User login

HM16 Session Analysis: ICD-10 Coding Tips

Presenter: Aziz Ansari, DO, FHM

Summary: With the implementation of ICD-10, correct and specific documentation to ensure proper patient diagnosis categorization has become increasingly important. Hospitalists are urged to understand the impact CDI has on quality and reimbursement.

Quality Impact: Documentation has a direct impact on quality reporting for mortality and complication rates, risk of mortality, as well as severity of illness. Documenting present on admission (POA) also directly impacts the hospital-acquired condition (HAC) classifications.

Reimbursement Impact: Documentation has a direct impact on expected length of stay, case mix index (CMI), cost reporting, and appropriate hospital reimbursement.

HM Takeaways:

- Be clear and specific.

- Document principle diagnosis and secondary diagnoses, and their associated interactions, are critically important.

- Ensure all diagnoses are a part of the discharge summary.

- Avoid saying “History of.”

- It’s OK to document “possible,” “probably,” “likely,” or “suspected.”

- Document “why” the patient has the diagnosis.

- List all differentials, and identify if ruled in or ruled out.

- Indicate acuity, even if obvious.

This presenter also reviewed common CDI opportunities in hospital medicine.

Note: This discussion was specific to the needs of the hospital patient diagnosis and billing, and not related to physician billing and CPT codes.

Presenter: Aziz Ansari, DO, FHM

Summary: With the implementation of ICD-10, correct and specific documentation to ensure proper patient diagnosis categorization has become increasingly important. Hospitalists are urged to understand the impact CDI has on quality and reimbursement.

Quality Impact: Documentation has a direct impact on quality reporting for mortality and complication rates, risk of mortality, as well as severity of illness. Documenting present on admission (POA) also directly impacts the hospital-acquired condition (HAC) classifications.

Reimbursement Impact: Documentation has a direct impact on expected length of stay, case mix index (CMI), cost reporting, and appropriate hospital reimbursement.

HM Takeaways:

- Be clear and specific.

- Document principle diagnosis and secondary diagnoses, and their associated interactions, are critically important.

- Ensure all diagnoses are a part of the discharge summary.

- Avoid saying “History of.”

- It’s OK to document “possible,” “probably,” “likely,” or “suspected.”

- Document “why” the patient has the diagnosis.

- List all differentials, and identify if ruled in or ruled out.

- Indicate acuity, even if obvious.

This presenter also reviewed common CDI opportunities in hospital medicine.

Note: This discussion was specific to the needs of the hospital patient diagnosis and billing, and not related to physician billing and CPT codes.

Presenter: Aziz Ansari, DO, FHM

Summary: With the implementation of ICD-10, correct and specific documentation to ensure proper patient diagnosis categorization has become increasingly important. Hospitalists are urged to understand the impact CDI has on quality and reimbursement.

Quality Impact: Documentation has a direct impact on quality reporting for mortality and complication rates, risk of mortality, as well as severity of illness. Documenting present on admission (POA) also directly impacts the hospital-acquired condition (HAC) classifications.

Reimbursement Impact: Documentation has a direct impact on expected length of stay, case mix index (CMI), cost reporting, and appropriate hospital reimbursement.

HM Takeaways:

- Be clear and specific.

- Document principle diagnosis and secondary diagnoses, and their associated interactions, are critically important.

- Ensure all diagnoses are a part of the discharge summary.

- Avoid saying “History of.”

- It’s OK to document “possible,” “probably,” “likely,” or “suspected.”

- Document “why” the patient has the diagnosis.

- List all differentials, and identify if ruled in or ruled out.

- Indicate acuity, even if obvious.

This presenter also reviewed common CDI opportunities in hospital medicine.

Note: This discussion was specific to the needs of the hospital patient diagnosis and billing, and not related to physician billing and CPT codes.

Key Elements of Critical Care

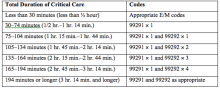

Code 99291 is used for critical care, evaluation, and management of the critically ill or critically injured patient, first 30–74 minutes.1 It is to be reported only once per day per physician or group member of the same specialty.

Code 99292 is for critical care, evaluation, and management of the critically ill or critically injured patient, each additional 30 minutes. It is to be listed separately in addition to the code for primary service.1 Code 99292 is categorized as an add-on code. It must be reported on the same invoice as its primary code, 99291. Multiple units of code 99292 can be reported per day per physician/group.

Despite the increased resources and references for critical care billing, critical care reporting issues persist. Medicare data analysis continues to identify 99291 as high risk for claim payment errors, perpetuating prepayment claim edits for outlier utilization and location discrepancies (i.e., settings other than inpatient hospital, outpatient hospital, or the emergency department). 2,3,4

Bolster your documentation with these three key elements.

Critical Illness, Injury Management

Current Procedural Terminology (CPT) and the Centers for Medicare & Medicaid Services (CMS) define “critical illness or injury” as a condition that acutely impairs one or more vital organ systems such that there is a high probability of imminent or life-threatening deterioration in the patient’s condition (e.g., central nervous system failure; circulatory failure; shock; renal, hepatic, metabolic, and/or respiratory failure).5

Hospitalists providing care to the critically ill patient must perform highly complex decision making and interventions of high intensity that are required to prevent the patient’s inevitable decline. CMS further elaborates that “the patient shall be critically ill or injured at the time of the physician’s visit.”6 This is to ensure that hospitalists and other specialists support the medical necessity of the service and do not continue to report critical care codes on days after the patient has become stable and improved.

Consider the following scenarios:

CMS examples of patients whose medical condition may warrant critical care services (99291, 99292):6

- An 81-year-old male patient is admitted to the ICU following abdominal aortic aneurysm resection. Two days after surgery, he requires fluids and pressors to maintain adequate perfusion and arterial pressures. He remains ventilator dependent.

- A 67-year-old female patient is three days post mitral valve repair. She develops petechiae, hypotension, and hypoxia requiring respiratory and circulatory support.

- A 70-year-old admitted for right lower lobe pneumococcal pneumonia with a history of COPD becomes hypoxic and hypotensive two days after admission.

- A 68-year-old admitted for an acute anterior wall myocardial infarction continues to have symptomatic ventricular tachycardia that is marginally responsive to antiarrhythmic therapy.

CMS examples of patients who may not satisfy Medicare medical necessity criteria, or do not meet critical care criteria, or who do not have a critical care illness or injury and, therefore, are not eligible for critical care payment but may be reported using another appropriate hospital care code, such as subsequent hospital care codes (99231–99233), initial hospital care codes (99221–99223), or hospital consultation codes (99251–99255) when applicable:1,6

- Patients admitted to a critical care unit because no other hospital beds were available;

- Patients admitted to a critical care unit for close nursing observation and/or frequent monitoring of vital signs (e.g., drug toxicity or overdose);

- Patients admitted to a critical care unit because hospital rules require certain treatments (e.g., insulin infusions) to be administered in the critical care unit; and

- Patients receiving only care of a chronic illness in absence of care for a critical illness (e.g., daily management of a chronic ventilator patient, management of or care related to dialysis for end-stage renal disease). Services considered palliative in nature as this type of care do not meet the definition of critical care services.7

Concurrent Care

Critically ill patients often require the care of hospitalists and other specialists throughout the course of treatment. Payors are sensitive to the multiple hours billed by multiple providers for a single patient on a given day. Claim logic provides an automated response to only allow reimbursement for 99291 once per day when reported by physicians of the same group and specialty.8 Physicians of different specialties can separately report critical care hours as long as they are caring for a condition that meets the definition of critical care.

The CMS example of this: A dermatologist evaluates and treats a rash on an ICU patient who is maintained on a ventilator and nitroglycerine infusion that are being managed by an intensivist. The dermatologist should not report a service for critical care.6

Similarly for hospitalists, if an intensivist is taking care of the critical condition and there is nothing more for the hospitalist to add to the plan of care for the critical condition, critical care services may not be justified.

