User login

Medically Unlikely Edits

Medically Unlikely Edits (MUEs) are benchmarks recognized by the Centers for Medicare & Medicaid Services (CMS) that are designed to prevent incorrect or excessive coding. Specifically, an MUE is an edit that tests medical claims for services billed in excess of the maximum number of units of service permitted for a single beneficiary on the same date of service from the same provider (eg, multiples of the same Healthcare Common Procedure Coding System [HCPCS] code listed on different claim lines).1

The MUE System

If the number of units of service billed by the same physician for the same patient on the same day exceeds the maximum number permitted by the CMS, the Medicare Administrative Contractor (MAC) will deny the code or return the claim to the provider for correction (return to provider [RTP]). Units of service billed in excess of the MUE will not be paid, but other services billed on the same claim form may still be paid. In the case of an MUE-associated RTP, the provider should resubmit a corrected claim, not an appeal; however, an appeal is possible in the case of an MUE-associated denial. An MUE-associated denial is a coding denial, not a medical necessity denial; therefore, the provider cannot use an Advance Beneficiary Notice to transfer liability for claim payment to the patient.

MUE Adjudication Indicators

In 2013, the CMS modified the MUE process to include 3 different MUE adjudication indicators (MAIs) with a value of 1, 2, or 3 so that some MUE values would be date of service edits rather than claim line edits.2 Medically Unlikely Edits for HCPCS codes with an MAI of 1 are identical to the prior claim line edits. If a provider needs to report excess units of service with an MAI of 1, appropriate modifiers should be used to report them on separate lines of a claim. Current Procedural Terminology (CPT) modifiers such as -76 (repeat procedure or service by the same physician) and -91 (repeat clinical diagnostic laboratory test) as well as anatomic modifiers (eg, RT, LT, F1, F2) may be used, with modifier -59 (distinct procedural service) used only if no other modifier suffices. An example of an MUE with an MAI of 1 is CPT code 17264 (destruction, malignant lesion [eg, laser surgery, electrosurgery, cryosurgery, chemosurgery, surgical curettement], trunk, arms or legs; lesion diameter 3.1–4.0 cm), for which the MUE threshold is 3, meaning no more than 3 destructions can be submitted per claim line without triggering an edit-based rejection or RTP.

An MAI of 2 denotes absolute date of service edits, or so-called “per day edits based on policy.” Such edits are in place because units of service billed in excess of the MUE value on the same date of service are considered to be impossible by the CMS based on regulatory guidance or anatomic considerations.2 For instance, although the same physician may destroy multiple actinic keratoses in a single patient on the same date of service, it would not be possible to code more than one unit of service as

CPT code 17000, which specifically and exclusively

refers to the first lesion destroyed. Similarly,

CPT code 13101 (repair, complex, trunk; lesion diameter 2.6–7.5 cm) could only be reported once that day, as all complex repairs at that anatomic site must be summed and smaller or larger totals would be reported with another code.

Anatomic limitations are sometimes obvious and do not require specific coding rules. For example, only 1 gallbladder can be removed per patient. Although Qualified Independent Contractors and Administrative Law Judges are not bound by MAIs, they do give particular deference to an MAI of

2 given its definitive nature.2 Because ambulatory surgical center providers (Medicare specialty code 49) cannot report modifier -50 for bilateral

procedures, the MUE value used for editing is doubled for HCPCS codes with an MAI of 2 or 3 if the bilateral surgery indicator for the HCPCS code is 1.3

An MAI of 3 describes less strict date of service edits, so-called “per day edits based on clinical benchmarks.”2 Similar to MAIs of 1, MUEs for MAIs of 3 are based on medically likely daily frequencies of services provided in most settings. To determine if an MUE with an MAI of 3 has been reached, the MAC sums the units of service billed on all claim lines of the current claim as well as all prior paid claims for the same patient billed by the same provider on the same date of service. If the total units of service obtained in this manner exceeds the MUE value, then all claim lines with the relevant code for the current claim will be denied, but prior paid claims will not be adjusted. Denials based on MUEs for codes with an MAI of 3 can be appealed to the local MAC. Successful appeals require documentation that the units of service in excess of the MUE value were actually delivered and demonstration of medical necessity.2 An example of a CPT code with an MAI of 3 is 40490 (biopsy of lip) for which the MUE value is 3.

Complications With MUE and MAI

Because MUEs are based on current coding guidelines as well as current clinical practice, they are only applicable for the time period in which they are in effect. A change made to an MUE value for a particular code is not retroactive; however, in exceptional circumstances when a retroactive effective date is applied, MACs are not directed to examine prior claims but only “claims that are brought to their attention.”2

It also is important to realize that not all MUEs are publicly available and many are confidential. When claim denials occur, particularly in the context of multiple units of a particular code, automated MUE edits should be among the issues that are suspected. Physicians may resubmit RTP claims on separate lines if a claim line edit (MAI of 1) is operative. An MAI of 2 suggests a coding error that needs to be corrected, as these coding approaches are generally impossible based on definitional issues or anatomy. If an MUE with an MAI of 3 is the reason for denial, an appeal is possible, provided there is documentation to show that the service was actually provided and that it was medically necessary.

Final Thoughts

Dermatologists should be vigilant for unexpected payment denials, which may coincide with the implementation of new MUE values. When such denials occur and MUE values are publicly available, dermatologists should consider filing an appeal if the relevant MUEs were associated with an MAI of 1 or 3. Overall, dermatologists should be aware that many MUEs that were formerly claim line edits (MAI of 1) have been recently transitioned to date of service edits (MAI of 3), which are more restrictive.

1. American Academy of Dermatology. Medicare’s expanded medically unlikely edits. https://www.aad.org/members

/practice-and-advocacy-resource-center/coding-resources

/derm-coding-consult-library/winter-2014/medicare-

s-expanded-medically-unlikely-edits. Published Winter 2014. Accessed August 6, 2015.

2. Centers for Medicare & Medicaid Services. Revised modification to the Medically Unlikely Edit (MUE) program. MLN Matters. Number MM8853. https://www.cms.gov

/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM8853.pdf. Published January 1, 2015. Accessed August 6, 2015.

3. Centers for Medicare & Medicaid Services.

Medically Unlikely Edits (MUE) and bilateral procedures. MLN Matters. Number SE1422.

https://www.cms.gov/Regulations-and-Guidance

/Guidance/Transmittals/2014-Transmittals-Items/SE1422.html?DLPage=2&DLEntries=10&DLSort=1&DLSort

Dir=ascending. Accessed July 28, 2015.

Medically Unlikely Edits (MUEs) are benchmarks recognized by the Centers for Medicare & Medicaid Services (CMS) that are designed to prevent incorrect or excessive coding. Specifically, an MUE is an edit that tests medical claims for services billed in excess of the maximum number of units of service permitted for a single beneficiary on the same date of service from the same provider (eg, multiples of the same Healthcare Common Procedure Coding System [HCPCS] code listed on different claim lines).1

The MUE System

If the number of units of service billed by the same physician for the same patient on the same day exceeds the maximum number permitted by the CMS, the Medicare Administrative Contractor (MAC) will deny the code or return the claim to the provider for correction (return to provider [RTP]). Units of service billed in excess of the MUE will not be paid, but other services billed on the same claim form may still be paid. In the case of an MUE-associated RTP, the provider should resubmit a corrected claim, not an appeal; however, an appeal is possible in the case of an MUE-associated denial. An MUE-associated denial is a coding denial, not a medical necessity denial; therefore, the provider cannot use an Advance Beneficiary Notice to transfer liability for claim payment to the patient.

