User login

Advanced endoscopy training in the United States

Introduction

Comprehensive training in endoscopic retrograde cholangioscopy (ERCP) and endoscopic ultrasound (EUS) is difficult to achieve within the curriculum of a standard 3-year Accreditation Council for Graduate Medical Education (ACGME)–accredited gastroenterology fellowship. ERCP and EUS are technically challenging, operator-dependent procedures that require specialized cognitive, technical, and integrative skills.1-4 A survey of physicians performing ERCP found that only 60% felt “very comfortable” performing the procedure after completion of a standard gastroenterology fellowship.5 Procedural volumes in ERCP and EUS tend to be low among general gastroenterology fellows; in a survey, only 9% and 4.5% of trainees in standard gastrointestinal fellowships had anticipated volumes of more than 200 ERCP and EUS procedures, respectively.6 The unique skills required to safely and effectively perform ERCP and EUS, along with the growing portfolio of therapeutic procedures such as endoscopic mucosal resection (EMR), endoluminal stent placement, deep enteroscopy, advanced closure techniques, bariatric endoscopy, therapeutic EUS, and submucosal endoscopy (including endoscopic submucosal dissection and peroral endoscopic myotomy), has led to the development of dedicated postgraduate advanced endoscopy training programs.7-9

Status of advanced endoscopy training in the United States

Advanced endoscopy fellowships are typically year-long training programs completed at tertiary care centers. Over the last 2 decades, there has been a dramatic increase in the number of advanced endoscopy training positions.9 In 2012, the American Society for Gastrointestinal Endoscopy established a match program to standardize the application process (www.asgematch.com).10 Since its inception, there have been approximately 100 applicants per year and 60 participating programs. In the 2018 match, there were 90 advanced endoscopy applicants for 69 positions. Each year, about 20% of graduating gastroenterology fellows apply for advanced endoscopy fellowship, and applicant match rates are approximately 60%.

The goal of advanced endoscopy fellowship is to teach trainees to safely and effectively perform high-risk endoscopic procedures.1,11,12 Without ACGME oversight, no defined curricular requirements exist, and programs can be quite variable. Stronger programs offer close mentorship, conferences, comprehensive didactics, research support, and regular feedback. All programs participating in this year’s match offered training in both ERCP and EUS with most offering training in EMR, ablation, and deep enteroscopy.10 Many programs also offered training in endoluminal stenting and advanced closure techniques, such as suturing. More than half offered training in endoscopic submucosal dissection, peroral endoscopic myotomy, and bariatric endoscopy, but trainee hands-on time is usually limited, and competence is not guaranteed. A recent, large, multicenter, prospective study found that the median number of ERCPs and EUSs performed by trainees during advancing endoscopy training was 350 (range 125-500) and 300 (range 155-650), respectively.2 Median number of ERCPs performed in patients with native papilla was 51 (range 32-79). Most ERCPs were performed for biliary indications, and most EUSs were performed for pancreaticobiliary indications. The study found that most advanced endoscopy trainees have limited exposure to interventional EUS procedures, ERCPs for pancreatic indications, and ERCPs requiring advanced cannulation techniques.

Competency assessment

Advanced endoscopy fellowship programs must ensure trainees have achieved technical and cognitive competence and are safe for independent practice. Methods to assess trainee competence in advanced procedures have changed significantly over the last several years.1 Historically, endoscopic training was based on an apprenticeship model. Procedural volume and subjective assessments from trainers were used as surrogates for competence. Most current societal guidelines now recommend competency thresholds – a minimum number of supervised procedures that a trainee should complete before competency can be assessed – instead of absolute procedure volume requirements.4,13,14 The ASGE recommends that at least 200 supervised independent ERCPs, including 80 independent sphincterotomies and 60 biliary stent placements, should be performed before assessing competence.4 Similarly, 225 supervised independent EUS cases are recommended before assessing competence. Importantly, these guidelines are not validated and do not account for the inherent variability in which different trainees acquire endoscopic skills.15-18

Because of the limitations of volume-based assessments of competence, a greater emphasis has been placed on developing comprehensive, standardized competency assessments. With the ACGME’s adoption of the Next Accreditation System (NAS), a greater emphasis has been placed on competency-based medical education throughout the United States. The goal of the Next Accreditation System is to ensure that specific milestones are achieved by trainees and that trainee progress is clearly reported. Similarly, within advanced endoscopic training, it is now accepted that a minimum procedural volume is a necessary, but insufficient, marker of competence.1 Therefore, recent work has focused on defining milestones, developing assessment tools with strong validity, establishing trainee learning curves, and providing trainees with continuous feedback that allows for targeted improvement. Although the data are limited, a few studies have assessed learning curves among trainees. A prospective study of 15 trainees from the Netherlands found that trainees acquire competence in ERCP skills at variable rates; specifically, trainees achieved competence in native papilla cannulation later than other ERCP skills.18 Similarly, a recent prospective multicenter study of advanced endoscopy trainees using a standardized assessment tool and cumulative sum analysis found significant variability in the learning curves for cognitive and technical aspects of ERCP.15

The EUS and ERCP Skills Assessment Tool (TEESAT) is a competence assessment tool for EUS and ERCP with strong validity evidence.2,15,19-21 The tool assesses several individual technical and cognitive skills, in addition to a global assessment of competence, and should be used in a continuous fashion throughout fellowship training. A prospective, multicenter study using the TEESAT showed substantial variability in EUS and ERCP learning curves among trainees and demonstrated the feasibility of creating a national, centralized database that allows for continuous monitoring and reporting of individualized learning curves for EUS and ERCP among advanced endoscopy trainees.2 Such a database is an important step in evolving with the ACGME/NAS reporting requirement and would allow for fellowship program directors and trainers to identify specific trainee deficiencies in order to deliver targeted remediation.

The impact of individualized feedback on trainee learning curves and EUS and ERCP quality indicators was addressed in a recently published prospective multicenter cohort study.22 In phase 1 of the study, 24 advanced endoscopy trainees from 20 programs were assessed using the TEESAT and given quarterly feedback. By the end of training, 92% and 74% of fellows had achieved overall technical competence in EUS and ERCP, respectively. In phase 2, trainees were assessed in their first year of independent practice to determine whether participation in competency-based fellowship programs results in high-quality care in independent practice. The study found that most trainees met performance thresholds for quality indicators in EUS (94% diagnostic rate of adequate samples and 84% diagnostic yield of malignancy in pancreatic masses) and ERCP (95% overall cannulation rate). While competence could not be confirmed for all trainees after fellowship completion, most met quality indicator thresholds for EUS and ERCP during the first year of independent practice. These data provide construct validity evidence for TEESAT and the data collection and reporting system that provides periodic feedback using learning curves and ultimately affirm the effectiveness of current training programs.

Establishing minimal standards for training programs

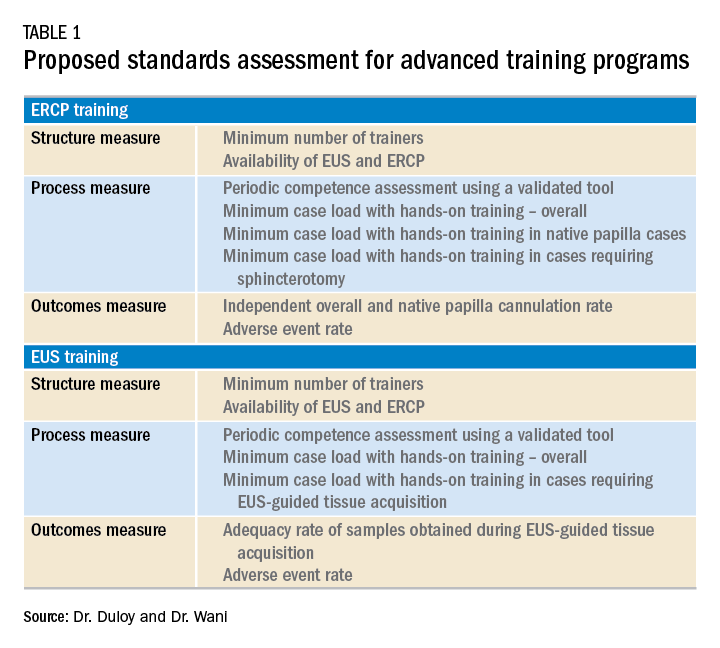

Although the ASGE offers rudimentary metrics to characterize fellowships through the match program, a more comprehensive evaluation of advanced endoscopy training programs would be of value to potential trainees. It is in this context that we offered the minimum ERCP (~250 cases for Grade 1 ERCP and ~300 cases for Grade 2 ERCP) and EUS (~225 cases) volumes that should serve as a basis for a more rigorous assessment of advanced endoscopy training programs. We also recently proposed structure, process, and outcomes measures that should be defined along with associated benchmarks (Table 1). These quality metrics could then be utilized to guide trainees in the selection of a program.