When different specialists are reporting critical care on the same day, it is imperative for the documentation to demonstrate that care is not duplicative of any other provider’s care (i.e., identify management of different conditions or revising elements of the plan). The care cannot overlap the same time period of any other physician reporting critical care services.

Calculating Time

Critical care time constitutes bedside time and time spent on the patient’s unit/floor where the physician is immediately available to the patient (see Table 1). Certain labs, diagnostic studies, and procedures are considered inherent to critical care services and are not reported separately on the claim form: cardiac output measurements (93561, 93562); chest X-rays (71010, 71015, 71020); pulse oximetry (94760, 94761, 94762); blood gases and interpretation of data stored in computers, such as ECGs, blood pressures, and hematologic data (99090); gastric intubation (43752, 43753); temporary transcutaneous pacing (92953); ventilation management (94002–94004, 94660, 94662); and vascular access procedures (36000, 36410, 36415, 36591, 36600).1

Instead, physician time associated with the performance and/or interpretation of these services is toward the cumulative critical care time of the day. Services or procedures that are considered separately billable (e.g., central line placement, intubation, CPR) cannot contribute to critical care time.

When separately billable procedures are performed by the same provider/specialty group on the same day as critical care, physicians should make a notation in the medical record indicating the non-overlapping service times (e.g., “central line insertion is not included as critical care time”). This may assist with securing reimbursement when the payor requests the documentation for each reported claim item.

Activities on the floor/unit that do not directly contribute to patient care or management (e.g., review of literature, teaching rounds) cannot be counted toward critical care time. Do not count time associated with indirect care provided outside of the patient’s unit/floor (e.g., reviewing data or calling the family from the office) toward critical care time.

Family discussions can be counted toward critical care time but must take place at bedside or on the patient’s unit/floor. The patient must participate in the discussion unless medically unable or clinically incompetent to participate. If unable to participate, a notation in the chart must delineate the patient’s inability to participate and the reason.

Credited time can only involve obtaining a medical history and/or discussing treatment options or limitation(s) of treatment. The conversation must bear directly on patient management.1,7 Do not count time associated with providing periodic condition updates to the family, answering questions about the patient’s condition that are unrelated to decision making, or counseling the family during their grief process. If the conversation must take place via phone, it may be counted toward critical care time if the physician is calling from the patient’s unit/floor and the conversation involves the same criterion identified for face-to-face family meetings.10

Physicians should keep track of their critical care time throughout the day. Since critical care time is a cumulative service, each entry should include the total time that critical care services were provided (e.g., 45 minutes).10 Some payors may still impose the notation of “start-and-stop time” per encounter (e.g., 2–2:50 a.m.).

Same-specialty physicians (i.e., two hospitalists from the same group practice) may require separate claims. The initial critical care hour (99291) must be met by a single physician. Medically necessary critical care time beyond the first hour (99292) may be met individually by the same physician or collectively with another physician from the same group. The physician performing the additional time, beyond the first hour, reports the appropriate units of 99292 (see Table 1) under the corresponding NPI.11

CMS has issued instructions for contractors to recognize this atypical reporting method. However, non-Medicare payors may not recognize this newer reporting method and maintain that the cumulative service (by the same-specialty physician in the same provider group) should be reported under one physician name. Be sure to query the payors for appropriate reporting methods. TH

References

- Abraham M, Ahlman J, Boudreau A, Connelly J, Crosslin, R. Current Procedural Terminology 2015 Professional Edition. Chicago: American Medical Association Press; 2014. 23-25.

- Widespread prepayment targeted review notification—CPT 99291. Cahaba website. Available at: www.cahabagba.com/news/widespread-prepayment-targeted-review-notification-part-b/. Accessed December 17, 2015.

- Critical care CPT 99291 widespread prepayment targeted review results. Cahaba website. Available at: https://www.cahabagba.com/news/critical-care-cpt-99291-widespread-prepayment-targeted-review-results-2/. Accessed December 17, 2015.

- Prepayment edit of evaluation and management (E/M) code 99291. First Coast Service Options, Inc. website. Available at: medicare.fcso.com/Publications_B/2013/251608.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12A. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12B. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Critical care fact sheet. CGS Administrators, LLC website. Available at: www.cgsmedicare.com/partb/mr/pdf/critical_care_fact_sheet.pdf. Accessed December 17, 2015.

- Same day same service policy. United Healthcare website. Available at: www.unitedhealthcareonline.com/ccmcontent/ProviderII/UHC/en-US/Main%20Menu/Tools%20&%20Resources/Policies%20and%20Protocols/Medicare%20Advantage%20Reimbursement%20Policies/S/SameDaySameService.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12G. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12E. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12I. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

Code 99291 is used for critical care, evaluation, and management of the critically ill or critically injured patient, first 30–74 minutes.1 It is to be reported only once per day per physician or group member of the same specialty.

Code 99292 is for critical care, evaluation, and management of the critically ill or critically injured patient, each additional 30 minutes. It is to be listed separately in addition to the code for primary service.1 Code 99292 is categorized as an add-on code. It must be reported on the same invoice as its primary code, 99291. Multiple units of code 99292 can be reported per day per physician/group.

Despite the increased resources and references for critical care billing, critical care reporting issues persist. Medicare data analysis continues to identify 99291 as high risk for claim payment errors, perpetuating prepayment claim edits for outlier utilization and location discrepancies (i.e., settings other than inpatient hospital, outpatient hospital, or the emergency department). 2,3,4

Bolster your documentation with these three key elements.

Critical Illness, Injury Management

Current Procedural Terminology (CPT) and the Centers for Medicare & Medicaid Services (CMS) define “critical illness or injury” as a condition that acutely impairs one or more vital organ systems such that there is a high probability of imminent or life-threatening deterioration in the patient’s condition (e.g., central nervous system failure; circulatory failure; shock; renal, hepatic, metabolic, and/or respiratory failure).5

Hospitalists providing care to the critically ill patient must perform highly complex decision making and interventions of high intensity that are required to prevent the patient’s inevitable decline. CMS further elaborates that “the patient shall be critically ill or injured at the time of the physician’s visit.”6 This is to ensure that hospitalists and other specialists support the medical necessity of the service and do not continue to report critical care codes on days after the patient has become stable and improved.

Consider the following scenarios:

CMS examples of patients whose medical condition may warrant critical care services (99291, 99292):6

- An 81-year-old male patient is admitted to the ICU following abdominal aortic aneurysm resection. Two days after surgery, he requires fluids and pressors to maintain adequate perfusion and arterial pressures. He remains ventilator dependent.

- A 67-year-old female patient is three days post mitral valve repair. She develops petechiae, hypotension, and hypoxia requiring respiratory and circulatory support.

- A 70-year-old admitted for right lower lobe pneumococcal pneumonia with a history of COPD becomes hypoxic and hypotensive two days after admission.

- A 68-year-old admitted for an acute anterior wall myocardial infarction continues to have symptomatic ventricular tachycardia that is marginally responsive to antiarrhythmic therapy.

CMS examples of patients who may not satisfy Medicare medical necessity criteria, or do not meet critical care criteria, or who do not have a critical care illness or injury and, therefore, are not eligible for critical care payment but may be reported using another appropriate hospital care code, such as subsequent hospital care codes (99231–99233), initial hospital care codes (99221–99223), or hospital consultation codes (99251–99255) when applicable:1,6

- Patients admitted to a critical care unit because no other hospital beds were available;

- Patients admitted to a critical care unit for close nursing observation and/or frequent monitoring of vital signs (e.g., drug toxicity or overdose);

- Patients admitted to a critical care unit because hospital rules require certain treatments (e.g., insulin infusions) to be administered in the critical care unit; and

- Patients receiving only care of a chronic illness in absence of care for a critical illness (e.g., daily management of a chronic ventilator patient, management of or care related to dialysis for end-stage renal disease). Services considered palliative in nature as this type of care do not meet the definition of critical care services.7

Concurrent Care

Critically ill patients often require the care of hospitalists and other specialists throughout the course of treatment. Payors are sensitive to the multiple hours billed by multiple providers for a single patient on a given day. Claim logic provides an automated response to only allow reimbursement for 99291 once per day when reported by physicians of the same group and specialty.8 Physicians of different specialties can separately report critical care hours as long as they are caring for a condition that meets the definition of critical care.

