User login

‘Reform School’ for Pharmacy Benefit Managers: How Might Legislation Help Patients?

The term “reform school” is a bit outdated. It used to refer to institutions where young offenders were sent instead of prison. Some argue that pharmacy benefit managers (PBMs) should bypass reform school and go straight to prison. “PBM reform” has become a ubiquitous term, encompassing any legislative or regulatory efforts aimed at curbing PBMs’ bad behavior. When discussing PBM reform, it’s crucial to understand the various segments of the healthcare system affected by PBMs. This complexity often makes it challenging to determine what these reform packages would actually achieve and who they would benefit.

Pharmacists have long been vocal critics of PBMs, and while their issues are extremely important, it is essential to remember that the ultimate victims of PBM misconduct, in terms of access to care, are patients. At some point, we will all be patients, making this issue universally relevant. It has been quite challenging to follow federal legislation on this topic as these packages attempt to address a number of bad behaviors by PBMs affecting a variety of victims. This discussion will examine those reforms that would directly improve patient’s access to available and affordable medications.

Policy Categories of PBM Reform

There are five policy categories of PBM reform legislation overall, including three that have the greatest potential to directly address patient needs. The first is patient access to medications (utilization management, copay assistance, prior authorization, etc.), followed by delinking drug list prices from PBM income and pass-through of price concessions from the manufacturer. The remaining two categories involve transparency and pharmacy-facing reform, both of which are very important. However, this discussion will revolve around the first three categories. It should be noted that many of the legislation packages addressing the categories of patient access, delinking, and pass-through also include transparency issues, particularly as they relate to pharmacy-facing issues.

Patient Access to Medications — Step Therapy Legislation

One of the major obstacles to patient access to medications is the use of PBM utilization management tools such as step therapy (“fail first”), prior authorizations, nonmedical switching, and formulary exclusions. These tools dictate when patients can obtain necessary medications and for how long patients who are stable on their current treatments can remain on them.

While many states have enacted step therapy reforms to prevent stable patients from being whip-sawed between medications that maximize PBM profits (often labeled as “savings”), these state protections apply only to state-regulated health plans. These include fully insured health plans and those offered through the Affordable Care Act’s Health Insurance Marketplace. It also includes state employees, state corrections, and, in some cases, state labor unions. State legislation does not extend to patients covered by employer self-insured health plans, called ERISA plans for the federal law that governs employee benefit plans, the Employee Retirement Income Security Act. These ERISA plans include nearly 35 million people nationwide.

This is where the Safe Step Act (S.652/H.R.2630) becomes crucial, as it allows employees to request exceptions to harmful fail-first protocols. The bill has gained significant momentum, having been reported out of the Senate HELP Committee and discussed in House markups. The Safe Step Act would mandate that an exception to a step therapy protocol must be granted if:

- The required treatment has been ineffective

- The treatment is expected to be ineffective, and delaying effective treatment would lead to irreversible consequences

- The treatment will cause or is likely to cause an adverse reaction

- The treatment is expected to prevent the individual from performing daily activities or occupational responsibilities

- The individual is stable on their current prescription drugs

- There are other circumstances as determined by the Employee Benefits Security Administration

This legislation is vital for ensuring that patients have timely access to the medications they need without unnecessary delays or disruptions.

Patient Access to Medications — Prior Authorizations

Another significant issue affecting patient access to medications is prior authorizations (PAs). According to an American Medical Association survey, nearly one in four physicians (24%) report that a PA has led to a serious adverse event for a patient in their care. In rheumatology, PAs often result in delays in care (even for those initially approved) and a significant increase in steroid usage. In particular, PAs in Medicare Advantage (MA) plans are harmful to Medicare beneficiaries.

The Improving Seniors’ Timely Access to Care Act (H.R.8702 / S.4532) aims to reform PAs used in MA plans, making the process more efficient and transparent to improve access to care for seniors. Unfortunately, it does not cover Part D drugs and may only cover Part B drugs depending on the MA plan’s benefit package. Here are the key provisions of the act:

- Electronic PA: Implementing real-time decisions for routinely approved items and services.

- Transparency: Requiring annual publication of PA information, such as the percentage of requests approved and the average response time.

- Quality and Timeliness Standards: The Centers for Medicare & Medicaid Services (CMS) will set standards for the quality and timeliness of PA determinations.

- Streamlining Approvals: Simplifying the approval process and reducing the time allowed for health plans to consider PA requests.

This bill passed the House in September 2022 but stalled in the Senate because of an unfavorable Congressional Budget Office score. CMS has since finalized portions of this bill via regulation, zeroing out the CBO score and increasing the chances of its passage.

Delinking Drug Prices from PBM Income and Pass-Through of Price Concessions

Affordability is a crucial aspect of accessibility, especially when it comes to medications. Over the years, we’ve learned that PBMs often favor placing the highest list price drugs on formularies because the rebates and various fees they receive from manufacturers are based on a percentage of the list price. In other words, the higher the medication’s price, the more money the PBM makes.

This practice is evident in both commercial and government formularies, where brand-name drugs are often preferred, while lower-priced generics are either excluded or placed on higher tiers. As a result, while major PBMs benefit from these rebates and fees, patients continue to pay their cost share based on the list price of the medication.

To improve the affordability of medications, a key aspect of PBM reform should be to disincentivize PBMs from selecting higher-priced medications and/or require the pass-through of manufacturer price concessions to patients.