Conclusion

Advanced endoscopy training is a critical first step to ensuring endoscopists have the procedural and cognitive skills necessary to safely and effectively perform these high-risk procedures. As the portfolio of new procedures grows longer and more complex, it will become even more important for training programs to establish a standardized curriculum, adopt universal competency assessment tools, and provide continuous and targeted feedback to their trainees.

References

1. Wani S et al. Gastrointest Endosc. 2018;87:1371-82.

2. Wani S et al. Clin Gastroenterol Hepatol. 2017;15:1758-67 e11.

3. Patel SG et al. Am J Gastroenterol. 2015;110:956-62.

4. Committee ASoP et al. Gastrointest Endosc. 2017;85:273-81.

5. Cote GA et al. Gastrointest Endosc. 2011;74:65-73 e12.

6. Cotton PB et al. Gastrointest Endosc 2017;86:866-9.

7. Moffatt DC et al. Gastrointest Endosc. 2014;79:615-22.

8. Training and Education Committee of the American Gastroenterological Association. Gastroenterology 1988;94:1083-6.

9. Elta GH et al. Gastroenterology 2015;148:488-90.

10. www.asgematch.com. (Accessed June 21, 2018)

11. Jowell PS et al. Ann Intern Med 1996;125:983-9.

12. Eisen GM et al. Gastrointest Endosc 2002;55:780-3.

13. Polkowski M et al. Endoscopy 2012;44:190-206.

14. Committee AT et al. Gastrointest Endosc 2016;83:279-89.

15. Wani S et al. Gastrointest Endosc 2016;83:711-9 e11.

16. Northup PG et al. Gastroenterology 2013;144:677-80.

17. Eisen GM et al. Gastrointest Endosc 2001;53:846-8.

18. Ekkelenkamp VE et al. Endoscopy 2014;46:949-55.

19. Wani S et al. Clin Gastroenterol Hepatol 2015;13:1318-25 e2.

20. Wani S et al. Gastrointest Endosc 2013;77:558-65.

Dr. Duloy is a therapeutic gastroenterology fellow; Dr. Wani is an associate professor of medicine, University of Colorado Anschutz Medical Campus, Aurora, Colo.

Introduction

Comprehensive training in endoscopic retrograde cholangioscopy (ERCP) and endoscopic ultrasound (EUS) is difficult to achieve within the curriculum of a standard 3-year Accreditation Council for Graduate Medical Education (ACGME)–accredited gastroenterology fellowship. ERCP and EUS are technically challenging, operator-dependent procedures that require specialized cognitive, technical, and integrative skills.1-4 A survey of physicians performing ERCP found that only 60% felt “very comfortable” performing the procedure after completion of a standard gastroenterology fellowship.5 Procedural volumes in ERCP and EUS tend to be low among general gastroenterology fellows; in a survey, only 9% and 4.5% of trainees in standard gastrointestinal fellowships had anticipated volumes of more than 200 ERCP and EUS procedures, respectively.6 The unique skills required to safely and effectively perform ERCP and EUS, along with the growing portfolio of therapeutic procedures such as endoscopic mucosal resection (EMR), endoluminal stent placement, deep enteroscopy, advanced closure techniques, bariatric endoscopy, therapeutic EUS, and submucosal endoscopy (including endoscopic submucosal dissection and peroral endoscopic myotomy), has led to the development of dedicated postgraduate advanced endoscopy training programs.7-9

Status of advanced endoscopy training in the United States

Advanced endoscopy fellowships are typically year-long training programs completed at tertiary care centers. Over the last 2 decades, there has been a dramatic increase in the number of advanced endoscopy training positions.9 In 2012, the American Society for Gastrointestinal Endoscopy established a match program to standardize the application process (www.asgematch.com).10 Since its inception, there have been approximately 100 applicants per year and 60 participating programs. In the 2018 match, there were 90 advanced endoscopy applicants for 69 positions. Each year, about 20% of graduating gastroenterology fellows apply for advanced endoscopy fellowship, and applicant match rates are approximately 60%.

The goal of advanced endoscopy fellowship is to teach trainees to safely and effectively perform high-risk endoscopic procedures.1,11,12 Without ACGME oversight, no defined curricular requirements exist, and programs can be quite variable. Stronger programs offer close mentorship, conferences, comprehensive didactics, research support, and regular feedback. All programs participating in this year’s match offered training in both ERCP and EUS with most offering training in EMR, ablation, and deep enteroscopy.10 Many programs also offered training in endoluminal stenting and advanced closure techniques, such as suturing. More than half offered training in endoscopic submucosal dissection, peroral endoscopic myotomy, and bariatric endoscopy, but trainee hands-on time is usually limited, and competence is not guaranteed. A recent, large, multicenter, prospective study found that the median number of ERCPs and EUSs performed by trainees during advancing endoscopy training was 350 (range 125-500) and 300 (range 155-650), respectively.2 Median number of ERCPs performed in patients with native papilla was 51 (range 32-79). Most ERCPs were performed for biliary indications, and most EUSs were performed for pancreaticobiliary indications. The study found that most advanced endoscopy trainees have limited exposure to interventional EUS procedures, ERCPs for pancreatic indications, and ERCPs requiring advanced cannulation techniques.

Competency assessment

Advanced endoscopy fellowship programs must ensure trainees have achieved technical and cognitive competence and are safe for independent practice. Methods to assess trainee competence in advanced procedures have changed significantly over the last several years.1 Historically, endoscopic training was based on an apprenticeship model. Procedural volume and subjective assessments from trainers were used as surrogates for competence. Most current societal guidelines now recommend competency thresholds – a minimum number of supervised procedures that a trainee should complete before competency can be assessed – instead of absolute procedure volume requirements.4,13,14 The ASGE recommends that at least 200 supervised independent ERCPs, including 80 independent sphincterotomies and 60 biliary stent placements, should be performed before assessing competence.4 Similarly, 225 supervised independent EUS cases are recommended before assessing competence. Importantly, these guidelines are not validated and do not account for the inherent variability in which different trainees acquire endoscopic skills.15-18

Because of the limitations of volume-based assessments of competence, a greater emphasis has been placed on developing comprehensive, standardized competency assessments. With the ACGME’s adoption of the Next Accreditation System (NAS), a greater emphasis has been placed on competency-based medical education throughout the United States. The goal of the Next Accreditation System is to ensure that specific milestones are achieved by trainees and that trainee progress is clearly reported. Similarly, within advanced endoscopic training, it is now accepted that a minimum procedural volume is a necessary, but insufficient, marker of competence.1 Therefore, recent work has focused on defining milestones, developing assessment tools with strong validity, establishing trainee learning curves, and providing trainees with continuous feedback that allows for targeted improvement. Although the data are limited, a few studies have assessed learning curves among trainees. A prospective study of 15 trainees from the Netherlands found that trainees acquire competence in ERCP skills at variable rates; specifically, trainees achieved competence in native papilla cannulation later than other ERCP skills.18 Similarly, a recent prospective multicenter study of advanced endoscopy trainees using a standardized assessment tool and cumulative sum analysis found significant variability in the learning curves for cognitive and technical aspects of ERCP.15

The EUS and ERCP Skills Assessment Tool (TEESAT) is a competence assessment tool for EUS and ERCP with strong validity evidence.2,15,19-21 The tool assesses several individual technical and cognitive skills, in addition to a global assessment of competence, and should be used in a continuous fashion throughout fellowship training. A prospective, multicenter study using the TEESAT showed substantial variability in EUS and ERCP learning curves among trainees and demonstrated the feasibility of creating a national, centralized database that allows for continuous monitoring and reporting of individualized learning curves for EUS and ERCP among advanced endoscopy trainees.2 Such a database is an important step in evolving with the ACGME/NAS reporting requirement and would allow for fellowship program directors and trainers to identify specific trainee deficiencies in order to deliver targeted remediation.

The impact of individualized feedback on trainee learning curves and EUS and ERCP quality indicators was addressed in a recently published prospective multicenter cohort study.22 In phase 1 of the study, 24 advanced endoscopy trainees from 20 programs were assessed using the TEESAT and given quarterly feedback. By the end of training, 92% and 74% of fellows had achieved overall technical competence in EUS and ERCP, respectively. In phase 2, trainees were assessed in their first year of independent practice to determine whether participation in competency-based fellowship programs results in high-quality care in independent practice. The study found that most trainees met performance thresholds for quality indicators in EUS (94% diagnostic rate of adequate samples and 84% diagnostic yield of malignancy in pancreatic masses) and ERCP (95% overall cannulation rate). While competence could not be confirmed for all trainees after fellowship completion, most met quality indicator thresholds for EUS and ERCP during the first year of independent practice. These data provide construct validity evidence for TEESAT and the data collection and reporting system that provides periodic feedback using learning curves and ultimately affirm the effectiveness of current training programs.