MUE Adjudication Indicators

In 2013, the CMS modified the MUE process to include 3 different MUE adjudication indicators (MAIs) with a value of 1, 2, or 3 so that some MUE values would be date of service edits rather than claim line edits.2 Medically Unlikely Edits for HCPCS codes with an MAI of 1 are identical to the prior claim line edits. If a provider needs to report excess units of service with an MAI of 1, appropriate modifiers should be used to report them on separate lines of a claim. Current Procedural Terminology (CPT) modifiers such as -76 (repeat procedure or service by the same physician) and -91 (repeat clinical diagnostic laboratory test) as well as anatomic modifiers (eg, RT, LT, F1, F2) may be used, with modifier -59 (distinct procedural service) used only if no other modifier suffices. An example of an MUE with an MAI of 1 is CPT code 17264 (destruction, malignant lesion [eg, laser surgery, electrosurgery, cryosurgery, chemosurgery, surgical curettement], trunk, arms or legs; lesion diameter 3.1–4.0 cm), for which the MUE threshold is 3, meaning no more than 3 destructions can be submitted per claim line without triggering an edit-based rejection or RTP.

An MAI of 2 denotes absolute date of service edits, or so-called “per day edits based on policy.” Such edits are in place because units of service billed in excess of the MUE value on the same date of service are considered to be impossible by the CMS based on regulatory guidance or anatomic considerations.2 For instance, although the same physician may destroy multiple actinic keratoses in a single patient on the same date of service, it would not be possible to code more than one unit of service as

CPT code 17000, which specifically and exclusively

refers to the first lesion destroyed. Similarly,

CPT code 13101 (repair, complex, trunk; lesion diameter 2.6–7.5 cm) could only be reported once that day, as all complex repairs at that anatomic site must be summed and smaller or larger totals would be reported with another code.

Anatomic limitations are sometimes obvious and do not require specific coding rules. For example, only 1 gallbladder can be removed per patient. Although Qualified Independent Contractors and Administrative Law Judges are not bound by MAIs, they do give particular deference to an MAI of

2 given its definitive nature.2 Because ambulatory surgical center providers (Medicare specialty code 49) cannot report modifier -50 for bilateral

procedures, the MUE value used for editing is doubled for HCPCS codes with an MAI of 2 or 3 if the bilateral surgery indicator for the HCPCS code is 1.3

An MAI of 3 describes less strict date of service edits, so-called “per day edits based on clinical benchmarks.”2 Similar to MAIs of 1, MUEs for MAIs of 3 are based on medically likely daily frequencies of services provided in most settings. To determine if an MUE with an MAI of 3 has been reached, the MAC sums the units of service billed on all claim lines of the current claim as well as all prior paid claims for the same patient billed by the same provider on the same date of service. If the total units of service obtained in this manner exceeds the MUE value, then all claim lines with the relevant code for the current claim will be denied, but prior paid claims will not be adjusted. Denials based on MUEs for codes with an MAI of 3 can be appealed to the local MAC. Successful appeals require documentation that the units of service in excess of the MUE value were actually delivered and demonstration of medical necessity.2 An example of a CPT code with an MAI of 3 is 40490 (biopsy of lip) for which the MUE value is 3.

Complications With MUE and MAI

Because MUEs are based on current coding guidelines as well as current clinical practice, they are only applicable for the time period in which they are in effect. A change made to an MUE value for a particular code is not retroactive; however, in exceptional circumstances when a retroactive effective date is applied, MACs are not directed to examine prior claims but only “claims that are brought to their attention.”2

It also is important to realize that not all MUEs are publicly available and many are confidential. When claim denials occur, particularly in the context of multiple units of a particular code, automated MUE edits should be among the issues that are suspected. Physicians may resubmit RTP claims on separate lines if a claim line edit (MAI of 1) is operative. An MAI of 2 suggests a coding error that needs to be corrected, as these coding approaches are generally impossible based on definitional issues or anatomy. If an MUE with an MAI of 3 is the reason for denial, an appeal is possible, provided there is documentation to show that the service was actually provided and that it was medically necessary.

Final Thoughts

Dermatologists should be vigilant for unexpected payment denials, which may coincide with the implementation of new MUE values. When such denials occur and MUE values are publicly available, dermatologists should consider filing an appeal if the relevant MUEs were associated with an MAI of 1 or 3. Overall, dermatologists should be aware that many MUEs that were formerly claim line edits (MAI of 1) have been recently transitioned to date of service edits (MAI of 3), which are more restrictive.

Medically Unlikely Edits (MUEs) are benchmarks recognized by the Centers for Medicare & Medicaid Services (CMS) that are designed to prevent incorrect or excessive coding. Specifically, an MUE is an edit that tests medical claims for services billed in excess of the maximum number of units of service permitted for a single beneficiary on the same date of service from the same provider (eg, multiples of the same Healthcare Common Procedure Coding System [HCPCS] code listed on different claim lines).1

The MUE System

If the number of units of service billed by the same physician for the same patient on the same day exceeds the maximum number permitted by the CMS, the Medicare Administrative Contractor (MAC) will deny the code or return the claim to the provider for correction (return to provider [RTP]). Units of service billed in excess of the MUE will not be paid, but other services billed on the same claim form may still be paid. In the case of an MUE-associated RTP, the provider should resubmit a corrected claim, not an appeal; however, an appeal is possible in the case of an MUE-associated denial. An MUE-associated denial is a coding denial, not a medical necessity denial; therefore, the provider cannot use an Advance Beneficiary Notice to transfer liability for claim payment to the patient.

MUE Adjudication Indicators

In 2013, the CMS modified the MUE process to include 3 different MUE adjudication indicators (MAIs) with a value of 1, 2, or 3 so that some MUE values would be date of service edits rather than claim line edits.2 Medically Unlikely Edits for HCPCS codes with an MAI of 1 are identical to the prior claim line edits. If a provider needs to report excess units of service with an MAI of 1, appropriate modifiers should be used to report them on separate lines of a claim. Current Procedural Terminology (CPT) modifiers such as -76 (repeat procedure or service by the same physician) and -91 (repeat clinical diagnostic laboratory test) as well as anatomic modifiers (eg, RT, LT, F1, F2) may be used, with modifier -59 (distinct procedural service) used only if no other modifier suffices. An example of an MUE with an MAI of 1 is CPT code 17264 (destruction, malignant lesion [eg, laser surgery, electrosurgery, cryosurgery, chemosurgery, surgical curettement], trunk, arms or legs; lesion diameter 3.1–4.0 cm), for which the MUE threshold is 3, meaning no more than 3 destructions can be submitted per claim line without triggering an edit-based rejection or RTP.

An MAI of 2 denotes absolute date of service edits, or so-called “per day edits based on policy.” Such edits are in place because units of service billed in excess of the MUE value on the same date of service are considered to be impossible by the CMS based on regulatory guidance or anatomic considerations.2 For instance, although the same physician may destroy multiple actinic keratoses in a single patient on the same date of service, it would not be possible to code more than one unit of service as

CPT code 17000, which specifically and exclusively

refers to the first lesion destroyed. Similarly,

CPT code 13101 (repair, complex, trunk; lesion diameter 2.6–7.5 cm) could only be reported once that day, as all complex repairs at that anatomic site must be summed and smaller or larger totals would be reported with another code.

Anatomic limitations are sometimes obvious and do not require specific coding rules. For example, only 1 gallbladder can be removed per patient. Although Qualified Independent Contractors and Administrative Law Judges are not bound by MAIs, they do give particular deference to an MAI of

2 given its definitive nature.2 Because ambulatory surgical center providers (Medicare specialty code 49) cannot report modifier -50 for bilateral

procedures, the MUE value used for editing is doubled for HCPCS codes with an MAI of 2 or 3 if the bilateral surgery indicator for the HCPCS code is 1.3

An MAI of 3 describes less strict date of service edits, so-called “per day edits based on clinical benchmarks.”2 Similar to MAIs of 1, MUEs for MAIs of 3 are based on medically likely daily frequencies of services provided in most settings. To determine if an MUE with an MAI of 3 has been reached, the MAC sums the units of service billed on all claim lines of the current claim as well as all prior paid claims for the same patient billed by the same provider on the same date of service. If the total units of service obtained in this manner exceeds the MUE value, then all claim lines with the relevant code for the current claim will be denied, but prior paid claims will not be adjusted. Denials based on MUEs for codes with an MAI of 3 can be appealed to the local MAC. Successful appeals require documentation that the units of service in excess of the MUE value were actually delivered and demonstration of medical necessity.2 An example of a CPT code with an MAI of 3 is 40490 (biopsy of lip) for which the MUE value is 3.