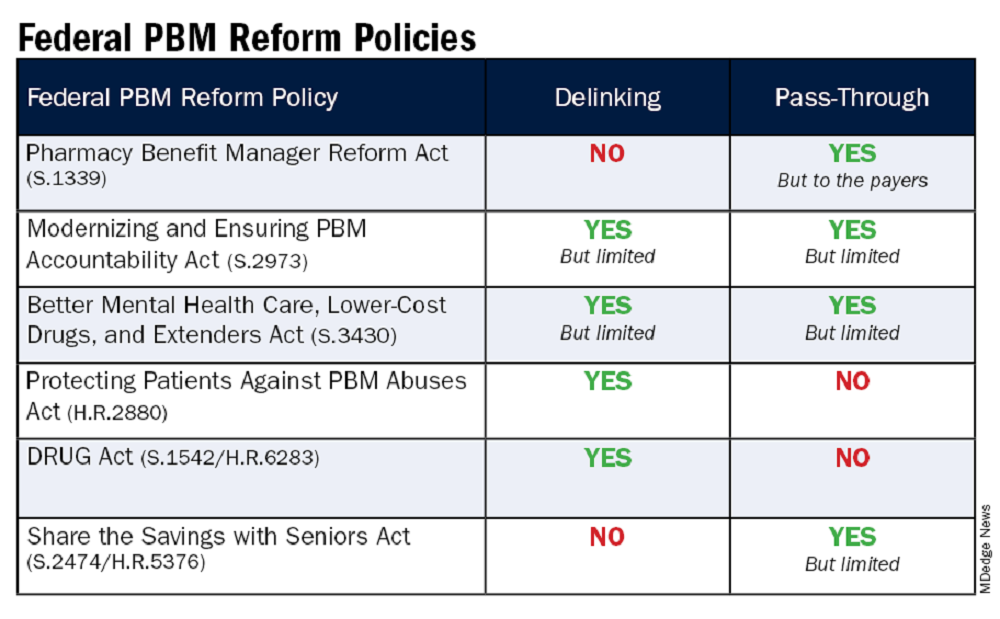

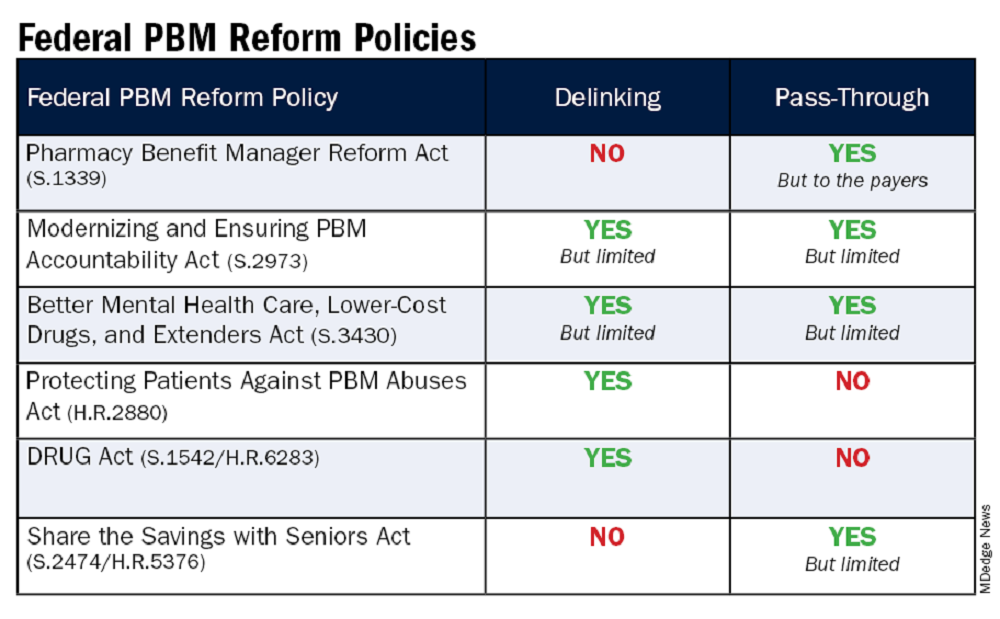

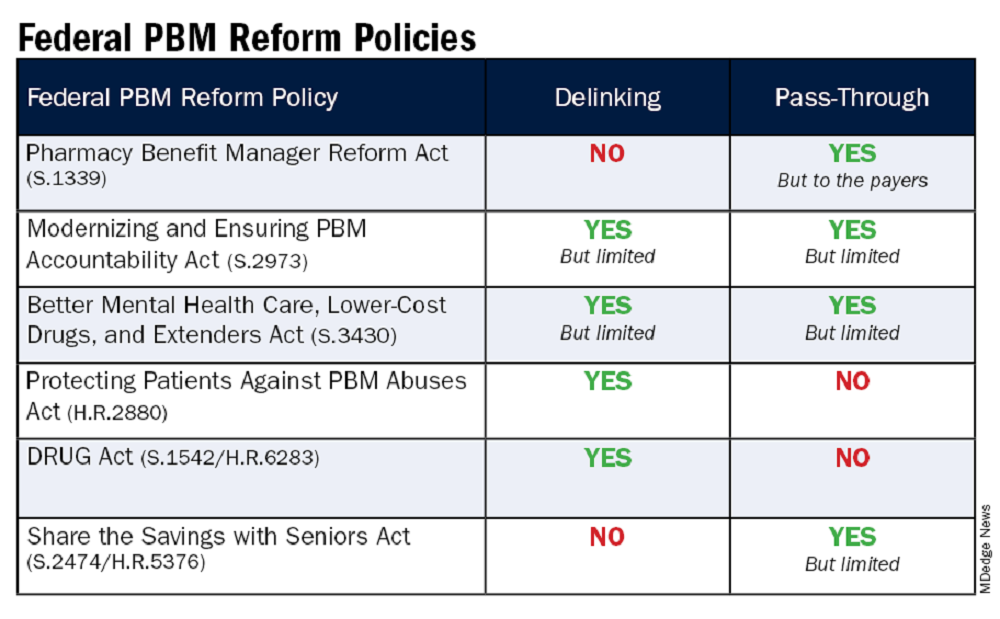

Several major PBM reform bills are currently being considered that address either the delinking of price concessions from the list price of the drug or some form of pass-through of these concessions. These reforms are essential to ensure that patients can access affordable medications without being burdened by inflated costs.

The legislation includes the Pharmacy Benefit Manager Reform Act (S.1339); the Modernizing & Ensuring PBM Accountability Act (S.2973); the Better Mental Health Care, Lower Cost Drugs, and Extenders Act (S.3430); the Protecting Patients Against PBM Abuses Act (H.R. 2880); the DRUG Act (S.2474 / H.R.6283); and the Share the Savings with Seniors Act (S.2474 / H.R.5376).

As with all legislation, there are limitations and compromises in each of these. However, these bills are a good first step in addressing PBM remuneration (rebates and fees) based on the list price of the drug and/or passing through to the patient the benefit of manufacturer price concessions. By focusing on key areas like utilization management, delinking drug prices from PBM income, and allowing patients to directly benefit from manufacturer price concessions, we can work toward a more equitable and efficient healthcare system. Reigning in PBM bad behavior is a challenge, but the potential benefits for patient care and access make it a crucial fight worth pursuing.

Please help in efforts to improve patients’ access to available and affordable medications by contacting your representatives in Congress to impart to them the importance of passing legislation. The CSRO’s legislative map tool can help to inform you of the latest information on these and other bills and assist you in engaging with your representatives on them.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. She has no relevant conflicts of interest to disclose. You can reach her at rhnews@mdedge.com.

The term “reform school” is a bit outdated. It used to refer to institutions where young offenders were sent instead of prison. Some argue that pharmacy benefit managers (PBMs) should bypass reform school and go straight to prison. “PBM reform” has become a ubiquitous term, encompassing any legislative or regulatory efforts aimed at curbing PBMs’ bad behavior. When discussing PBM reform, it’s crucial to understand the various segments of the healthcare system affected by PBMs. This complexity often makes it challenging to determine what these reform packages would actually achieve and who they would benefit.

Pharmacists have long been vocal critics of PBMs, and while their issues are extremely important, it is essential to remember that the ultimate victims of PBM misconduct, in terms of access to care, are patients. At some point, we will all be patients, making this issue universally relevant. It has been quite challenging to follow federal legislation on this topic as these packages attempt to address a number of bad behaviors by PBMs affecting a variety of victims. This discussion will examine those reforms that would directly improve patient’s access to available and affordable medications.

Policy Categories of PBM Reform

There are five policy categories of PBM reform legislation overall, including three that have the greatest potential to directly address patient needs. The first is patient access to medications (utilization management, copay assistance, prior authorization, etc.), followed by delinking drug list prices from PBM income and pass-through of price concessions from the manufacturer. The remaining two categories involve transparency and pharmacy-facing reform, both of which are very important. However, this discussion will revolve around the first three categories. It should be noted that many of the legislation packages addressing the categories of patient access, delinking, and pass-through also include transparency issues, particularly as they relate to pharmacy-facing issues.

Patient Access to Medications — Step Therapy Legislation

One of the major obstacles to patient access to medications is the use of PBM utilization management tools such as step therapy (“fail first”), prior authorizations, nonmedical switching, and formulary exclusions. These tools dictate when patients can obtain necessary medications and for how long patients who are stable on their current treatments can remain on them.

While many states have enacted step therapy reforms to prevent stable patients from being whip-sawed between medications that maximize PBM profits (often labeled as “savings”), these state protections apply only to state-regulated health plans. These include fully insured health plans and those offered through the Affordable Care Act’s Health Insurance Marketplace. It also includes state employees, state corrections, and, in some cases, state labor unions. State legislation does not extend to patients covered by employer self-insured health plans, called ERISA plans for the federal law that governs employee benefit plans, the Employee Retirement Income Security Act. These ERISA plans include nearly 35 million people nationwide.

This is where the Safe Step Act (S.652/H.R.2630) becomes crucial, as it allows employees to request exceptions to harmful fail-first protocols. The bill has gained significant momentum, having been reported out of the Senate HELP Committee and discussed in House markups. The Safe Step Act would mandate that an exception to a step therapy protocol must be granted if:

- The required treatment has been ineffective

- The treatment is expected to be ineffective, and delaying effective treatment would lead to irreversible consequences

- The treatment will cause or is likely to cause an adverse reaction

- The treatment is expected to prevent the individual from performing daily activities or occupational responsibilities

- The individual is stable on their current prescription drugs

- There are other circumstances as determined by the Employee Benefits Security Administration

This legislation is vital for ensuring that patients have timely access to the medications they need without unnecessary delays or disruptions.