The CMS example of this: A dermatologist evaluates and treats a rash on an ICU patient who is maintained on a ventilator and nitroglycerine infusion that are being managed by an intensivist. The dermatologist should not report a service for critical care.6

Similarly for hospitalists, if an intensivist is taking care of the critical condition and there is nothing more for the hospitalist to add to the plan of care for the critical condition, critical care services may not be justified.

When different specialists are reporting critical care on the same day, it is imperative for the documentation to demonstrate that care is not duplicative of any other provider’s care (i.e., identify management of different conditions or revising elements of the plan). The care cannot overlap the same time period of any other physician reporting critical care services.

Calculating Time

Critical care time constitutes bedside time and time spent on the patient’s unit/floor where the physician is immediately available to the patient (see Table 1). Certain labs, diagnostic studies, and procedures are considered inherent to critical care services and are not reported separately on the claim form: cardiac output measurements (93561, 93562); chest X-rays (71010, 71015, 71020); pulse oximetry (94760, 94761, 94762); blood gases and interpretation of data stored in computers, such as ECGs, blood pressures, and hematologic data (99090); gastric intubation (43752, 43753); temporary transcutaneous pacing (92953); ventilation management (94002–94004, 94660, 94662); and vascular access procedures (36000, 36410, 36415, 36591, 36600).1

Instead, physician time associated with the performance and/or interpretation of these services is toward the cumulative critical care time of the day. Services or procedures that are considered separately billable (e.g., central line placement, intubation, CPR) cannot contribute to critical care time.

When separately billable procedures are performed by the same provider/specialty group on the same day as critical care, physicians should make a notation in the medical record indicating the non-overlapping service times (e.g., “central line insertion is not included as critical care time”). This may assist with securing reimbursement when the payor requests the documentation for each reported claim item.

Activities on the floor/unit that do not directly contribute to patient care or management (e.g., review of literature, teaching rounds) cannot be counted toward critical care time. Do not count time associated with indirect care provided outside of the patient’s unit/floor (e.g., reviewing data or calling the family from the office) toward critical care time.

Family discussions can be counted toward critical care time but must take place at bedside or on the patient’s unit/floor. The patient must participate in the discussion unless medically unable or clinically incompetent to participate. If unable to participate, a notation in the chart must delineate the patient’s inability to participate and the reason.

Credited time can only involve obtaining a medical history and/or discussing treatment options or limitation(s) of treatment. The conversation must bear directly on patient management.1,7 Do not count time associated with providing periodic condition updates to the family, answering questions about the patient’s condition that are unrelated to decision making, or counseling the family during their grief process. If the conversation must take place via phone, it may be counted toward critical care time if the physician is calling from the patient’s unit/floor and the conversation involves the same criterion identified for face-to-face family meetings.10

Physicians should keep track of their critical care time throughout the day. Since critical care time is a cumulative service, each entry should include the total time that critical care services were provided (e.g., 45 minutes).10 Some payors may still impose the notation of “start-and-stop time” per encounter (e.g., 2–2:50 a.m.).

Same-specialty physicians (i.e., two hospitalists from the same group practice) may require separate claims. The initial critical care hour (99291) must be met by a single physician. Medically necessary critical care time beyond the first hour (99292) may be met individually by the same physician or collectively with another physician from the same group. The physician performing the additional time, beyond the first hour, reports the appropriate units of 99292 (see Table 1) under the corresponding NPI.11

CMS has issued instructions for contractors to recognize this atypical reporting method. However, non-Medicare payors may not recognize this newer reporting method and maintain that the cumulative service (by the same-specialty physician in the same provider group) should be reported under one physician name. Be sure to query the payors for appropriate reporting methods. TH

References

- Abraham M, Ahlman J, Boudreau A, Connelly J, Crosslin, R. Current Procedural Terminology 2015 Professional Edition. Chicago: American Medical Association Press; 2014. 23-25.

- Widespread prepayment targeted review notification—CPT 99291. Cahaba website. Available at: www.cahabagba.com/news/widespread-prepayment-targeted-review-notification-part-b/. Accessed December 17, 2015.

- Critical care CPT 99291 widespread prepayment targeted review results. Cahaba website. Available at: https://www.cahabagba.com/news/critical-care-cpt-99291-widespread-prepayment-targeted-review-results-2/. Accessed December 17, 2015.

- Prepayment edit of evaluation and management (E/M) code 99291. First Coast Service Options, Inc. website. Available at: medicare.fcso.com/Publications_B/2013/251608.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12A. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12B. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Critical care fact sheet. CGS Administrators, LLC website. Available at: www.cgsmedicare.com/partb/mr/pdf/critical_care_fact_sheet.pdf. Accessed December 17, 2015.

- Same day same service policy. United Healthcare website. Available at: www.unitedhealthcareonline.com/ccmcontent/ProviderII/UHC/en-US/Main%20Menu/Tools%20&%20Resources/Policies%20and%20Protocols/Medicare%20Advantage%20Reimbursement%20Policies/S/SameDaySameService.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12G. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12E. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12I. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

Code 99291 is used for critical care, evaluation, and management of the critically ill or critically injured patient, first 30–74 minutes.1 It is to be reported only once per day per physician or group member of the same specialty.

Code 99292 is for critical care, evaluation, and management of the critically ill or critically injured patient, each additional 30 minutes. It is to be listed separately in addition to the code for primary service.1 Code 99292 is categorized as an add-on code. It must be reported on the same invoice as its primary code, 99291. Multiple units of code 99292 can be reported per day per physician/group.

Despite the increased resources and references for critical care billing, critical care reporting issues persist. Medicare data analysis continues to identify 99291 as high risk for claim payment errors, perpetuating prepayment claim edits for outlier utilization and location discrepancies (i.e., settings other than inpatient hospital, outpatient hospital, or the emergency department). 2,3,4

Bolster your documentation with these three key elements.

Critical Illness, Injury Management

Current Procedural Terminology (CPT) and the Centers for Medicare & Medicaid Services (CMS) define “critical illness or injury” as a condition that acutely impairs one or more vital organ systems such that there is a high probability of imminent or life-threatening deterioration in the patient’s condition (e.g., central nervous system failure; circulatory failure; shock; renal, hepatic, metabolic, and/or respiratory failure).5

Hospitalists providing care to the critically ill patient must perform highly complex decision making and interventions of high intensity that are required to prevent the patient’s inevitable decline. CMS further elaborates that “the patient shall be critically ill or injured at the time of the physician’s visit.”6 This is to ensure that hospitalists and other specialists support the medical necessity of the service and do not continue to report critical care codes on days after the patient has become stable and improved.

Consider the following scenarios:

CMS examples of patients whose medical condition may warrant critical care services (99291, 99292):6

- An 81-year-old male patient is admitted to the ICU following abdominal aortic aneurysm resection. Two days after surgery, he requires fluids and pressors to maintain adequate perfusion and arterial pressures. He remains ventilator dependent.

- A 67-year-old female patient is three days post mitral valve repair. She develops petechiae, hypotension, and hypoxia requiring respiratory and circulatory support.

- A 70-year-old admitted for right lower lobe pneumococcal pneumonia with a history of COPD becomes hypoxic and hypotensive two days after admission.

- A 68-year-old admitted for an acute anterior wall myocardial infarction continues to have symptomatic ventricular tachycardia that is marginally responsive to antiarrhythmic therapy.