Complications With MUE and MAI

Because MUEs are based on current coding guidelines as well as current clinical practice, they are only applicable for the time period in which they are in effect. A change made to an MUE value for a particular code is not retroactive; however, in exceptional circumstances when a retroactive effective date is applied, MACs are not directed to examine prior claims but only “claims that are brought to their attention.”2

It also is important to realize that not all MUEs are publicly available and many are confidential. When claim denials occur, particularly in the context of multiple units of a particular code, automated MUE edits should be among the issues that are suspected. Physicians may resubmit RTP claims on separate lines if a claim line edit (MAI of 1) is operative. An MAI of 2 suggests a coding error that needs to be corrected, as these coding approaches are generally impossible based on definitional issues or anatomy. If an MUE with an MAI of 3 is the reason for denial, an appeal is possible, provided there is documentation to show that the service was actually provided and that it was medically necessary.

Final Thoughts

Dermatologists should be vigilant for unexpected payment denials, which may coincide with the implementation of new MUE values. When such denials occur and MUE values are publicly available, dermatologists should consider filing an appeal if the relevant MUEs were associated with an MAI of 1 or 3. Overall, dermatologists should be aware that many MUEs that were formerly claim line edits (MAI of 1) have been recently transitioned to date of service edits (MAI of 3), which are more restrictive.

1. American Academy of Dermatology. Medicare’s expanded medically unlikely edits. https://www.aad.org/members

/practice-and-advocacy-resource-center/coding-resources

/derm-coding-consult-library/winter-2014/medicare-

s-expanded-medically-unlikely-edits. Published Winter 2014. Accessed August 6, 2015.

2. Centers for Medicare & Medicaid Services. Revised modification to the Medically Unlikely Edit (MUE) program. MLN Matters. Number MM8853. https://www.cms.gov

/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM8853.pdf. Published January 1, 2015. Accessed August 6, 2015.

3. Centers for Medicare & Medicaid Services.

Medically Unlikely Edits (MUE) and bilateral procedures. MLN Matters. Number SE1422.

https://www.cms.gov/Regulations-and-Guidance

/Guidance/Transmittals/2014-Transmittals-Items/SE1422.html?DLPage=2&DLEntries=10&DLSort=1&DLSort

Dir=ascending. Accessed July 28, 2015.

1. American Academy of Dermatology. Medicare’s expanded medically unlikely edits. https://www.aad.org/members

/practice-and-advocacy-resource-center/coding-resources

/derm-coding-consult-library/winter-2014/medicare-

s-expanded-medically-unlikely-edits. Published Winter 2014. Accessed August 6, 2015.

2. Centers for Medicare & Medicaid Services. Revised modification to the Medically Unlikely Edit (MUE) program. MLN Matters. Number MM8853. https://www.cms.gov

/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM8853.pdf. Published January 1, 2015. Accessed August 6, 2015.

3. Centers for Medicare & Medicaid Services.

Medically Unlikely Edits (MUE) and bilateral procedures. MLN Matters. Number SE1422.

https://www.cms.gov/Regulations-and-Guidance

/Guidance/Transmittals/2014-Transmittals-Items/SE1422.html?DLPage=2&DLEntries=10&DLSort=1&DLSort

Dir=ascending. Accessed July 28, 2015.

Practice Points

- Medically Unlikely Edits (MUEs) are designed to prevent incorrect or excessive coding. Units of service billed in excess of the MUE will not be paid.

- Three different MUE adjudication indicators (MAIs) were added so that some MUE values would be date of service edits.

- Dermatologists should be vigilant for unexpected payment denials.

Is Your Electronic Health Record Putting You at Risk for a Documentation Audit?

A group of 3 busy orthopedists attended coding education each year and did their best to accurately code and document their services. As a risk-reduction strategy, the group engaged our firm to conduct an audit to determine whether they were documenting their services properly and to provide feedback about how they could improve.

What we found was shocking to the surgeons, but all too common, as we review thousands of orthopedic visit notes every year: The same examination had been documented for all visits, with physicians stating in their notes that the examination was medically necessary. In addition, their documentation supported Current Procedural Terminology (CPT) code 99214 at every visit, with visit frequencies of 2 weeks to 4 months.

The culprit of all this sameness? The practice’s electronic health record (EHR).

“Practices with EHRs often have a large volume of visit notes that look almost identical for a patient who is seen for multiple visits,” explains Mary LeGrand, RN, MA, CCS-P, CPC, KarenZupko & Associates consultant and coding educator. “And that is putting physicians at higher risk of being audited or of not passing an audit.”

According to LeGrand, this is because physicians are using the practice’s EHR to “pull forward” the patient’s previous visit note for the current visit, but failing to customize it for the current visit. The unintended consequence of this workflow efficiency is twofold:

1. It creates documentation that looks strikingly similar to, if not exactly like, the patient’s last billed visit note. This is often referred to as note “cloning.”

2. It creates documentation that includes a lot of unnecessary detail that, even if delivered and documented, doesn’t match the medical necessity of the visit, based on the history of present illness statements.

Both of these things can come back to bite you.

Zero in on the Risk

If your practice has an EHR, it is important that you evaluate whether certain workflow efficiency features are putting the practice at risk. You do not necessarily need to dump the EHR, but you may need to take action to reduce the risk of using these features.

In a pre-EHR practice, physicians began each visit with a blank piece of paper or dictated the entire visit. Then along came EHR vendors who, in an effort to make things easier and more efficient, created visit templates and the ability to “pull forward” the last visit note and use it as a basis for the current visit. The intention was always that physicians would modify it based on the current visit. But the reality is that physicians are busy, editing is time-consuming, and the unintended consequence is cloning.

“If you pull in unnecessary history or exam information from a previous visit that’s not relevant to the current visit, you can get dinged in an audit for not customizing the note to the patient’s specific presenting complaint,” LeGrand explains, “or, for attempting to bill a higher-level code by unintentionally padding the note with irrelevant information. What is documented for ‘reference’ has to be separated from what can be used to select the level of service.”

Your first documentation risk-reduction strategy is to review notes and look for signs of cloning.

LeGrand explains that a practice may be predisposed to cloning simply because of the way the EHR templates and workflow were set up when the system was implemented. “But,” she says, “‘the EHR made me do it’ defense won’t hold water, because it’s still the physician’s responsibility to customize or remove the information from templates and make the note unique to the visit.”

Yes, physician time is precious. But the reality is that the onus is on the physician to integrate EHR features with clinic workflow and to follow documentation rules.

The second documentation risk-reduction strategy is to make sure the level of evaluation and management (E/M) service billed is supported by medical necessity, not only by documentation artifacts that were relevant to the patient in the past but irrelevant to his or her current presenting complaint or condition.

“Medicare won’t pay for services that aren’t supported by medical necessity,” says LeGrand, “and you can’t achieve medical necessity by simply documenting additional E/M elements.”

This has always been the rule, LeGrand says. “But with the increased use of EHRs, and templates that automatically document visit elements and drive visits to a higher level of service, the Centers for Medicare & Medicaid Services [CMS] and private payers have added scrutiny to medical necessity reviews. They want to validate that higher-level visits billed indeed required a higher level of history and/or exam.”