Patient Access to Medications — Prior Authorizations

Another significant issue affecting patient access to medications is prior authorizations (PAs). According to an American Medical Association survey, nearly one in four physicians (24%) report that a PA has led to a serious adverse event for a patient in their care. In rheumatology, PAs often result in delays in care (even for those initially approved) and a significant increase in steroid usage. In particular, PAs in Medicare Advantage (MA) plans are harmful to Medicare beneficiaries.

The Improving Seniors’ Timely Access to Care Act (H.R.8702 / S.4532) aims to reform PAs used in MA plans, making the process more efficient and transparent to improve access to care for seniors. Unfortunately, it does not cover Part D drugs and may only cover Part B drugs depending on the MA plan’s benefit package. Here are the key provisions of the act:

- Electronic PA: Implementing real-time decisions for routinely approved items and services.

- Transparency: Requiring annual publication of PA information, such as the percentage of requests approved and the average response time.

- Quality and Timeliness Standards: The Centers for Medicare & Medicaid Services (CMS) will set standards for the quality and timeliness of PA determinations.

- Streamlining Approvals: Simplifying the approval process and reducing the time allowed for health plans to consider PA requests.

This bill passed the House in September 2022 but stalled in the Senate because of an unfavorable Congressional Budget Office score. CMS has since finalized portions of this bill via regulation, zeroing out the CBO score and increasing the chances of its passage.

Delinking Drug Prices from PBM Income and Pass-Through of Price Concessions

Affordability is a crucial aspect of accessibility, especially when it comes to medications. Over the years, we’ve learned that PBMs often favor placing the highest list price drugs on formularies because the rebates and various fees they receive from manufacturers are based on a percentage of the list price. In other words, the higher the medication’s price, the more money the PBM makes.

This practice is evident in both commercial and government formularies, where brand-name drugs are often preferred, while lower-priced generics are either excluded or placed on higher tiers. As a result, while major PBMs benefit from these rebates and fees, patients continue to pay their cost share based on the list price of the medication.

To improve the affordability of medications, a key aspect of PBM reform should be to disincentivize PBMs from selecting higher-priced medications and/or require the pass-through of manufacturer price concessions to patients.

Several major PBM reform bills are currently being considered that address either the delinking of price concessions from the list price of the drug or some form of pass-through of these concessions. These reforms are essential to ensure that patients can access affordable medications without being burdened by inflated costs.

The legislation includes the Pharmacy Benefit Manager Reform Act (S.1339); the Modernizing & Ensuring PBM Accountability Act (S.2973); the Better Mental Health Care, Lower Cost Drugs, and Extenders Act (S.3430); the Protecting Patients Against PBM Abuses Act (H.R. 2880); the DRUG Act (S.2474 / H.R.6283); and the Share the Savings with Seniors Act (S.2474 / H.R.5376).

As with all legislation, there are limitations and compromises in each of these. However, these bills are a good first step in addressing PBM remuneration (rebates and fees) based on the list price of the drug and/or passing through to the patient the benefit of manufacturer price concessions. By focusing on key areas like utilization management, delinking drug prices from PBM income, and allowing patients to directly benefit from manufacturer price concessions, we can work toward a more equitable and efficient healthcare system. Reigning in PBM bad behavior is a challenge, but the potential benefits for patient care and access make it a crucial fight worth pursuing.

Please help in efforts to improve patients’ access to available and affordable medications by contacting your representatives in Congress to impart to them the importance of passing legislation. The CSRO’s legislative map tool can help to inform you of the latest information on these and other bills and assist you in engaging with your representatives on them.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. She has no relevant conflicts of interest to disclose. You can reach her at rhnews@mdedge.com.

The term “reform school” is a bit outdated. It used to refer to institutions where young offenders were sent instead of prison. Some argue that pharmacy benefit managers (PBMs) should bypass reform school and go straight to prison. “PBM reform” has become a ubiquitous term, encompassing any legislative or regulatory efforts aimed at curbing PBMs’ bad behavior. When discussing PBM reform, it’s crucial to understand the various segments of the healthcare system affected by PBMs. This complexity often makes it challenging to determine what these reform packages would actually achieve and who they would benefit.

Pharmacists have long been vocal critics of PBMs, and while their issues are extremely important, it is essential to remember that the ultimate victims of PBM misconduct, in terms of access to care, are patients. At some point, we will all be patients, making this issue universally relevant. It has been quite challenging to follow federal legislation on this topic as these packages attempt to address a number of bad behaviors by PBMs affecting a variety of victims. This discussion will examine those reforms that would directly improve patient’s access to available and affordable medications.

Policy Categories of PBM Reform

There are five policy categories of PBM reform legislation overall, including three that have the greatest potential to directly address patient needs. The first is patient access to medications (utilization management, copay assistance, prior authorization, etc.), followed by delinking drug list prices from PBM income and pass-through of price concessions from the manufacturer. The remaining two categories involve transparency and pharmacy-facing reform, both of which are very important. However, this discussion will revolve around the first three categories. It should be noted that many of the legislation packages addressing the categories of patient access, delinking, and pass-through also include transparency issues, particularly as they relate to pharmacy-facing issues.

Patient Access to Medications — Step Therapy Legislation

One of the major obstacles to patient access to medications is the use of PBM utilization management tools such as step therapy (“fail first”), prior authorizations, nonmedical switching, and formulary exclusions. These tools dictate when patients can obtain necessary medications and for how long patients who are stable on their current treatments can remain on them.

While many states have enacted step therapy reforms to prevent stable patients from being whip-sawed between medications that maximize PBM profits (often labeled as “savings”), these state protections apply only to state-regulated health plans. These include fully insured health plans and those offered through the Affordable Care Act’s Health Insurance Marketplace. It also includes state employees, state corrections, and, in some cases, state labor unions. State legislation does not extend to patients covered by employer self-insured health plans, called ERISA plans for the federal law that governs employee benefit plans, the Employee Retirement Income Security Act. These ERISA plans include nearly 35 million people nationwide.

This is where the Safe Step Act (S.652/H.R.2630) becomes crucial, as it allows employees to request exceptions to harmful fail-first protocols. The bill has gained significant momentum, having been reported out of the Senate HELP Committee and discussed in House markups. The Safe Step Act would mandate that an exception to a step therapy protocol must be granted if:

- The required treatment has been ineffective

- The treatment is expected to be ineffective, and delaying effective treatment would lead to irreversible consequences

- The treatment will cause or is likely to cause an adverse reaction

- The treatment is expected to prevent the individual from performing daily activities or occupational responsibilities

- The individual is stable on their current prescription drugs

- There are other circumstances as determined by the Employee Benefits Security Administration

This legislation is vital for ensuring that patients have timely access to the medications they need without unnecessary delays or disruptions.

Patient Access to Medications — Prior Authorizations

Another significant issue affecting patient access to medications is prior authorizations (PAs). According to an American Medical Association survey, nearly one in four physicians (24%) report that a PA has led to a serious adverse event for a patient in their care. In rheumatology, PAs often result in delays in care (even for those initially approved) and a significant increase in steroid usage. In particular, PAs in Medicare Advantage (MA) plans are harmful to Medicare beneficiaries.

The Improving Seniors’ Timely Access to Care Act (H.R.8702 / S.4532) aims to reform PAs used in MA plans, making the process more efficient and transparent to improve access to care for seniors. Unfortunately, it does not cover Part D drugs and may only cover Part B drugs depending on the MA plan’s benefit package. Here are the key provisions of the act:

- Electronic PA: Implementing real-time decisions for routinely approved items and services.

- Transparency: Requiring annual publication of PA information, such as the percentage of requests approved and the average response time.

- Quality and Timeliness Standards: The Centers for Medicare & Medicaid Services (CMS) will set standards for the quality and timeliness of PA determinations.

- Streamlining Approvals: Simplifying the approval process and reducing the time allowed for health plans to consider PA requests.

This bill passed the House in September 2022 but stalled in the Senate because of an unfavorable Congressional Budget Office score. CMS has since finalized portions of this bill via regulation, zeroing out the CBO score and increasing the chances of its passage.