Establishing minimal standards for training programs

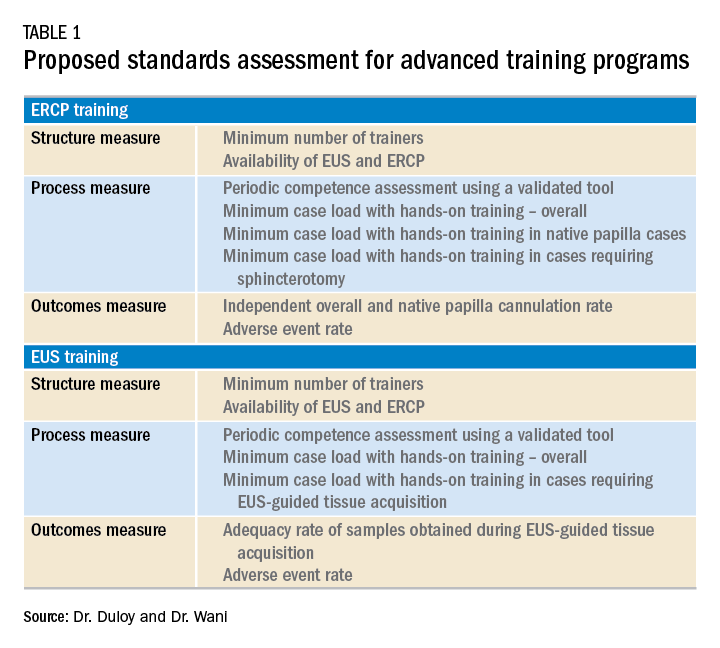

Although the ASGE offers rudimentary metrics to characterize fellowships through the match program, a more comprehensive evaluation of advanced endoscopy training programs would be of value to potential trainees. It is in this context that we offered the minimum ERCP (~250 cases for Grade 1 ERCP and ~300 cases for Grade 2 ERCP) and EUS (~225 cases) volumes that should serve as a basis for a more rigorous assessment of advanced endoscopy training programs. We also recently proposed structure, process, and outcomes measures that should be defined along with associated benchmarks (Table 1). These quality metrics could then be utilized to guide trainees in the selection of a program.

Conclusion

Advanced endoscopy training is a critical first step to ensuring endoscopists have the procedural and cognitive skills necessary to safely and effectively perform these high-risk procedures. As the portfolio of new procedures grows longer and more complex, it will become even more important for training programs to establish a standardized curriculum, adopt universal competency assessment tools, and provide continuous and targeted feedback to their trainees.

References

1. Wani S et al. Gastrointest Endosc. 2018;87:1371-82.

2. Wani S et al. Clin Gastroenterol Hepatol. 2017;15:1758-67 e11.

3. Patel SG et al. Am J Gastroenterol. 2015;110:956-62.

4. Committee ASoP et al. Gastrointest Endosc. 2017;85:273-81.

5. Cote GA et al. Gastrointest Endosc. 2011;74:65-73 e12.

6. Cotton PB et al. Gastrointest Endosc 2017;86:866-9.

7. Moffatt DC et al. Gastrointest Endosc. 2014;79:615-22.

8. Training and Education Committee of the American Gastroenterological Association. Gastroenterology 1988;94:1083-6.

9. Elta GH et al. Gastroenterology 2015;148:488-90.

10. www.asgematch.com. (Accessed June 21, 2018)

11. Jowell PS et al. Ann Intern Med 1996;125:983-9.

12. Eisen GM et al. Gastrointest Endosc 2002;55:780-3.

13. Polkowski M et al. Endoscopy 2012;44:190-206.

14. Committee AT et al. Gastrointest Endosc 2016;83:279-89.

15. Wani S et al. Gastrointest Endosc 2016;83:711-9 e11.

16. Northup PG et al. Gastroenterology 2013;144:677-80.

17. Eisen GM et al. Gastrointest Endosc 2001;53:846-8.

18. Ekkelenkamp VE et al. Endoscopy 2014;46:949-55.

19. Wani S et al. Clin Gastroenterol Hepatol 2015;13:1318-25 e2.

20. Wani S et al. Gastrointest Endosc 2013;77:558-65.

Dr. Duloy is a therapeutic gastroenterology fellow; Dr. Wani is an associate professor of medicine, University of Colorado Anschutz Medical Campus, Aurora, Colo.

Introduction

Comprehensive training in endoscopic retrograde cholangioscopy (ERCP) and endoscopic ultrasound (EUS) is difficult to achieve within the curriculum of a standard 3-year Accreditation Council for Graduate Medical Education (ACGME)–accredited gastroenterology fellowship. ERCP and EUS are technically challenging, operator-dependent procedures that require specialized cognitive, technical, and integrative skills.1-4 A survey of physicians performing ERCP found that only 60% felt “very comfortable” performing the procedure after completion of a standard gastroenterology fellowship.5 Procedural volumes in ERCP and EUS tend to be low among general gastroenterology fellows; in a survey, only 9% and 4.5% of trainees in standard gastrointestinal fellowships had anticipated volumes of more than 200 ERCP and EUS procedures, respectively.6 The unique skills required to safely and effectively perform ERCP and EUS, along with the growing portfolio of therapeutic procedures such as endoscopic mucosal resection (EMR), endoluminal stent placement, deep enteroscopy, advanced closure techniques, bariatric endoscopy, therapeutic EUS, and submucosal endoscopy (including endoscopic submucosal dissection and peroral endoscopic myotomy), has led to the development of dedicated postgraduate advanced endoscopy training programs.7-9

Status of advanced endoscopy training in the United States

Advanced endoscopy fellowships are typically year-long training programs completed at tertiary care centers. Over the last 2 decades, there has been a dramatic increase in the number of advanced endoscopy training positions.9 In 2012, the American Society for Gastrointestinal Endoscopy established a match program to standardize the application process (www.asgematch.com).10 Since its inception, there have been approximately 100 applicants per year and 60 participating programs. In the 2018 match, there were 90 advanced endoscopy applicants for 69 positions. Each year, about 20% of graduating gastroenterology fellows apply for advanced endoscopy fellowship, and applicant match rates are approximately 60%.

The goal of advanced endoscopy fellowship is to teach trainees to safely and effectively perform high-risk endoscopic procedures.1,11,12 Without ACGME oversight, no defined curricular requirements exist, and programs can be quite variable. Stronger programs offer close mentorship, conferences, comprehensive didactics, research support, and regular feedback. All programs participating in this year’s match offered training in both ERCP and EUS with most offering training in EMR, ablation, and deep enteroscopy.10 Many programs also offered training in endoluminal stenting and advanced closure techniques, such as suturing. More than half offered training in endoscopic submucosal dissection, peroral endoscopic myotomy, and bariatric endoscopy, but trainee hands-on time is usually limited, and competence is not guaranteed. A recent, large, multicenter, prospective study found that the median number of ERCPs and EUSs performed by trainees during advancing endoscopy training was 350 (range 125-500) and 300 (range 155-650), respectively.2 Median number of ERCPs performed in patients with native papilla was 51 (range 32-79). Most ERCPs were performed for biliary indications, and most EUSs were performed for pancreaticobiliary indications. The study found that most advanced endoscopy trainees have limited exposure to interventional EUS procedures, ERCPs for pancreatic indications, and ERCPs requiring advanced cannulation techniques.