To do this, the Office of the Inspector General (OIG) has supplemented its audit team with registered nurses. “The nurses assist certified coders by determining whether medical necessity has been met,” explains LeGrand.

Look at a patient who presents with toe pain. You take a detailed family history, conduct a review of systems (ROS), bill a high-level code, and document all the elements to support it. LeGrand explains, “There is no medical necessity to support doing an eye exam for a patient with toe pain in the absence of any other medical history, or performing a ROS to correlate an eye exam with toe pain. So, even if you do it and document it, the higher-level code won’t pass muster in an audit because the information documented is not medically necessary.”

According to LeGrand, the extent of the history and examination should be based on the presenting problem and the patient’s condition. “If an ankle sprain patient returns 2 weeks after the initial evaluation of the injury with a negative medical or surgical history, and the patient has been treated conservatively, it’s probably not necessary to conduct a ROS that includes 10 organ systems,” she says. “If your standard of care is to perform this level of service, no one will fault you for your care delivery; however, if you also choose a level of service based on this system review, without relevance to the presenting problem, and you bill a higher level of service than is supported by the nature of the presenting problem or the plan of care, the documentation probably won’t hold up in an audit where medical necessity is valued into the equation.”

On the other hand, LeGrand adds, if a patient presents to the emergency department after an automobile accident with an open fracture and other injuries, and the surgeon performs a complete ROS, the medical necessity would most likely be supported as the surgeon is preparing the patient for surgery.

Based on LeGrand’s work with practices, this distinction about medical necessity is news to many nonclinical billing staff. “They confuse medical necessity with medical decision-making, an E/M code documentation component, and incorrectly bill for a high-level visit because medical decision-making elements meet the documentation requirements—yet the code is not supported by medical necessity of the presenting problem.”

Talk with your billing team to make sure all staff members understand this critical difference. They must comprehend that the medically necessary level of service is determined by a number of clinical factors, not medical decision-making. Describe some of these clinical factors, which include, but are not limited to, chief complaint, clinical judgment, standards of practice, acute exacerbations/onsets of medical conditions or injuries, and comorbidities.

EHR Dos and Don’ts

LeGrand recommends the following best practices for using EHR documentation features:

1. DON’T simply cut and paste from a previous note. “This is what leads to verbose notes that have little to do with the patient you are documenting,” she says. “If you don’t cut and paste, you’ll avoid the root cause of this risk.”

2. DON’T pull forward information from previous visit notes that have nothing to do with the nature of the patient’s problem. “We understand that this takes extra time because physicians must review the previous note,” LeGrand says. “So if you don’t have time to review the past note, just don’t pull it forward. Start fresh with a new drop-down menu and select elements pertinent to the current visit. Or, dictate or type a note relevant to the current condition and presenting problems.”

How you choose to work this into your process will vary depending on which EHR system you use. “One surgeon I work with dictates everything because the drop-down menus and templates are cumbersome,” LeGrand says. “Some groups find it faster to use the EHR templates that they have customized. Others find their EHR’s point-and-click features most efficient for customizing quickly.”

3. DO customize your EHR visit templates if the use of templates is critical to your efficiency. “This is the most overlooked step in the EHR implementation process because it takes a fair amount of time to do,” LeGrand says. She suggests avoiding the use of multisystem examination templates created for medicine specialties altogether, and insists, “Don’t assume ‘that is how the vendor built it so we have to use it.’ Customize a template for each of your visit types so you can document in the EHR in the same fashion as when you used a paper system. Doing so will save you loads of documentation time.”

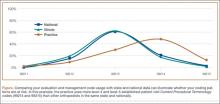

4. DO review your E/M code distribution. Generate a CPT frequency report for each physician and for the practice as a whole. Compare the data with state and national usage in orthopedics as a baseline. The American Academy of Orthopaedic Surgeon’s Code-X tool enables easy comparison of your practice’s E/M code usage with state and national data for orthopedics. Simply generate a CPT frequency report from your practice management system and enter the E/M data. Line graphs are automatically generated, making trends and patterns easy to see (Figure).

“Identify your outliers, pull charts randomly, and review the notes,” recommends LeGrand. “Make sure there is medical necessity for the level of code that’s been billed and that documentation supports it.”

You may be surprised to find you are an outlier on inpatient hospital codes, or your distribution of level-2 or -3 codes varies from your practice, state, or national data. Orthopedic surgeons don’t typically report high volumes of CPT codes 99204, 99205 or 99215, but if your practice does and you are an outlier, best to pay attention before someone else does.

5. DO select auditors with the right skill sets. Evaluating medical necessity in the note requires a clinical background. “If internal documentation reviews are conducted by the billing team, that’s fine,” LeGrand advises. “Just add a physician assistant or nurse to your internal review team. They can provide clinical oversight and review the note when necessary for medical necessity.”

If you are contracting with external auditors or consultants, verify auditor credentials and skill sets to ensure they can abstract and incorporate medical necessity into the review. “Auditors must be able to do more than count elements,” LeGrand says. “They must have clinical knowledge, and expertise in orthopedics is critical. This knowledge should be used to verify that medical necessity is present in every note.” LeGrand is quick to point out that not every note will be at risk, based on the amount of work performed and documented and the level of service billed. “But medical necessity must always be present.”

The addition of nurses to the OIG’s audit team is a big change and will refine the auditing process by adding more clinical scrutiny. The EHR documentation features are intended to improve efficiency, but only a clinician can determine and document unique visit elements and medical necessity.

Address these intersections of risk by ensuring your documentation meets medical necessity as well as E/M documentation elements. Conduct internal audits bi-annually to verify that E/M usage patterns align with peers and physician documentation is appropriate. And be sure there is clinical expertise on your audit team, whether it is internal or external. CMS now has it, and your practice should too. ◾

A group of 3 busy orthopedists attended coding education each year and did their best to accurately code and document their services. As a risk-reduction strategy, the group engaged our firm to conduct an audit to determine whether they were documenting their services properly and to provide feedback about how they could improve.

What we found was shocking to the surgeons, but all too common, as we review thousands of orthopedic visit notes every year: The same examination had been documented for all visits, with physicians stating in their notes that the examination was medically necessary. In addition, their documentation supported Current Procedural Terminology (CPT) code 99214 at every visit, with visit frequencies of 2 weeks to 4 months.

The culprit of all this sameness? The practice’s electronic health record (EHR).

“Practices with EHRs often have a large volume of visit notes that look almost identical for a patient who is seen for multiple visits,” explains Mary LeGrand, RN, MA, CCS-P, CPC, KarenZupko & Associates consultant and coding educator. “And that is putting physicians at higher risk of being audited or of not passing an audit.”

According to LeGrand, this is because physicians are using the practice’s EHR to “pull forward” the patient’s previous visit note for the current visit, but failing to customize it for the current visit. The unintended consequence of this workflow efficiency is twofold:

1. It creates documentation that looks strikingly similar to, if not exactly like, the patient’s last billed visit note. This is often referred to as note “cloning.”

2. It creates documentation that includes a lot of unnecessary detail that, even if delivered and documented, doesn’t match the medical necessity of the visit, based on the history of present illness statements.

Both of these things can come back to bite you.

Zero in on the Risk

If your practice has an EHR, it is important that you evaluate whether certain workflow efficiency features are putting the practice at risk. You do not necessarily need to dump the EHR, but you may need to take action to reduce the risk of using these features.

In a pre-EHR practice, physicians began each visit with a blank piece of paper or dictated the entire visit. Then along came EHR vendors who, in an effort to make things easier and more efficient, created visit templates and the ability to “pull forward” the last visit note and use it as a basis for the current visit. The intention was always that physicians would modify it based on the current visit. But the reality is that physicians are busy, editing is time-consuming, and the unintended consequence is cloning.