Delinking Drug Prices from PBM Income and Pass-Through of Price Concessions

Affordability is a crucial aspect of accessibility, especially when it comes to medications. Over the years, we’ve learned that PBMs often favor placing the highest list price drugs on formularies because the rebates and various fees they receive from manufacturers are based on a percentage of the list price. In other words, the higher the medication’s price, the more money the PBM makes.

This practice is evident in both commercial and government formularies, where brand-name drugs are often preferred, while lower-priced generics are either excluded or placed on higher tiers. As a result, while major PBMs benefit from these rebates and fees, patients continue to pay their cost share based on the list price of the medication.

To improve the affordability of medications, a key aspect of PBM reform should be to disincentivize PBMs from selecting higher-priced medications and/or require the pass-through of manufacturer price concessions to patients.

Several major PBM reform bills are currently being considered that address either the delinking of price concessions from the list price of the drug or some form of pass-through of these concessions. These reforms are essential to ensure that patients can access affordable medications without being burdened by inflated costs.

The legislation includes the Pharmacy Benefit Manager Reform Act (S.1339); the Modernizing & Ensuring PBM Accountability Act (S.2973); the Better Mental Health Care, Lower Cost Drugs, and Extenders Act (S.3430); the Protecting Patients Against PBM Abuses Act (H.R. 2880); the DRUG Act (S.2474 / H.R.6283); and the Share the Savings with Seniors Act (S.2474 / H.R.5376).

As with all legislation, there are limitations and compromises in each of these. However, these bills are a good first step in addressing PBM remuneration (rebates and fees) based on the list price of the drug and/or passing through to the patient the benefit of manufacturer price concessions. By focusing on key areas like utilization management, delinking drug prices from PBM income, and allowing patients to directly benefit from manufacturer price concessions, we can work toward a more equitable and efficient healthcare system. Reigning in PBM bad behavior is a challenge, but the potential benefits for patient care and access make it a crucial fight worth pursuing.

Please help in efforts to improve patients’ access to available and affordable medications by contacting your representatives in Congress to impart to them the importance of passing legislation. The CSRO’s legislative map tool can help to inform you of the latest information on these and other bills and assist you in engaging with your representatives on them.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. She has no relevant conflicts of interest to disclose. You can reach her at rhnews@mdedge.com.

Fed Worker Health Plans Ban Maximizers and Copay Accumulators: Why Not for the Rest of the US?

The escalating costs of medications and the prevalence of medical bankruptcy in our country have drawn criticism from governments, regulators, and the media. Federal and state governments are exploring various strategies to mitigate this issue, including the Inflation Reduction Act (IRA) for drug price negotiations and the establishment of state Pharmaceutical Drug Affordability Boards (PDABs). However, it’s uncertain whether these measures will effectively reduce patients’ medication expenses, given the tendency of pharmacy benefit managers (PBMs) to favor more expensive drugs on their formularies and the implementation challenges faced by PDABs.

The question then arises: How can we promptly assist patients, especially those with multiple chronic conditions, in affording their healthcare? Many of these patients are enrolled in high-deductible plans and struggle to cover all their medical and pharmacy costs.

A significant obstacle to healthcare affordability emerged in 2018 with the introduction of Copay Accumulator Programs by PBMs. These programs prevent patients from applying manufacturer copay cards toward their deductible and maximum out-of-pocket (OOP) costs. The impact of these policies has been devastating, leading to decreased adherence to medications and delayed necessary medical procedures, such as colonoscopies. Copay accumulators do nothing to address the high cost of medical care. They merely shift the burden from insurance companies to patients.

There is a direct solution to help patients, particularly those burdened with high pharmacy bills, afford their medical care. It would be that all payments from patients, including manufacturer copay cards, count toward their deductible and maximum OOP costs. This should apply regardless of whether the insurance plan is fully funded or a self-insured employer plan. This would be an immediate step toward making healthcare more affordable for patients.

Copay Accumulator Programs

How did these detrimental policies, which have been proven to harm patients, originate? It’s interesting that health insurance policies for federal employees do not allow these programs and yet the federal government has done little to protect its citizens from these egregious policies. More on that later.

In 2018, insurance companies and PBMs conceived an idea to introduce what they called copay accumulator adjustment programs. These programs would prevent the use of manufacturer copay cards from counting toward patient deductibles or OOP maximums. They justified this by arguing that manufacturer copay cards encouraged patients to opt for higher-priced brand drugs when lower-cost generics were available.

However, data from IQVIA contradicts this claim. An analysis of copay card usage from 2013 to 2017 revealed that a mere 0.4% of these cards were used for brand-name drugs that had already lost their exclusivity. This indicates that the vast majority of copay cards were not being used to purchase more expensive brand-name drugs when cheaper, generic alternatives were available.

Another argument put forth by one of the large PBMs was that patients with high deductibles don’t have enough “skin in the game” due to their low premiums, and therefore don’t deserve to have their deductible covered by a copay card. This raises the question, “Does a patient with hemophilia or systemic lupus who can’t afford a low deductible plan not have ‘skin in the game’? Is that a fair assessment?” It’s disconcerting to see a multibillion-dollar company dictating who deserves to have their deductible covered. These policies clearly disproportionately harm patients with chronic illnesses, especially those with high deductibles. As a result, many organizations have labeled these policies as discriminatory.

Following the implementation of accumulator programs in 2018 and 2019, many patients were unaware that their copay cards weren’t contributing toward their deductibles. They were taken aback when specialty pharmacies informed them of owing substantial amounts because of unmet deductibles. Consequently, patients discontinued their medications, leading to disease progression and increased costs. The only downside for health insurers and PBMs was the negative publicity associated with patients losing medication access.

Maximizer Programs

By the end of 2019, the three major PBMs had devised a strategy to keep patients on their medication throughout the year, without counting copay cards toward the deductible, and found a way to profit more from these cards, sometimes quadrupling their value. This was the birth of the maximizer programs.

Maximizers exploit a “loophole” in the Affordable Care Act (ACA). The ACA defines Essential Healthcare Benefits (EHB); anything not listed as an EHB is deemed “non-essential.” As a result, neither personal payments nor copay cards count toward deductibles or OOP maximums. Patients were informed that neither their own money nor manufacturer copay cards would count toward their deductible/OOP max.

One of my patients was warned that without enrolling in the maximizer program through SaveOnSP (owned by Express Scripts), she would bear the full cost of the drug, and nothing would count toward her OOP max. Frightened, she enrolled and surrendered her manufacturer copay card to SaveOnSP. Maximizers pocket the maximum value of the copay card, even if it exceeds the insurance plan’s yearly cost share by threefold or more. To do this legally, PBMs increase the patient’s original cost share amount during the plan year to match the value of the manufacturer copay card.

Combating These Programs

Nineteen states, the District of Columbia, and Puerto Rico have outlawed copay accumulators in health plans under state jurisdiction. I personally testified in Louisiana, leading to a ban in our state. CSRO’s award-winning map tool can show if your state has passed the ban on copay accumulator programs. However, many states have not passed bans on copay accumulators and self-insured employer groups, which fall under the Department of Labor and not state regulation, are still unaffected. There is also proposed federal legislation, the “Help Ensure Lower Patient Copays Act,” that would prohibit the use of copay accumulators in exchange plans. Despite having bipartisan support, it is having a hard time getting across the finish line in Congress.

In 2020, the Department of Health and Human Services (HHS) issued a rule prohibiting accumulator programs in all plans if the product was a brand name without a generic alternative. Unfortunately, this rule was rescinded in 2021, allowing copay accumulators even if a lower-cost generic was available.

In a positive turn of events, the US District Court of the District of Columbia overturned the 2021 rule in late 2023, reinstating the 2020 ban on copay accumulators. However, HHS has yet to enforce this ban.

Double Standard

Why is it that our federal government refrains from enforcing bans on copay accumulators for the American public, yet the US Office of Personnel Management (OPM) in its 2024 health plan for federal employees has explicitly stated that it “will decline any arrangements which may manipulate the prescription drug benefit design or incorporate any programs such as copay maximizers, copay optimizers, or other similar programs as these types of benefit designs are not in the best interest of enrollees or the Government.”

