar, Pfizer’s adalimumab-afzb (Abrilada), is not yet on the market and is currently awaiting an approval decision from the Food and Drug Administration to add an interchangeability designation to its prior approval for a low-concentration formulation.

Why are they priced differently?

The two price points offer different deals to payers. Pharmacy benefit managers make confidential agreements with drug manufacturers to get a discount – called a rebate – to get the drug on the PBM’s formulary. The PBM keeps a portion of that rebate, and the rest is passed on to the insurance company and patients. Biosimilars at a higher price point will likely offer larger rebates. Biosimilars offered at lower price points incorporate this discount up front in their list pricing and likely will not offer large rebates.

Will biosimilars be covered by payers?

Currently, biosimilars are being offered on formularies at parity with Humira, meaning they are on the same tier. The PBM companies OptumRx and Cigna Group’s Express Scripts will offer Amjevita (at both price points), Cyltezo, and Hyrimoz (at both price points).

“This decision allows our clients flexibility to provide access to the lower list price, so members in high-deductible plans and benefit designs with coinsurance can experience lower out-of-pocket costs,” said OptumRx spokesperson Isaac Sorensen in an email.

Mark Cuban Cost Plus Drug Company, which uses a direct-to-consumer model, will offer Yusimry for $567.27 on its website. SmithRx, a PBM based in San Francisco, announced it would partner with Cost Plus Drugs to offer Yusimry, adding that SmithRx members can use their insurance benefits to further reduce out-of-pocket costs. RxPreferred, another PBM, will also offer Yusimry through its partnership with Cuban’s company.

The news website Formulary Watch previously reported that CVS Caremark, another of the biggest PBMs, will be offering Amjevita, but as a nonpreferred brand, while Humira remains the preferred brand. CVS Caremark did not respond to a request for comment.

Will patients pay less?

Biosimilars have been touted as a potential solution to lower spending on biologic drugs, but it’s unknown if patients will ultimately benefit with lower out-of-pocket costs. It’s “impossible to predict” if the discount that third-party payers pay will be passed on to consumers, said Mark Fendrick, MD, who directs the University of Michigan Center for Value-based Insurance Design in Ann Arbor.

Generally, a consumer’s copay is a percentage of a drug’s list price, so it stands to reason that a low drug price would result in lower out-of-pocket payments. While this is mostly true, Humira has a successful copay assistance program to lower prescription costs for consumers. According to a 2022 IQVIA report, 82% of commercial prescriptions cost patients less than $10 for Humira because of this program.

To appeal to patients, biosimilar companies will need to offer similar savings, Dr. Fendrick added. “There will be some discontent if patients are actually asked to pay more out-of-pocket for a less expensive drug,” he said.

All eight companies behind these biosimilars are offering or will be launching copay saving programs, many which advertise copays as low as $0 per month for eligible patients.

How will Humira respond?

Marta Wosińska, PhD, a health care economist at the Brookings Institute, Washington, predicts payers will use these lower biosimilar prices to negotiate better deals with AbbVie, Humira’s manufacturer. “We have a lot of players coming into [the market] right now, so the competition is really fierce,” she said. In response, AbbVie will need to increase rebates on Humira and/or lower its price to compete with these biosimilars.

“The ball is in AbbVie’s court,” she said. “If [the company] is not willing to drop price sufficiently, then payers will start switching to biosimilars.”

Dr. Fendrick reported past financial relationships and consulting arrangements with AbbVie, Amgen, Arnold Ventures, Bayer, CareFirst, BlueCross BlueShield, and many other companies. Dr. Wosińska has received funding from Arnold Ventures and serves as an expert witness on antitrust cases involving generic medication.

A version of this article first appeared on Medscape.com.

The best-selling drug Humira (adalimumab) now faces competition in the United States after a 20-year monopoly. The first adalimumab biosimilar, Amjevita, launched in the United States on January 31, and in July, seven additional biosimilars became available. These drugs have the potential to lower prescription drug prices, but when and by how much remains to be seen.

Here’s what you need to know about adalimumab biosimilars.

What Humira biosimilars are now available?

Eight different biosimilars have launched in 2023 with discounts as large at 85% from Humira’s list price of $6,922. A few companies also offer two price points.

Three of these biosimilars – Hadlima, Hyrimoz, and Yuflyma – are available in high concentration formulations. This high concentration formulation makes up 85% of Humira prescriptions, according to a report from Goodroot, a collection of companies focused on lowering health care costs.

Cyltezo is currently the only adalimumab biosimilar with an interchangeability designation, meaning that a pharmacist can substitute the biosimilar for an equivalent Humira prescription without the intervention of a clinician. A total of 47 states allow for these substitutions without prior approval from a clinician, according to Goodroot, and the clinician must be notified of the switch within a certain time frame. A total of 40 states require that patients be notified of the switch before substitution.