“If you pull in unnecessary history or exam information from a previous visit that’s not relevant to the current visit, you can get dinged in an audit for not customizing the note to the patient’s specific presenting complaint,” LeGrand explains, “or, for attempting to bill a higher-level code by unintentionally padding the note with irrelevant information. What is documented for ‘reference’ has to be separated from what can be used to select the level of service.”

Your first documentation risk-reduction strategy is to review notes and look for signs of cloning.

LeGrand explains that a practice may be predisposed to cloning simply because of the way the EHR templates and workflow were set up when the system was implemented. “But,” she says, “‘the EHR made me do it’ defense won’t hold water, because it’s still the physician’s responsibility to customize or remove the information from templates and make the note unique to the visit.”

Yes, physician time is precious. But the reality is that the onus is on the physician to integrate EHR features with clinic workflow and to follow documentation rules.

The second documentation risk-reduction strategy is to make sure the level of evaluation and management (E/M) service billed is supported by medical necessity, not only by documentation artifacts that were relevant to the patient in the past but irrelevant to his or her current presenting complaint or condition.

“Medicare won’t pay for services that aren’t supported by medical necessity,” says LeGrand, “and you can’t achieve medical necessity by simply documenting additional E/M elements.”

This has always been the rule, LeGrand says. “But with the increased use of EHRs, and templates that automatically document visit elements and drive visits to a higher level of service, the Centers for Medicare & Medicaid Services [CMS] and private payers have added scrutiny to medical necessity reviews. They want to validate that higher-level visits billed indeed required a higher level of history and/or exam.”

To do this, the Office of the Inspector General (OIG) has supplemented its audit team with registered nurses. “The nurses assist certified coders by determining whether medical necessity has been met,” explains LeGrand.

Look at a patient who presents with toe pain. You take a detailed family history, conduct a review of systems (ROS), bill a high-level code, and document all the elements to support it. LeGrand explains, “There is no medical necessity to support doing an eye exam for a patient with toe pain in the absence of any other medical history, or performing a ROS to correlate an eye exam with toe pain. So, even if you do it and document it, the higher-level code won’t pass muster in an audit because the information documented is not medically necessary.”

According to LeGrand, the extent of the history and examination should be based on the presenting problem and the patient’s condition. “If an ankle sprain patient returns 2 weeks after the initial evaluation of the injury with a negative medical or surgical history, and the patient has been treated conservatively, it’s probably not necessary to conduct a ROS that includes 10 organ systems,” she says. “If your standard of care is to perform this level of service, no one will fault you for your care delivery; however, if you also choose a level of service based on this system review, without relevance to the presenting problem, and you bill a higher level of service than is supported by the nature of the presenting problem or the plan of care, the documentation probably won’t hold up in an audit where medical necessity is valued into the equation.”

On the other hand, LeGrand adds, if a patient presents to the emergency department after an automobile accident with an open fracture and other injuries, and the surgeon performs a complete ROS, the medical necessity would most likely be supported as the surgeon is preparing the patient for surgery.

Based on LeGrand’s work with practices, this distinction about medical necessity is news to many nonclinical billing staff. “They confuse medical necessity with medical decision-making, an E/M code documentation component, and incorrectly bill for a high-level visit because medical decision-making elements meet the documentation requirements—yet the code is not supported by medical necessity of the presenting problem.”

Talk with your billing team to make sure all staff members understand this critical difference. They must comprehend that the medically necessary level of service is determined by a number of clinical factors, not medical decision-making. Describe some of these clinical factors, which include, but are not limited to, chief complaint, clinical judgment, standards of practice, acute exacerbations/onsets of medical conditions or injuries, and comorbidities.

EHR Dos and Don’ts

LeGrand recommends the following best practices for using EHR documentation features:

1. DON’T simply cut and paste from a previous note. “This is what leads to verbose notes that have little to do with the patient you are documenting,” she says. “If you don’t cut and paste, you’ll avoid the root cause of this risk.”

2. DON’T pull forward information from previous visit notes that have nothing to do with the nature of the patient’s problem. “We understand that this takes extra time because physicians must review the previous note,” LeGrand says. “So if you don’t have time to review the past note, just don’t pull it forward. Start fresh with a new drop-down menu and select elements pertinent to the current visit. Or, dictate or type a note relevant to the current condition and presenting problems.”

How you choose to work this into your process will vary depending on which EHR system you use. “One surgeon I work with dictates everything because the drop-down menus and templates are cumbersome,” LeGrand says. “Some groups find it faster to use the EHR templates that they have customized. Others find their EHR’s point-and-click features most efficient for customizing quickly.”

3. DO customize your EHR visit templates if the use of templates is critical to your efficiency. “This is the most overlooked step in the EHR implementation process because it takes a fair amount of time to do,” LeGrand says. She suggests avoiding the use of multisystem examination templates created for medicine specialties altogether, and insists, “Don’t assume ‘that is how the vendor built it so we have to use it.’ Customize a template for each of your visit types so you can document in the EHR in the same fashion as when you used a paper system. Doing so will save you loads of documentation time.”

4. DO review your E/M code distribution. Generate a CPT frequency report for each physician and for the practice as a whole. Compare the data with state and national usage in orthopedics as a baseline. The American Academy of Orthopaedic Surgeon’s Code-X tool enables easy comparison of your practice’s E/M code usage with state and national data for orthopedics. Simply generate a CPT frequency report from your practice management system and enter the E/M data. Line graphs are automatically generated, making trends and patterns easy to see (Figure).

“Identify your outliers, pull charts randomly, and review the notes,” recommends LeGrand. “Make sure there is medical necessity for the level of code that’s been billed and that documentation supports it.”

You may be surprised to find you are an outlier on inpatient hospital codes, or your distribution of level-2 or -3 codes varies from your practice, state, or national data. Orthopedic surgeons don’t typically report high volumes of CPT codes 99204, 99205 or 99215, but if your practice does and you are an outlier, best to pay attention before someone else does.

5. DO select auditors with the right skill sets. Evaluating medical necessity in the note requires a clinical background. “If internal documentation reviews are conducted by the billing team, that’s fine,” LeGrand advises. “Just add a physician assistant or nurse to your internal review team. They can provide clinical oversight and review the note when necessary for medical necessity.”

If you are contracting with external auditors or consultants, verify auditor credentials and skill sets to ensure they can abstract and incorporate medical necessity into the review. “Auditors must be able to do more than count elements,” LeGrand says. “They must have clinical knowledge, and expertise in orthopedics is critical. This knowledge should be used to verify that medical necessity is present in every note.” LeGrand is quick to point out that not every note will be at risk, based on the amount of work performed and documented and the level of service billed. “But medical necessity must always be present.”

The addition of nurses to the OIG’s audit team is a big change and will refine the auditing process by adding more clinical scrutiny. The EHR documentation features are intended to improve efficiency, but only a clinician can determine and document unique visit elements and medical necessity.

Address these intersections of risk by ensuring your documentation meets medical necessity as well as E/M documentation elements. Conduct internal audits bi-annually to verify that E/M usage patterns align with peers and physician documentation is appropriate. And be sure there is clinical expertise on your audit team, whether it is internal or external. CMS now has it, and your practice should too. ◾

A group of 3 busy orthopedists attended coding education each year and did their best to accurately code and document their services. As a risk-reduction strategy, the group engaged our firm to conduct an audit to determine whether they were documenting their services properly and to provide feedback about how they could improve.

What we found was shocking to the surgeons, but all too common, as we review thousands of orthopedic visit notes every year: The same examination had been documented for all visits, with physicians stating in their notes that the examination was medically necessary. In addition, their documentation supported Current Procedural Terminology (CPT) code 99214 at every visit, with visit frequencies of 2 weeks to 4 months.

The culprit of all this sameness? The practice’s electronic health record (EHR).