If such practices are deemed unsuitable for federal employees, why are they considered acceptable for the rest of the American population? This discrepancy raises important questions about healthcare equity.

In conclusion, the prevalence of medical bankruptcy in our country is a pressing issue that requires immediate attention. The introduction of copay accumulator programs and maximizers by PBMs has led to decreased adherence to needed medications, as well as delay in important medical procedures, exacerbating this situation. An across-the-board ban on these programs would offer immediate relief to many families that no longer can afford needed care.

It is clear that more needs to be done to ensure that all patients, regardless of their financial situation or the nature of their health insurance plan, can afford the healthcare they need. This includes ensuring that patients are not penalized for using manufacturer copay cards to help cover their costs. As we move forward, it is crucial that we continue to advocate for policies that prioritize the health and well-being of all patients.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. You can reach her at rhnews@mdedge.com.

The escalating costs of medications and the prevalence of medical bankruptcy in our country have drawn criticism from governments, regulators, and the media. Federal and state governments are exploring various strategies to mitigate this issue, including the Inflation Reduction Act (IRA) for drug price negotiations and the establishment of state Pharmaceutical Drug Affordability Boards (PDABs). However, it’s uncertain whether these measures will effectively reduce patients’ medication expenses, given the tendency of pharmacy benefit managers (PBMs) to favor more expensive drugs on their formularies and the implementation challenges faced by PDABs.

The question then arises: How can we promptly assist patients, especially those with multiple chronic conditions, in affording their healthcare? Many of these patients are enrolled in high-deductible plans and struggle to cover all their medical and pharmacy costs.

A significant obstacle to healthcare affordability emerged in 2018 with the introduction of Copay Accumulator Programs by PBMs. These programs prevent patients from applying manufacturer copay cards toward their deductible and maximum out-of-pocket (OOP) costs. The impact of these policies has been devastating, leading to decreased adherence to medications and delayed necessary medical procedures, such as colonoscopies. Copay accumulators do nothing to address the high cost of medical care. They merely shift the burden from insurance companies to patients.

There is a direct solution to help patients, particularly those burdened with high pharmacy bills, afford their medical care. It would be that all payments from patients, including manufacturer copay cards, count toward their deductible and maximum OOP costs. This should apply regardless of whether the insurance plan is fully funded or a self-insured employer plan. This would be an immediate step toward making healthcare more affordable for patients.

Copay Accumulator Programs

How did these detrimental policies, which have been proven to harm patients, originate? It’s interesting that health insurance policies for federal employees do not allow these programs and yet the federal government has done little to protect its citizens from these egregious policies. More on that later.

In 2018, insurance companies and PBMs conceived an idea to introduce what they called copay accumulator adjustment programs. These programs would prevent the use of manufacturer copay cards from counting toward patient deductibles or OOP maximums. They justified this by arguing that manufacturer copay cards encouraged patients to opt for higher-priced brand drugs when lower-cost generics were available.

However, data from IQVIA contradicts this claim. An analysis of copay card usage from 2013 to 2017 revealed that a mere 0.4% of these cards were used for brand-name drugs that had already lost their exclusivity. This indicates that the vast majority of copay cards were not being used to purchase more expensive brand-name drugs when cheaper, generic alternatives were available.

Another argument put forth by one of the large PBMs was that patients with high deductibles don’t have enough “skin in the game” due to their low premiums, and therefore don’t deserve to have their deductible covered by a copay card. This raises the question, “Does a patient with hemophilia or systemic lupus who can’t afford a low deductible plan not have ‘skin in the game’? Is that a fair assessment?” It’s disconcerting to see a multibillion-dollar company dictating who deserves to have their deductible covered. These policies clearly disproportionately harm patients with chronic illnesses, especially those with high deductibles. As a result, many organizations have labeled these policies as discriminatory.

Following the implementation of accumulator programs in 2018 and 2019, many patients were unaware that their copay cards weren’t contributing toward their deductibles. They were taken aback when specialty pharmacies informed them of owing substantial amounts because of unmet deductibles. Consequently, patients discontinued their medications, leading to disease progression and increased costs. The only downside for health insurers and PBMs was the negative publicity associated with patients losing medication access.

Maximizer Programs

By the end of 2019, the three major PBMs had devised a strategy to keep patients on their medication throughout the year, without counting copay cards toward the deductible, and found a way to profit more from these cards, sometimes quadrupling their value. This was the birth of the maximizer programs.

Maximizers exploit a “loophole” in the Affordable Care Act (ACA). The ACA defines Essential Healthcare Benefits (EHB); anything not listed as an EHB is deemed “non-essential.” As a result, neither personal payments nor copay cards count toward deductibles or OOP maximums. Patients were informed that neither their own money nor manufacturer copay cards would count toward their deductible/OOP max.

One of my patients was warned that without enrolling in the maximizer program through SaveOnSP (owned by Express Scripts), she would bear the full cost of the drug, and nothing would count toward her OOP max. Frightened, she enrolled and surrendered her manufacturer copay card to SaveOnSP. Maximizers pocket the maximum value of the copay card, even if it exceeds the insurance plan’s yearly cost share by threefold or more. To do this legally, PBMs increase the patient’s original cost share amount during the plan year to match the value of the manufacturer copay card.

Combating These Programs

Nineteen states, the District of Columbia, and Puerto Rico have outlawed copay accumulators in health plans under state jurisdiction. I personally testified in Louisiana, leading to a ban in our state. CSRO’s award-winning map tool can show if your state has passed the ban on copay accumulator programs. However, many states have not passed bans on copay accumulators and self-insured employer groups, which fall under the Department of Labor and not state regulation, are still unaffected. There is also proposed federal legislation, the “Help Ensure Lower Patient Copays Act,” that would prohibit the use of copay accumulators in exchange plans. Despite having bipartisan support, it is having a hard time getting across the finish line in Congress.

In 2020, the Department of Health and Human Services (HHS) issued a rule prohibiting accumulator programs in all plans if the product was a brand name without a generic alternative. Unfortunately, this rule was rescinded in 2021, allowing copay accumulators even if a lower-cost generic was available.

In a positive turn of events, the US District Court of the District of Columbia overturned the 2021 rule in late 2023, reinstating the 2020 ban on copay accumulators. However, HHS has yet to enforce this ban.

Double Standard

Why is it that our federal government refrains from enforcing bans on copay accumulators for the American public, yet the US Office of Personnel Management (OPM) in its 2024 health plan for federal employees has explicitly stated that it “will decline any arrangements which may manipulate the prescription drug benefit design or incorporate any programs such as copay maximizers, copay optimizers, or other similar programs as these types of benefit designs are not in the best interest of enrollees or the Government.”

If such practices are deemed unsuitable for federal employees, why are they considered acceptable for the rest of the American population? This discrepancy raises important questions about healthcare equity.

In conclusion, the prevalence of medical bankruptcy in our country is a pressing issue that requires immediate attention. The introduction of copay accumulator programs and maximizers by PBMs has led to decreased adherence to needed medications, as well as delay in important medical procedures, exacerbating this situation. An across-the-board ban on these programs would offer immediate relief to many families that no longer can afford needed care.

It is clear that more needs to be done to ensure that all patients, regardless of their financial situation or the nature of their health insurance plan, can afford the healthcare they need. This includes ensuring that patients are not penalized for using manufacturer copay cards to help cover their costs. As we move forward, it is crucial that we continue to advocate for policies that prioritize the health and well-being of all patients.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. You can reach her at rhnews@mdedge.com.

The escalating costs of medications and the prevalence of medical bankruptcy in our country have drawn criticism from governments, regulators, and the media. Federal and state governments are exploring various strategies to mitigate this issue, including the Inflation Reduction Act (IRA) for drug price negotiations and the establishment of state Pharmaceutical Drug Affordability Boards (PDABs). However, it’s uncertain whether these measures will effectively reduce patients’ medication expenses, given the tendency of pharmacy benefit managers (PBMs) to favor more expensive drugs on their formularies and the implementation challenges faced by PDABs.