Competency assessment

Advanced endoscopy fellowship programs must ensure trainees have achieved technical and cognitive competence and are safe for independent practice. Methods to assess trainee competence in advanced procedures have changed significantly over the last several years.1 Historically, endoscopic training was based on an apprenticeship model. Procedural volume and subjective assessments from trainers were used as surrogates for competence. Most current societal guidelines now recommend competency thresholds – a minimum number of supervised procedures that a trainee should complete before competency can be assessed – instead of absolute procedure volume requirements.4,13,14 The ASGE recommends that at least 200 supervised independent ERCPs, including 80 independent sphincterotomies and 60 biliary stent placements, should be performed before assessing competence.4 Similarly, 225 supervised independent EUS cases are recommended before assessing competence. Importantly, these guidelines are not validated and do not account for the inherent variability in which different trainees acquire endoscopic skills.15-18

Because of the limitations of volume-based assessments of competence, a greater emphasis has been placed on developing comprehensive, standardized competency assessments. With the ACGME’s adoption of the Next Accreditation System (NAS), a greater emphasis has been placed on competency-based medical education throughout the United States. The goal of the Next Accreditation System is to ensure that specific milestones are achieved by trainees and that trainee progress is clearly reported. Similarly, within advanced endoscopic training, it is now accepted that a minimum procedural volume is a necessary, but insufficient, marker of competence.1 Therefore, recent work has focused on defining milestones, developing assessment tools with strong validity, establishing trainee learning curves, and providing trainees with continuous feedback that allows for targeted improvement. Although the data are limited, a few studies have assessed learning curves among trainees. A prospective study of 15 trainees from the Netherlands found that trainees acquire competence in ERCP skills at variable rates; specifically, trainees achieved competence in native papilla cannulation later than other ERCP skills.18 Similarly, a recent prospective multicenter study of advanced endoscopy trainees using a standardized assessment tool and cumulative sum analysis found significant variability in the learning curves for cognitive and technical aspects of ERCP.15

The EUS and ERCP Skills Assessment Tool (TEESAT) is a competence assessment tool for EUS and ERCP with strong validity evidence.2,15,19-21 The tool assesses several individual technical and cognitive skills, in addition to a global assessment of competence, and should be used in a continuous fashion throughout fellowship training. A prospective, multicenter study using the TEESAT showed substantial variability in EUS and ERCP learning curves among trainees and demonstrated the feasibility of creating a national, centralized database that allows for continuous monitoring and reporting of individualized learning curves for EUS and ERCP among advanced endoscopy trainees.2 Such a database is an important step in evolving with the ACGME/NAS reporting requirement and would allow for fellowship program directors and trainers to identify specific trainee deficiencies in order to deliver targeted remediation.

The impact of individualized feedback on trainee learning curves and EUS and ERCP quality indicators was addressed in a recently published prospective multicenter cohort study.22 In phase 1 of the study, 24 advanced endoscopy trainees from 20 programs were assessed using the TEESAT and given quarterly feedback. By the end of training, 92% and 74% of fellows had achieved overall technical competence in EUS and ERCP, respectively. In phase 2, trainees were assessed in their first year of independent practice to determine whether participation in competency-based fellowship programs results in high-quality care in independent practice. The study found that most trainees met performance thresholds for quality indicators in EUS (94% diagnostic rate of adequate samples and 84% diagnostic yield of malignancy in pancreatic masses) and ERCP (95% overall cannulation rate). While competence could not be confirmed for all trainees after fellowship completion, most met quality indicator thresholds for EUS and ERCP during the first year of independent practice. These data provide construct validity evidence for TEESAT and the data collection and reporting system that provides periodic feedback using learning curves and ultimately affirm the effectiveness of current training programs.

Establishing minimal standards for training programs

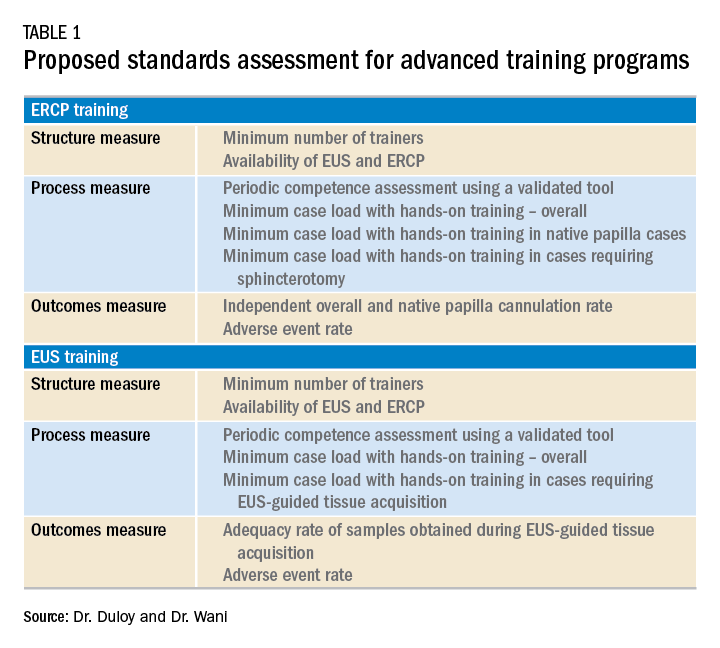

Although the ASGE offers rudimentary metrics to characterize fellowships through the match program, a more comprehensive evaluation of advanced endoscopy training programs would be of value to potential trainees. It is in this context that we offered the minimum ERCP (~250 cases for Grade 1 ERCP and ~300 cases for Grade 2 ERCP) and EUS (~225 cases) volumes that should serve as a basis for a more rigorous assessment of advanced endoscopy training programs. We also recently proposed structure, process, and outcomes measures that should be defined along with associated benchmarks (Table 1). These quality metrics could then be utilized to guide trainees in the selection of a program.

Conclusion

Advanced endoscopy training is a critical first step to ensuring endoscopists have the procedural and cognitive skills necessary to safely and effectively perform these high-risk procedures. As the portfolio of new procedures grows longer and more complex, it will become even more important for training programs to establish a standardized curriculum, adopt universal competency assessment tools, and provide continuous and targeted feedback to their trainees.

References

1. Wani S et al. Gastrointest Endosc. 2018;87:1371-82.

2. Wani S et al. Clin Gastroenterol Hepatol. 2017;15:1758-67 e11.

3. Patel SG et al. Am J Gastroenterol. 2015;110:956-62.

4. Committee ASoP et al. Gastrointest Endosc. 2017;85:273-81.

5. Cote GA et al. Gastrointest Endosc. 2011;74:65-73 e12.

6. Cotton PB et al. Gastrointest Endosc 2017;86:866-9.

7. Moffatt DC et al. Gastrointest Endosc. 2014;79:615-22.

8. Training and Education Committee of the American Gastroenterological Association. Gastroenterology 1988;94:1083-6.

9. Elta GH et al. Gastroenterology 2015;148:488-90.

10. www.asgematch.com. (Accessed June 21, 2018)

11. Jowell PS et al. Ann Intern Med 1996;125:983-9.

12. Eisen GM et al. Gastrointest Endosc 2002;55:780-3.

13. Polkowski M et al. Endoscopy 2012;44:190-206.

14. Committee AT et al. Gastrointest Endosc 2016;83:279-89.

15. Wani S et al. Gastrointest Endosc 2016;83:711-9 e11.

16. Northup PG et al. Gastroenterology 2013;144:677-80.

17. Eisen GM et al. Gastrointest Endosc 2001;53:846-8.

18. Ekkelenkamp VE et al. Endoscopy 2014;46:949-55.

19. Wani S et al. Clin Gastroenterol Hepatol 2015;13:1318-25 e2.

20. Wani S et al. Gastrointest Endosc 2013;77:558-65.

Dr. Duloy is a therapeutic gastroenterology fellow; Dr. Wani is an associate professor of medicine, University of Colorado Anschutz Medical Campus, Aurora, Colo.

Planning for future college expenses with 529 accounts

Financial planning for families can involve multiple investment goals. The big ones usually are investing for retirement and for your children’s college expenses. With any investment strategy, once you have identified an investment goal, you will want to utilize the right investment account to achieve that goal. If investing for future college expenses is your goal, then one of the investment accounts you will want to utilize is called a 529 plan.

What is a 529 plan?

A 529 plan is a tax-favored account authorized by Section 529 of the Internal Revenue Code and sponsored by a state or educational institution. These plans have specific tax-saving features to them, compared with other taxable accounts, which are listed below. To begin with, there are two types of 529 plans: prepaid tuition plans and education savings plans. Every state has at least one type of 529 plan. Additionally, some private colleges sponsor a prepaid tuition plan.

Prepaid tuition plan

The first type of 529 account is a prepaid tuition plan. These let an account owner purchase college credits (or units) for participating colleges or universities at today’s prices to be used for the student’s future tuition charges. The states that sponsor prepaid plans do so primarily for the benefit of their in-state public colleges and universities. Things to know about the prepaid plans: States may or may not guarantee that the prepaid units keep up with increases in tuition charges. The plan also may have a state residency requirement. If the student decides not to attend one of the eligible schools, the equivalent payout may be less than had the student attended one of the participating institutions. There are no federal guarantees on the state prepaid plans and they are not available for private elementary and high school programs.

Education savings plan

The second type of 529 account is an education savings plan, an investment account into which you can invest your after-tax dollars. The intent with these accounts is to grow the balance for use at a future date. These are tax-deferred accounts, which means each year the interest, dividends, and capital gains created within the account do not show up on your tax return. If the funds are used for a “qualified” higher-education expense, then gains on the account are not taxed upon withdrawal.