“Practices with EHRs often have a large volume of visit notes that look almost identical for a patient who is seen for multiple visits,” explains Mary LeGrand, RN, MA, CCS-P, CPC, KarenZupko & Associates consultant and coding educator. “And that is putting physicians at higher risk of being audited or of not passing an audit.”

According to LeGrand, this is because physicians are using the practice’s EHR to “pull forward” the patient’s previous visit note for the current visit, but failing to customize it for the current visit. The unintended consequence of this workflow efficiency is twofold:

1. It creates documentation that looks strikingly similar to, if not exactly like, the patient’s last billed visit note. This is often referred to as note “cloning.”

2. It creates documentation that includes a lot of unnecessary detail that, even if delivered and documented, doesn’t match the medical necessity of the visit, based on the history of present illness statements.

Both of these things can come back to bite you.

Zero in on the Risk

If your practice has an EHR, it is important that you evaluate whether certain workflow efficiency features are putting the practice at risk. You do not necessarily need to dump the EHR, but you may need to take action to reduce the risk of using these features.

In a pre-EHR practice, physicians began each visit with a blank piece of paper or dictated the entire visit. Then along came EHR vendors who, in an effort to make things easier and more efficient, created visit templates and the ability to “pull forward” the last visit note and use it as a basis for the current visit. The intention was always that physicians would modify it based on the current visit. But the reality is that physicians are busy, editing is time-consuming, and the unintended consequence is cloning.

“If you pull in unnecessary history or exam information from a previous visit that’s not relevant to the current visit, you can get dinged in an audit for not customizing the note to the patient’s specific presenting complaint,” LeGrand explains, “or, for attempting to bill a higher-level code by unintentionally padding the note with irrelevant information. What is documented for ‘reference’ has to be separated from what can be used to select the level of service.”

Your first documentation risk-reduction strategy is to review notes and look for signs of cloning.

LeGrand explains that a practice may be predisposed to cloning simply because of the way the EHR templates and workflow were set up when the system was implemented. “But,” she says, “‘the EHR made me do it’ defense won’t hold water, because it’s still the physician’s responsibility to customize or remove the information from templates and make the note unique to the visit.”

Yes, physician time is precious. But the reality is that the onus is on the physician to integrate EHR features with clinic workflow and to follow documentation rules.

The second documentation risk-reduction strategy is to make sure the level of evaluation and management (E/M) service billed is supported by medical necessity, not only by documentation artifacts that were relevant to the patient in the past but irrelevant to his or her current presenting complaint or condition.

“Medicare won’t pay for services that aren’t supported by medical necessity,” says LeGrand, “and you can’t achieve medical necessity by simply documenting additional E/M elements.”

This has always been the rule, LeGrand says. “But with the increased use of EHRs, and templates that automatically document visit elements and drive visits to a higher level of service, the Centers for Medicare & Medicaid Services [CMS] and private payers have added scrutiny to medical necessity reviews. They want to validate that higher-level visits billed indeed required a higher level of history and/or exam.”

To do this, the Office of the Inspector General (OIG) has supplemented its audit team with registered nurses. “The nurses assist certified coders by determining whether medical necessity has been met,” explains LeGrand.

Look at a patient who presents with toe pain. You take a detailed family history, conduct a review of systems (ROS), bill a high-level code, and document all the elements to support it. LeGrand explains, “There is no medical necessity to support doing an eye exam for a patient with toe pain in the absence of any other medical history, or performing a ROS to correlate an eye exam with toe pain. So, even if you do it and document it, the higher-level code won’t pass muster in an audit because the information documented is not medically necessary.”

According to LeGrand, the extent of the history and examination should be based on the presenting problem and the patient’s condition. “If an ankle sprain patient returns 2 weeks after the initial evaluation of the injury with a negative medical or surgical history, and the patient has been treated conservatively, it’s probably not necessary to conduct a ROS that includes 10 organ systems,” she says. “If your standard of care is to perform this level of service, no one will fault you for your care delivery; however, if you also choose a level of service based on this system review, without relevance to the presenting problem, and you bill a higher level of service than is supported by the nature of the presenting problem or the plan of care, the documentation probably won’t hold up in an audit where medical necessity is valued into the equation.”

On the other hand, LeGrand adds, if a patient presents to the emergency department after an automobile accident with an open fracture and other injuries, and the surgeon performs a complete ROS, the medical necessity would most likely be supported as the surgeon is preparing the patient for surgery.

Based on LeGrand’s work with practices, this distinction about medical necessity is news to many nonclinical billing staff. “They confuse medical necessity with medical decision-making, an E/M code documentation component, and incorrectly bill for a high-level visit because medical decision-making elements meet the documentation requirements—yet the code is not supported by medical necessity of the presenting problem.”

Talk with your billing team to make sure all staff members understand this critical difference. They must comprehend that the medically necessary level of service is determined by a number of clinical factors, not medical decision-making. Describe some of these clinical factors, which include, but are not limited to, chief complaint, clinical judgment, standards of practice, acute exacerbations/onsets of medical conditions or injuries, and comorbidities.

EHR Dos and Don’ts

LeGrand recommends the following best practices for using EHR documentation features:

1. DON’T simply cut and paste from a previous note. “This is what leads to verbose notes that have little to do with the patient you are documenting,” she says. “If you don’t cut and paste, you’ll avoid the root cause of this risk.”

2. DON’T pull forward information from previous visit notes that have nothing to do with the nature of the patient’s problem. “We understand that this takes extra time because physicians must review the previous note,” LeGrand says. “So if you don’t have time to review the past note, just don’t pull it forward. Start fresh with a new drop-down menu and select elements pertinent to the current visit. Or, dictate or type a note relevant to the current condition and presenting problems.”

How you choose to work this into your process will vary depending on which EHR system you use. “One surgeon I work with dictates everything because the drop-down menus and templates are cumbersome,” LeGrand says. “Some groups find it faster to use the EHR templates that they have customized. Others find their EHR’s point-and-click features most efficient for customizing quickly.”

3. DO customize your EHR visit templates if the use of templates is critical to your efficiency. “This is the most overlooked step in the EHR implementation process because it takes a fair amount of time to do,” LeGrand says. She suggests avoiding the use of multisystem examination templates created for medicine specialties altogether, and insists, “Don’t assume ‘that is how the vendor built it so we have to use it.’ Customize a template for each of your visit types so you can document in the EHR in the same fashion as when you used a paper system. Doing so will save you loads of documentation time.”

4. DO review your E/M code distribution. Generate a CPT frequency report for each physician and for the practice as a whole. Compare the data with state and national usage in orthopedics as a baseline. The American Academy of Orthopaedic Surgeon’s Code-X tool enables easy comparison of your practice’s E/M code usage with state and national data for orthopedics. Simply generate a CPT frequency report from your practice management system and enter the E/M data. Line graphs are automatically generated, making trends and patterns easy to see (Figure).

“Identify your outliers, pull charts randomly, and review the notes,” recommends LeGrand. “Make sure there is medical necessity for the level of code that’s been billed and that documentation supports it.”

You may be surprised to find you are an outlier on inpatient hospital codes, or your distribution of level-2 or -3 codes varies from your practice, state, or national data. Orthopedic surgeons don’t typically report high volumes of CPT codes 99204, 99205 or 99215, but if your practice does and you are an outlier, best to pay attention before someone else does.

5. DO select auditors with the right skill sets. Evaluating medical necessity in the note requires a clinical background. “If internal documentation reviews are conducted by the billing team, that’s fine,” LeGrand advises. “Just add a physician assistant or nurse to your internal review team. They can provide clinical oversight and review the note when necessary for medical necessity.”

