To the Editor:

Although biologics provide major therapeutic benefits for dermatologic conditions, they also come with a substantial cost, making them among the most expensive medications available. Medicare and Medicaid spending on biologics for dermatologic conditions increased by 320% from 2012 to 2018, reaching a staggering $10.6 billion in 2018 alone.1 Biosimilars show promise in reducing health care spending for dermatologic conditions; however, their utilization has been limited due to multiple factors, including delayed market entry from patent thickets, exclusionary formulary contracts, and prescriber skepticism regarding their safety and efficacy.2 For instance, a national survey of 1201 US physicians in specialties that are high prescribers of biologics reported that 55% doubted the safety and appropriateness of biosimilars.3

US Food and Drug Administration approval of biosimilars for adalimumab and etanercept offers the potential to reduce health care spending for dermatologic conditions. However, this cost reduction is dependent on utilization rates among dermatologists. In this national cross-sectional review of Medicare data, we predicted the impact of these biosimilars on dermatologic Medicare costs and demonstrated how differing utilization rates among dermatologists can influence potential savings.

To model 2023 utilization and cost reduction from biosimilars, we analyzed Medicare Part D data from 2020 on existing biosimilars, including granulocyte colony–stimulating factors, erythropoiesis-stimulating agents, and tumor necrosis factor α inhibitors.4 Methods in line with a 2021 report from the US Department of Health and Human Services5 as well as those of Yazdany et al6 were used. For each class, we calculated the 2020 distribution of biosimilar and originator drug claims as well as biosimilar cost reduction per 30-day claim. We utilized 2018-2021 annual growth rates for branded adalimumab and etanercept to estimate 30-day claims for 2023 and the cost of these branded agents in the absence of biosimilars. The hypothetical 2023 cost reduction from adalimumab and etanercept biosimilars was estimated by assuming 2020 biosimilar utilization rates and mean cost reduction per claim. This study utilized publicly available or aggregate summary data (not attributable to specific patients) and did not qualify as human subject research; therefore, institutional review board approval was not required.