As with most investments, the longer your money is invested, the more time it has to grow via accumulated interest, dividends, and appreciation. The larger the growth, the larger the tax benefits. This offers a tremendous advantage for a high-income and high-tax bracket household to invest for future goals (such as private school tuition or college expenses). By contrast, if you had invested in a fully taxable account, you would be subject to taxes each year on the interest, dividends, and capital gain distributions. Also, with taxable accounts, your investments would be subject to capital gains tax on the growth when they are sold to pay for those future expenses.

An account owner may choose among a range of investment options that the 529 plan provides. These are typically individual mutual funds or preformed mutual fund portfolios. The portfolios may have a fixed allocation percentage that stays the same over time or come “age-weighted,” meaning the investment allocation becomes more conservative the closer the student gets to college age when withdrawals would occur. This is a similar approach to the “target retirement date” offerings one sees in retirement accounts.

If one is using the 529 account for the student’s elementary or high school years, the investment time frame may be shorter and necessitate a more conservative approach, as the time for withdrawals would be nearer than the college years. As with most investments, the account can lose value based on investment performance.

Owner versus beneficiary

There are two parties to any 529 plan account: The account owner, who has control over the account and can name the beneficiary to the account, and the beneficiary (the student). The account owner can change beneficiaries on the account and can even name themselves as the beneficiary. One can name anyone as the beneficiary (e.g., child, friend, relative, yourself). You can be proactive by creating an account and naming yourself the beneficiary now, before switching to your child in the future. The account owner can live in one state with the beneficiary in another and invest in the 529 from a third state, and the student may eventually go to an educational institution in a fourth state. The 529 education savings account is not limited to any specific college, as a prepaid plan may be.

Withdrawals from 529s

If a 529 account withdrawal is for qualified higher education expenses or tuition for elementary or secondary schools, earnings are not subject to federal income tax or, in many cases, state income tax. Qualified withdrawals need to take place in the same tax year as the qualified expense.

Withdrawals not used for qualified higher education expenses in that year are considered “nonqualified” and would be subject to tax and 10% penalty on the earnings. State and local taxes may apply as well.

You can use the proceeds from the account free of taxes for the following qualified higher-education expenses:

- Tuition and school fees for both full and part time students at an eligible college, university, trade, or vocational institution.

- Room and board if the student is enrolled at more than half-time status. The amount up to the school’s room and board charges are eligible if paid directly to the school or to a landlord if living in nonschool housing. If actual charges to the landlord exceed the schools’ charges, then the amount above the school’s charges would be considered an excess withdrawal.

- Required books, supplies, and equipment for the academic program. Computer and technology equipment, printers, and required software, and such related services as Internet access also are qualified expenses.

- Private elementary or secondary school tuition up to $10,000 annually also is a qualified expense for 529 withdrawals.

Health insurance for the student and transportation-related costs to and from the school are not qualified expenses.

Contributions and fees

Like all investments, the fees associated with a 529 account need to be considered, as excess fees lower the investment returns. Prepaid tuition plans may charge initial application, transaction, and ongoing administrative fees. Investment 529 accounts may also have administrative costs such as program management fees, per-transaction fees, and the underlying investment expense ratios. Some states have broker-sold plans as well as direct-sold plans. Broker-sold plans can be purchased only through a broker and have the additional expenses associated with that either in the form of a load (sales charge) or higher expense ratio.

Contributions to a 529 plan can only be made in cash. If you currently have other investments, they need to be liquidated first (with the associated tax consequence) and then the proceeds invested into the 529 plan. Establishing the account and ongoing contributions are subject to gift tax limits ($15,000 for 2019). A married couple may make a “joint gift” to the account to double the limit. The 529 plans also allow the owner to front-load the account in 1 year with up to 5 years’ worth of gift limit contributions all at once. This lump sum is treated for tax reasons as a pro-rata 5 consecutive years of contributions all at once. Any additional gifts to that beneficiary during that year and the remaining four would be subject to gift tax issues if it means the annual gift limits were exceeded. Contributions are considered a “completed gift” for gift- and estate-tax purposes even though the account owner retains an element of control. The up-front 5-year gift election is available only on 529 accounts and is a great way for parents and grandparents (hint-hint) to reduce their estates and get a significant initial balance into the account. This can come in handy for those who may have procrastinated working toward this investment goal and need to catch up.

If the beneficiary does not need all or some of the funds for qualified higher education expenses, the account owner has options: One can change beneficiary to another relative who may need the funds or keep the account going and eventually add a grandchild as a beneficiary. Graduate school expenses also are eligible. A student can have multiple 529 accounts set up in their name.

Additional tax considerations

Education Tax Credits like the American Opportunity Tax Credit and the Lifetime Learning Credit have income phase-outs that you may or may not be eligible for based on your income. Education expenses used to qualify for the tax-free withdrawal from a 529 plan cannot be used to claim these tax credits. Several states offer state income tax deductions for contributions to a 529 plan but may have eligibility limited to the in-state plan only. It is wise to look to your own state’s plan first to see if that is the case and consider that as a factor when you choose a plan right for you. Refer to your tax professional for your eligibility.

In conclusion, 529 savings plans represent a tax-free way to grow your investments for future education expenses down the road, even if you don’t have a child yet. Speak to your financial adviser to learn about plans and contribution schedules that work with your current and future investing goals.

Good sources for further information include:

- www.savingforcollege.com.

- www.irs.gov/forms-pubs/about-publication-970.

- www.finra.org/investors/saving-college.

Mr. Clancy is director of financial planning, Drexel University College of Medicine.

Financial planning for families can involve multiple investment goals. The big ones usually are investing for retirement and for your children’s college expenses. With any investment strategy, once you have identified an investment goal, you will want to utilize the right investment account to achieve that goal. If investing for future college expenses is your goal, then one of the investment accounts you will want to utilize is called a 529 plan.

What is a 529 plan?

A 529 plan is a tax-favored account authorized by Section 529 of the Internal Revenue Code and sponsored by a state or educational institution. These plans have specific tax-saving features to them, compared with other taxable accounts, which are listed below. To begin with, there are two types of 529 plans: prepaid tuition plans and education savings plans. Every state has at least one type of 529 plan. Additionally, some private colleges sponsor a prepaid tuition plan.

Prepaid tuition plan

The first type of 529 account is a prepaid tuition plan. These let an account owner purchase college credits (or units) for participating colleges or universities at today’s prices to be used for the student’s future tuition charges. The states that sponsor prepaid plans do so primarily for the benefit of their in-state public colleges and universities. Things to know about the prepaid plans: States may or may not guarantee that the prepaid units keep up with increases in tuition charges. The plan also may have a state residency requirement. If the student decides not to attend one of the eligible schools, the equivalent payout may be less than had the student attended one of the participating institutions. There are no federal guarantees on the state prepaid plans and they are not available for private elementary and high school programs.

Education savings plan

The second type of 529 account is an education savings plan, an investment account into which you can invest your after-tax dollars. The intent with these accounts is to grow the balance for use at a future date. These are tax-deferred accounts, which means each year the interest, dividends, and capital gains created within the account do not show up on your tax return. If the funds are used for a “qualified” higher-education expense, then gains on the account are not taxed upon withdrawal.

As with most investments, the longer your money is invested, the more time it has to grow via accumulated interest, dividends, and appreciation. The larger the growth, the larger the tax benefits. This offers a tremendous advantage for a high-income and high-tax bracket household to invest for future goals (such as private school tuition or college expenses). By contrast, if you had invested in a fully taxable account, you would be subject to taxes each year on the interest, dividends, and capital gain distributions. Also, with taxable accounts, your investments would be subject to capital gains tax on the growth when they are sold to pay for those future expenses.

An account owner may choose among a range of investment options that the 529 plan provides. These are typically individual mutual funds or preformed mutual fund portfolios. The portfolios may have a fixed allocation percentage that stays the same over time or come “age-weighted,” meaning the investment allocation becomes more conservative the closer the student gets to college age when withdrawals would occur. This is a similar approach to the “target retirement date” offerings one sees in retirement accounts.

If one is using the 529 account for the student’s elementary or high school years, the investment time frame may be shorter and necessitate a more conservative approach, as the time for withdrawals would be nearer than the college years. As with most investments, the account can lose value based on investment performance.

Owner versus beneficiary

There are two parties to any 529 plan account: The account owner, who has control over the account and can name the beneficiary to the account, and the beneficiary (the student). The account owner can change beneficiaries on the account and can even name themselves as the beneficiary. One can name anyone as the beneficiary (e.g., child, friend, relative, yourself). You can be proactive by creating an account and naming yourself the beneficiary now, before switching to your child in the future. The account owner can live in one state with the beneficiary in another and invest in the 529 from a third state, and the student may eventually go to an educational institution in a fourth state. The 529 education savings account is not limited to any specific college, as a prepaid plan may be.