However, it’s not clear if this interchangeability designation will prove an advantage for Cyltezo, as it is interchangeable with the lower concentration version of Humira that makes up just 15% of prescriptions.

Most of the companies behind these biosimilars are pursuing interchangeability designations for their drugs, except for Fresenius Kabi (Idacio) and Coherus (Yusimry).

A ninth biosimilar, Pfizer’s adalimumab-afzb (Abrilada), is not yet on the market and is currently awaiting an approval decision from the Food and Drug Administration to add an interchangeability designation to its prior approval for a low-concentration formulation.

Why are they priced differently?

The two price points offer different deals to payers. Pharmacy benefit managers make confidential agreements with drug manufacturers to get a discount – called a rebate – to get the drug on the PBM’s formulary. The PBM keeps a portion of that rebate, and the rest is passed on to the insurance company and patients. Biosimilars at a higher price point will likely offer larger rebates. Biosimilars offered at lower price points incorporate this discount up front in their list pricing and likely will not offer large rebates.

Will biosimilars be covered by payers?

Currently, biosimilars are being offered on formularies at parity with Humira, meaning they are on the same tier. The PBM companies OptumRx and Cigna Group’s Express Scripts will offer Amjevita (at both price points), Cyltezo, and Hyrimoz (at both price points).

“This decision allows our clients flexibility to provide access to the lower list price, so members in high-deductible plans and benefit designs with coinsurance can experience lower out-of-pocket costs,” said OptumRx spokesperson Isaac Sorensen in an email.

Mark Cuban Cost Plus Drug Company, which uses a direct-to-consumer model, will offer Yusimry for $567.27 on its website. SmithRx, a PBM based in San Francisco, announced it would partner with Cost Plus Drugs to offer Yusimry, adding that SmithRx members can use their insurance benefits to further reduce out-of-pocket costs. RxPreferred, another PBM, will also offer Yusimry through its partnership with Cuban’s company.

The news website Formulary Watch previously reported that CVS Caremark, another of the biggest PBMs, will be offering Amjevita, but as a nonpreferred brand, while Humira remains the preferred brand. CVS Caremark did not respond to a request for comment.

Will patients pay less?

Biosimilars have been touted as a potential solution to lower spending on biologic drugs, but it’s unknown if patients will ultimately benefit with lower out-of-pocket costs. It’s “impossible to predict” if the discount that third-party payers pay will be passed on to consumers, said Mark Fendrick, MD, who directs the University of Michigan Center for Value-based Insurance Design in Ann Arbor.

Generally, a consumer’s copay is a percentage of a drug’s list price, so it stands to reason that a low drug price would result in lower out-of-pocket payments. While this is mostly true, Humira has a successful copay assistance program to lower prescription costs for consumers. According to a 2022 IQVIA report, 82% of commercial prescriptions cost patients less than $10 for Humira because of this program.

To appeal to patients, biosimilar companies will need to offer similar savings, Dr. Fendrick added. “There will be some discontent if patients are actually asked to pay more out-of-pocket for a less expensive drug,” he said.

All eight companies behind these biosimilars are offering or will be launching copay saving programs, many which advertise copays as low as $0 per month for eligible patients.

How will Humira respond?

Marta Wosińska, PhD, a health care economist at the Brookings Institute, Washington, predicts payers will use these lower biosimilar prices to negotiate better deals with AbbVie, Humira’s manufacturer. “We have a lot of players coming into [the market] right now, so the competition is really fierce,” she said. In response, AbbVie will need to increase rebates on Humira and/or lower its price to compete with these biosimilars.

“The ball is in AbbVie’s court,” she said. “If [the company] is not willing to drop price sufficiently, then payers will start switching to biosimilars.”

Dr. Fendrick reported past financial relationships and consulting arrangements with AbbVie, Amgen, Arnold Ventures, Bayer, CareFirst, BlueCross BlueShield, and many other companies. Dr. Wosińska has received funding from Arnold Ventures and serves as an expert witness on antitrust cases involving generic medication.

A version of this article first appeared on Medscape.com.

The best-selling drug Humira (adalimumab) now faces competition in the United States after a 20-year monopoly. The first adalimumab biosimilar, Amjevita, launched in the United States on January 31, and in July, seven additional biosimilars became available. These drugs have the potential to lower prescription drug prices, but when and by how much remains to be seen.

Here’s what you need to know about adalimumab biosimilars.

What Humira biosimilars are now available?

Eight different biosimilars have launched in 2023 with discounts as large at 85% from Humira’s list price of $6,922. A few companies also offer two price points.