If you are contracting with external auditors or consultants, verify auditor credentials and skill sets to ensure they can abstract and incorporate medical necessity into the review. “Auditors must be able to do more than count elements,” LeGrand says. “They must have clinical knowledge, and expertise in orthopedics is critical. This knowledge should be used to verify that medical necessity is present in every note.” LeGrand is quick to point out that not every note will be at risk, based on the amount of work performed and documented and the level of service billed. “But medical necessity must always be present.”

The addition of nurses to the OIG’s audit team is a big change and will refine the auditing process by adding more clinical scrutiny. The EHR documentation features are intended to improve efficiency, but only a clinician can determine and document unique visit elements and medical necessity.

Address these intersections of risk by ensuring your documentation meets medical necessity as well as E/M documentation elements. Conduct internal audits bi-annually to verify that E/M usage patterns align with peers and physician documentation is appropriate. And be sure there is clinical expertise on your audit team, whether it is internal or external. CMS now has it, and your practice should too. ◾

ICD-10 Medical Coding System Likely to Improve Documentation, Reimbursement

ICD-10 is the system that will replace ICD-9 for all parties covered by the Health Insurance Portability and Accountability Act (HIPAA). ICD-10 contains a code set used for inpatient procedural reporting and a code set used for diagnosis reporting. Physicians billing for professional services will only be affected when reporting diagnoses codes on their claims, but both physician and hospital selection of ICD-10 codes relies heavily on physician documentation. Therefore, documentation must be scrutinized. The most widely noted impact ICD-10 will have on documentation is increased specificity, with enhanced reporting of the patient’s presenting problem(s). Expanding from a pool of 14,000 3/5-digit codes to 69,000 7-digit codes, and accommodating this change, are daunting tasks. These anticipated burdens make it hard for physicians to recognize the positive effects ICD-10 may create, such as:1

- Better clinical decisions as better data is documented, collected, and evaluated;

- Improved protocol and clinical pathway design for various health conditions;

- Improved public health reporting and tracking of illnesses and severity over time;

- Better definition of patient conditions, providing improved matching of professional resources and care teams and increasing communications between providers;

- Support in practice transition to risk-sharing models with more precise data for patients and populations;

- Provision of clear objective data for credentialing and privileges, and support for professional Maintenance of Certification reporting across specialties;

- Better documentation of patient complexity and level of care, supporting reimbursement and measures for quality and efficiency reporting; and

- Reduction in audit risk exposure by encouraging the use of diagnosis codes with a greater degree of specificity as supported by the clinical documentation.

With the Oct. 1 implementation date rapidly approaching, physicians need to ask themselves, “Am I prepared?”

Getting Started

Everyone has a role and responsibility in transitioning to ICD-10. Active participation by all involved parties guarantees a more successful outcome. Practice administration must ensure that each aspect of implementation is reviewed and appropriately addressed. If not already done, immediate steps should be taken to verify the products and services that affect implementation. These include:

- Payer mix and related contracts: Entities not covered by HIPAA (e.g. workers’ compensation and auto insurance companies) may choose not to implement ICD-10. Since ICD-9 will no longer be maintained post-ICD-10 implementation, it is in the best interest of non-covered entities to use the new coding system.2 For payers who are required to transition to ICD-10, it is important to identify whether patient eligibility, claim processing, and/or payment timelines will be affected, as well as fee schedules or capitated rates.

- Vendor readiness: Physician groups may use a variety of vendors to assist with different aspects of the revenue cycle, including an electronic health record (e.g. documenting services and transmitting physician orders/prescriptions); a practice management system (e.g. scheduling and registering patients); a billing service (e.g. processing patient claims and payments); and a clearinghouse (e.g. verifying patient eligibility and obtaining authorizations). Know when software and/or hardware upgrades are available and if there are additional upgrade fees. Identify vendors that provide support services, training, and tools or templates to ease the transition. Most importantly, inquire about a testing period for products and applications to ensure functionality and adequate feedback on use of the system(s).

- Internal coding and billing resources. Identify physicians and staff who use ICD-9 codes and need to know ICD-10 codes in order to fulfill their responsibilities. Both physicians and staff can assist in identifying common clinical scenarios and the most frequently used ICD-9 codes, in order to develop a list of common ICD-10 specialty codes. Payer coverage policies currently include ICD-10 codes for provider review and comparison. Revise current forms/templates that include diagnosis codes to reflect this updated information. Schedule ICD-10 training for clinicians, office managers, billers, coders, and other key staff. Coding professionals recommend that training take place approximately six months prior to the ICD-10 compliance deadline.3 Training sessions are available from consultants, professional societies, payers, and other entities. Cost varies depending upon the type and length of training. CMS provides some free services, but in-depth training or certification for at least one practice member should be considered.

Once training is completed, dual coding is an option. Dual coding is the process by which both ICD-9 codes and ICD-10 codes are selected during the coding process. Some practices rely on independent selection of each code, while others rely on the General Equivalence Mappings (GEMs). GEMs were developed to assist industry migration to ICD-10. They are intended to be used primarily for translations of code lists or code tables used by an application or other coded data when codes in one code set are the only source of information; they are not intended as a substitution for direct use of ICD-9-CM and ICD-10-CM/PCS.4 Manual coding enhances coding efficiency and also identifies physician documentation deficiencies. Dual coding should begin as soon as possible, prior to October 1.

End-to-end testing is an opportunity to submit test claims to CMS with ICD-10 codes; providers will receive a remittance advice that explains the adjudication of the claims.5 This testing is limited to a small group of providers who were required to register in April, and its final week is July 20-24.

Provide Feedback

The importance of feedback is often understated. Many physician practices do not have the time to plan ahead and, as a result, find themselves in a reactive rather than proactive role. Over the next couple of months, find the time and resources to audit physician documentation based on ICD-10 criteria. Ask yourself whether or not the information contains enough specificity to select the best possible code, or does code selection default to an “unspecified” code?

Avoid “unspecified” codes when possible in preparation for payer policy revisions that are aimed at reducing or eliminating these types of codes. If the documentation lacks detail, educate physicians on the missing elements.

Review ICD-10 code sets with physicians to improve their understanding of the new system. For example, diabetes mellitus is identified in ICD-9 as one category (250.xx), with digits to specify Type I or Type II, controlled vs. uncontrolled, with or without complications. ICD-10 separates diabetes into categories of Type I (E10) or Type II (E11), with subcategories to identify complications and affected body systems, thereby expanding the volume of codes and corresponding documentation criteria.6

Post-implementation feedback will become even more important. Monitor claim denials for invalid codes and medical necessity issues (i.e., valid codes not included for coverage). If the medical necessity denials are a result of inaccurate code selection related to insufficient documentation details, provider education will be crucial in resolving these errors. Continuing education to strengthen and update staff skills is imperative.

CMS has developed many tools and resources to promote a successful transition and assess your ICD-10 preparedness. Physician practices can develop an “action plan,” learn basic ICD-10 concepts, and much more.

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She is also on the faculty of SHM’s inpatient coding course.

References

- Centers for Medicare and Medicaid Services. Road to 10: the small physician practice’s route to ICD-10? Accessed June 6, 2015.

- Department of Health and Human Services. Centers for Medicare and Medicaid Services. Medicare Learning Network: ICD-10-CM/PCS Myths and Facts. Accessed June 6, 2015.

- Centers for Medicare and Medicaid Services. ICD-10: ICD-10 Basics for Medical Practices. Accessed June 6, 2015.

- American Health Information Management Association (AHIMA). Putting the ICD-10-CM/PCS GEMs into practice. Accessed June 6, 2015.

- Novitas Solutions. Medicare JL, Part B. ICD-10 Implementation. Accessed June 6, 2015.

- Centers for Medicare and Medicaid Services. ICD-10 Coding and Diabetes. Accessed June 6, 2015.