Withdrawals from 529s

If a 529 account withdrawal is for qualified higher education expenses or tuition for elementary or secondary schools, earnings are not subject to federal income tax or, in many cases, state income tax. Qualified withdrawals need to take place in the same tax year as the qualified expense.

Withdrawals not used for qualified higher education expenses in that year are considered “nonqualified” and would be subject to tax and 10% penalty on the earnings. State and local taxes may apply as well.

You can use the proceeds from the account free of taxes for the following qualified higher-education expenses:

- Tuition and school fees for both full and part time students at an eligible college, university, trade, or vocational institution.

- Room and board if the student is enrolled at more than half-time status. The amount up to the school’s room and board charges are eligible if paid directly to the school or to a landlord if living in nonschool housing. If actual charges to the landlord exceed the schools’ charges, then the amount above the school’s charges would be considered an excess withdrawal.

- Required books, supplies, and equipment for the academic program. Computer and technology equipment, printers, and required software, and such related services as Internet access also are qualified expenses.

- Private elementary or secondary school tuition up to $10,000 annually also is a qualified expense for 529 withdrawals.

Health insurance for the student and transportation-related costs to and from the school are not qualified expenses.

Contributions and fees

Like all investments, the fees associated with a 529 account need to be considered, as excess fees lower the investment returns. Prepaid tuition plans may charge initial application, transaction, and ongoing administrative fees. Investment 529 accounts may also have administrative costs such as program management fees, per-transaction fees, and the underlying investment expense ratios. Some states have broker-sold plans as well as direct-sold plans. Broker-sold plans can be purchased only through a broker and have the additional expenses associated with that either in the form of a load (sales charge) or higher expense ratio.

Contributions to a 529 plan can only be made in cash. If you currently have other investments, they need to be liquidated first (with the associated tax consequence) and then the proceeds invested into the 529 plan. Establishing the account and ongoing contributions are subject to gift tax limits ($15,000 for 2019). A married couple may make a “joint gift” to the account to double the limit. The 529 plans also allow the owner to front-load the account in 1 year with up to 5 years’ worth of gift limit contributions all at once. This lump sum is treated for tax reasons as a pro-rata 5 consecutive years of contributions all at once. Any additional gifts to that beneficiary during that year and the remaining four would be subject to gift tax issues if it means the annual gift limits were exceeded. Contributions are considered a “completed gift” for gift- and estate-tax purposes even though the account owner retains an element of control. The up-front 5-year gift election is available only on 529 accounts and is a great way for parents and grandparents (hint-hint) to reduce their estates and get a significant initial balance into the account. This can come in handy for those who may have procrastinated working toward this investment goal and need to catch up.

If the beneficiary does not need all or some of the funds for qualified higher education expenses, the account owner has options: One can change beneficiary to another relative who may need the funds or keep the account going and eventually add a grandchild as a beneficiary. Graduate school expenses also are eligible. A student can have multiple 529 accounts set up in their name.

Additional tax considerations

Education Tax Credits like the American Opportunity Tax Credit and the Lifetime Learning Credit have income phase-outs that you may or may not be eligible for based on your income. Education expenses used to qualify for the tax-free withdrawal from a 529 plan cannot be used to claim these tax credits. Several states offer state income tax deductions for contributions to a 529 plan but may have eligibility limited to the in-state plan only. It is wise to look to your own state’s plan first to see if that is the case and consider that as a factor when you choose a plan right for you. Refer to your tax professional for your eligibility.

In conclusion, 529 savings plans represent a tax-free way to grow your investments for future education expenses down the road, even if you don’t have a child yet. Speak to your financial adviser to learn about plans and contribution schedules that work with your current and future investing goals.

Good sources for further information include:

- www.savingforcollege.com.

- www.irs.gov/forms-pubs/about-publication-970.

- www.finra.org/investors/saving-college.

Mr. Clancy is director of financial planning, Drexel University College of Medicine.

Financial planning for families can involve multiple investment goals. The big ones usually are investing for retirement and for your children’s college expenses. With any investment strategy, once you have identified an investment goal, you will want to utilize the right investment account to achieve that goal. If investing for future college expenses is your goal, then one of the investment accounts you will want to utilize is called a 529 plan.

What is a 529 plan?

A 529 plan is a tax-favored account authorized by Section 529 of the Internal Revenue Code and sponsored by a state or educational institution. These plans have specific tax-saving features to them, compared with other taxable accounts, which are listed below. To begin with, there are two types of 529 plans: prepaid tuition plans and education savings plans. Every state has at least one type of 529 plan. Additionally, some private colleges sponsor a prepaid tuition plan.

Prepaid tuition plan

The first type of 529 account is a prepaid tuition plan. These let an account owner purchase college credits (or units) for participating colleges or universities at today’s prices to be used for the student’s future tuition charges. The states that sponsor prepaid plans do so primarily for the benefit of their in-state public colleges and universities. Things to know about the prepaid plans: States may or may not guarantee that the prepaid units keep up with increases in tuition charges. The plan also may have a state residency requirement. If the student decides not to attend one of the eligible schools, the equivalent payout may be less than had the student attended one of the participating institutions. There are no federal guarantees on the state prepaid plans and they are not available for private elementary and high school programs.

Education savings plan

The second type of 529 account is an education savings plan, an investment account into which you can invest your after-tax dollars. The intent with these accounts is to grow the balance for use at a future date. These are tax-deferred accounts, which means each year the interest, dividends, and capital gains created within the account do not show up on your tax return. If the funds are used for a “qualified” higher-education expense, then gains on the account are not taxed upon withdrawal.

As with most investments, the longer your money is invested, the more time it has to grow via accumulated interest, dividends, and appreciation. The larger the growth, the larger the tax benefits. This offers a tremendous advantage for a high-income and high-tax bracket household to invest for future goals (such as private school tuition or college expenses). By contrast, if you had invested in a fully taxable account, you would be subject to taxes each year on the interest, dividends, and capital gain distributions. Also, with taxable accounts, your investments would be subject to capital gains tax on the growth when they are sold to pay for those future expenses.

An account owner may choose among a range of investment options that the 529 plan provides. These are typically individual mutual funds or preformed mutual fund portfolios. The portfolios may have a fixed allocation percentage that stays the same over time or come “age-weighted,” meaning the investment allocation becomes more conservative the closer the student gets to college age when withdrawals would occur. This is a similar approach to the “target retirement date” offerings one sees in retirement accounts.

If one is using the 529 account for the student’s elementary or high school years, the investment time frame may be shorter and necessitate a more conservative approach, as the time for withdrawals would be nearer than the college years. As with most investments, the account can lose value based on investment performance.

Owner versus beneficiary

There are two parties to any 529 plan account: The account owner, who has control over the account and can name the beneficiary to the account, and the beneficiary (the student). The account owner can change beneficiaries on the account and can even name themselves as the beneficiary. One can name anyone as the beneficiary (e.g., child, friend, relative, yourself). You can be proactive by creating an account and naming yourself the beneficiary now, before switching to your child in the future. The account owner can live in one state with the beneficiary in another and invest in the 529 from a third state, and the student may eventually go to an educational institution in a fourth state. The 529 education savings account is not limited to any specific college, as a prepaid plan may be.

Withdrawals from 529s

If a 529 account withdrawal is for qualified higher education expenses or tuition for elementary or secondary schools, earnings are not subject to federal income tax or, in many cases, state income tax. Qualified withdrawals need to take place in the same tax year as the qualified expense.

Withdrawals not used for qualified higher education expenses in that year are considered “nonqualified” and would be subject to tax and 10% penalty on the earnings. State and local taxes may apply as well.

You can use the proceeds from the account free of taxes for the following qualified higher-education expenses:

- Tuition and school fees for both full and part time students at an eligible college, university, trade, or vocational institution.

- Room and board if the student is enrolled at more than half-time status. The amount up to the school’s room and board charges are eligible if paid directly to the school or to a landlord if living in nonschool housing. If actual charges to the landlord exceed the schools’ charges, then the amount above the school’s charges would be considered an excess withdrawal.

- Required books, supplies, and equipment for the academic program. Computer and technology equipment, printers, and required software, and such related services as Internet access also are qualified expenses.

- Private elementary or secondary school tuition up to $10,000 annually also is a qualified expense for 529 withdrawals.

Health insurance for the student and transportation-related costs to and from the school are not qualified expenses.