CMS examples of patients who may not satisfy Medicare medical necessity criteria, or do not meet critical care criteria, or who do not have a critical care illness or injury and, therefore, are not eligible for critical care payment but may be reported using another appropriate hospital care code, such as subsequent hospital care codes (99231–99233), initial hospital care codes (99221–99223), or hospital consultation codes (99251–99255) when applicable:1,6

- Patients admitted to a critical care unit because no other hospital beds were available;

- Patients admitted to a critical care unit for close nursing observation and/or frequent monitoring of vital signs (e.g., drug toxicity or overdose);

- Patients admitted to a critical care unit because hospital rules require certain treatments (e.g., insulin infusions) to be administered in the critical care unit; and

- Patients receiving only care of a chronic illness in absence of care for a critical illness (e.g., daily management of a chronic ventilator patient, management of or care related to dialysis for end-stage renal disease). Services considered palliative in nature as this type of care do not meet the definition of critical care services.7

Concurrent Care

Critically ill patients often require the care of hospitalists and other specialists throughout the course of treatment. Payors are sensitive to the multiple hours billed by multiple providers for a single patient on a given day. Claim logic provides an automated response to only allow reimbursement for 99291 once per day when reported by physicians of the same group and specialty.8 Physicians of different specialties can separately report critical care hours as long as they are caring for a condition that meets the definition of critical care.

The CMS example of this: A dermatologist evaluates and treats a rash on an ICU patient who is maintained on a ventilator and nitroglycerine infusion that are being managed by an intensivist. The dermatologist should not report a service for critical care.6

Similarly for hospitalists, if an intensivist is taking care of the critical condition and there is nothing more for the hospitalist to add to the plan of care for the critical condition, critical care services may not be justified.

When different specialists are reporting critical care on the same day, it is imperative for the documentation to demonstrate that care is not duplicative of any other provider’s care (i.e., identify management of different conditions or revising elements of the plan). The care cannot overlap the same time period of any other physician reporting critical care services.

Calculating Time

Critical care time constitutes bedside time and time spent on the patient’s unit/floor where the physician is immediately available to the patient (see Table 1). Certain labs, diagnostic studies, and procedures are considered inherent to critical care services and are not reported separately on the claim form: cardiac output measurements (93561, 93562); chest X-rays (71010, 71015, 71020); pulse oximetry (94760, 94761, 94762); blood gases and interpretation of data stored in computers, such as ECGs, blood pressures, and hematologic data (99090); gastric intubation (43752, 43753); temporary transcutaneous pacing (92953); ventilation management (94002–94004, 94660, 94662); and vascular access procedures (36000, 36410, 36415, 36591, 36600).1

Instead, physician time associated with the performance and/or interpretation of these services is toward the cumulative critical care time of the day. Services or procedures that are considered separately billable (e.g., central line placement, intubation, CPR) cannot contribute to critical care time.

When separately billable procedures are performed by the same provider/specialty group on the same day as critical care, physicians should make a notation in the medical record indicating the non-overlapping service times (e.g., “central line insertion is not included as critical care time”). This may assist with securing reimbursement when the payor requests the documentation for each reported claim item.

Activities on the floor/unit that do not directly contribute to patient care or management (e.g., review of literature, teaching rounds) cannot be counted toward critical care time. Do not count time associated with indirect care provided outside of the patient’s unit/floor (e.g., reviewing data or calling the family from the office) toward critical care time.

Family discussions can be counted toward critical care time but must take place at bedside or on the patient’s unit/floor. The patient must participate in the discussion unless medically unable or clinically incompetent to participate. If unable to participate, a notation in the chart must delineate the patient’s inability to participate and the reason.

Credited time can only involve obtaining a medical history and/or discussing treatment options or limitation(s) of treatment. The conversation must bear directly on patient management.1,7 Do not count time associated with providing periodic condition updates to the family, answering questions about the patient’s condition that are unrelated to decision making, or counseling the family during their grief process. If the conversation must take place via phone, it may be counted toward critical care time if the physician is calling from the patient’s unit/floor and the conversation involves the same criterion identified for face-to-face family meetings.10

Physicians should keep track of their critical care time throughout the day. Since critical care time is a cumulative service, each entry should include the total time that critical care services were provided (e.g., 45 minutes).10 Some payors may still impose the notation of “start-and-stop time” per encounter (e.g., 2–2:50 a.m.).

Same-specialty physicians (i.e., two hospitalists from the same group practice) may require separate claims. The initial critical care hour (99291) must be met by a single physician. Medically necessary critical care time beyond the first hour (99292) may be met individually by the same physician or collectively with another physician from the same group. The physician performing the additional time, beyond the first hour, reports the appropriate units of 99292 (see Table 1) under the corresponding NPI.11

CMS has issued instructions for contractors to recognize this atypical reporting method. However, non-Medicare payors may not recognize this newer reporting method and maintain that the cumulative service (by the same-specialty physician in the same provider group) should be reported under one physician name. Be sure to query the payors for appropriate reporting methods. TH

References

- Abraham M, Ahlman J, Boudreau A, Connelly J, Crosslin, R. Current Procedural Terminology 2015 Professional Edition. Chicago: American Medical Association Press; 2014. 23-25.

- Widespread prepayment targeted review notification—CPT 99291. Cahaba website. Available at: www.cahabagba.com/news/widespread-prepayment-targeted-review-notification-part-b/. Accessed December 17, 2015.

- Critical care CPT 99291 widespread prepayment targeted review results. Cahaba website. Available at: https://www.cahabagba.com/news/critical-care-cpt-99291-widespread-prepayment-targeted-review-results-2/. Accessed December 17, 2015.

- Prepayment edit of evaluation and management (E/M) code 99291. First Coast Service Options, Inc. website. Available at: medicare.fcso.com/Publications_B/2013/251608.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12A. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12B. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Critical care fact sheet. CGS Administrators, LLC website. Available at: www.cgsmedicare.com/partb/mr/pdf/critical_care_fact_sheet.pdf. Accessed December 17, 2015.

- Same day same service policy. United Healthcare website. Available at: www.unitedhealthcareonline.com/ccmcontent/ProviderII/UHC/en-US/Main%20Menu/Tools%20&%20Resources/Policies%20and%20Protocols/Medicare%20Advantage%20Reimbursement%20Policies/S/SameDaySameService.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12G. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12E. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

- Medicare claims processing manual: chapter 12, section 30.6.12I. Centers for Medicare & Medicaid Services website. Available at: www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/clm104c12.pdf. Accessed December 17, 2015.

Medicare Grants Billing Code for Hospitalists

PHILADELPHIA—The Society of Hospital Medicine (SHM) is pleased to announce the introduction of a dedicated billing code for hospitalists by the Centers for Medicare & Medicaid Services (CMS). This decision comes in response to concerted advocacy efforts from SHM for CMS to recognize the specialty. This is a monumental step for hospital medicine, which continues to be the fastest growing medical specialty in the United States with over 48,000 practitioners identifying as hospitalists, growing from approximately 1,000 in the mid-1990s.

“We see each day that hospitalists are driving positive change in healthcare, and this recognition by CMS affirms that hospital medicine is growing both in scope and impact,” notes Laurence Wellikson, MD, MHM, CEO of SHM. “The ability for hospital medicine practitioners to differentiate themselves from providers in other specialties will have a huge impact, particularly for upcoming value-based or pay-for-performance programs.”

Until now, hospitalists could only compare performance to that of practitioners in internal medicine or another related specialty. This new billing code will allow hospitalists to appropriately benchmark and focus improvement efforts with others in the hospital medicine specialty, facilitating more accurate comparisons and fairer assessments of hospitalist performance.

Despite varied training backgrounds, hospitalists have become focused within their own unique specialty, dedicated to providing care to hospitalized patients and working toward high-quality, patient-centered care in the hospital. They have developed institutional-based skills that differentiate them from practitioners in other specialties, such as internal and family medicine. Their specialized expertise includes improving both the efficiency and safety of care for hospitalized patients and the ability to manage and innovate in a hospital’s team-based environment.

