Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

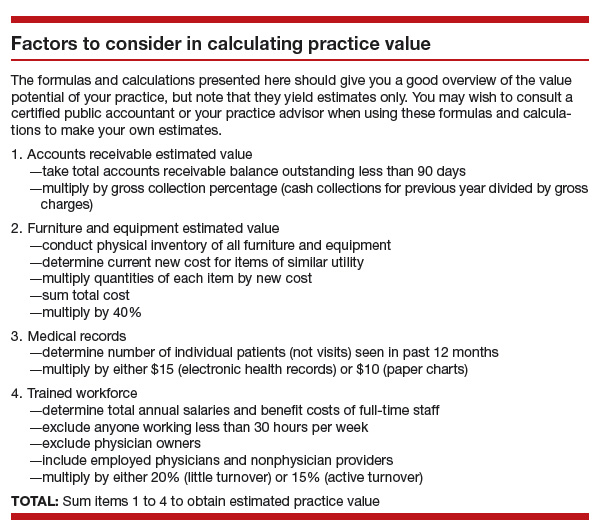

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.