The question then arises: How can we promptly assist patients, especially those with multiple chronic conditions, in affording their healthcare? Many of these patients are enrolled in high-deductible plans and struggle to cover all their medical and pharmacy costs.

A significant obstacle to healthcare affordability emerged in 2018 with the introduction of Copay Accumulator Programs by PBMs. These programs prevent patients from applying manufacturer copay cards toward their deductible and maximum out-of-pocket (OOP) costs. The impact of these policies has been devastating, leading to decreased adherence to medications and delayed necessary medical procedures, such as colonoscopies. Copay accumulators do nothing to address the high cost of medical care. They merely shift the burden from insurance companies to patients.

There is a direct solution to help patients, particularly those burdened with high pharmacy bills, afford their medical care. It would be that all payments from patients, including manufacturer copay cards, count toward their deductible and maximum OOP costs. This should apply regardless of whether the insurance plan is fully funded or a self-insured employer plan. This would be an immediate step toward making healthcare more affordable for patients.

Copay Accumulator Programs

How did these detrimental policies, which have been proven to harm patients, originate? It’s interesting that health insurance policies for federal employees do not allow these programs and yet the federal government has done little to protect its citizens from these egregious policies. More on that later.

In 2018, insurance companies and PBMs conceived an idea to introduce what they called copay accumulator adjustment programs. These programs would prevent the use of manufacturer copay cards from counting toward patient deductibles or OOP maximums. They justified this by arguing that manufacturer copay cards encouraged patients to opt for higher-priced brand drugs when lower-cost generics were available.

However, data from IQVIA contradicts this claim. An analysis of copay card usage from 2013 to 2017 revealed that a mere 0.4% of these cards were used for brand-name drugs that had already lost their exclusivity. This indicates that the vast majority of copay cards were not being used to purchase more expensive brand-name drugs when cheaper, generic alternatives were available.

Another argument put forth by one of the large PBMs was that patients with high deductibles don’t have enough “skin in the game” due to their low premiums, and therefore don’t deserve to have their deductible covered by a copay card. This raises the question, “Does a patient with hemophilia or systemic lupus who can’t afford a low deductible plan not have ‘skin in the game’? Is that a fair assessment?” It’s disconcerting to see a multibillion-dollar company dictating who deserves to have their deductible covered. These policies clearly disproportionately harm patients with chronic illnesses, especially those with high deductibles. As a result, many organizations have labeled these policies as discriminatory.

Following the implementation of accumulator programs in 2018 and 2019, many patients were unaware that their copay cards weren’t contributing toward their deductibles. They were taken aback when specialty pharmacies informed them of owing substantial amounts because of unmet deductibles. Consequently, patients discontinued their medications, leading to disease progression and increased costs. The only downside for health insurers and PBMs was the negative publicity associated with patients losing medication access.

Maximizer Programs

By the end of 2019, the three major PBMs had devised a strategy to keep patients on their medication throughout the year, without counting copay cards toward the deductible, and found a way to profit more from these cards, sometimes quadrupling their value. This was the birth of the maximizer programs.

Maximizers exploit a “loophole” in the Affordable Care Act (ACA). The ACA defines Essential Healthcare Benefits (EHB); anything not listed as an EHB is deemed “non-essential.” As a result, neither personal payments nor copay cards count toward deductibles or OOP maximums. Patients were informed that neither their own money nor manufacturer copay cards would count toward their deductible/OOP max.

One of my patients was warned that without enrolling in the maximizer program through SaveOnSP (owned by Express Scripts), she would bear the full cost of the drug, and nothing would count toward her OOP max. Frightened, she enrolled and surrendered her manufacturer copay card to SaveOnSP. Maximizers pocket the maximum value of the copay card, even if it exceeds the insurance plan’s yearly cost share by threefold or more. To do this legally, PBMs increase the patient’s original cost share amount during the plan year to match the value of the manufacturer copay card.

Combating These Programs

Nineteen states, the District of Columbia, and Puerto Rico have outlawed copay accumulators in health plans under state jurisdiction. I personally testified in Louisiana, leading to a ban in our state. CSRO’s award-winning map tool can show if your state has passed the ban on copay accumulator programs. However, many states have not passed bans on copay accumulators and self-insured employer groups, which fall under the Department of Labor and not state regulation, are still unaffected. There is also proposed federal legislation, the “Help Ensure Lower Patient Copays Act,” that would prohibit the use of copay accumulators in exchange plans. Despite having bipartisan support, it is having a hard time getting across the finish line in Congress.

In 2020, the Department of Health and Human Services (HHS) issued a rule prohibiting accumulator programs in all plans if the product was a brand name without a generic alternative. Unfortunately, this rule was rescinded in 2021, allowing copay accumulators even if a lower-cost generic was available.

In a positive turn of events, the US District Court of the District of Columbia overturned the 2021 rule in late 2023, reinstating the 2020 ban on copay accumulators. However, HHS has yet to enforce this ban.

Double Standard

Why is it that our federal government refrains from enforcing bans on copay accumulators for the American public, yet the US Office of Personnel Management (OPM) in its 2024 health plan for federal employees has explicitly stated that it “will decline any arrangements which may manipulate the prescription drug benefit design or incorporate any programs such as copay maximizers, copay optimizers, or other similar programs as these types of benefit designs are not in the best interest of enrollees or the Government.”

If such practices are deemed unsuitable for federal employees, why are they considered acceptable for the rest of the American population? This discrepancy raises important questions about healthcare equity.

In conclusion, the prevalence of medical bankruptcy in our country is a pressing issue that requires immediate attention. The introduction of copay accumulator programs and maximizers by PBMs has led to decreased adherence to needed medications, as well as delay in important medical procedures, exacerbating this situation. An across-the-board ban on these programs would offer immediate relief to many families that no longer can afford needed care.

It is clear that more needs to be done to ensure that all patients, regardless of their financial situation or the nature of their health insurance plan, can afford the healthcare they need. This includes ensuring that patients are not penalized for using manufacturer copay cards to help cover their costs. As we move forward, it is crucial that we continue to advocate for policies that prioritize the health and well-being of all patients.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of Advocacy and Government Affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. You can reach her at rhnews@mdedge.com.

Specialists Are ‘Underwater’ With Some Insurance-Preferred Biosimilars

Editor’s note: This article is adapted from an explanatory statement that Dr. Feldman wrote for the Coalition of State Rheumatology Organizations (CSRO).

According to the Guinness Book of World records, the longest time someone has held their breath underwater voluntarily is 24 minutes and 37.36 seconds. While certainly an amazing feat, UnitedHealthcare, many of the Blues, and other national “payers” are expecting rheumatologists and other specialists to live “underwater” in order to take care of their patients. In other words, these insurance companies are mandating that specialists use certain provider-administered biosimilars whose acquisition cost is higher than what the insurance company is willing to reimburse them. Essentially, the insurance companies expect the rheumatologists to pay them to take care of their patients. Because of the substantial and destabilizing financial losses incurred, many practices and free-standing infusion centers have been forced to cease offering these biosimilars. Most rheumatologists will provide patients with appropriate alternatives when available and permitted by the insurer; otherwise, they must refer patients to hospital-based infusion centers. That results in delayed care and increased costs for patients and the system, because hospital-based infusion typically costs more than twice what office-based infusion costs.

Quantifying the Problem

To help quantify the magnitude of this issue, the Coalition of State Rheumatology Organizations (CSRO) recently conducted a survey of its membership. A shocking 97% of respondents reported that their practice had been affected by reimbursement rates for some biosimilars being lower than acquisition costs, with 91% of respondents stating that this issue is more pronounced for certain biosimilars than others. Across the board, respondents most frequently identified Inflectra (infliximab-dyyb) and Avsola (infliximab-axxq) as being especially affected: Over 88% and over 85% of respondents identified these two products, respectively, as being underwater. These results support the ongoing anecdotal reports CSRO continues to receive from rheumatology practices.