This momentous decision coincides with the twenty-year anniversary of the coining of the term ‘hospitalist’ by Robert Wachter, MD, MHM, and Lee Goldman, MD in the New England Journal of Medicine. In recognition of this anniversary, SHM introduced a year-long celebration, the “Year of the Hospitalist,” to commemorate the specialty’s continued success and bright future.

“We have known who we are for years, and the special role that hospitalists play in the well-being of our patients, communities and health systems,” explains Brian Harte, MD, SFHM, president-elect of SHM. “The hospitalist provider code will provide Medicare and other players in the healthcare system an important new tool to better understand and acknowledge the critical role we play in the care of hospitalized patients nationwide.”

Lisa Zoks is SHM's Vice-President of Communications.

ABOUT SHM

Representing the fastest growing specialty in modern healthcare, SHM is the leading medical society for more than 48,000 hospitalists and their patients. SHM is dedicated to promoting the highest quality care for all hospitalized patients and overall excellence in the practice of hospital medicine through quality improvement, education, advocacy and research. Over the past decade, studies have shown that hospitalists can contribute to decreased patient lengths of stay, reductions in hospital costs and readmission rates, and increased patient satisfaction.

PHILADELPHIA—The Society of Hospital Medicine (SHM) is pleased to announce the introduction of a dedicated billing code for hospitalists by the Centers for Medicare & Medicaid Services (CMS). This decision comes in response to concerted advocacy efforts from SHM for CMS to recognize the specialty. This is a monumental step for hospital medicine, which continues to be the fastest growing medical specialty in the United States with over 48,000 practitioners identifying as hospitalists, growing from approximately 1,000 in the mid-1990s.

“We see each day that hospitalists are driving positive change in healthcare, and this recognition by CMS affirms that hospital medicine is growing both in scope and impact,” notes Laurence Wellikson, MD, MHM, CEO of SHM. “The ability for hospital medicine practitioners to differentiate themselves from providers in other specialties will have a huge impact, particularly for upcoming value-based or pay-for-performance programs.”

Until now, hospitalists could only compare performance to that of practitioners in internal medicine or another related specialty. This new billing code will allow hospitalists to appropriately benchmark and focus improvement efforts with others in the hospital medicine specialty, facilitating more accurate comparisons and fairer assessments of hospitalist performance.

Despite varied training backgrounds, hospitalists have become focused within their own unique specialty, dedicated to providing care to hospitalized patients and working toward high-quality, patient-centered care in the hospital. They have developed institutional-based skills that differentiate them from practitioners in other specialties, such as internal and family medicine. Their specialized expertise includes improving both the efficiency and safety of care for hospitalized patients and the ability to manage and innovate in a hospital’s team-based environment.

This momentous decision coincides with the twenty-year anniversary of the coining of the term ‘hospitalist’ by Robert Wachter, MD, MHM, and Lee Goldman, MD in the New England Journal of Medicine. In recognition of this anniversary, SHM introduced a year-long celebration, the “Year of the Hospitalist,” to commemorate the specialty’s continued success and bright future.

“We have known who we are for years, and the special role that hospitalists play in the well-being of our patients, communities and health systems,” explains Brian Harte, MD, SFHM, president-elect of SHM. “The hospitalist provider code will provide Medicare and other players in the healthcare system an important new tool to better understand and acknowledge the critical role we play in the care of hospitalized patients nationwide.”

Lisa Zoks is SHM's Vice-President of Communications.

ABOUT SHM

Representing the fastest growing specialty in modern healthcare, SHM is the leading medical society for more than 48,000 hospitalists and their patients. SHM is dedicated to promoting the highest quality care for all hospitalized patients and overall excellence in the practice of hospital medicine through quality improvement, education, advocacy and research. Over the past decade, studies have shown that hospitalists can contribute to decreased patient lengths of stay, reductions in hospital costs and readmission rates, and increased patient satisfaction.

PHILADELPHIA—The Society of Hospital Medicine (SHM) is pleased to announce the introduction of a dedicated billing code for hospitalists by the Centers for Medicare & Medicaid Services (CMS). This decision comes in response to concerted advocacy efforts from SHM for CMS to recognize the specialty. This is a monumental step for hospital medicine, which continues to be the fastest growing medical specialty in the United States with over 48,000 practitioners identifying as hospitalists, growing from approximately 1,000 in the mid-1990s.

“We see each day that hospitalists are driving positive change in healthcare, and this recognition by CMS affirms that hospital medicine is growing both in scope and impact,” notes Laurence Wellikson, MD, MHM, CEO of SHM. “The ability for hospital medicine practitioners to differentiate themselves from providers in other specialties will have a huge impact, particularly for upcoming value-based or pay-for-performance programs.”

Until now, hospitalists could only compare performance to that of practitioners in internal medicine or another related specialty. This new billing code will allow hospitalists to appropriately benchmark and focus improvement efforts with others in the hospital medicine specialty, facilitating more accurate comparisons and fairer assessments of hospitalist performance.

Despite varied training backgrounds, hospitalists have become focused within their own unique specialty, dedicated to providing care to hospitalized patients and working toward high-quality, patient-centered care in the hospital. They have developed institutional-based skills that differentiate them from practitioners in other specialties, such as internal and family medicine. Their specialized expertise includes improving both the efficiency and safety of care for hospitalized patients and the ability to manage and innovate in a hospital’s team-based environment.

This momentous decision coincides with the twenty-year anniversary of the coining of the term ‘hospitalist’ by Robert Wachter, MD, MHM, and Lee Goldman, MD in the New England Journal of Medicine. In recognition of this anniversary, SHM introduced a year-long celebration, the “Year of the Hospitalist,” to commemorate the specialty’s continued success and bright future.

“We have known who we are for years, and the special role that hospitalists play in the well-being of our patients, communities and health systems,” explains Brian Harte, MD, SFHM, president-elect of SHM. “The hospitalist provider code will provide Medicare and other players in the healthcare system an important new tool to better understand and acknowledge the critical role we play in the care of hospitalized patients nationwide.”

Lisa Zoks is SHM's Vice-President of Communications.

ABOUT SHM

Representing the fastest growing specialty in modern healthcare, SHM is the leading medical society for more than 48,000 hospitalists and their patients. SHM is dedicated to promoting the highest quality care for all hospitalized patients and overall excellence in the practice of hospital medicine through quality improvement, education, advocacy and research. Over the past decade, studies have shown that hospitalists can contribute to decreased patient lengths of stay, reductions in hospital costs and readmission rates, and increased patient satisfaction.

A Guide to Ultrasound of the Shoulder, Part 1: Coding and Reimbursement

Although ultrasound has been around for many years, the technology is underutilized. It has been used primarily by the radiologists and obstetricians-gynecologists. However, orthopedic surgeons and sports medicine doctors are beginning to realize the utility of this imaging modality for their specialties. Ultrasound has classically been used as a diagnostic tool. This usage is beneficial to sports medicine specialists for on-field coverage at sports competitions to efficiently evaluate injuries without the need for taking the athletes back to the locker room for an x-ray or magnetic resonance imaging (MRI). Ultrasound can quickly assess for damage to soft tissue, joints, and superficial bones. Another of ultrasound’s benefits is its use as an adjunct to treatment. Ultrasound has been shown to vastly increase the accuracy of injections and can be used in surgery to accurately guide percutaneous techniques or to identify structures that previously required radiation-exposing fluoroscopy or large incisions to find by feel or eye.

Ultrasound is a technician-dependent modality. The surgeon and physician must become facile with the use of the probe and how ultrasound works. The use of the probe is similar to an arthroscope, requiring small movements of the hand to reveal the best imaging of the tissues. Rather than relying on just the patient’s position with an immobile machine, the user must use the probe position and the placement of the patient’s limb or body to optimize the use of ultrasound. Doing so saves time, money, and exposure to dangerous radiation. In a retrospective study of 1012 patients treated over a 10-month period, Sivan and colleagues1 concluded that the use of clinic-based musculoskeletal (MSK) ultrasound enables a one-stop approach, reduces repeat hospital appointments, and improves quality of care.With the increased use of ultrasound comes the need to accurately code and bill for the use of ultrasound. According to the College of Radiology, Medicare reimbursements for MSK ultrasound studies has increased by 316% from 2000-2009.2 Paradoxically, ultrasound has still been relatively underutilized when compared to the use of MSK MRI.