ICD-10 is the system that will replace ICD-9 for all parties covered by the Health Insurance Portability and Accountability Act (HIPAA). ICD-10 contains a code set used for inpatient procedural reporting and a code set used for diagnosis reporting. Physicians billing for professional services will only be affected when reporting diagnoses codes on their claims, but both physician and hospital selection of ICD-10 codes relies heavily on physician documentation. Therefore, documentation must be scrutinized. The most widely noted impact ICD-10 will have on documentation is increased specificity, with enhanced reporting of the patient’s presenting problem(s). Expanding from a pool of 14,000 3/5-digit codes to 69,000 7-digit codes, and accommodating this change, are daunting tasks. These anticipated burdens make it hard for physicians to recognize the positive effects ICD-10 may create, such as:1

- Better clinical decisions as better data is documented, collected, and evaluated;

- Improved protocol and clinical pathway design for various health conditions;

- Improved public health reporting and tracking of illnesses and severity over time;

- Better definition of patient conditions, providing improved matching of professional resources and care teams and increasing communications between providers;

- Support in practice transition to risk-sharing models with more precise data for patients and populations;

- Provision of clear objective data for credentialing and privileges, and support for professional Maintenance of Certification reporting across specialties;

- Better documentation of patient complexity and level of care, supporting reimbursement and measures for quality and efficiency reporting; and

- Reduction in audit risk exposure by encouraging the use of diagnosis codes with a greater degree of specificity as supported by the clinical documentation.

With the Oct. 1 implementation date rapidly approaching, physicians need to ask themselves, “Am I prepared?”

Getting Started

Everyone has a role and responsibility in transitioning to ICD-10. Active participation by all involved parties guarantees a more successful outcome. Practice administration must ensure that each aspect of implementation is reviewed and appropriately addressed. If not already done, immediate steps should be taken to verify the products and services that affect implementation. These include:

- Payer mix and related contracts: Entities not covered by HIPAA (e.g. workers’ compensation and auto insurance companies) may choose not to implement ICD-10. Since ICD-9 will no longer be maintained post-ICD-10 implementation, it is in the best interest of non-covered entities to use the new coding system.2 For payers who are required to transition to ICD-10, it is important to identify whether patient eligibility, claim processing, and/or payment timelines will be affected, as well as fee schedules or capitated rates.

- Vendor readiness: Physician groups may use a variety of vendors to assist with different aspects of the revenue cycle, including an electronic health record (e.g. documenting services and transmitting physician orders/prescriptions); a practice management system (e.g. scheduling and registering patients); a billing service (e.g. processing patient claims and payments); and a clearinghouse (e.g. verifying patient eligibility and obtaining authorizations). Know when software and/or hardware upgrades are available and if there are additional upgrade fees. Identify vendors that provide support services, training, and tools or templates to ease the transition. Most importantly, inquire about a testing period for products and applications to ensure functionality and adequate feedback on use of the system(s).

- Internal coding and billing resources. Identify physicians and staff who use ICD-9 codes and need to know ICD-10 codes in order to fulfill their responsibilities. Both physicians and staff can assist in identifying common clinical scenarios and the most frequently used ICD-9 codes, in order to develop a list of common ICD-10 specialty codes. Payer coverage policies currently include ICD-10 codes for provider review and comparison. Revise current forms/templates that include diagnosis codes to reflect this updated information. Schedule ICD-10 training for clinicians, office managers, billers, coders, and other key staff. Coding professionals recommend that training take place approximately six months prior to the ICD-10 compliance deadline.3 Training sessions are available from consultants, professional societies, payers, and other entities. Cost varies depending upon the type and length of training. CMS provides some free services, but in-depth training or certification for at least one practice member should be considered.

Once training is completed, dual coding is an option. Dual coding is the process by which both ICD-9 codes and ICD-10 codes are selected during the coding process. Some practices rely on independent selection of each code, while others rely on the General Equivalence Mappings (GEMs). GEMs were developed to assist industry migration to ICD-10. They are intended to be used primarily for translations of code lists or code tables used by an application or other coded data when codes in one code set are the only source of information; they are not intended as a substitution for direct use of ICD-9-CM and ICD-10-CM/PCS.4 Manual coding enhances coding efficiency and also identifies physician documentation deficiencies. Dual coding should begin as soon as possible, prior to October 1.

End-to-end testing is an opportunity to submit test claims to CMS with ICD-10 codes; providers will receive a remittance advice that explains the adjudication of the claims.5 This testing is limited to a small group of providers who were required to register in April, and its final week is July 20-24.

Provide Feedback

The importance of feedback is often understated. Many physician practices do not have the time to plan ahead and, as a result, find themselves in a reactive rather than proactive role. Over the next couple of months, find the time and resources to audit physician documentation based on ICD-10 criteria. Ask yourself whether or not the information contains enough specificity to select the best possible code, or does code selection default to an “unspecified” code?

Avoid “unspecified” codes when possible in preparation for payer policy revisions that are aimed at reducing or eliminating these types of codes. If the documentation lacks detail, educate physicians on the missing elements.

Review ICD-10 code sets with physicians to improve their understanding of the new system. For example, diabetes mellitus is identified in ICD-9 as one category (250.xx), with digits to specify Type I or Type II, controlled vs. uncontrolled, with or without complications. ICD-10 separates diabetes into categories of Type I (E10) or Type II (E11), with subcategories to identify complications and affected body systems, thereby expanding the volume of codes and corresponding documentation criteria.6

Post-implementation feedback will become even more important. Monitor claim denials for invalid codes and medical necessity issues (i.e., valid codes not included for coverage). If the medical necessity denials are a result of inaccurate code selection related to insufficient documentation details, provider education will be crucial in resolving these errors. Continuing education to strengthen and update staff skills is imperative.

CMS has developed many tools and resources to promote a successful transition and assess your ICD-10 preparedness. Physician practices can develop an “action plan,” learn basic ICD-10 concepts, and much more.

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She is also on the faculty of SHM’s inpatient coding course.

References

- Centers for Medicare and Medicaid Services. Road to 10: the small physician practice’s route to ICD-10? Accessed June 6, 2015.

- Department of Health and Human Services. Centers for Medicare and Medicaid Services. Medicare Learning Network: ICD-10-CM/PCS Myths and Facts. Accessed June 6, 2015.

- Centers for Medicare and Medicaid Services. ICD-10: ICD-10 Basics for Medical Practices. Accessed June 6, 2015.

- American Health Information Management Association (AHIMA). Putting the ICD-10-CM/PCS GEMs into practice. Accessed June 6, 2015.

- Novitas Solutions. Medicare JL, Part B. ICD-10 Implementation. Accessed June 6, 2015.

- Centers for Medicare and Medicaid Services. ICD-10 Coding and Diabetes. Accessed June 6, 2015.

ICD-10 is the system that will replace ICD-9 for all parties covered by the Health Insurance Portability and Accountability Act (HIPAA). ICD-10 contains a code set used for inpatient procedural reporting and a code set used for diagnosis reporting. Physicians billing for professional services will only be affected when reporting diagnoses codes on their claims, but both physician and hospital selection of ICD-10 codes relies heavily on physician documentation. Therefore, documentation must be scrutinized. The most widely noted impact ICD-10 will have on documentation is increased specificity, with enhanced reporting of the patient’s presenting problem(s). Expanding from a pool of 14,000 3/5-digit codes to 69,000 7-digit codes, and accommodating this change, are daunting tasks. These anticipated burdens make it hard for physicians to recognize the positive effects ICD-10 may create, such as:1

- Better clinical decisions as better data is documented, collected, and evaluated;

- Improved protocol and clinical pathway design for various health conditions;

- Improved public health reporting and tracking of illnesses and severity over time;

- Better definition of patient conditions, providing improved matching of professional resources and care teams and increasing communications between providers;

- Support in practice transition to risk-sharing models with more precise data for patients and populations;