However, the survey results indicated that this issue is by no means confined to those two biosimilars. Truxima (rituximab-abbs) — a biosimilar for Rituxan — was frequently mentioned as well. Notably, respondents almost uniformly identified biosimilars in the infliximab and rituximab families, which illustrates that this issue is no longer confined to one or two early-to-market biosimilars but has almost become a hallmark of this particular biosimilars market. Remarkably, one respondent commented that the brand products are now cheaper to acquire than the biosimilars. Furthermore, the survey included respondents from across the country, indicating that this issue is not confined to a particular region.

How Did This Happen?

Biosimilars held promise for increasing availability and decreasing biologic costs for patients but, thus far, no patients have seen their cost go down. It appears that the only biosimilars that have made it to “preferred” status on the formulary are the ones that have made more money for the middlemen in the drug supply chain, particularly those that construct formularies. Now, we have provider-administered biosimilars whose acquisition cost exceeds the reimbursement for these drugs. This disparity was ultimately created by biosimilar manufacturers “over-rebating” their drugs to health insurance companies to gain “fail-first” status on the formulary.

For example, the manufacturer of Inflectra offered substantial rebates to health insurers for preferred formulary placement. These rebates are factored into the sales price of the medication, which then results in a rapidly declining average sales price (ASP) for the biosimilar. Unfortunately, the acquisition cost for the drug does not experience commensurate reductions, resulting in physicians being reimbursed far less for the drug than it costs to acquire. The financial losses for physicians put them underwater as a result of the acquisition costs for the preferred drugs far surpassing the reimbursement from the health insurance company that constructed the formulary.

While various factors affect ASPs and acquisition costs, this particular consequence of formulary placement based on price concessions is a major driver of the underwater situation in which physicians have found themselves with many biosimilars. Not only does that lead to a lower uptake of biosimilars, but it also results in patients being referred to the hospital outpatient infusion sites to receive this care, as freestanding infusion centers cannot treat these patients either. Hospitals incur higher costs because of facility fees and elevated rates, and this makes private rheumatology in-office infusion centers a much lower-cost option. Similarly, home infusion services, while convenient, are marginally more expensive than private practices and, in cases of biologic infusions, it is important to note that physicians’ offices have a greater safety profile than home infusion of biologics. The overall result of these “fail-first underwater drugs” is delayed and more costly care for the patient and the “system,” particularly self-insured employers.

What Is Being Done to Correct This?

Since ASPs are updated quarterly, it is possible that acquisition costs and reimbursements might stabilize over time, making the drugs affordable again to practices. However, that does not appear to be happening in the near future, so that possibility does not offer immediate relief to struggling practices. It doesn’t promise a favorable outlook for future biosimilar entries of provider-administered medications if formularies continue to prefer the highest-rebated medication.

This dynamic between ASP and acquisition cost does not happen on the pharmacy side because the price concessions on specific drug rebates and fees are proprietary. There appears to be no equivalent to a publicly known ASP on the pharmacy side, which has led to myriad pricing definitions and manipulation on the pharmacy benefit side of medications. In any event, the savings from rebates and other manufacturer price concessions on pharmacy drugs do not influence ASPs of medical benefit drugs.

The Inflation Reduction Act provided a temporary increase in the add-on payment for biosimilars from ASP+6% to ASP+8%, but as long as the biosimilar’s ASP is lower than the reference brand’s ASP, that temporary increase does not appear to make up for the large differential between ASP and acquisition cost. It should be noted that any federal attempt to artificially lower the ASP of a provider-administered drug without a pathway assuring that the acquisition cost for the provider is less than the reimbursement is going to result in loss of access for patients to those medications and/or higher hospital site of care costs.

A Few Partial Fixes, But Most Complaints Go Ignored

Considering the higher costs of hospital-based infusion, insurers should be motivated to keep patients within private practices. Perhaps through insurers’ recognition of that fact, some practices have successfully negotiated exceptions for specific patients by discussing this situation with insurers. From the feedback that CSRO has received from rheumatology practices, it appears that most insurers have been ignoring the complaints from physicians. The few who have responded have resulted in only partial fixes, with some of the biosimilars still left underwater.

Ultimate Solution?

This issue is a direct result of the “rebate game,” whereby price concessions from drug manufacturers drive formulary placement. For provider-administered medications, this results in an artificially lowered ASP, not as a consequence of free-market incentives that benefit the patient, but as a result of misaligned incentives created by Safe Harbor–protected “kickbacks,” distorting the free market and paradoxically reducing access to these medications, delaying care, and increasing prices for patients and the healthcare system.

While federal and state governments are not likely to address this particular situation in the biosimilars market, CSRO is highlighting this issue as a prime example of why the current formulary construction system urgently requires federal reform. At this time, the biosimilars most affected are Inflectra and Avsola, but if nothing changes, more and more biosimilars will fall victim to the short-sighted pricing strategy of aggressive rebating to gain formulary position, with physician purchasers and patients left to navigate the aftermath. The existing system, which necessitates drug companies purchasing formulary access from pharmacy benefit managers, has led to delayed and even denied patient access to certain provider-administered drugs. Moreover, it now appears to be hindering the adoption of biosimilars.

To address this, a multifaceted approach is required. It not only involves reevaluating the rebate system and its impact on formulary construction and ASP, but also ensuring that acquisition costs for providers are aligned with reimbursement rates. Insurers must recognize the economic and clinical value of maintaining infusions within private practices and immediately update their policies to ensure that physician in-office infusion is financially feasible for these “fail-first” biosimilars.

Ultimately, the goal should be to create a sustainable model that promotes the use of affordable biosimilars, enhances patient access to affordable care, and supports the financial viability of medical practices. Concerted efforts to reform the current formulary construction system are required to achieve a healthcare environment that is both cost effective and patient centric.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of advocacy and government affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. You can reach her at rhnews@mdedge.com.

Editor’s note: This article is adapted from an explanatory statement that Dr. Feldman wrote for the Coalition of State Rheumatology Organizations (CSRO).

According to the Guinness Book of World records, the longest time someone has held their breath underwater voluntarily is 24 minutes and 37.36 seconds. While certainly an amazing feat, UnitedHealthcare, many of the Blues, and other national “payers” are expecting rheumatologists and other specialists to live “underwater” in order to take care of their patients. In other words, these insurance companies are mandating that specialists use certain provider-administered biosimilars whose acquisition cost is higher than what the insurance company is willing to reimburse them. Essentially, the insurance companies expect the rheumatologists to pay them to take care of their patients. Because of the substantial and destabilizing financial losses incurred, many practices and free-standing infusion centers have been forced to cease offering these biosimilars. Most rheumatologists will provide patients with appropriate alternatives when available and permitted by the insurer; otherwise, they must refer patients to hospital-based infusion centers. That results in delayed care and increased costs for patients and the system, because hospital-based infusion typically costs more than twice what office-based infusion costs.

Quantifying the Problem

To help quantify the magnitude of this issue, the Coalition of State Rheumatology Organizations (CSRO) recently conducted a survey of its membership. A shocking 97% of respondents reported that their practice had been affected by reimbursement rates for some biosimilars being lower than acquisition costs, with 91% of respondents stating that this issue is more pronounced for certain biosimilars than others. Across the board, respondents most frequently identified Inflectra (infliximab-dyyb) and Avsola (infliximab-axxq) as being especially affected: Over 88% and over 85% of respondents identified these two products, respectively, as being underwater. These results support the ongoing anecdotal reports CSRO continues to receive from rheumatology practices.

However, the survey results indicated that this issue is by no means confined to those two biosimilars. Truxima (rituximab-abbs) — a biosimilar for Rituxan — was frequently mentioned as well. Notably, respondents almost uniformly identified biosimilars in the infliximab and rituximab families, which illustrates that this issue is no longer confined to one or two early-to-market biosimilars but has almost become a hallmark of this particular biosimilars market. Remarkably, one respondent commented that the brand products are now cheaper to acquire than the biosimilars. Furthermore, the survey included respondents from across the country, indicating that this issue is not confined to a particular region.

How Did This Happen?