Diagnostic Ultrasound

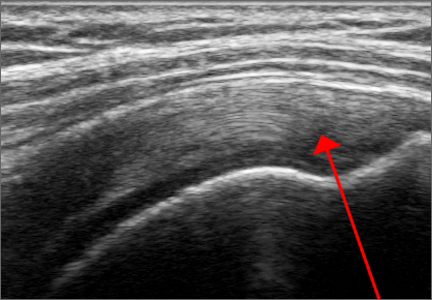

Ultrasound is based off sound waves, emitted from a transducer, which are then bounced back off the underlying structures based on the density of that structure. The computer interprets the returning sound waves and produces an image reflecting the quality and strength of those returning waves. When the sound waves are bounced back strongly and quickly, like when hitting bone, we see an image that is intensely white (“hyperechoic”). When the sound waves encounter a substance that transmits those waves easily and do not return, like air or fluid, the image is dark (“hypoechoic”).

Ultrasound’s fundamental advantages start with every patient being able to have an ultrasound: no interference from metal, pacemakers, claustrophobia, or obesity. Contralateral comparisons, sono-palpation at the site of pathology, and real-time dynamic studies allow for a more comprehensive diagnostic evaluation. Doppler capabilities can further expand the usefulness of the evaluation and guide safer interventions. With the advent of high-resolution portable ultrasound machines, these studies can essentially be performed anywhere, and are typically done in a timely and cost-effective manner.

Ultrasound has many diagnostic uses for soft tissue, joint, and bone disorders. For soft tissues, ultrasound can image tears of muscles, tendons, and ligaments; show inflammation like tenosynovitis; demonstrate masses like hematomas, cysts, solid tumors, or calcific tendonitis; display nerve disorders like Morton’s neuroma; or confirm foreign bodies or infections.3-5 For joint disorders, ultrasound can show erosions on bones, loose bodies, pannus, inflammation, or effusions. For bone disorders, ultrasound can diagnose fractures and, sometimes, even stress fractures. Tomer and colleagues6 compared 51 patients with bone contusions and fractures; they determined that ultrasound was most reliable in the diagnosis of long bone diaphyseal fractures. The one disadvantage, especially when compared to MRI, is ultrasound’s inability to fully evaluate intra-articular or deep structures such as articular cartilage, the glenohumeral labrum, the biceps’ anchor, etc.

Magnetic Resonance Imaging

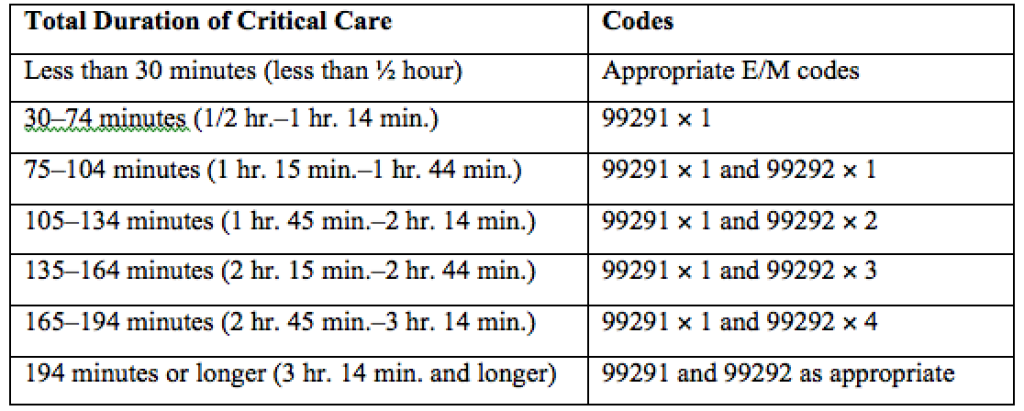

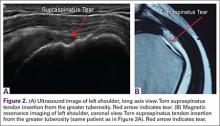

Ultrasound is similar to MRI as it images tissues and gives us ideas whether that tissue is normal, damaged, or diseased (Figures 1A, 1B). MRI is based on magnetics and large machines that cannot be moved. MRI yields planar images that can only be changed by changing the position of the limb or body in the MRI tube. This can create an issue with obese patients or with postoperative patients who cannot maintain the operated body part in one position for the length of the MRI scan. Ultrasound is better tolerated by patients without the need for claustrophobic large machines (Table 1). In 2004, Middleton and colleagues7 surveyed 118 patients who obtained an ultrasound and MRI of the shoulder for suspected rotator cuff pathology; ultrasound had higher satisfaction levels, and 93% of patients preferred ultrasound to MRI.

For rotator cuff tears, ultrasound is also comparable diagnostically with MRI (Figures 2A, 2B). In a prospective study of 124 patients, MRI and ultrasound had comparable accuracy for identifying and measuring the size of full-thickness and partial-thickness rotator cuff tears, with arthroscopic findings used as the standard.8 A 2015 meta-analysis published in the British Journal of Sports Medicine showed that the diagnostic accuracy of ultrasound, MRI, and MR arthrography in the characterization of full thickness rotator cuff tears had >90% sensitivity and specificity. As for partial rotator cuff tears and tendinopathy, overall estimates of specificity were also high (>90%), while sensitivity was as high as 83%. Diagnostic accuracy of ultrasound was similar whether it was performed by a trained radiologist, sonographer, or orthopedist.9

Medicare reimbursements for MSK ultrasound studies has increased by 316% in the past decade.2 Private practice MSK ultrasound procedures increased from 19,372 in 2000 to 158,351 in 2009.2 In 2010, non-radiologists accounted for more ultrasound-guided procedures than radiologists for the first time.10 MSK ultrasound is still underutilized compared to MRI. This underutilization is also unfortunate economically. The cost of MRIs is significantly higher. According to Parker and colleagues10, the projected Medicare cost for MSK imaging in 2020 is $3.6 billion, with MRI accounting for $2 billion. They also concluded that replacing MSK MRI with MSK ultrasound when clinically indicated could save over $6.9 billion between 2006 and 2020.11

Ultrasound-Guided Procedures

MSK ultrasound has gained significant ground on other imaging modalities when it comes to procedures, both in office and in the operating room. The ability to have a small, mobile, inexpensive machine that can be used in real time has dramatically changed how interventions are done. Most imaging modalities used to perform injections or percutaneous surgery use fluoroscopy machines. This exposes the patients to significant radiation, costs significantly more, and usually requires a secondary consultation with radiologists in a different facility. This wastes time and money, and results in potentially unnecessary exposure to radiation.

Accuracy is the most common reason for referral for guided injections. The guidance can help avoid nerves, vessels, and other sensitive tissues. However, accuracy is also important to make sure the injection is placed in the correct location. When injections are placed into a muscle, tendon, or ligament, it causes significant pain; however, injections placed into a bursal space or joint do not cause pain. Numerous studies have shown that even in the hands of experts, “simple” injections can still miss their mark over 30% of the time.12-19 Therefore, if a patient experiences pain during a bursal space or joint injection, the injection was not placed properly.

The American Medical Society for Sports Medicine Position Paper on MSK ultrasound is based on a systematic review of the literature, including 124 studies. It states that ultrasound-guided joint injections (USGI) are more accurate and efficacious than landmark guided injections (LMGI), with a strength of recommendation taxonomy (SORT) evidence rating of A and B, respectively.19 In terms of patient satisfaction, in a randomized controlled trial of 148 patients undergoing knee injections, Sibbitt and colleagues20 showed that USGI had a 48% reduction (P < .001) in procedural pain, a 58.5% reduction (P < .001) in absolute pain scores at the 2-week outcome mark, and a 75% reduction (P < .001) in significant pain and 62% reduction in nonresponder rate.20 From a financial point of view, Sibbitt and colleagues20 also demonstrated a 13% reduction in cost per patient per year, and a 58% reduction in cost per responder per year for a hospital outpatient center (P < .001).