Three of these biosimilars – Hadlima, Hyrimoz, and Yuflyma – are available in high concentration formulations. This high concentration formulation makes up 85% of Humira prescriptions, according to a report from Goodroot, a collection of companies focused on lowering health care costs.

Cyltezo is currently the only adalimumab biosimilar with an interchangeability designation, meaning that a pharmacist can substitute the biosimilar for an equivalent Humira prescription without the intervention of a clinician. A total of 47 states allow for these substitutions without prior approval from a clinician, according to Goodroot, and the clinician must be notified of the switch within a certain time frame. A total of 40 states require that patients be notified of the switch before substitution.

However, it’s not clear if this interchangeability designation will prove an advantage for Cyltezo, as it is interchangeable with the lower concentration version of Humira that makes up just 15% of prescriptions.

Most of the companies behind these biosimilars are pursuing interchangeability designations for their drugs, except for Fresenius Kabi (Idacio) and Coherus (Yusimry).

A ninth biosimilar, Pfizer’s adalimumab-afzb (Abrilada), is not yet on the market and is currently awaiting an approval decision from the Food and Drug Administration to add an interchangeability designation to its prior approval for a low-concentration formulation.

Why are they priced differently?

The two price points offer different deals to payers. Pharmacy benefit managers make confidential agreements with drug manufacturers to get a discount – called a rebate – to get the drug on the PBM’s formulary. The PBM keeps a portion of that rebate, and the rest is passed on to the insurance company and patients. Biosimilars at a higher price point will likely offer larger rebates. Biosimilars offered at lower price points incorporate this discount up front in their list pricing and likely will not offer large rebates.

Will biosimilars be covered by payers?

Currently, biosimilars are being offered on formularies at parity with Humira, meaning they are on the same tier. The PBM companies OptumRx and Cigna Group’s Express Scripts will offer Amjevita (at both price points), Cyltezo, and Hyrimoz (at both price points).

“This decision allows our clients flexibility to provide access to the lower list price, so members in high-deductible plans and benefit designs with coinsurance can experience lower out-of-pocket costs,” said OptumRx spokesperson Isaac Sorensen in an email.

Mark Cuban Cost Plus Drug Company, which uses a direct-to-consumer model, will offer Yusimry for $567.27 on its website. SmithRx, a PBM based in San Francisco, announced it would partner with Cost Plus Drugs to offer Yusimry, adding that SmithRx members can use their insurance benefits to further reduce out-of-pocket costs. RxPreferred, another PBM, will also offer Yusimry through its partnership with Cuban’s company.

The news website Formulary Watch previously reported that CVS Caremark, another of the biggest PBMs, will be offering Amjevita, but as a nonpreferred brand, while Humira remains the preferred brand. CVS Caremark did not respond to a request for comment.

Will patients pay less?

Biosimilars have been touted as a potential solution to lower spending on biologic drugs, but it’s unknown if patients will ultimately benefit with lower out-of-pocket costs. It’s “impossible to predict” if the discount that third-party payers pay will be passed on to consumers, said Mark Fendrick, MD, who directs the University of Michigan Center for Value-based Insurance Design in Ann Arbor.

Generally, a consumer’s copay is a percentage of a drug’s list price, so it stands to reason that a low drug price would result in lower out-of-pocket payments. While this is mostly true, Humira has a successful copay assistance program to lower prescription costs for consumers. According to a 2022 IQVIA report, 82% of commercial prescriptions cost patients less than $10 for Humira because of this program.

To appeal to patients, biosimilar companies will need to offer similar savings, Dr. Fendrick added. “There will be some discontent if patients are actually asked to pay more out-of-pocket for a less expensive drug,” he said.

All eight companies behind these biosimilars are offering or will be launching copay saving programs, many which advertise copays as low as $0 per month for eligible patients.

How will Humira respond?

Marta Wosińska, PhD, a health care economist at the Brookings Institute, Washington, predicts payers will use these lower biosimilar prices to negotiate better deals with AbbVie, Humira’s manufacturer. “We have a lot of players coming into [the market] right now, so the competition is really fierce,” she said. In response, AbbVie will need to increase rebates on Humira and/or lower its price to compete with these biosimilars.

“The ball is in AbbVie’s court,” she said. “If [the company] is not willing to drop price sufficiently, then payers will start switching to biosimilars.”

Dr. Fendrick reported past financial relationships and consulting arrangements with AbbVie, Amgen, Arnold Ventures, Bayer, CareFirst, BlueCross BlueShield, and many other companies. Dr. Wosińska has received funding from Arnold Ventures and serves as an expert witness on antitrust cases involving generic medication.

A version of this article first appeared on Medscape.com.