Biosimilars held promise for increasing availability and decreasing biologic costs for patients but, thus far, no patients have seen their cost go down. It appears that the only biosimilars that have made it to “preferred” status on the formulary are the ones that have made more money for the middlemen in the drug supply chain, particularly those that construct formularies. Now, we have provider-administered biosimilars whose acquisition cost exceeds the reimbursement for these drugs. This disparity was ultimately created by biosimilar manufacturers “over-rebating” their drugs to health insurance companies to gain “fail-first” status on the formulary.

For example, the manufacturer of Inflectra offered substantial rebates to health insurers for preferred formulary placement. These rebates are factored into the sales price of the medication, which then results in a rapidly declining average sales price (ASP) for the biosimilar. Unfortunately, the acquisition cost for the drug does not experience commensurate reductions, resulting in physicians being reimbursed far less for the drug than it costs to acquire. The financial losses for physicians put them underwater as a result of the acquisition costs for the preferred drugs far surpassing the reimbursement from the health insurance company that constructed the formulary.

While various factors affect ASPs and acquisition costs, this particular consequence of formulary placement based on price concessions is a major driver of the underwater situation in which physicians have found themselves with many biosimilars. Not only does that lead to a lower uptake of biosimilars, but it also results in patients being referred to the hospital outpatient infusion sites to receive this care, as freestanding infusion centers cannot treat these patients either. Hospitals incur higher costs because of facility fees and elevated rates, and this makes private rheumatology in-office infusion centers a much lower-cost option. Similarly, home infusion services, while convenient, are marginally more expensive than private practices and, in cases of biologic infusions, it is important to note that physicians’ offices have a greater safety profile than home infusion of biologics. The overall result of these “fail-first underwater drugs” is delayed and more costly care for the patient and the “system,” particularly self-insured employers.

What Is Being Done to Correct This?

Since ASPs are updated quarterly, it is possible that acquisition costs and reimbursements might stabilize over time, making the drugs affordable again to practices. However, that does not appear to be happening in the near future, so that possibility does not offer immediate relief to struggling practices. It doesn’t promise a favorable outlook for future biosimilar entries of provider-administered medications if formularies continue to prefer the highest-rebated medication.

This dynamic between ASP and acquisition cost does not happen on the pharmacy side because the price concessions on specific drug rebates and fees are proprietary. There appears to be no equivalent to a publicly known ASP on the pharmacy side, which has led to myriad pricing definitions and manipulation on the pharmacy benefit side of medications. In any event, the savings from rebates and other manufacturer price concessions on pharmacy drugs do not influence ASPs of medical benefit drugs.

The Inflation Reduction Act provided a temporary increase in the add-on payment for biosimilars from ASP+6% to ASP+8%, but as long as the biosimilar’s ASP is lower than the reference brand’s ASP, that temporary increase does not appear to make up for the large differential between ASP and acquisition cost. It should be noted that any federal attempt to artificially lower the ASP of a provider-administered drug without a pathway assuring that the acquisition cost for the provider is less than the reimbursement is going to result in loss of access for patients to those medications and/or higher hospital site of care costs.

A Few Partial Fixes, But Most Complaints Go Ignored

Considering the higher costs of hospital-based infusion, insurers should be motivated to keep patients within private practices. Perhaps through insurers’ recognition of that fact, some practices have successfully negotiated exceptions for specific patients by discussing this situation with insurers. From the feedback that CSRO has received from rheumatology practices, it appears that most insurers have been ignoring the complaints from physicians. The few who have responded have resulted in only partial fixes, with some of the biosimilars still left underwater.

Ultimate Solution?

This issue is a direct result of the “rebate game,” whereby price concessions from drug manufacturers drive formulary placement. For provider-administered medications, this results in an artificially lowered ASP, not as a consequence of free-market incentives that benefit the patient, but as a result of misaligned incentives created by Safe Harbor–protected “kickbacks,” distorting the free market and paradoxically reducing access to these medications, delaying care, and increasing prices for patients and the healthcare system.

While federal and state governments are not likely to address this particular situation in the biosimilars market, CSRO is highlighting this issue as a prime example of why the current formulary construction system urgently requires federal reform. At this time, the biosimilars most affected are Inflectra and Avsola, but if nothing changes, more and more biosimilars will fall victim to the short-sighted pricing strategy of aggressive rebating to gain formulary position, with physician purchasers and patients left to navigate the aftermath. The existing system, which necessitates drug companies purchasing formulary access from pharmacy benefit managers, has led to delayed and even denied patient access to certain provider-administered drugs. Moreover, it now appears to be hindering the adoption of biosimilars.

To address this, a multifaceted approach is required. It not only involves reevaluating the rebate system and its impact on formulary construction and ASP, but also ensuring that acquisition costs for providers are aligned with reimbursement rates. Insurers must recognize the economic and clinical value of maintaining infusions within private practices and immediately update their policies to ensure that physician in-office infusion is financially feasible for these “fail-first” biosimilars.

Ultimately, the goal should be to create a sustainable model that promotes the use of affordable biosimilars, enhances patient access to affordable care, and supports the financial viability of medical practices. Concerted efforts to reform the current formulary construction system are required to achieve a healthcare environment that is both cost effective and patient centric.

Dr. Feldman is a rheumatologist in private practice with The Rheumatology Group in New Orleans. She is the CSRO’s vice president of advocacy and government affairs and its immediate past president, as well as past chair of the Alliance for Safe Biologic Medicines and a past member of the American College of Rheumatology insurance subcommittee. You can reach her at rhnews@mdedge.com.

Editor’s note: This article is adapted from an explanatory statement that Dr. Feldman wrote for the Coalition of State Rheumatology Organizations (CSRO).

According to the Guinness Book of World records, the longest time someone has held their breath underwater voluntarily is 24 minutes and 37.36 seconds. While certainly an amazing feat, UnitedHealthcare, many of the Blues, and other national “payers” are expecting rheumatologists and other specialists to live “underwater” in order to take care of their patients. In other words, these insurance companies are mandating that specialists use certain provider-administered biosimilars whose acquisition cost is higher than what the insurance company is willing to reimburse them. Essentially, the insurance companies expect the rheumatologists to pay them to take care of their patients. Because of the substantial and destabilizing financial losses incurred, many practices and free-standing infusion centers have been forced to cease offering these biosimilars. Most rheumatologists will provide patients with appropriate alternatives when available and permitted by the insurer; otherwise, they must refer patients to hospital-based infusion centers. That results in delayed care and increased costs for patients and the system, because hospital-based infusion typically costs more than twice what office-based infusion costs.

Quantifying the Problem

To help quantify the magnitude of this issue, the Coalition of State Rheumatology Organizations (CSRO) recently conducted a survey of its membership. A shocking 97% of respondents reported that their practice had been affected by reimbursement rates for some biosimilars being lower than acquisition costs, with 91% of respondents stating that this issue is more pronounced for certain biosimilars than others. Across the board, respondents most frequently identified Inflectra (infliximab-dyyb) and Avsola (infliximab-axxq) as being especially affected: Over 88% and over 85% of respondents identified these two products, respectively, as being underwater. These results support the ongoing anecdotal reports CSRO continues to receive from rheumatology practices.

However, the survey results indicated that this issue is by no means confined to those two biosimilars. Truxima (rituximab-abbs) — a biosimilar for Rituxan — was frequently mentioned as well. Notably, respondents almost uniformly identified biosimilars in the infliximab and rituximab families, which illustrates that this issue is no longer confined to one or two early-to-market biosimilars but has almost become a hallmark of this particular biosimilars market. Remarkably, one respondent commented that the brand products are now cheaper to acquire than the biosimilars. Furthermore, the survey included respondents from across the country, indicating that this issue is not confined to a particular region.

How Did This Happen?

Biosimilars held promise for increasing availability and decreasing biologic costs for patients but, thus far, no patients have seen their cost go down. It appears that the only biosimilars that have made it to “preferred” status on the formulary are the ones that have made more money for the middlemen in the drug supply chain, particularly those that construct formularies. Now, we have provider-administered biosimilars whose acquisition cost exceeds the reimbursement for these drugs. This disparity was ultimately created by biosimilar manufacturers “over-rebating” their drugs to health insurance companies to gain “fail-first” status on the formulary.