Coding

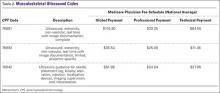

Coding for diagnostic MSK ultrasound requires an understanding of a few current procedural terminology (CPT) codes (Table 2). Ultrasound usage should follow the usual requirements of medical necessity and the CPT code selected should be based on the elements of the study performed. A complete examination, described by CPT code 76881, includes the examination and documentation of the muscles, tendons, joint, and other soft tissue structures and any identifiable abnormality of the joint being evaluated. If anything less is done, then the CPT code 76882 should be used.

New CPT codes for joint injections became effective January 2015 (Table 3). The new changes affect only the joint injection series (20600-20610). Previously, injections could be billed with CPT code 76942, which was “Ultrasonic guidance for needle placement (eg, biopsy, aspiration, injection, localization device), imaging supervision and interpretation.” This code can still be used, but with only specific injections, when the verbiage “with ultrasound/image guidance” is not included in the injection CPT code descriptor (Table 4).

Under the National Correct Coding Initiative (NCCI), which sets Centers for Medicare & Medicaid Services (CMS) payment policy as well as that of many private payers, one unit of service is allowed for CPT code 76942 in a single patient encounter regardless of the number of needle placements performed. Per NCCI, “The unit of service for these codes is the patient encounter, not number of lesions, number of aspirations, number of biopsies, number of injections, or number of localizations.”

Per the Radiology section of the NCCI, “Ultrasound guidance and diagnostic ultrasound (echography) procedures may be reported separately only if each service is distinct and separate. If a diagnostic ultrasound study identifies a previously unknown abnormality that requires a therapeutic procedure with ultrasound guidance at the same patient encounter, both the diagnostic ultrasound and ultrasound guidance procedure codes may be reported separately. However, a previously unknown abnormality identified during ultrasound guidance for a procedure should not be reported separately as a diagnostic ultrasound procedure.”

Under the Medicare program, the International Classification of Diseases 10th Revision (ICD-10) code selected should be based on the test results, with 2 exceptions. If the test does not yield a diagnosis or was normal, the physician should use the pre-service signs, symptoms, and conditions that prompted the study. If the test is a screening examination ordered in the absence of any signs or symptoms of illness or injury, the physician should select “screening” as the primary reason for the service and record the test results, if any, as additional diagnoses.

Modifiers must be used in specific settings. In the office, physicians who own the equipment and perform the service themselves (or the service is performed by an employed or contracted sonographer) may bill the global fee without any modifiers. However, if billing for a procedure on the same day as an office visit, the -25 modifier must be used. This indicates “[a] significant, separately identifiable evaluation and management service.” This modifier should not be used routinely. If the service is performed in a hospital, the -26 modifier must be used to indicate that the professional service only was provided when the physician does not own the machine (Tables 2, 3, 4). The payers will not reimburse physicians for the technical component in the hospital setting.

Reimbursement

In general, medical insurance plans will cover ultrasound studies when they are medically indicated. However, we recommend checking with each individual private payer directly, including Medicare. Medicare Part B will generally reimburse physicians for medically necessary diagnostic ultrasound services, provided the services are within the scope of the physician’s license. Some Medicare contractors require that the physician who performs and/or interprets some types of ultrasound examinations be capable of demonstrating relevant, documented training through recent residency training or post-graduate continuing medical education (CME) and experience. Medicare does not differentiate by medical specialty with respect to billing medically necessary diagnostic ultrasound services, provided the services are within the scope of the physician’s license. Some Medicare contractors have coverage policies regarding either the diagnostic study or ultrasound guidance of certain injections, or both.

Payment policies for beneficiaries enrolled in Medicare Part C, known as the Medicare Advantage plans, will reflect those of the private insurance administrator. The Medicare Advantage plan may be either a health maintenance organization (HMO) or a preferred provider organization (PPO). Private insurance payment rules vary by payer and plan with respect to which specialties may perform and receive reimbursement for ultrasound services. Some payers will reimburse providers of any specialty for ultrasound services, while others may restrict imaging procedures to specific specialties or providers possessing specific certifications or accreditations. Some insurers require physicians to submit applications requesting ultrasound be added to their list of services performed in their practice. Physicians should contact private payers before submitting claims to determine their requirements and request that they add ultrasound to the list of services.

When contacting the private payers, ask the following questions:

- What do I need to do to have ultrasound added to my practice’s contract or list of services?

- Are there any specific training requirements that I must meet or credentials that I must obtain in order to be privileged to perform ultrasound in my office?

- Do I need to send a letter or can I submit the request verbally?

- Is there an application that must be completed?

- If there is a privileging program, how long will it take after submission of the application before we are accepted?

- What is the fee schedule associated with these codes?

- Are there any bundling edits in place covering any of the services I am considering performing? (Be prepared to provide the codes for any non-ultrasound services you will be performing in conjunction with the ultrasound services.)

- Are there any preauthorization requirements for specific ultrasound studies?

- Are there any preauthorization requirements for specific ultrasound studies?

Documentation Requirements

All diagnostic ultrasound examinations, including those when ultrasound is used to guide a procedure, require that permanently recorded images be maintained in the patient record. The images can be kept in the patient record or some other archive—they do not need to be submitted with the claim. Images can be stored as printed images, on a tape or electronic medium. Documentation of the study must be available to the insurer upon request.

A written report of all ultrasound studies should be maintained in the patient’s record. In the case of ultrasound guidance, the written report may be filed as a separate item in the patient’s record or it may be included within the report of the procedure for which the guidance is utilized.

As examples of our documentation in the office, copies of 3 of our standard forms are available: “Ultrasound report of the shoulder” (Appendix 1), “Procedure note for an ultrasound-guided injection of cortisone” (Appendix 2), and “Procedure note for an ultrasound-guided injection of platelet-rich plasma” (Appendix 3).

Appropriate Use Criteria (AUC)

The Protecting Access to Medicare Act of 2014 was an effort to help reduce unnecessary imaging services and reduce costs; the Secretary of Health and Human Services was to establish a program to promote the use of “appropriate use criteria” (AUC) for advanced imaging services such as MRI, computed tomography, positron emission tomography, and nuclear cardiology. AUC are criteria that are developed or endorsed by national professional medical specialty societies or other provider-led entities to assist ordering professionals and furnishing professionals in making the most appropriate treatment decision for a specific clinical condition for an individual. The law also noted that the criteria should be evidence-based, meaning they should have stakeholder consensus, be scientifically valid, and be based on studies that are published and reviewable by stakeholders.

By April 2016, the Secretary will identify and publish the list of qualified clinical decision support mechanisms, which are tools that could be used by ordering professionals to ensure that AUC is met for applicable imaging services. These may include certified health electronic record technology, private sector clinical decision support mechanisms, and others. Actual use of the AUC will begin in January 2017. This legislation applies only to Medicare services, but other payers have cited concerns and may follow in the future.

Conclusion

Ultrasound is being increasingly used in varying specialties, especially orthopedic surgery. It provides a time- and cost-efficient modality with diagnostic power comparable to MRI. Portability and a high safety profile allows for ease of implementation as an in-office or sideline tool. Needle guidance and other intraoperative applications highlight its versatility as an adjunct to orthopedic treatments. This article provides a comprehensive guide to billing and coding for both diagnostic and therapeutic MSK ultrasound of the shoulder. Providers should stay up to date with upcoming appropriate use criteria and adjustments to current billing procedures.

1. Sivan M, Brown J, Brennan S, Bhakta B. A one-stop approach to the management of soft tissue and degenerative musculoskeletal conditions using clinic-based ultrasonography. Musculoskeletal Care. 2011;9(2):63-68.