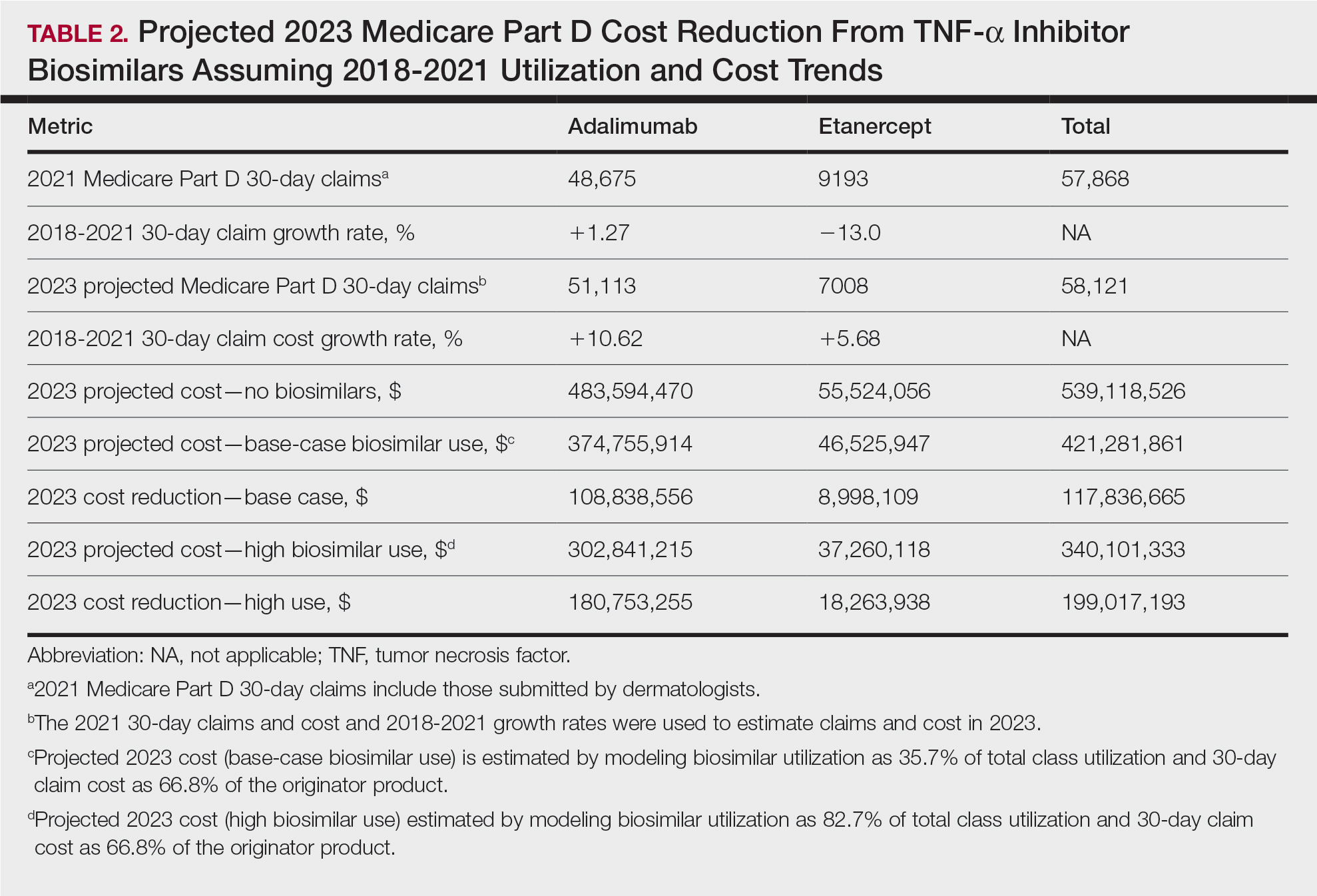

In 2020, biosimilar utilization proportions ranged from 6.4% (tumor necrosis factor α inhibitors) to 82.7% (granulocyte colony–stimulating factors), with a mean across all classes of 35.7%. On average, the cost per 30-day claim of biosimilars was 66.8% of originator agents (Table 1). In 2021, we identified 57,868 30-day claims for branded adalimumab and etanercept submitted by dermatologists. From 2018 to 2021, 30-day branded adalimumab claims increased by 1.27% annually (cost + 10.62% annually), while claims for branded etanercept decreased by 13.0% annually (cost + 5.68% annually). Assuming these trends, the cost of branded adalimumab and etanercept was estimated to be $539 million in 2023. Applying the aforementioned 35.7% utilization, the introduction of biosimilars in dermatology would yield a cost reduction of approximately $118 million (21.9%). A high utilization rate (82.7%) of biosimilars among dermatologists would increase cost savings to $199 million (36.9%)(Table 2).

Our study demonstrates that the introduction of 2 biosimilars into dermatology may result in a notable reduction in Medicare expenditures. The savings observed are likely to translate to substantial cost savings for patients. A cross-sectional analysis of 2020 Medicare data indicated that coverage for psoriasis medications was 10.0% to 99.8% across different products and Medicare Part D plans. Consequently, patients faced considerable out-of-pocket expenses, amounting to $5653 and $5714 per year for adalimumab and etanercept, respectively.7

We found that the extent of savings from biosimilars was dependent on the utilization rates among dermatologists, with the highest utilization rate almost doubling the total savings of average utilization rates. Given the impact of high utilization and the wide variation observed, understanding the factors that have influenced uptake of biosimilars is important to increasing utilization as these medications become integrated into dermatology. For instance, limited uptake of infliximab initially may have been influenced by concerns about efficacy and increased adverse events.8,9 In contrast, the high utilization of filgrastim biosimilars (82.7%) may be attributed to its longevity in the market and familiarity to prescribers, as filgrastim was the first biosimilar to be approved in the United States.10

Promoting reasonable utilization of biosimilars may require prescriber education on their safety and approval processes, which could foster increased utilization and reduce skepticism.4 Under the Biologics Price Competition and Innovation Act, the US Food and Drug Administration approves biosimilars only when they exhibit “high similarity” and show no “clinically meaningful differences” compared to the reference biologic, with no added safety risks or reduced efficacy.11 Moreover, a 2023 systematic review of 17 studies found no major difference in efficacy and safety between biosimilars and originators of etanercept, infliximab, and other biologics.12 Understanding these findings may reassure dermatologists and patients about the reliability and safety of biosimilars.

A limitation of our study is that it solely assesses Medicare data and estimates derived from existing (separate) biologic classes. It also does not account for potential expenditure shifts to newer biologic agents (eg, IL-12/17/23 inhibitors) or changes in manufacturer behavior or promotions. Nevertheless, it indicates notable financial savings from new biosimilar agents in dermatology; along with their compelling efficacy and safety profiles, this could represent a substantial benefit to patients and the health care system.