Contributions and fees

Like all investments, the fees associated with a 529 account need to be considered, as excess fees lower the investment returns. Prepaid tuition plans may charge initial application, transaction, and ongoing administrative fees. Investment 529 accounts may also have administrative costs such as program management fees, per-transaction fees, and the underlying investment expense ratios. Some states have broker-sold plans as well as direct-sold plans. Broker-sold plans can be purchased only through a broker and have the additional expenses associated with that either in the form of a load (sales charge) or higher expense ratio.

Contributions to a 529 plan can only be made in cash. If you currently have other investments, they need to be liquidated first (with the associated tax consequence) and then the proceeds invested into the 529 plan. Establishing the account and ongoing contributions are subject to gift tax limits ($15,000 for 2019). A married couple may make a “joint gift” to the account to double the limit. The 529 plans also allow the owner to front-load the account in 1 year with up to 5 years’ worth of gift limit contributions all at once. This lump sum is treated for tax reasons as a pro-rata 5 consecutive years of contributions all at once. Any additional gifts to that beneficiary during that year and the remaining four would be subject to gift tax issues if it means the annual gift limits were exceeded. Contributions are considered a “completed gift” for gift- and estate-tax purposes even though the account owner retains an element of control. The up-front 5-year gift election is available only on 529 accounts and is a great way for parents and grandparents (hint-hint) to reduce their estates and get a significant initial balance into the account. This can come in handy for those who may have procrastinated working toward this investment goal and need to catch up.

If the beneficiary does not need all or some of the funds for qualified higher education expenses, the account owner has options: One can change beneficiary to another relative who may need the funds or keep the account going and eventually add a grandchild as a beneficiary. Graduate school expenses also are eligible. A student can have multiple 529 accounts set up in their name.

Additional tax considerations

Education Tax Credits like the American Opportunity Tax Credit and the Lifetime Learning Credit have income phase-outs that you may or may not be eligible for based on your income. Education expenses used to qualify for the tax-free withdrawal from a 529 plan cannot be used to claim these tax credits. Several states offer state income tax deductions for contributions to a 529 plan but may have eligibility limited to the in-state plan only. It is wise to look to your own state’s plan first to see if that is the case and consider that as a factor when you choose a plan right for you. Refer to your tax professional for your eligibility.

In conclusion, 529 savings plans represent a tax-free way to grow your investments for future education expenses down the road, even if you don’t have a child yet. Speak to your financial adviser to learn about plans and contribution schedules that work with your current and future investing goals.

Good sources for further information include:

- www.savingforcollege.com.

- www.irs.gov/forms-pubs/about-publication-970.

- www.finra.org/investors/saving-college.

Mr. Clancy is director of financial planning, Drexel University College of Medicine.

Pyrotinib shows promise in HER2-mutant non–small cell lung cancer

Pyrotinib, an irreversible pan-HER receptor tyrosine kinase inhibitor, showed promising safety and efficacy in a phase 2 trial of 15 adults with HER2-mutant non–small cell lung cancer and also topped afatinib in in vitro and murine studies, investigators reported.

In the phase 2 trial, objective response rate was 53%, a median overall survival was 12.9 months, and median progression-free survival was 6.4 months, wrote Yan Wang of Tongji University, Shanghai, China, together with associates. Pyrotinib showed superior antitumor activity, compared with afatinib, in a patient-derived organoid (P = .004) and xenograft mouse model (P = .0471), they reported in Annals of Oncology.

About 2% to 3% of patients with non–small cell lung cancer (NSCLC) have HER2 mutations, which most often involve an exon 20 insertion. Because HER2-targeting agents such as afatinib, dacomitinib, neratinib, and trastuzumab have limited activity against these cancers, patients usually receive chemotherapy, even though it is less effective than in lung cancers with ALK or ROS1 rearrangements.

To seek a better treatment option, the researchers created a HER2YVMA insertion patient-derived organoid model and a patient-derived xenograft mouse model, both of which confirmed the superior antitumor activity of pyrotinib, compared with afatinib or T-DM1 (ado-trastuzumab emtansine). For example, tumor burdens in mice fell by an average of 52% with pyrotinib but rose by 25% on afatinib and by 11% on T-DM1.

Accordingly, the researchers conducted a phase 2 trial of oral pyrotinib (400 mg daily) in 15 adults with NSCLC characterized by HER2 mutations in exon 20 or exon 19, the tyrosine kinase domain. Patients had an Eastern Cooperative Oncology Group performance status of 0-2, lacked symptomatic brain metastases, and had progressed on standard therapy.

In all, nine patients (60%) developed adverse events, the most common of which were grade 1 or 2 diarrhea, decreased hemoglobin levels, and hypocalcemia. There were no grade 3 or 4 events. Progression-free survival ranged from 1.7 to 23.4 months and one-third of patients stayed on pyrotinib for more than 1 year. Among two patients with asymptomatic brain metastases, one stopped pyrotinib at 4 weeks because of primary tumor progression but the other achieved stable disease on treatment. Three (23%) patients developed incident brain metastases on pyrotinib. The sole patient who progressed on a prior HER2-targeted therapy (afatinib) responded to pyrotinib.

Taken together, these findings support further study of pyrotinib in patients with NSCLC with HER2 exon 20 mutations, the researchers wrote. They have initiated a multicenter, phase 2 trial, which is currently in progress.

Funders included the National Natural Science Foundation of China, the “Shuguang Program” supported by Shanghai Education Development Foundation and Shanghai Municipal Education Commission, the Science and Technology Commission of Shanghai Municipality, the Development Fund for Shanghai Talents, the University of Iowa Start-up Funds, and the American Cancer Society. The investigators reported having no conflicts of interest.

SOURCE: Wang Y et al. Ann Oncol. 2018 Dec 31. doi: 10.1093/annonc/mdy542.

Pyrotinib, an irreversible pan-HER receptor tyrosine kinase inhibitor, showed promising safety and efficacy in a phase 2 trial of 15 adults with HER2-mutant non–small cell lung cancer and also topped afatinib in in vitro and murine studies, investigators reported.

In the phase 2 trial, objective response rate was 53%, a median overall survival was 12.9 months, and median progression-free survival was 6.4 months, wrote Yan Wang of Tongji University, Shanghai, China, together with associates. Pyrotinib showed superior antitumor activity, compared with afatinib, in a patient-derived organoid (P = .004) and xenograft mouse model (P = .0471), they reported in Annals of Oncology.

About 2% to 3% of patients with non–small cell lung cancer (NSCLC) have HER2 mutations, which most often involve an exon 20 insertion. Because HER2-targeting agents such as afatinib, dacomitinib, neratinib, and trastuzumab have limited activity against these cancers, patients usually receive chemotherapy, even though it is less effective than in lung cancers with ALK or ROS1 rearrangements.

To seek a better treatment option, the researchers created a HER2YVMA insertion patient-derived organoid model and a patient-derived xenograft mouse model, both of which confirmed the superior antitumor activity of pyrotinib, compared with afatinib or T-DM1 (ado-trastuzumab emtansine). For example, tumor burdens in mice fell by an average of 52% with pyrotinib but rose by 25% on afatinib and by 11% on T-DM1.

Accordingly, the researchers conducted a phase 2 trial of oral pyrotinib (400 mg daily) in 15 adults with NSCLC characterized by HER2 mutations in exon 20 or exon 19, the tyrosine kinase domain. Patients had an Eastern Cooperative Oncology Group performance status of 0-2, lacked symptomatic brain metastases, and had progressed on standard therapy.

In all, nine patients (60%) developed adverse events, the most common of which were grade 1 or 2 diarrhea, decreased hemoglobin levels, and hypocalcemia. There were no grade 3 or 4 events. Progression-free survival ranged from 1.7 to 23.4 months and one-third of patients stayed on pyrotinib for more than 1 year. Among two patients with asymptomatic brain metastases, one stopped pyrotinib at 4 weeks because of primary tumor progression but the other achieved stable disease on treatment. Three (23%) patients developed incident brain metastases on pyrotinib. The sole patient who progressed on a prior HER2-targeted therapy (afatinib) responded to pyrotinib.

Taken together, these findings support further study of pyrotinib in patients with NSCLC with HER2 exon 20 mutations, the researchers wrote. They have initiated a multicenter, phase 2 trial, which is currently in progress.

Funders included the National Natural Science Foundation of China, the “Shuguang Program” supported by Shanghai Education Development Foundation and Shanghai Municipal Education Commission, the Science and Technology Commission of Shanghai Municipality, the Development Fund for Shanghai Talents, the University of Iowa Start-up Funds, and the American Cancer Society. The investigators reported having no conflicts of interest.

SOURCE: Wang Y et al. Ann Oncol. 2018 Dec 31. doi: 10.1093/annonc/mdy542.