2. Sharpe R, Nazarian L, Parker L, Rao V, Levin D. Dramatically increased musculoskeletal ultrasound utilization from 2000 to 2009, especially by podiatrists in private offices. Department of Radiology Faculty Papers. Paper 16. http://jdc.jefferson.edu/radiologyfp/16. Accessed January 7, 2016.

3. Blankstein A. Ultrasound in the diagnosis of clinical orthopedics: The orthopedic stethoscope. World J Orthop. 2011;2(2):13-24.

4. Sinha TP, Bhoi S, Kumar S, et al. Diagnostic accuracy of bedside emergency ultrasound screening for fractures in pediatric trauma patients. J Emerg Trauma Shock. 2011;4(4);443-445.

5. Bica D, Armen J, Kulas AS, Young K, Womack Z. Reliability and precision of stress sonography of the ulnar collateral ligament. J Ultrasound Med. 2015;34(3):371-376.

6. Tomer K, Kleinbaum Y, Heyman Z, Dudkiewicz I, Blankstein A. Ultrasound diagnosis of fractures in adults. Akt Traumatol. 2006;36(4):171-174.

7. Middleton W, Payne WT, Teefey SA, Hidebolt CF, Rubin DA, Yamaguchi K. Sonography and MRI of the shoulder: comparison of patient satisfaction. AJR Am J Roentgenol. 2004;183(5):1449-1452.

8. Teefey SA, Rubin DA, Middleton WD, Hildebolt CF, Leibold RA, Yamaguchi K. Detection and quantification of rotator cuff tears. Comparison of ultrasonographic, magnetic resonance and arthroscopic finding in seventy-one consecutive cases. J Bone Joint Surg Am. 2004;86-A(4):708-716.

9. Roy-JS, Braën C, Leblond J, et al. Diagnostic accuracy of ultrasonography, MRI and MR arthrography in the characterization of rotator cuff disorders: a meta-analysis. Br J Sports Med. 2015;49(20):1316-1328.

10. Parker L, Nazarian LN, Carrino JA, et al. Musculoskeletal Imaging: Medicare use, costs, and potential for cost substitution. J Am Coll Radiol. 2008;5(3):182-188.

11. Eustace J, Brophy D, Gibney R, Bresnihan B, FitzGerald O. Comparison of the accuracy of steroid placement with clinical outcome in patients with shoulder symptoms. Ann Rheum Dis. 1997;56(1):59-63.

12. Partington P, Broome G. Diagnostic injection around the shoulder: Hit and miss? A cadaveric study of injection accuracy. J Shoulder Elbow Surg. 1998;7(2):147-150.

13. Rutten M, Maresch B, Jager G, de Waal Malefijt M. Injection of the subacromial-subdeltoid bursa: Blind or ultrasound-guided? Acta Orthop. 2007;78(2):254-257.

14. Kang M, Rizio L, Prybicien M, Middlemas D, Blacksin M. The accuracy of subacromial corticosteroid injections: A comparison of multiple methods. J Shoulder Elbow Surg. 2008;17(1 Suppl):61S-66S.

15. Yamakado K. The targeting accuracy of subacromial injection to the shoulder: An arthrographic evaluation. Arthroscopy. 2002;19(8):887-891.

16. Henkus HE, Cobben M, Coerkamp E, Nelissen R, van Arkel E. The accuracy of subacromial injections: A prospective randomized magnetic resonance imaging study. Arthroscopy. 2006;22(3):277-282.

17. Sethi PM, El Attrache N. Accuracy of intra-articular injection of the glenohumeral joint: a cadaveric study. Orthopedics. 2006;29(2):149-152.

18. Naredo E, Cabero F, Beneyto P, et al. A randomized comparative study of short term response to blind injection versus sonographic-guided injection of local corticosteroids in patients with painful shoulder. J Rheumatol. 2004;31(2):308-314.

19. Finnoff JT, Hall MM, Adams E, et al. American Medical Society for Sports Medicine (AMSSM) position statement: interventional musculoskeletal ultrasound in sports medicine. Br J Sports Med. 2015;49(3):145-150.

20. Sibbitt WL Jr, Peisajovich A, Michael AA, et al. Does sonographic needle guidance affect the clinical outcome of intra-articular injections? J Rheumatol. 2009;36(9):1892-1902.

Although ultrasound has been around for many years, the technology is underutilized. It has been used primarily by the radiologists and obstetricians-gynecologists. However, orthopedic surgeons and sports medicine doctors are beginning to realize the utility of this imaging modality for their specialties. Ultrasound has classically been used as a diagnostic tool. This usage is beneficial to sports medicine specialists for on-field coverage at sports competitions to efficiently evaluate injuries without the need for taking the athletes back to the locker room for an x-ray or magnetic resonance imaging (MRI). Ultrasound can quickly assess for damage to soft tissue, joints, and superficial bones. Another of ultrasound’s benefits is its use as an adjunct to treatment. Ultrasound has been shown to vastly increase the accuracy of injections and can be used in surgery to accurately guide percutaneous techniques or to identify structures that previously required radiation-exposing fluoroscopy or large incisions to find by feel or eye.

Ultrasound is a technician-dependent modality. The surgeon and physician must become facile with the use of the probe and how ultrasound works. The use of the probe is similar to an arthroscope, requiring small movements of the hand to reveal the best imaging of the tissues. Rather than relying on just the patient’s position with an immobile machine, the user must use the probe position and the placement of the patient’s limb or body to optimize the use of ultrasound. Doing so saves time, money, and exposure to dangerous radiation. In a retrospective study of 1012 patients treated over a 10-month period, Sivan and colleagues1 concluded that the use of clinic-based musculoskeletal (MSK) ultrasound enables a one-stop approach, reduces repeat hospital appointments, and improves quality of care.With the increased use of ultrasound comes the need to accurately code and bill for the use of ultrasound. According to the College of Radiology, Medicare reimbursements for MSK ultrasound studies has increased by 316% from 2000-2009.2 Paradoxically, ultrasound has still been relatively underutilized when compared to the use of MSK MRI.

Diagnostic Ultrasound

Ultrasound is based off sound waves, emitted from a transducer, which are then bounced back off the underlying structures based on the density of that structure. The computer interprets the returning sound waves and produces an image reflecting the quality and strength of those returning waves. When the sound waves are bounced back strongly and quickly, like when hitting bone, we see an image that is intensely white (“hyperechoic”). When the sound waves encounter a substance that transmits those waves easily and do not return, like air or fluid, the image is dark (“hypoechoic”).

Ultrasound’s fundamental advantages start with every patient being able to have an ultrasound: no interference from metal, pacemakers, claustrophobia, or obesity. Contralateral comparisons, sono-palpation at the site of pathology, and real-time dynamic studies allow for a more comprehensive diagnostic evaluation. Doppler capabilities can further expand the usefulness of the evaluation and guide safer interventions. With the advent of high-resolution portable ultrasound machines, these studies can essentially be performed anywhere, and are typically done in a timely and cost-effective manner.

Ultrasound has many diagnostic uses for soft tissue, joint, and bone disorders. For soft tissues, ultrasound can image tears of muscles, tendons, and ligaments; show inflammation like tenosynovitis; demonstrate masses like hematomas, cysts, solid tumors, or calcific tendonitis; display nerve disorders like Morton’s neuroma; or confirm foreign bodies or infections.3-5 For joint disorders, ultrasound can show erosions on bones, loose bodies, pannus, inflammation, or effusions. For bone disorders, ultrasound can diagnose fractures and, sometimes, even stress fractures. Tomer and colleagues6 compared 51 patients with bone contusions and fractures; they determined that ultrasound was most reliable in the diagnosis of long bone diaphyseal fractures. The one disadvantage, especially when compared to MRI, is ultrasound’s inability to fully evaluate intra-articular or deep structures such as articular cartilage, the glenohumeral labrum, the biceps’ anchor, etc.

Magnetic Resonance Imaging