Pyrotinib, an irreversible pan-HER receptor tyrosine kinase inhibitor, showed promising safety and efficacy in a phase 2 trial of 15 adults with HER2-mutant non–small cell lung cancer and also topped afatinib in in vitro and murine studies, investigators reported.

In the phase 2 trial, objective response rate was 53%, a median overall survival was 12.9 months, and median progression-free survival was 6.4 months, wrote Yan Wang of Tongji University, Shanghai, China, together with associates. Pyrotinib showed superior antitumor activity, compared with afatinib, in a patient-derived organoid (P = .004) and xenograft mouse model (P = .0471), they reported in Annals of Oncology.

About 2% to 3% of patients with non–small cell lung cancer (NSCLC) have HER2 mutations, which most often involve an exon 20 insertion. Because HER2-targeting agents such as afatinib, dacomitinib, neratinib, and trastuzumab have limited activity against these cancers, patients usually receive chemotherapy, even though it is less effective than in lung cancers with ALK or ROS1 rearrangements.

To seek a better treatment option, the researchers created a HER2YVMA insertion patient-derived organoid model and a patient-derived xenograft mouse model, both of which confirmed the superior antitumor activity of pyrotinib, compared with afatinib or T-DM1 (ado-trastuzumab emtansine). For example, tumor burdens in mice fell by an average of 52% with pyrotinib but rose by 25% on afatinib and by 11% on T-DM1.

Accordingly, the researchers conducted a phase 2 trial of oral pyrotinib (400 mg daily) in 15 adults with NSCLC characterized by HER2 mutations in exon 20 or exon 19, the tyrosine kinase domain. Patients had an Eastern Cooperative Oncology Group performance status of 0-2, lacked symptomatic brain metastases, and had progressed on standard therapy.

In all, nine patients (60%) developed adverse events, the most common of which were grade 1 or 2 diarrhea, decreased hemoglobin levels, and hypocalcemia. There were no grade 3 or 4 events. Progression-free survival ranged from 1.7 to 23.4 months and one-third of patients stayed on pyrotinib for more than 1 year. Among two patients with asymptomatic brain metastases, one stopped pyrotinib at 4 weeks because of primary tumor progression but the other achieved stable disease on treatment. Three (23%) patients developed incident brain metastases on pyrotinib. The sole patient who progressed on a prior HER2-targeted therapy (afatinib) responded to pyrotinib.

Taken together, these findings support further study of pyrotinib in patients with NSCLC with HER2 exon 20 mutations, the researchers wrote. They have initiated a multicenter, phase 2 trial, which is currently in progress.

Funders included the National Natural Science Foundation of China, the “Shuguang Program” supported by Shanghai Education Development Foundation and Shanghai Municipal Education Commission, the Science and Technology Commission of Shanghai Municipality, the Development Fund for Shanghai Talents, the University of Iowa Start-up Funds, and the American Cancer Society. The investigators reported having no conflicts of interest.

SOURCE: Wang Y et al. Ann Oncol. 2018 Dec 31. doi: 10.1093/annonc/mdy542.

FROM ANNALS OF ONCOLOGY

Key clinical point: Pyrotinib showed promising antitumor activity in patients with HER2-mutant non–small cell lung cancer.

Major finding: The objective response rate was 53%, median overall survival was 12.9 months, and median progression-free survival was 6.4 months. Pyrotinib showed superior antitumor activity, compared with afatinib in vitro (P = .004) and in a patient-derived xenograft model (P = .0471).

Study details: A phase 2 trial of 15 adults with progressive HER2-mutant non–small cell lung cancer, along with organoid and patient-derived xenograft models.

Disclosures: Funders included the National Natural Science Foundation of China, the “Shuguang Program” supported by Shanghai Education Development Foundation and Shanghai Municipal Education Commission, the Science and Technology Commission of Shanghai Municipality, the Development Fund for Shanghai Talents, the University of Iowa Start-up Funds, and the American Cancer Society. The investigators reported having no conflicts of interest.

Source: Wang Y et al. Ann Oncol. 2018 Dec 31. doi: 10.1093/annonc/mdy542.

Does rituximab delay disability progression in patients with secondary progressive MS?

, according to a retrospective analysis published online Jan. 7 in JAMA Neurology.

The results suggest that “B-cell depletion by rituximab may be therapeutically beneficial in these patients,” said study author Yvonne Naegelin, MD, of the department of neurology at University Hospital Basel, Switzerland, and her colleagues. “A prospective randomized clinical trial with a better level of evidence is needed to confirm the efficacy of rituximab in such patients.”

Research indicates that B cells play a role in the pathogenesis of relapsing-remitting and secondary progressive MS, and rituximab, a monoclonal CD20 antibody, may deplete B cells in the peripheral immune system and CNS. “Owing to the limited treatment options for secondary progressive MS and the extrapolation of results in relapsing-remitting MS and primary progressive MS, rituximab was used off-label for the treatment of secondary progressive MS,” the authors said. They compared disability progression in patients who were treated with rituximab at MS centers in Switzerland with disability of control patients with secondary progressive MS who did not receive rituximab. The control patients were part of an observational cohort study at MS centers in Switzerland and the Netherlands. Data for the present analysis were collected between 2004 and 2017.

The investigators matched rituximab-treated and control patients 1:1 using propensity scores. Matching variables were sex, age, EDSS score, and disease duration at baseline. Rituximab-treated patients had a mean age of 49.7 years, mean disease duration of 18.2 years, and mean EDSS score of 5.9; 59% were women. Controls had a mean age of 51.3 years, mean disease duration of 19.4 years, and mean EDSS score of 5.7; 61% were women.

A covariate-adjusted analysis of the matched set found that rituximab-treated patients had a significantly lower EDSS score during a mean follow-up of 3.5 years (mean difference, –0.52). In addition, time to confirmed disability progression was delayed in the rituximab-treated group (hazard ratio, 0.49). “Approximately 75% of untreated and 50% of treated individuals in our cohorts developed clinically significant confirmed progression for the 10-year period,” Dr. Naegelin and her colleagues reported. Complications, mainly related to infections, occurred in five cases during treatment. The researchers did not identify major safety concerns, however.

Dr. Naegelin had no conflict of interest disclosures. Several coauthors disclosed research support and compensation from pharmaceutical companies.

SOURCE: Naegelin Y et al. JAMA Neurol. 2019 Jan 7. doi: 10.1001/jamaneurol.2018.4239.

, according to a retrospective analysis published online Jan. 7 in JAMA Neurology.

The results suggest that “B-cell depletion by rituximab may be therapeutically beneficial in these patients,” said study author Yvonne Naegelin, MD, of the department of neurology at University Hospital Basel, Switzerland, and her colleagues. “A prospective randomized clinical trial with a better level of evidence is needed to confirm the efficacy of rituximab in such patients.”

Research indicates that B cells play a role in the pathogenesis of relapsing-remitting and secondary progressive MS, and rituximab, a monoclonal CD20 antibody, may deplete B cells in the peripheral immune system and CNS. “Owing to the limited treatment options for secondary progressive MS and the extrapolation of results in relapsing-remitting MS and primary progressive MS, rituximab was used off-label for the treatment of secondary progressive MS,” the authors said. They compared disability progression in patients who were treated with rituximab at MS centers in Switzerland with disability of control patients with secondary progressive MS who did not receive rituximab. The control patients were part of an observational cohort study at MS centers in Switzerland and the Netherlands. Data for the present analysis were collected between 2004 and 2017.

The investigators matched rituximab-treated and control patients 1:1 using propensity scores. Matching variables were sex, age, EDSS score, and disease duration at baseline. Rituximab-treated patients had a mean age of 49.7 years, mean disease duration of 18.2 years, and mean EDSS score of 5.9; 59% were women. Controls had a mean age of 51.3 years, mean disease duration of 19.4 years, and mean EDSS score of 5.7; 61% were women.

A covariate-adjusted analysis of the matched set found that rituximab-treated patients had a significantly lower EDSS score during a mean follow-up of 3.5 years (mean difference, –0.52). In addition, time to confirmed disability progression was delayed in the rituximab-treated group (hazard ratio, 0.49). “Approximately 75% of untreated and 50% of treated individuals in our cohorts developed clinically significant confirmed progression for the 10-year period,” Dr. Naegelin and her colleagues reported. Complications, mainly related to infections, occurred in five cases during treatment. The researchers did not identify major safety concerns, however.

Dr. Naegelin had no conflict of interest disclosures. Several coauthors disclosed research support and compensation from pharmaceutical companies.

SOURCE: Naegelin Y et al. JAMA Neurol. 2019 Jan 7. doi: 10.1001/jamaneurol.2018.4239.